6 Key Takeaways from PSR’s Inaugural APP Scams Performance Report

The Payment Systems Regulator (PSR) has published its inaugural APP Scams Performance Report, which presents data from the year 2022. This report aims to provide

The Payment Systems Regulator (PSR) has published its inaugural APP Scams Performance Report, which presents data from the year 2022. This report aims to provide

As retail open banking continues to grow, mechanisms should be put in place to balance innovative products for consumers while ensuring adequate fraud protection.

We are excited to invite you to the Modulr GEN AI Summit, scheduled for Tuesday, December 5th at Scale Space in White City, London. The summit will

Due to a dwindling economy, higher inflation and a cash-starved population, retailers are facing a tough battle from the standpoint of acquiring new customers or

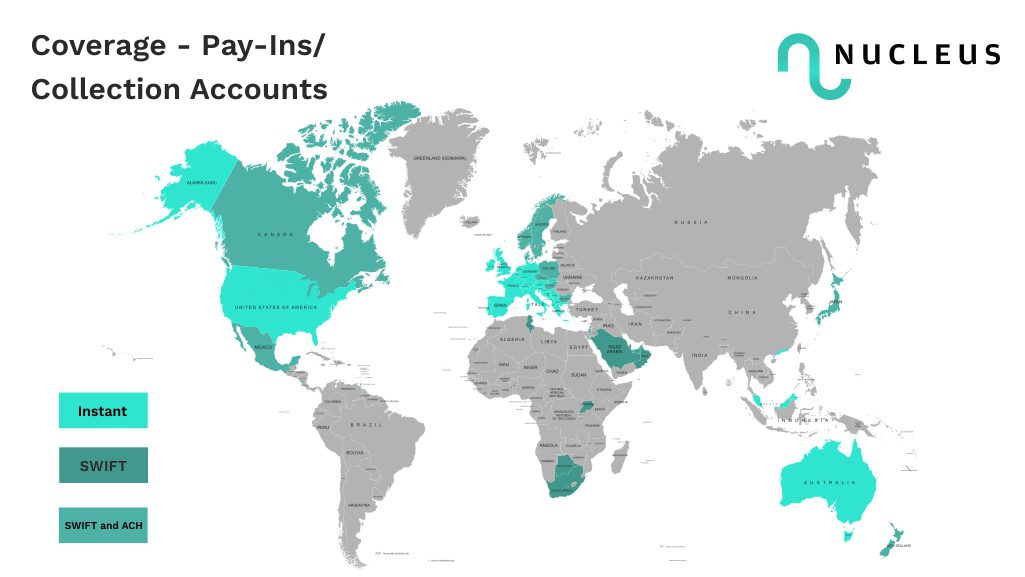

This addition to the Nucleus365 platform unlocks global payments with over 92 licences supporting operations in 30 different currencies, enabling merchants across the globe to

Projective Group, a leading Financial Services change specialist, has today announced it has partnered with The Payments Association, an international payments community that aims to

Can FI’s look beyond transaction data to uncover the true picture of risk? ComplyAdvantage’s research revealed that payment screening teams continue to grapple with siloed data sets and disparate systems. And yet, as the financial crime landscape grows more complex, the need to connect fragmented data sets to understand the global networks behind financial crime has never been more important. ComplyAdvantage’s Iain Armstrong give his top tips for integration success in payment screening.

The financial industry is experiencing a seismic shift, fueled by the advent of artificial intelligence (AI) and open banking. Far from being isolated phenomena, these two revolutionary forces are converging

ARYZE, the leading Web3 financial technology company, announced the launch of reForge, a function built-in to the Digital Cash suite of stablecoins. reForge supports seamless

Asia is the largest and most populous continent in the world, home to more than 60% of the global population – some 4.56 billion people.

Today, The Payments Association head of policy and government relations, Riccardo Tordera attended the release of Visa’s report, Payments: Putting customers first at the offices of EY.

At Starling Banking Services, we want to help financial services thrive. By providing organisations – FinTechs, credit unions, insurance dispersers, investment companies, and point of

The Bank of England (BoE) and the Financial Conduct Authority (FCA) have taken a significant step in addressing the rapid growth of stablecoins and related payment services in the financial sector by publishing its proposed regulatory regime.

The flagship store of luxury pharmacy John Bell & Croyden is transforming shopper experiences with the installation of new checkout & inventory management technology from Trust

Trust Retail, part of the Trust Payments Group and one of the UK’s leading EPOS suppliers has teamed up with the fastest-growing home delivery app

Guy W. Lecky-Thompson, head of products & processing services at Trionis explains why ATMs still have a prominent role in the future of the payments industry.

