2021 Malware Trends

– Introduction

– Evolution of Ransomware

– Beyond Windows

– Financial and Banking Sector

– Vulnerabilities and Malware

– Conclusions

– Introduction

– Evolution of Ransomware

– Beyond Windows

– Financial and Banking Sector

– Vulnerabilities and Malware

– Conclusions

– The Now: Rise of digital banking to cause further online banking fraud

– The New: Increase in new account fraud

– How can we stop these types of attacks as we enter 2021?

– Conclusion

If your goal is to service the largest percentage of market users, respect must be given across all accessibility levels. But what is a reliable solution for non-smartphone users? In this post, we review our remote dial option as a reliable PSD2 SCA fallback.

Bottomline and Strategic Treasurer release the results of the 2021 Treasury Fraud & Controls Survey. This is the 6th annual survey between the long-time collaborators, whose research partnership also includes the annual B2B Payments Survey.

We have spoken a lot about strong customer authentication (SCA) over the past year. However, the regulation has technically been in effect since mid-September of 2019. Now well into 2021, it is time for all European countries to fully enforce the updated SCA regulations. Let’s take a look at some of the deadlines.

Close to a quarter of a million people around Ireland received a Perx Reward from their boss while working from home last year.

Okay wants to make the payment process as smooth as possible, specifically when it comes to customer authentication. While this is just one part of the payment process that can introduce friction, it is often where checkout abandonment occurs. In this post, we’ll try to describe some of the options that we’ve seen in the market regarding frictionless payments, including their strengths and weaknesses.

One of the great innovations of the modern age is the ability of eCommerce to connect businesses, merchants, and consumers all across the world. Not only has this opened up new opportunities for businesses and consumers alike, but also it has expanded the realm of what is possible for small and medium enterprises on the global stage. And here we start with the interesting part of the current topic.

The global economy is expected to begin the process of recovery from the 2020 pandemic throughout 2021 and an integral part of that will be the payments industry as well as virtual IBANs and digital banking.

Analysts see five major trends on the horizon for 2021 in how things will change for the payments industry and digital banking services including enhanced automation to more robust identity verification as well as an authentication technology.

Over the last few years, Okay has gone through both security certifications and penetration testing. While they represent two uniquely different processes, each has greatly improved our product’s security, code quality and architecture. In this post, we discuss the importance of each, as well as what we’ve learned along the way.

Now, in 2021, and with the Brexit negotiations in their rearview mirror, the EU market is looking to digital banking solutions to help address problems of inequality, sustainability, and supporting a circular economy.

Indeed, the future of the market in Europe is not only digital but digital banking, in particular, will play a huge role in bringing about the social transformations and member-state cohesion needed to build economic resilience and growth for the future.

What are some of the major forces driving the corporate banking digitization process? What are the factors and trends behind some of the most seismic moves in recent years in this otherwise quite conservative industry? What are the main key-topics we should have on our radar in order to stay ahead of our business competitors and be the first to learn what would be the next

“big thing”?

Not only is the extension of digital banking services and digital payments solutions integral to the growth of mobile and online marketplaces, but also it is central to the monetary revolution taking place right now with cryptocurrencies and the rise of a cashless economy. We have identified three major movements in digital banking that could shape how the next several years play out, from enhanced payments processing to the integration of new consumer blocks into the financial system.

Will our smart devices be able to implement the necessary security measures to keep up with an ever-increasing digital marketplace? If so, which ones will reign supreme? In this article, we reflect on an age-old question of iPhone vs Android device, well worth considering by all financial industry players, big or small.

Radar Payments launches Tap to Phone, making it easier for sellers to use their mobile devices to accept payments and offer enhanced customer experience.

