ISO 20022 drives payments transformation

The ISO 20022 messaging format isn’t new. But it is on the cusp of what is arguably the most urgent and relevant period in its existence – as it becomes widely adopted in the payments industry.

The ISO 20022 messaging format isn’t new. But it is on the cusp of what is arguably the most urgent and relevant period in its existence – as it becomes widely adopted in the payments industry.

Expect open banking to become a more global conversation in 2022. According to Bottomline General Manager and Director, Payments Ed Adshead-Grant, in the UK Open Banking will pick up increased adoption among businesses and consumer communities.

Blue Train Marketing’s latest article, written by Bethany Pegram-Mills, outlines the key benefits of event marketing and what attending events can do for your business.

Interview by Global and US publication, Green Sheet.

Holmes went on to say that Kani’s platform has reconciled more than €8 billion in processed payments volume while helping payment providers and fintechs organize data across multiple processor, card scheme and issuing relationships. It can be challenging to turn disparate data sources in varying formats and raw files into actionable reporting, he stated, adding that global privacy laws can also slow the process, and manual reports can take weeks to complete.

EML and Correos are thrilled to further their eco commitments in Spain by planting 15,000 trees with Mastercard.

Chargebacks911, a post transaction fraud platform, is working with Microsoft to launch a new fraud protection solution for financial institutions that identifies and combats fraud with the use of integrated data and adaptive artificial intelligence (AI) technology.

Join ECOM21 on April 8th 2022 to look into the future through the lens of expertise – insightful speeches and eye-opening workshops that will help your business achieve more.

In a big step for Tink in the Irish market, we’re joining forces with postal giant An Post to give its customers the power to better manage their money. With the An Post Money Manager app, users can keep track of their spending and set achievable savings goals.

EML’s loyalty proposition for gaming operators creates revenue.

Buy now, pay later (BNPL) programs

have risen in popularity thanks to the

ease of use, flexibility and mutual

benefits for consumers, merchants

and BNPL providers.

Now, the BNPL surge is also impacting

the credit market. See how much you

know about BNPL, and how you can

turn the current popularity into a strategic advantage.

Spotlight Report: The Paradigm Shift Towards Growth

Benchmark your strategy against the global leaders in payments

VIXIO’s latest survey of 100+ payments executives has shown a big shift in priorities. Businesses are moving from firefighting to capturing and capitalising on new market growth.

Get your copy now to get unique insights on how they plan to accelerate market growth and identify new opportunities in 2022 while dealing with the many market threats to their ambitions.

Download here: https://bit.ly/VIXIOPCOutlook

2021 was a rollercoaster of a year for eCommerce merchants. With consumers increasingly turning to digital platforms, businesses need to strengthen their fraud security measures in the wake of increasingly frequent fraudulent attacks. Learn what eCommerce fraud trends your business should keep in mind this year.

DiPocket, a leading Corporate Disbursements and Payment Solutions Provider, is improving customer access to Faster Payments through its new partnership with tech-first Payments Bank, Banking Circle. Utilising Banking Circle Virtual IBAN for both company and client fund accounts, DiPocket will provide its customers with access to Faster Payments and SWIFT, with improved systems availability to bypass the operational issues experienced with other partner banks. It will also be using Banking Circle for SEPA EUR payments.

An insight into Manifestos take on Customer Experience (CX), drawing upon best in class examples and highlighting the factors that make a successful customer centric business.

In computing, the ability to isolate processes and the resources those processes can access has been a remarkable feature, making software solutions more secure than they used to be. Of course, this concept of isolation is not new. It has been around for a while, with applications standing the test of time by providing continuous outstanding security benefits to users of computing devices. In this post, as a homage to such technology, we will discuss how virtualisation and sandboxes have provided sound isolation on computing devices.

Buy Now Pay Later (BNPL) is racing into 2022 firing on all cylinders, and according to Insider Intelligence, is expected to keep growing at pace and will reach $680 billion in transaction volume worldwide by 2025. The promise of impending regulation, and the need to balance oversight with consumer protection, will see the emergence of new innovative solutions and business models. As competition heats up and new players enter the market, banks will naturally get in on the action to protect their market share.

Let’s look at four trends that will disrupt the BNPL industry.

Fintech companies are often flush with talent, but it’s their business environments that ultimately dictate their success. You could have all the right pieces in place, but if they don’t mesh or they aren’t equipped to address adversity, it won’t matter. That’s because team resiliency is not inherent — it must be cultivated, starting from the top down.

