Some firms are lagging behind on Consumer Duty implementation

Many firms still haven’t had the opportunity to drill down on the implications that the Consumer Duty has on their business. A recent webinar outlines the key steps to take.

Many firms still haven’t had the opportunity to drill down on the implications that the Consumer Duty has on their business. A recent webinar outlines the key steps to take.

Virtual cards used for B2B transactions can offer tailored payment solutions for customers, while suppliers could gain instant payments and enhanced data, according to several firms using the payment method for B2B transactions.

Join VIXIO PaymentsCompliance and guest speakers to learn about how to tap into the opportunities in five key growth markets, and how to overcome the challenges.

Modulr has recently conducted the research Laggards vs Leaders: Fast-tracking financial technology innovation from 280+ interviews and surveys of CEOs and leaders at financial institutions has brought to light how financial service innovators are responding to the post-pandemic world and how they give great customer experiences.

This upcoming digital event taking place on 16 September at 10 AM BST is on the same theme bringing together financial services leaders from EverUp, Crypterium and Paysafe to explore how to fast-track financial technology innovation.

During the 45-minute live webinar, we will share with you:

-The 3 key challenges faced by today’s FinTechs and non-banks

-The tips and recommendations on how to overcome those challenges

-The 5-point plan to fast-track payments innovation to give great customer experiences

As an attendee, you can expect an exclusive access to valuable recommendations and a chance to ask the speakers any questions you might have.

Secure your place for the webinar here: https://landing.modulrfinance.com/fast-tracking-financial-technology-innovation-webinar

Register today for your place at fscom’s ‘The Dark Money Conference 2021’, taking place over 3 half days from 15-17 September 2021, with 20% OFF exclusive to Payments Association members using the promo code DMCPayments Association20.

On 14 July, Marion King, Director of Payments, NatWest took part in the 2nd webinar in NatWest’s Banks 45 Series. Joining Marion on the panel was Gerard Lemos, Independent Chairman

How can your bank or building society avoid the payments transformation sinkhole?

Join us and our guest speaker Chris Jones, Managing Director PSE Consulting, on the 20th July to learn:

How customers experience your brand through your payments experience

How to fast track payments technology

What can de-rail your digitisation

Book your spot today and make getting payments right easier for your financial institution https://landing.modulrfinance.com/how-to-avoid-the-payments-transformation-sinkhole-epa

Invitation for EY’s upcoming Payment Services and E-Money Safeguarding Industry update on 13 July at 10am BST

Payments Association members can receive an exclusive 20% discount when purchasing their tickets for the Dark Money Conference 2021!

In this training session, featuring fscom Director of Financial Crime Philip Creed and Chainalysis Account Executive Jed Sibley, you will learn more about the latest in cryptocurrency regulation in the UK and Ireland, as well as getting a first-hand insight into some of the recent high profile cryptocurrency-related fincrime cases.

Join us in this insightful webinar, with a range of experts in the mobile payments, cards and risk space, to learn how payments are changing, and how mobile applications can help strengthen authentication and improve your customer experience – all at the same time.

Join VIXIO’s upcoming webinar on May 20 with guest speakers from Gemini, Mackrell.Solicitors and the European Parliament to discuss how payments firms can balance innovation with crypto regulation.

Join our upcoming webinar on May 11 to hear how fintech partnerships are driving innovation in payments in 2021.

In the wake of the financial crisis of 2008, financial institutions increasingly turned to ‘de-risking’ – exiting relationships and limiting interaction with clients deemed high-risk – as a way to reduce their exposure. Join industry leaders Mitch Trehan, Banking Circle’s Head of Compliance and MLRO, and Philip Doyle, Group Director, Financial Crime, Revolut as they take a deeper dive into the topic. They will explore some key questions:

– How has de-risking impacted the industry?

– Why are institutions de-risking, rather than managing existing risk?

– Has de-risking by traditional banks created a vacuum for new players to fill?

– How is the regulatory landscape shifting?

– What’s next for the payments industry?

On Thursday 29 April at 1.30pm BST / 2.30pm CEST join Eversheds Sutherland’s international panel as they discuss the future for blockchain, crypto-assets and smart contracts in financial services, including: crypto-asset regulatory regimes and how they differ; custody, security, smart contracts and tokenization innovations; and how the technology is shaping change in process applications and efficiency savings.

Join Tandem, Lloyds, Trading 212, and TrueLayer on this webinar tomorrow, 28th April, and uncover the blueprint for high converting payment flows.