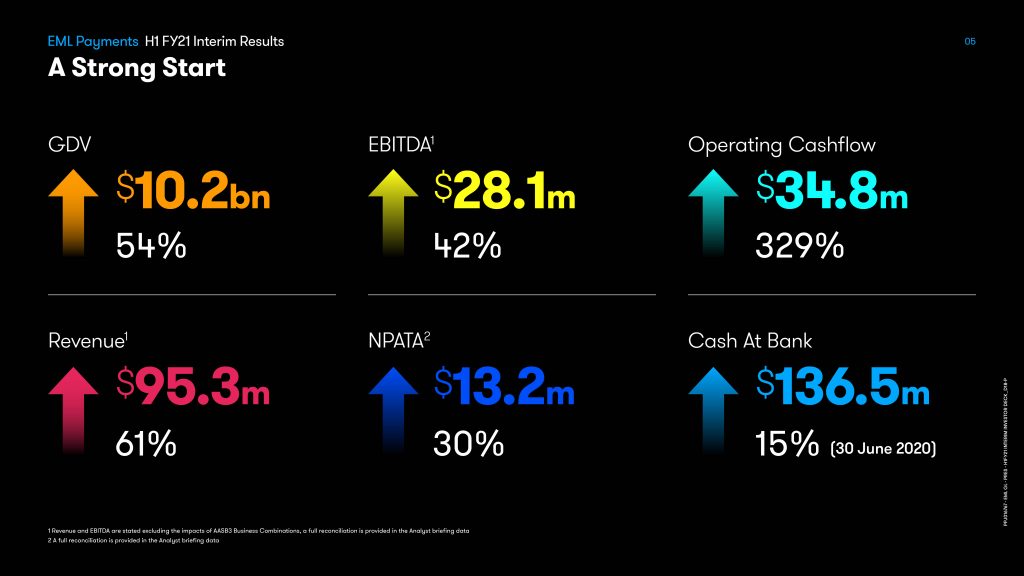

EML Payments Limited (ASX: EML) is pleased to release its FY21 Interim Report.

Beam launches new service, to bring instant and secure payments to WooCommerce merchants via Open Banking. Leveraging Nuapay’s payments platform, Beam is aiming to help UK businesses save £100k over the next year.

The partnership enables Beam to provide Open Banking payments to its clients on WooCommerce – the open-source e-commerce plugin for WordPress – bringing online and omnichannel retailers the benefits of faster, more secure and cost-efficient payments.

Rob Shore, Group CFO at EML, is very excited about the company’s 3-year Accelerator strategy.

The rise in technology companies looking to help us make better decisions in our finances has created a host of so-called FinTechs emerging into the market. But what is the right solution for you?

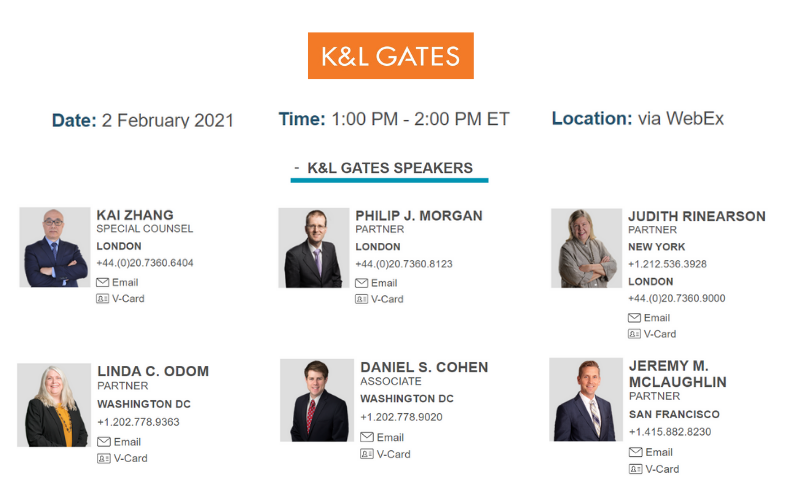

Join us for a cross pond webinar focusing on the enormous changes that are expected to impact payments in the US and UK featuring:

•In London, new K&L Gates Special Payments Counsel, Kai Zhang, and Partner, Philip Morgan.

•In New York, Partner and Global Fintech Co-Chair, Judie Rinearson.

•In Washington DC, Partner and Technology Law Specialist, Linda Odom, and Associate, Daniel Cohen.

•In San Francisco, Partner, Cryptocurrency and Fintech Lawyer, Jeremy McLaughlin.

Topics to be covered include:

•Expected changes to be implemented by the new US Democratic administration

•New leadership in the CFPB, SEC, OCC, and CFTC and what it means for banks and Fintechs

•UK and the implementation of Brexit with respect to payments and banking

•Anticipated changes in providing payment services to the UK and Europe

•The outlook for Fintech investment, Mergers and Acquisitions in the next 12 months on both sides of the pond

•What products and services are the winners and losers from these sweeping changes? Mobile apps? Traditional banking? Digital assets, stable coins and cryptocurrencies?

Every business from sole traders to large corporations are always on the lookout for ways to save time and money.

With the big banks’ monopoly on providing financial services now broken by FinTechs and new players in the Open Banking space, the choice of alternatives has never been more exciting – and maybe a little confusing for newcomers.

Leading European Banking-as-a Service and payments provider, Contis, is delighted to announce its partnership with Pin4, an international fintech pioneering access to cash. This collaboration will enable account holders to access cash via their mobile phones which they can instantly collect at any enabled ATM, including any of 12,000 Cardtronics ATMs across the UK, without the need for a card or pre-registration.

