‘PSR roadmap will be available by June’

Chris Hemsley, managing director of the Payment Services Regulator (PSR), says the watchdog’s plan will be published by the end of June 2023.

Chris Hemsley, managing director of the Payment Services Regulator (PSR), says the watchdog’s plan will be published by the end of June 2023.

The Payments Association’s Tony Craddock sits down with FIS to discuss how the threat of a recession is driving a need for quicker and easier access to cash for organisations.

London-based global fintech, Unlimint, has announced a rebranding of its name to Unlimit, which will reflect the company’s new positioning, unify its product line, and highlight

The ability to shield your core. No financial institution should have to worry about the risk of compromising its core in the name of modernization.

In an ever-evolving landscape where fraudsters use increasingly sophisticated techniques, keeping your business safe is paramount. The key to successful fraud management? Proactive prevention. Dealing

24 May 2023, London. New Look. Advanced client experience. Same reliability and efficiency. In continued effort to provide exceptional financial services, PayAlly launches the latest

As the cost-of-living crisis takes its toll, more vulnerable groups are at risk of not receiving the support and help they need to access financial services.

High levels of data and machine learning are key if financial institutions want to tackle the sophisticated nature of payment scams.

In a challenging economic climate, businesses must adapt and innovate to keep up with consumer needs and preferences.

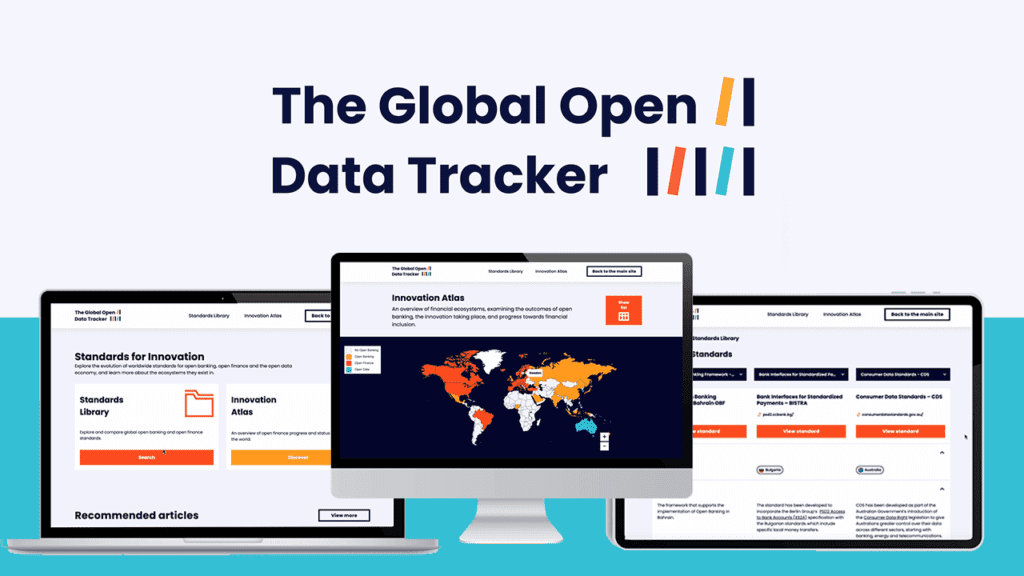

LONDON, 23 May – Ozone API and Smart Data Foundry have today announced a partnership and the launch of two new products – the Standards

ConnexPay’s Anant Patel, president of international markets, discusses the future of payments, highlighting the potential of virtual cards to provide multiple efficiencies and cost savings,

PEXA Pay, the first deferred net settlement scheme launched in the UK in collaboration with the Bank of England since 2008, are beginning to increase

Trust Payments, the disruptive leader in frictionless payments and value-added services for merchants, is delighted to announce the signing of a strategic agreement with the

Guavapay, a London-based fintech company, and Discover® Global Network signed a strategic agreement on acquiring and issuing with processing coming over the next months. This

allpay cards, one of the UK’s fastest growing and most trusted brands in plastic card manufacturing, is proud to announce a recent investment of £1.5

We are pleased to invite you to our next Payments industry webinar, where we will discuss priorities for payments firms following increased regulatory focus across

Paymentology’s Martin Heraghty explores how the lending landscape is changing and what this means for consumers.