The Payments Association is pleased with the declaration released from the recent summit on artificial intelligence (AI) at Bletchley Park, which saw global leaders, tech executives, and academics address the challenges and advancements of the technology.

With over 50 leading brands including Aldi, Asda, Ikea, Primark, Amazon and Currys, HyperJar’s innovative service offers up to 15% cashback Alex Preece, CEO and

Tony Petrov, chief legal officer at Sumsub, summarises the rules incorporated in the EU Artificial Intelligence Act (EU AI Act) and how they might impact on the industry.

In this webinar, Bottomline, HSBC and Swift will discuss the current status of the ISO 20022 migration and what Banks and FIs should focus on

The transition to real-time payments is well underway. AutoRek global payments manager, Nick Botha, explains why those who prepare and adapt now will be better poised to become a leader in the world of real-time payments.

The Payment Systems Regulator (PSR) has published its report detailing the latest data on the pressing issue of APP fraud scams.

Sumsub, a full-cycle verification platform, releases its ‘State of Verification and Monitoring in the Crypto Industry 2023’ report. Polina Uzhva, partner marketing manager, Sumsub, provides a summary, focusing on the regulations and verification practices for crypto companies, with highlights from verification performance and identity fraud statistics.

The UK government has taken a significant step towards clarifying its stance on the regulation of cryptoassets, digital settlement asset firms, and fiat-backed stablecoins by publishing key documents outlining their responses to recent consultations.

In a digital age where immediacy in payments is crucial, understanding the challenges and opportunities in real-time systems is paramount. As industry leaders, we’ve compiled

Having a good credit score is life changing. For many, it can open the door to opportunities they would never have been able to access

Baringa were thrilled to attend Sibos this year. The four days of content covered everything from geo-political and financial headwinds, global payments modernisation, T+1 settlement

Eduardo Martínez of Toqio outlines why embedded finance has become an essential component of developing systems and providing customer satisfaction.

Sumsub, a full-cycle verification platform, today releases its “State of Verification and Monitoring in the Crypto Industry 2023” report. The findings focus on the regulations

Confirmation of Payee (CoP), initiated in 2017 and launched in 2020, has proven to be an effective tool against Authorised Push Payment (APP) Fraud in

Banks and FIs need to take advantage of the opportunity to compare their strategic priorities, product roadmaps, and plans for future innovation with their peers.

Headline: Too legit to quit: Crypto is going mainstream, whether we like it or not By Dima Kats, Founder and CEO, Clear Junction For thousands

Join Head of Market Insights Steve Dooley as he shares a taste of the 2024 edition of Convera’s annual flagship report to help businesses navigate

From high inflation to rising interest rates and geopolitical uncertainty, the global trade landscape is as complex as ever. As 2024 approaches, how can your

The FCA recently published its latest guidance on detecting and preventing money mules. This came off the back of the national Economic Crime Plan 2 and Fraud Strategy that has been introduced to focus on disrupting money mule activity.

The Payments Association’s George Iddenden sat down with Intellias senior vice president and global head of sales Olaf Baunack to discuss how his company helps financial services firms use ecosystems to their advantage.

Christien Ackroyd explains how the ethical grade concept works, covering best practices, benefits, and which banks are getting it right.

American Express releases new research revealing that UK businesses are investing in modernising their payment systems to boost efficiency and protection against fraudulent activity. The

