Can your business benefit from a payment card programme?

Roberto Rivero of Lerex Technology explores the value branded cards could have for businesses.

Roberto Rivero of Lerex Technology explores the value branded cards could have for businesses.

Alex Mifsud of Weavr.io examines how technological advancements mean that customers can experience seamless banking across financial institutions.

Nikulipe’s Frank Breuss discusses the correlation between a country’s GDP and its accessibility to digital financial services, which suggests fintechs are key to financial inclusion in emerging markets.

Payzone and allpay are excited to announce the official launch of their latest enhancement to their payment solutions portfolio providing real-time payment notifications to clients

Several payment initiatives are happening at the same time. If regulators and the industry fail to collaborate now, banks and other businesses face a challenging situation, according to Paul Horlock, chief payments officer at Santander UK.

Read Now – https://www.bottomline.com/uk/resources/aite-matrix-payment-hub-vendors This Impact Report explores some key trends within the payments hub and infrastructure market. It discusses how technology is evolving to address

Watch Now – https://www.bigmarker.com/the-paypers1/EU-Commission-Mandate-SCT-Inst-How-to-choose-the-most-efficient-strategy-and-maximise-on-the-benefits The EU Commission’s proposed mandate will make instant payments universally available in euros within six months after said proposal is approved.

29th March, London: Paymentology, the leading global issuer-processor, has joined forces with Wio Bank PJSC, the region’s first platform bank, to power its innovative banking

We’ve previously discussed our conviction that building a fintech solution on our platform is quicker, easier, and better in every way than trying to do

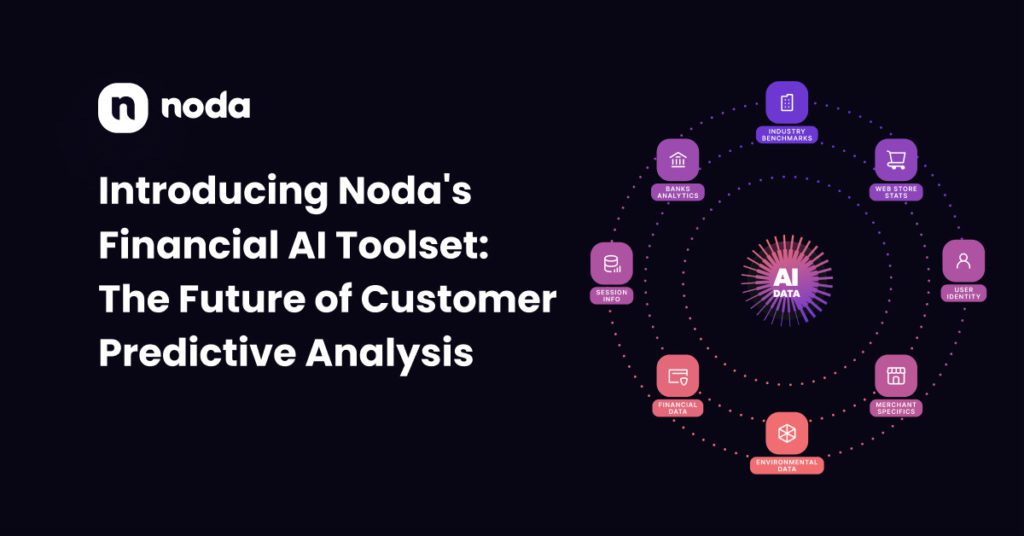

In today’s fast-paced business world, staying ahead of the competition is essential. That’s why Noda has developed a revolutionary new B2B product called the Financial

Join us at the upcoming ECOM’21 international conference, co-organised by DECTA, KPMG, and Mastercard, taking place on April 12-13, 2023, in Hanzas Perons, Riga, Latvia.

Banks and businesses are struggling to work out the impact of HSBC’s purchase of SVB because the deal and the bank’s intentions lacks transparency. Investors and payment experts come together to discuss the matter.

The collaboration provides PXP Financial’s customers with safe, compliant and efficient cross-border payments and international transfers 17th of March 2023 – PXP Financial, an expert in acquiring and

Embedded and invisible payments with reduced friction is on the horizon for retail payments, but players across the chain must not forget why there is friction. Santander’s chief payments officer Paul Horlock dives into what’s next.

With the Bank of England opening its consultation on digital currencies, the key question for the payments sector is could a digital pound interact with the existing infrastructure.

Open banking is leading the way for open finance and open data where robust open APIs and data management will be the cornerstones of success.