FMPay, the independent fintech company known for its out-of-the-box financial products and services, is proud to announce the relaunch of its website, FMPay.me. Four years

Top trends that are driving how Cardholders pay today! Download your copy now

Join TSYS and Auriemma live on the 16th of May for our “The Importance of ISO 20022 to Debit Card Issuers” webinar where TSYS’ Head

ConnexPay, the first and only payments technology company that integrates payments acceptance and issuance inside a single platform, announces a partnership with Payouts Network, an

Market and industry disruption have increased the need for fast digital payments. Here’s why prepaid cards are good for businesses, benefit providers, and workers and

Learn how a unified platform can differentiate your payment experience and build cardholder engagement and loyalty while improving your operations, cost efficiency and portfolio profitability.

DECTA, a global payment processing company, announces a new partnership with UnionPay International (UPI) a major global card scheme. In accordance with this partnership, DECTA

Peter Harmston and Robert Dean at KPMG UK explore how AI can be adopted to have the biggest benefits for both business and customers.

Vienna-based corplife, the all-in-one solution for employee benefits, has announced a new partnership with embedded-finance firm, Weavr. The partnership sees the launch of a digital

LONDON, 26 April – Ozone API, a leading provider of standards-compliant open banking API technology today announced that the Ozone API software solution is available

Join Daon and our guest speakers from AIB, BankID and NatWest in our thought leadership session to discuss how financial institutions in the UK and

Yesterday, the Joint Regulatory Oversight Committee (JROC) delivered its Roadmap for the future of open banking in the UK. Why this is important This is

Consumers favor financial institutions that offer modern authentication methods to secure their data and transactions In the first half of 2022, in the UK alone,

Certification recognizes global CX provider’s long-term investment in people and culture Ubiquity, a leading global business process outsourcer, has been recognized as a Great Place

Blackadder – “I’ve got a plan so cunning, you could put a tail on it and call it a weasel!” The similarities between Nikhil Rathi, Chief

ARYZE’s Jack Nikogosian discusses how private sector stablecoin initiatives could be the key to stability and innovation in the current financial system.

The world of business payments is awash in deadlines, mandates and other milestones that will make this arguably one of the more impactful years in

Watch Now – https://www.bottomline.com/uk/resources/eu-commission-sct-inst-mandate-choose-most-efficient-strategy-maximise-benefitshttps://www.bigmarker.com/the-paypers1/EU-Commission-Mandate-SCT-Inst-How-to-choose-the-most-efficient-strategy-and-maximise-on-the-benefits The EU Commission’s proposed mandate will make instant payments universally available in euros within six months after said proposal is approved.

Well-known names such as Uber, Starbucks and – most recently – Twitter are often cited whenever the topic of embedded finance comes up. But while

As the embedded finance industry grows, a question that often comes up from innovators and digital startup founders is: what’s the difference between embedded finance

The Payments Association’s Project Regulator has created a five-step checklist for firms that have fallen behind on preparing for the new rules.

Dialect Communications, a Business Process Outsource (BPO) that offers customer experience (CX) solutions for Fintechs, is partnering with Paynetics, one of Europe’s leading providers of

Financial exclusion in the older population continues to rise and businesses must work together to find solutions that can help this group transition as payments become more digital.

The payments sector has the knowledge and expertise to make open finance a frictionless process that helps customers improve their financial health.

While those hit hardest by the cost-of-living crisis could benefit from using open banking, Stuart Wakefield questions whether the payments sector should be doing more to help.

Noda’s ladies have joined the Women in Open Banking initiative The financial industry has been traditionally dominated by men, but in recent years, there has

BPC and strategy consultancy Fincog today announced the launch of a new report highlighting the current state of the digital banking market in Europe, providing

Sanctions against companies and individuals are constantly changing and the pace of change over the last 12 months has been unprecedented. A major reason is

The UK’s regulatory landscape is expected to change significantly as the Financial Conduct Authority (FCA) brings in new requirements for payments and e-money firms in

New comprehensive library of KYC resources provides critical information for businesses navigating changing compliance guidelines Veriff, a global identity verification provider, today announced its new

Netcetera is proud to announce its win in the Regtech category of the 2023 MPE Awards, for its 3DS Server and 3DS SDK. The solutions

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.