New data from Open Banking pioneer Nuapay, powered by Sentenial, has revealed that consumers are frustrated with the user experience when making card payments online. This follows recent findings that highlighted a raft of payment card security failings. The news comes as retailers ready themselves for the busy festive shopping season – an event that is even more important this year as businesses seek to plug pandemic losses.

2020 saw significant growth in digital payments with the pandemic as one of the key factors. Covid 19 and shifting consumer behaviours steered the move toward contactless options and Open Banking for a safe, efficient, and contactless alternative to traditional payment methods.

Discover how Account to Account payment providers like Nuapay have worked to enable seamless recurring payments for businesses to deliver a faster and more frictionless experience for their customers.

Explore key trends including subscription models powered by recurring payments and QR codes which are fast becoming a mainstream payment method.

Digital banking is not only the future of banking but also it is allowing for new business segments to emerge and for smaller companies to compete on a more level playing field with major competitors. We’ll explain what they are and how they are making such a massive impact on the financial landscape of today.

The COVID-19 pandemic is changing the way businesses conduct themselves online as well as customer expectations about what they can do. In other words, shopping has moved from the retail space to anywhere a consumer has a smartphone and digital banking is among the greatest business innovations that have enabled this brave new world.

Disruption is a buzzword that is often bandied about in the media for one reason or another but rarely do we take time to consider what it actually means in the marketplace.

To watch that in action, we need only look as far as banking and how banking as a service, or BaaS, is changing the landscape of the once-staid financial industry forever.

Visa and Conferma Pay announced a strategic partnership to launch Visa Commercial Pay, a suite of B2B payment solutions, to help improve cashflow for businesses and eliminate outdated manual processes.

Miroslava Betinova, Head of Strategic Sales at PPS, discusses the trends we’ll see in the fintech industry this 2021.

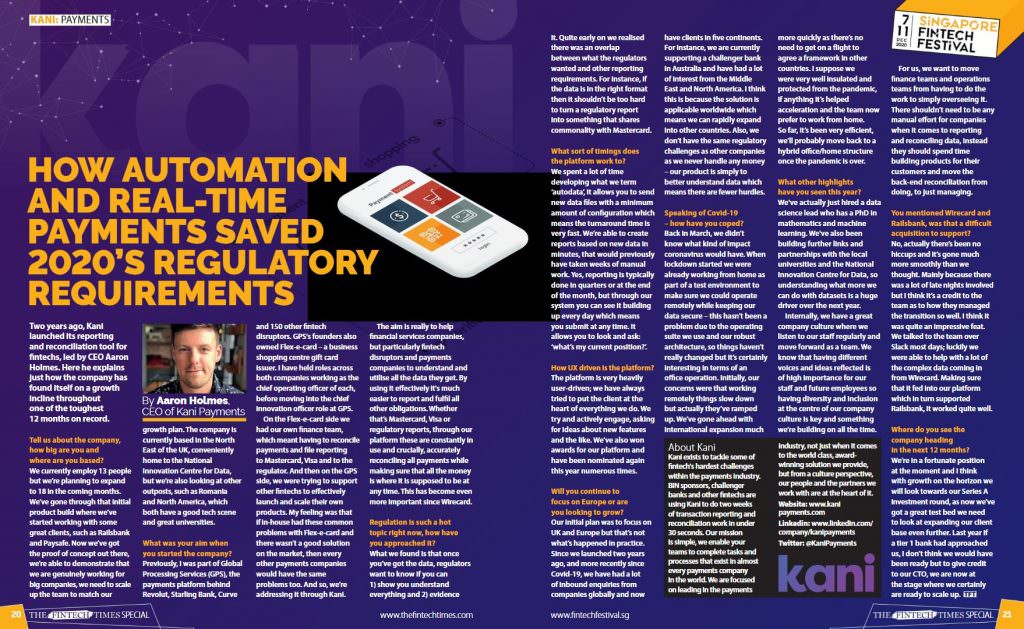

An interview with Kani CEO Aaron Holmes

– Trust

– Safety

– Building trust and safety using behavioral biometrics

– Preventing fraud and maintaining mutual trust

– There has been an increase in fraud seeking to circumvent payments security

– Behavioral biometrics took steps towards becoming a foundational cybersecurity technology

– Fraud prevention in 2021 will become as much about response as detection

EML CEO Relishes Marching To The Beat Of A Different Drum in 2021.

