Reduce your environmental impact using Doconomy digital tools

Fighting environmental issues using fintech? Definitely possible with Doconomy.

Fighting environmental issues using fintech? Definitely possible with Doconomy.

PPS announces partnership with exceet to power sustainable cards for the fintech industry

Judopay partners with UK Government to drive the adoption of digital payments across the public sector – The strategic partnership will also help to boost financial inclusion in the UK

Boom in the fintech industry during 2020 brought an increased need for identity, verification and KYB. And W2 manages to keep the pace!

Payments Association and For Good Causes co-promoting Gift of Giving Christmas campaign with many companies signing up to celebrate Christmas with their staff by helping them support their favourite social and environmental causes

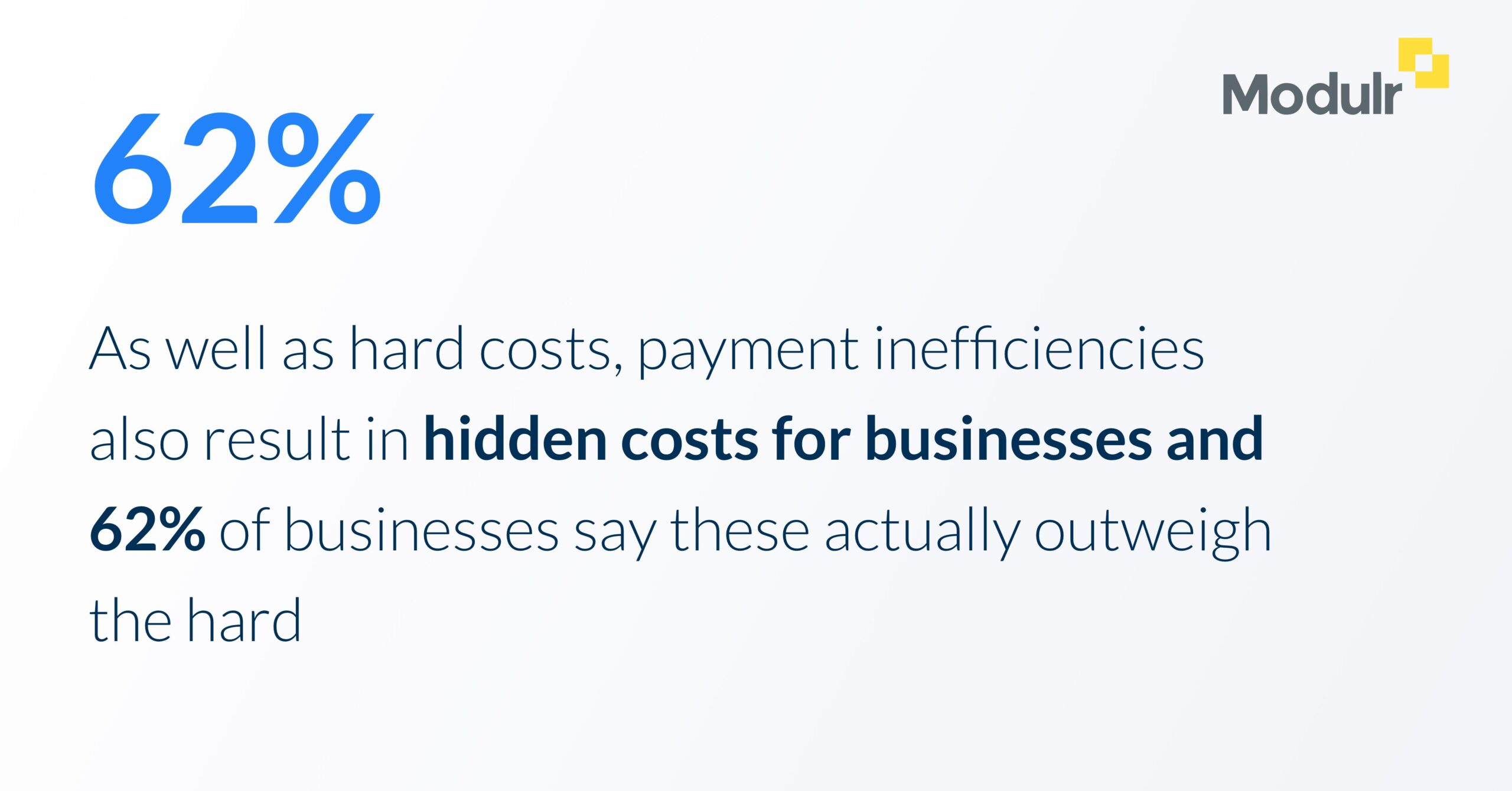

We’ve written a major research report into the true cost of payment inefficiencies, using independent data sourced from over 260 UK business leaders. We explore themes around operational efficiencies, collaboration and ultimately the impact on customer experience.