Digital Payments Group (DPG), a market-leading Payments Issuing Processor, is partnering with Netcetera, an international expert in secure digital payments. This partnership benefits the global

The large amounts of money being processed and sensitive information being handled means payments operators are a ripe target for today’s fraudsters. ID verification is the first step to establish a prospective customer’s legitimacy.

How businesses can accept bitcoin without accepting bitcoin.

Should payment firms be limited in how they reuse data or are the laws based on GDPR sufficient?

Financial columnist Matthew Lynn discusses how digital IDs could open up market competition.

Self-proclaimed payments geek, Dan Baker, head of payment rails product at J.P. Morgan, speaks to The Payments Association’s Kate McKenzie about the evolving payments landscape.

As the regulatory landscape continues to evolve, is innovation at risk in the fintech space?

Luke Cutajar, director of customer success at Ripple, fell into the payments sector 17 years ago after landing a role at American Express when he left university in Brighton. Specialising in foreign exchange services initially, Luke speaks to The Payment Association’s editor Jyoti Rambhai about building his payments career.

The UK’s financial watchdog has warned that e-money firms must undertake a “significant shift in culture and behaviour” if it is to comply with the new Consumer Duty rules, due to come into force in July.

The Payments Association’s Riccardo Tordera and Robert Courtneidge examine what the latest government consultations could mean for the UK payments sector.

With the UK government launching a second phase consultation on the future of cryptoassets, Max Savoie and Martin Dowdall of Sidley Austin examine what this means for firms.

Central and commercial banks see “clear potential and value” in Swift’s pioneering CBDC interoperability solution, following successful testing in a sandbox environment. Central bank digital

Ingenico, a global leader in payments acceptance solutions, announces the appointment of Laurent Blanchard as the company’s President and Chief Executive Officer (CEO), as well

Payzone and allpay are pleased to announce new enhancements to their relationship benefiting clients, their processes and efficiency. “We are thrilled to announce our latest

Paymentology, the leading global issuer-processor, and Mexico’s leading financial service provider Fondeadora, today announce a strategic partnership to expand payment services in Mexico and are

HSBC’s purchase of Silicon Valley Bank UK (SVB UK) will protect the immediate future of fintechs in the UK, but it does raise the question

As technology continues to advance, fintech companies are becoming more prevalent, highlighting a greater need for diversity and inclusion. Women, in particular, have been underrepresented

Following the announcement of impressive growth in the past year, Weavr has confirmed the acquisition of B2B Open Banking platform, Comma Payments, in a first-of-its

Paying your dues is crucial for every company, regardless of size, since not accruing debt will unquestionably increase an organization’s Business Confidence Index (BCI).

London, March 7th, 2023 – Today, Griffin announced that it has been authorised as a UK bank subject to restrictions. The company is now officially in mobilisation – a huge

Having led companies through transformation, Monika Liikamaa (Enfuce) and Filippa Jennersjö (OKQ8) share their dos and don’ts for companies who are at a point where their legacy systems and

Have you ever wondered whether your business can benefit from providing customers with your own brand payment cards? Would it help your marketing to have

Shanghai Commercial Bank (“ShaComBank”), an international bank based in Hong Kong offering banking and financial services across the world, including the UK, joined forces with

Global Processing Services (“GPS”), a fast-growing next-gen global payments technology platform, today announced the appointment of Paulette Rowe, Shane Happach, and Lynn McCreary as independent

The fintech industry is celebrating International Women’s Day in March. This year’s theme is ‘embracing equity’. It’s no secret, however, that the fintech industry has

Open Banking is 5 years old and has undoubtedly been a success so far. 6.5 million users, 7.5 million payments in total, and 1 billion API calls

ISO 20022 has been written about and reported on extensively across the industry. We are facing the largest migration to a single message standard ever.

A rise in the number of regulations, safeguarding rules, payment methods, corporate costs and the opportunities of ISO 20022 are just some of the biggest

Be ready to enjoy countless networking opportunities, hear from top-notch speakers, attend dynamic workshops and so much more! Mark your calendars for April 12th-13th, 2023. SEE

London-based global fintech, Unlimint, has announced it is further expanding its alternative payment methods portfolio with the addition of one of Brazil’s leading online payment

As we approach the one year mark of the 2022 Russian invasion of Ukraine on 24 February; we’re hosting a Fintech Without Frontiers webinar event

With decreased payment volumes and increased risks of market consolidation, The Payment Association examines how a recession could reshape the industry.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.