The rise in cloud-based technology has paved the way for a whole new industry, fondly known as Software as a Service (SaaS). This global industry has resulted in a number of small businesses ‘accidentally’ importing goods from abroad, which can result in hidden foreign exchange costs.

A gift card isn’t just for Christmas, it’s handy for a crisis too: reflecting on the small things making a huge difference

Merchant dispute technology specialist, Chargebacks911, is driving its ambitious growth plans in the Asia-Pacific (APAC) region with the appointment of its new Director of Business Development, APAC – Jia Min Tan.

Being based in Singapore, Jia Min will help facilitate the growth of Chargebacks911 and Fi911 (its new brand for financial institutions) in APAC, while bridging any language barriers that may be encountered in the region.

The future of global commerce could be a cashless society, many experts predict, and that puts the burden on financial institutions to make sure their customers’ data is secure and protected.

As digital banking rises to replace the more traditional industry, one phenomenon has arisen hand-in-hand with it and that is the use of biometric technologies.

The rise of digital banking has taken the traditional financial sector by surprise and for many good reasons. From pioneering the art of customer service online to using artificial intelligence to handle many of their operational tasks, digital banking is not just a glimpse of the future of finance. It is a peek into the future of the world of business itself.

The fast-changing world of digital business is one in which staying ahead of the competition is often as much about thinking outside of the box as it is anything else.

But that’s much harder than it might seem at first glance, especially for firms in highly-competitive environments.

– Introduction

– GDPR and behavioral biometrics – what can’t be seen, can’t be stolen

– PSD2: A smarter way of customer authentication

– SCA

– Malware

– Maintaining customer trust and safety

The COVID-19 pandemic is nothing less than an inflection point for the global economy. From this point on, people will discuss business in terms of pre-COVID-19 and post-pandemic, and for good reason.

The global pandemic has initiated changes in the global supply chain that were slowly developing before but that are now becoming more prominent features of the landscape. Not only are companies pulling resources in towards the home base, but also they are recentering their businesses for the digital landscape.

– Introduction

– What happens if a fraudster has already infiltrated a bank’s system and is operating undetected from within?

– Fraudster Hunter’s Policy Manager

– Rule-based fraud prevention campaigns

– Key benefits of Policy Manager

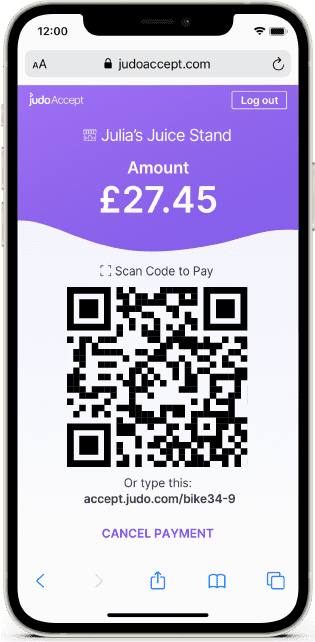

Judopay has launched its integrated payments offering, JudoAccept, that will help SMEs maintain safety and social distancing measures at the checkout as highstreets reopen.

JudoAccept totally removes the need for interaction with any sort of payment terminal by allowing businesses to use smartphones and tablets to present the customer with a QR code that can be scanned by their devices at a distance.

Removing the need for costly payment terminals, integration resources and development time, JudoAccept also presents companies with a cost-effective alternative to usual payment methods as they operate in the current economic downturn. It can also be used can also create and send payment links for items such as takeaway food, taxi fares, invoices or utility bills.

At Consult Hyperion we always round off the year with some time reflecting on what has been, and kicking off our thinking for what’s ahead. This is our Live 5. Readers over the years will know our Live 5 traditionally takes market insight, coupled with research and conversations with our clients; then we consolidate our thinking and detail four short- to medium-term trends and one that’s perhaps not as obvious, or maybe a little further out. When we reviewed previous years, we’ve been a pretty good weather vane. 2020 has been a year like no other, so our Live 5 is taking a slightly different approach. If 2020 has taught us anything, it is that the best laid plans can be rendered irrelevant by a “black swan” event.

Taxi Companies in Scandinavia Go Contactless and COVID-safe with HIPS Payment Group’s QR Payment Solution, a First for the European Market Solution supports current trend towards contactless payments HIPS launches

A discussion with Fintech Finance about Kani and Railsbank’s partnership – from automation and innovation to how partnerships are key to the fintech industry as a whole.

Elemental.io and Flash Labs Corporation—of Big Sun Holdings Group, Inc., and a member of Hyundai BS&C family of companies—today announced a strategic partnership and joint venture to advance software development, distribution and availability of consumer credit, using financial technologies in Latin America and Asian markets.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.