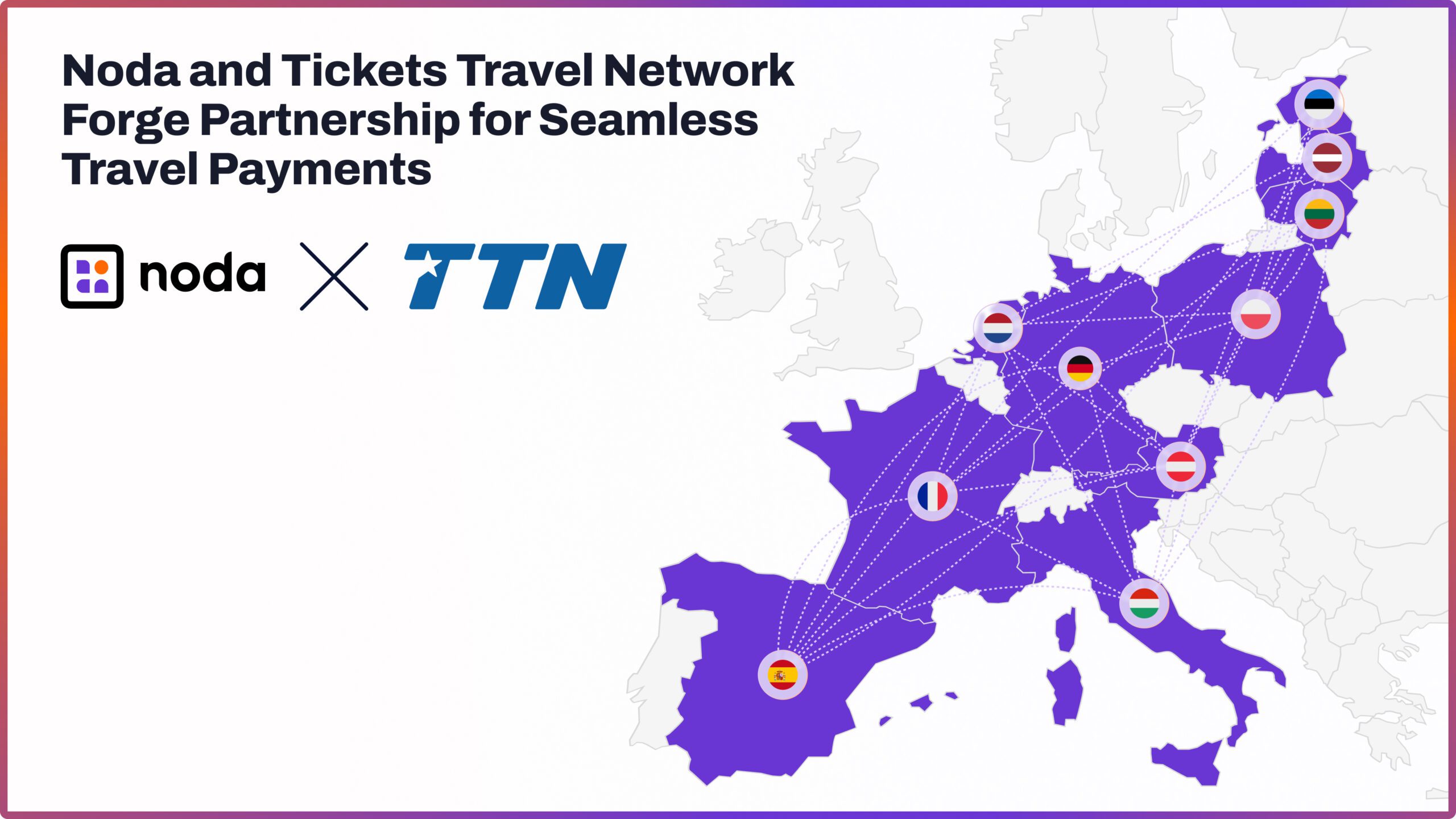

The partnership enables streamlined payment processes across multiple European destinations, with a focus on delivering convenient and efficient payment solutions to travellers. The global open

Richard Dunlop of fscom summarises the major points of the 2023 Financial Crime Compliance Report and highlights key issues in anti-money laundering strategies that have been identified.

This month is Attention deficit hyperactivity disorder (ADHD) awareness month, so it seems fitting to talk about how feature-rich banking products can make a huge difference for

Jonathan Tyce speaks to Nexi’s Tommaso Jacopo Ulissi on how the paytech firm is driving innovation in the sector and what this could mean for the use of digital currencies.

What is SRE? Google introduced Site Reliability Engineering (SRE) in 2003, and it gained widespread recognition through their 2017 publication. SRE encompasses various methodologies, tools,

In recent years, blockchain has evolved and played an important role in technology optimisation, security, and transparency. Blockchain is not just a cryptocurrency and bitcoin; blockchain has the potential

The emergence of Web3 is just one of the technological evolutions that could be pivotal, which is why banks and payments firms need to start now to understand its core values.

Decentralized finance experts discuss how the technology could accelerate and shape the next generation of payments As the outsized hype of decentralized finance (DeFi) from

Pavlo Khropatyy explains how banks should embark on the journey of digital transformation, keeping their customers firmly at the heart of their strategies.

With big tech entering the banking space, payment firms need to be at the forefront of changing the ‘software sabotage’ culture to ensure consumers and those in the supply are protected as well as reducing e-waste.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.