Tune in to hear Cybertonica Chairwoman Jane Butler’s fireside chat “How to Keep Bias Out of Payments” on the 12th of November at 12pm (GMT). Hosted by the European Women Payments Network (EWPN), this event will explore the impact of human bias on the payments industry.

Entersekt, a leader in device identity and authentication, today announced the appointment of Nicolas Huss to its board of directors.

How is the payment industry progressing towards building a digital payments ecosystem?

London, U.K. (October 5th, 2020) – Bottomline Technologies (NASDAQ: Payments AssociationY), a leading provider of financial technology that makes complex business payments simple, smart and secure, today announced a partnership with Dow Jones Risk & Compliance, that adds key data to Bottomline’s Anti-Money Laundering and Counter Terrorist Financing monitoring and screening capabilities, used to identify and thwart illicit transactions.

Lockdown 2 – Ordo is the safe & free alternative to cash and cheques for the UK’s community of helpers….again

EQ (Equiniti Group plc), the international technology-led services and payments specialist, is pleased to announce that seven of its services, including its payments division EQPay, have been approved as suppliers for the Government’s G-Cloud 12 framework.

Tech partnership making the lives of countless SMEs easier – Ordo and Contis – a match amde in heaven!

London, U.K. (October 5th, 2020) – Bottomline Technologies (NASDAQ: Payments AssociationY), a leading provider of financial technology that makes complex business payments simple, smart and secure, today announced a partnership with Dow Jones Risk & Compliance, that adds key data to Bottomline’s Anti-Money Laundering and Counter Terrorist Financing monitoring and screening capabilities, used to identify and thwart illicit transactions.

Changes to EU Regulations governing DCC and the impact on the payments industry

EML’s new FINLAB incubator has invested in Hydrogen.

Novalnet AG, a full-service Payment Provider, is partnering with Banking Circle, for faster and lower cost foreign exchange (FX) and settlement solutions for its 12,000+ customers around the world. Banking Circle is helping Novalnet to efficiently support its global clientele with local and cross border settlement at competitive rates and with faster reconciliation to help online merchants manage and maintain cashflow.

Allstar Business Solutions has today announced its partnership with major petrol forecourt retailer, Applegreen, that will see another 102 mainland UK fuel sites added to the Allstar network. Allstar fuel cards will now be accepted at all of Applegreen’s mainland UK locations from this month.

EML’s new FINLAB incubator has made its first investment in US FinTech disrupter Interchecks.

The Payments Association have decided to co-promote For Good Causes Christmas campaign. It’s a great opportunity to work together to make a difference. It gives:

UNDER EMBARGO UNTIL 9AM OCTOBER 28 TH , 2020 The Fintech Power 50 launches the Fintech KICKSTART scheme to provide employment opportunities for young people.

GPS technology will power Lanistar’s polymorphic debit card as the fintech challenger seeks to capture the Millennial and Gen-Z market London, UK – 2nd

Early payment discounts: Research from Barclaycard reveals that a Chief Financial Officer’s (CFO’s) leadership style and willingness to invest in their financial and accounting software has a tangible impact on their business’ bottom line.

The London based E-Money solution for global citizens Privat 3 Money (P3) has selected leading anti-money laundering and intelligent compliance software provider Napier, to integrate enhanced transaction monitoring into the core P3 platform.

The adoption of ISO20022 is at the core of a major transformation across the payments industry- find out how Barclays is supporting customers getting ready for it, and the key benefits of the adoption.

EML’s New FINLAB Incubator Will Immediately Benefit Two Disruptive Tech Brands.

PPS, formerly PrePay Solutions and subsidiary of Edenred, has announced that it is powering the first card created by Yolt, the smart money app, following the companies recent launch of its contactless debit Mastercard. This partnership was formed thanks to PPS’ years of experience powering payments cards and Yolt’s desire to expand beyond the confines of the digital space and into the physical one.

Despite having registered over two million users in the UK, Open Banking is still failing to meet its objectives of creating a more competitive retail banking landscape. Moorwand CCO Luc Gueriane and David Monty, Founder of Tell.Money, speak to Bobsguide.