Join Modulr on 11th May at 10 am for the launch of this quarter’s industry pulse on payments – Leaders vs Laggards: The Race to Escape the Payments Dilemma.

We will discuss how leaders are overcoming their payments dilemma and overcoming the laggards as fintech fast-tracks innovations in a legacy ecosystem.

Secure your spot today: https://landing.modulrfinance.com/laggards-and-leaders-exclusive-launch-epa

Join in this webinar from Finextra, held in association with Bottomline Technologies, to hear the discussion on the following areas with industry experts:

– Why have the G20 become so focused on cross-border payments today?

– What are the most attractive ways to modernise the cross-border payments operation?

– What impact does trapped liquidity bear on the cost of cross-border payments?

– How does Visa-Swift interoperability enable greater service options and value?

– What role do technology enablers play within this network?

– What are the key benefits of the GPI and Visa B2B Connect solutions?

– Can networks succeed alone or is collaboration the new model?

How do Financial Institutions in EMEA Migrate to ISO 20022, Hit Deadlines & Create New Business Opportunity?

ISO 20022 is predicted to support 80% of volume and 90% of the value of high-value transactions and SWIFT has mandated that ANY financial institution that processes SWIFT messages must be able to receive and process ISO messages by the end of 2022.

With its modern alternative approach to banking, U Account is helping to deliver greater financial inclusivity with a solution, powered by Modulr, that’s designed to help those underserved by traditional banks to improve their financial wellbeing.

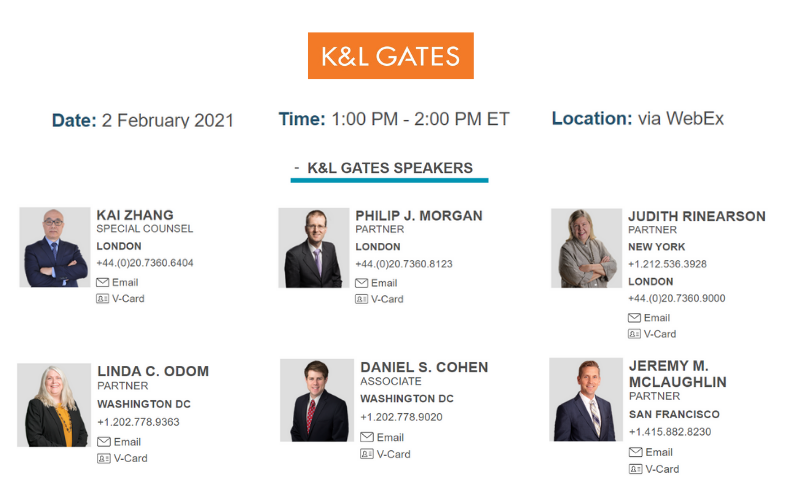

Join us for a cross pond webinar focusing on the enormous changes that are expected to impact payments in the US and UK featuring:

•In London, new K&L Gates Special Payments Counsel, Kai Zhang, and Partner, Philip Morgan.

•In New York, Partner and Global Fintech Co-Chair, Judie Rinearson.

•In Washington DC, Partner and Technology Law Specialist, Linda Odom, and Associate, Daniel Cohen.

•In San Francisco, Partner, Cryptocurrency and Fintech Lawyer, Jeremy McLaughlin.

Topics to be covered include:

•Expected changes to be implemented by the new US Democratic administration

•New leadership in the CFPB, SEC, OCC, and CFTC and what it means for banks and Fintechs

•UK and the implementation of Brexit with respect to payments and banking

•Anticipated changes in providing payment services to the UK and Europe

•The outlook for Fintech investment, Mergers and Acquisitions in the next 12 months on both sides of the pond

•What products and services are the winners and losers from these sweeping changes? Mobile apps? Traditional banking? Digital assets, stable coins and cryptocurrencies?

Webinar | January & February 2021 View in browser As the UK’s transition arrangements with the EU draw to a close and the US beds in a new Administration, significant

Do you want to know how are profitable banking services being built? Join us for the virtual event Banking 2021 on February 11 at 5 PM GMT, meet the industry experts and learn more!

Join K&L Gates For ‘The Future of Financial Services Regulation’ Webinar 17 December 2020 2:00 – 3:00 p.m. ET Please join us for a lively discussion addressing the changing political

Join Kathy Heath, VP Business Development, Konsentus and Paul Meadowcroft, Chief Product Officer, Konsentus to understand what needs to be done to comply with the new open banking rules on digital certificates.

