Join Daon and our guest speakers from AIB, BankID and NatWest in our thought leadership session to discuss how financial institutions in the UK and Europe are getting ready to leverage their digital identity programs to enhance their customer experience, improve security, and comply with regulatory requirements.

Digital Identity is becoming a necessity in different countries around the world, each one with its own processes and regulations. According to the digital watch observatory: “It is estimated that governments will have issued about 5 billion digital IDs globally by 2024”.

Apart from the practicalities for end users to access public sector services, the financial services industry is the one which can benefit immediately from using digital identities to help prevent fraud and money laundering, just to mention some.

In this 45 mins webinar session, we’ll discuss in a panel format how FSI in the UK and Europe are facing the changes digital identities will bring to its customers, how it impacts customers in their everyday banking, and how financial institutions can leverage the digital identities. We will discuss biometric authentication, multi-factor authentication, digital onboarding, enhanced identity verification, third-party partnerships, and regulatory compliance.

Some topics we’ll cover:

• What role do financial institutions play in the digital identity space?

• The impact of digital identity on AML and KYC processes?

• How financial institutions are leveraging digital identities in the UK and EU?

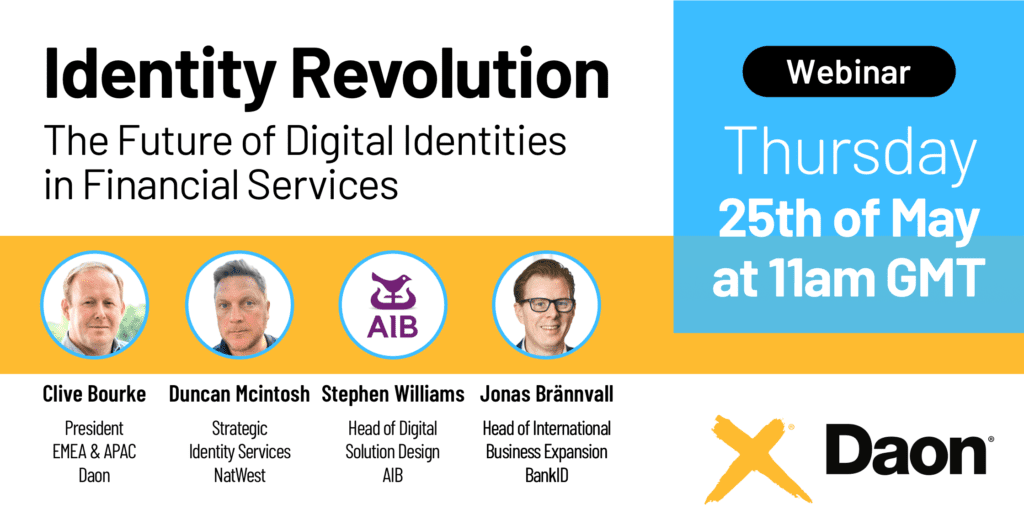

Speakers:

• Duncan Mcintosh – Strategic identity services, NatWest

• Stephen Williams – Head of digital solution design, AIB

• Jonas Brännvall – Head of international business expansion, BankID

• Clive Bourke – President EMEA & APAC, Daon (Moderator)

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.