As #emerchants face high market volume and volatility, they will benefit from setting a North Star to focus on customer experience while effectively managing #fraud and #transaction risk. At Cybertonica, we create solutions on our SaaS/PaaS platform to make trust and frictionless commerce safe and secure for businesses and consumers. We know that outdated rules and operations can create almost Kafka-like situations. This happens through false positives and inappropriate rule-action that make consumers unhappy and businesses less profitable. We decided to collect stories from colleagues, friends and people in our network, including our customers and their clients, telling us how their e-commerce experience is going in this period. What we found was that there are both nightmares and nice surprises, but the payment experience is still far from perfect.

The Payments Association challenges the Government’s changes to the payments landscape, alongside its recommendations London, United Kingdom. 21st October 2020: The The Payments Association, which

What is the future of authentication? Many solutions have appeared in the past two decades since online sales and payments were born to secure and verify both the ability to make a payment and user’s identity. In this article, ‘Authentication, Privacy and Our Digital Future’, Cybertonica discuss the history of authentication, the ways in which a users personal data is leveraged, and how behavioural biometrics can offer secure, frictionless authentication experiences while maintaining user privacy.

Currencycloud, the leader in providing B2B embedded cross-border solutions, and Tribe Payments, a tech company dedicated to deliver the future of payments technology across the ecosystem, have partnered to deliver complete transparency to foreign exchange costs charged on international card transactions, whilst also giving customers access to multi-currency wallets.

A panel of industry experts has selected Banking Circle’s SME lending initiative, delivered by Cardstream, as winner of the 2020 Tech Ascension FinTech Award for Most Innovative FinTech Solution.

Global Processing Services Continues International Growth with Visa Investment

Information gathering

Establish a bond with the victim

Exploit the bond

– It’s hard for us to say “no”

– We are trusting

– We like to be taken into consideration

– We are empathetic

Why do we need continuous authentication?

Current ID checks not stringent enough

What is continuous authentication?

A frictionless user experience

Continuous authentication: dynamic fraud prevention that leaves the user uninterrupted

The Konsentus Third Party Provider Open Banking tracker reports on the number of newly regulated Third Party providers being approved to provide services both in their Home jurisdiction and in other countries across the EEA. Our Q3 Tracker reports on the growth of newly regulated TPPs from 30th June 2020 to 30th September 2020.

Fredrik Neumann, Kathy Heath, and Clare Haskins have joined Konsentus in senior leadership roles as Financial Institutions across the EEA embrace Open Banking.

Wayne Mckenzie appointed Head of Business Development by xpate, bringing over 14 years of payments expertise to the up-and-coming fintech

Blue Train Marketing launches new website!

After a few months of hard work and dedication, we are excited to announce the launch of our all-new website https://bluetrain.co.uk/!

Invite to New Economics of Banking Webinar

Mental health problems can affect anyone at any time. Which is why it’s so important to nurture a culture where your mental health comes first.

For #WorldMentalHealthDay Contis launched a week of activities to boost wellbeing and raise money for Mind Charity.

Vizolution and W2 have announced they have formed a strategic partnership to integrate W2’s range of customer due diligence solutions into Vizolution’s customer experience technology suite.

Even though it is hard to put a figure on the potential scale of virtual currency misuse, given the size of the market, it is no real surprise over the concern that unregulated systems could offer the anonymity needed for criminals to use virtual assets to launder their profits. At that point, regulators were duty bound to step in and the EU’s Fifth Money Laundering Directive (5MLD) now means that virtual currency exchanges and custodian wallet providers are subject to the same regulatory requirements as other financial services covered by the preceding 4th directive.

Three in four shoppers (76%) admit local high streets need support while four in five (80%) are shopping with local small businesses as much or more frequently since lockdown lifted, both in person and online

Despite this support, the next three months are crucial to the survival of two fifths (42%) of small businesses

Visa has partnered with grassroots initiative Totally Locally to sponsor Fiver Fest from 10th – 24th October and together they are calling on consumers to divert £5 of their weekly spend to support local businesses in store or online

Small businesses undoubtedly play a significant role in communities across Ireland but they have also been some of the hardest hit by the negative impact of Covid-19. Insights from the “Visa Back to Business” study have revealed that almost 1 in 5 Irish small to medium enterprises (SMEs) believe that their future viability is at risk due to the commercial impact of COVID-19. Despite these concerns, the study also revealed that consumers across Ireland do really value independent businesses in their community with 63%1 of consumers admitting to wanting to support small businesses.

RegTech specialists launch Kompli-Outsource™ to help regulated entities complete comprehensive customer onboarding

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.