Tune in to hear Cybertonica Chairwoman Jane Butler’s fireside chat “How to Keep Bias Out of Payments” on the 12th of November at 12pm (GMT). Hosted by the European Women Payments Network (EWPN), this event will explore the impact of human bias on the payments industry.

Invite to New Economics of Banking Webinar

No Badge? No Problem.

Join us at our 3D stand for a virtually replicated tradeshow experience with swag, info and more – but from the comfort of your own seat.

26.10.20 – 29.10.20.

Coming soon: We’re arranging a star-studded line up of industry greats, we’re concocting carefully crafted content and we’re sourcing superb swag.

For one afternoon only, receive a generous dose of high value payments entertainment. For CTOs, COOs, CFOs, Product Managers. If you like payments, this is what you should be doing on an early December afternoon.

No decks. No awful webinar platforms. Just pure payments discussion. The theme this year: Where’s the hidden cost in payments?

Join a webinar of The Payments Association EU on the recent EU initiatives in Digital Finance

Jem Shaw from our Patron, Choice International, attended the recent meeting on cross-border payments and international remittances at the Bank of England on behalf of the Payments Association. Download here

Many thanks to the Payments Association for last week allowing me to join the Bank of England’s recent Webinar, ‘Enhancing Cross-Border Payments – A dialogue with UK Industry’, on their

See above

Grab your morning coffee and join us as we reveal insight from our flagship research of 2020. You’ll be joined by peers in the payments community as we uncover the latest opportunities and use-cases in the industry.

Date 1st October 2020 Time 09:30 – 10:30

Book your place → https://landing.modulrfinance.com/cost-of-hidden-inefficiencies-epa

Have you registered for our Tomorrow’s Transactions events?

Join Dave Birch and colleagues from Consult Hyperion for our weekly webinars and fireside chats, to discuss transaction technologies and the issues our industry is facing. Every Thursday at 4 PM BST/11 AM EDT.

Join us on online at 9.30 on 15th September for a demo of our new Confirmation of Payee product followed by a live Q&A session with our payments experts. Register now. https://landing.modulrfinance.com/coffeemorning_confirmation_of_payee

Modulr is the first non-bank or building society to join the Confirmation of Payee service.

Confirmation of Payee allows users to check if the payment details they’ve entered for a person or business match the details held by the recipient’s bank.

This provides reassurance that payments are being sent to the right recipient and protects Modulr customers from certain types of payment fraud.

Join Dave Birch and colleagues from Consult Hyperion for a weekly snapshot on transaction technology and the issues our industry is facing. Every Thursday at 4 PM BST/11 AM EDT.

Join us as we interview CEO of Ordo, Craig Tillotson, about their digital journey to disrupt the market. We’ll ask questions about Ordo’s product development, delivery approach and how COVID-19 impacted their plans.

Allstar Business Solutions is pleased to announce its latest webinar: ‘Fuel Market Monitor Webinar – After Covid oil price crash: what’s next for fleets’.

Taking place on Tuesday 21st July at 10am BST, the session will examine one of the most dramatic periods of the past few decades, and how the seismic impact of Covid-19 has reshaped the fuel and fleet landscape for the foreseeable future.

Cybertonica CEO and Co-Founder Joshua Bower-Saul along with Tony Craddock of The Payments Association discussed the Impact of COVID-19 on Payments Security at Payment Systems Regulation and Innovation Online Conference on June 4th, 2020.

Hosted by City & Financial Global, Payment Systems Regulation and Innovation Online Conference focused on all aspects of payments innovations, including regulatory framework, in the context of the new challenges brought on by the current global crisis.

Issues covered in the event include:

– Reducing the risk of fraud and cyber risk with and within the next generation of payments security

– Shaping and re-shaping the payment industry: privacy, data access and regulatory considerations

Join fscom’s Alison Donnelly and Carol Rossborough of ESTHER for the second in our series of EWPN Ireland Virtual Meetups.

Register here… https://www.eventbrite.co.uk/e/ewpn-ireland-virtual-meetup-tickets-111801617648

In the UK, a consequence of the prolonged lockdown resulting from Covid-19 has been to lay bare the differences of the ‘haves’ and ‘have nots’ in society. The shutdown of

With the EU predicting a recession of ‘historic proportions’ this year, how will this impact the growth of digital banks in Europe? Where are the opportunities and challenges moving forward?

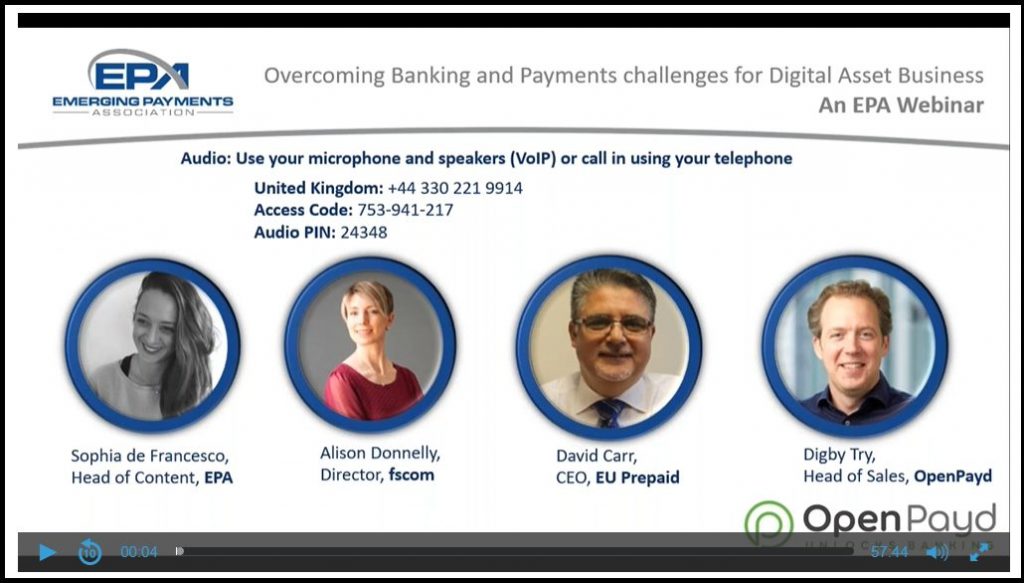

An insightful webinar session hosted by OpenPayd that focussed on overcoming banking and payments challenges for digital asset businesses. Businesses dealing with digital assets have always been faced with significant

This webinar discusses why open banking is the transformation the payments industry has been waiting for, the potential barriers it faces along the way and what we can all do

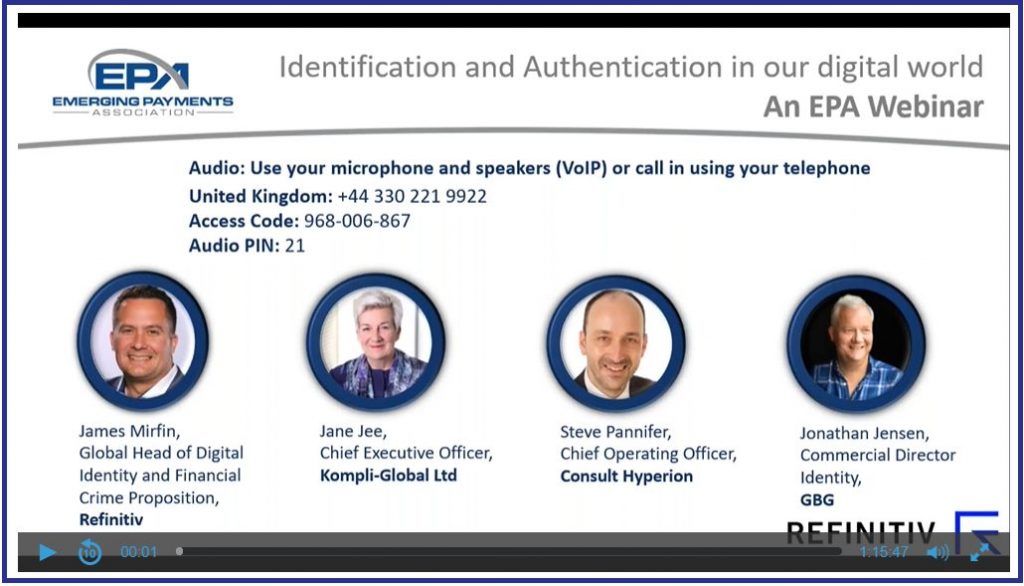

The Payments Association’s panel of digital identity experts discuss project financial crime’s latest whitepaper: ‘The Payments Association’s Guidebook to Digital Identification and Authentication’ View the On Demand version This whitepaper

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.