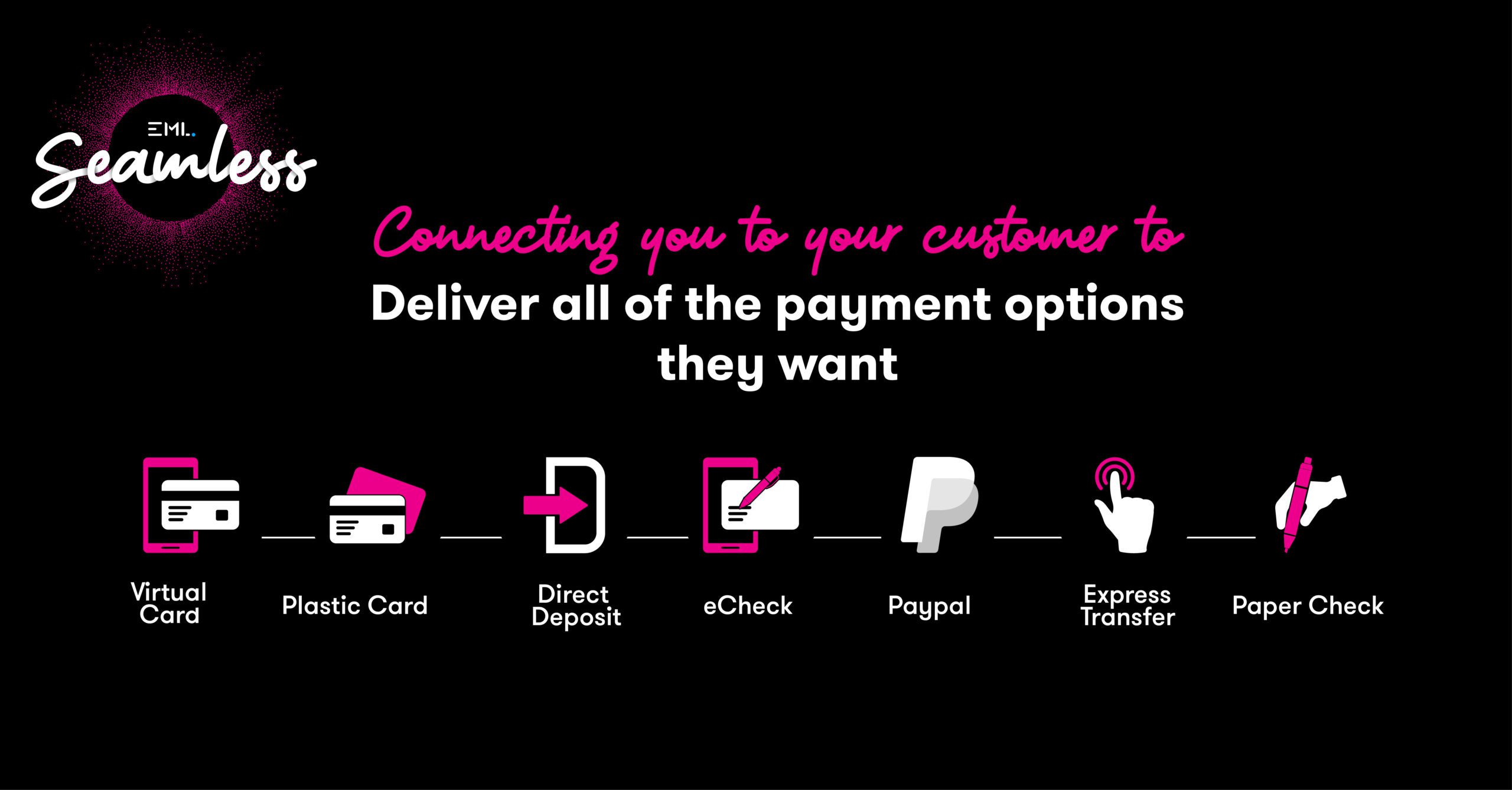

Seamless from EML enhances the customer experience with instant refunds or disbursements.

Driven by the COVID-19 pandemic, the battle for talent is increasing for companies and organisations – forcing them to rethink their recruitment and retention strategies. In this session – the first of two webinars focused on ‘The Great Resignation’ – Banking Circle and industry experts discuss how recruitment is changing within the current landscape, whether the power really is shifting from employer to employee, and what financial services businesses should be doing to ensure that they attract the best talent.

Following Transact365’s recent entry into the Indian market, they are now expanding their coverage and able to provide payments solutions in Latin America. The move enables cross border and local e-commerce transactions through bank transfers and a large number of local payment methods.

Hi there,

We are trying to promote our Cards Week on-demand content that we produce last December with experts such as Visa, TagNitecrest and Zumo and I was wondering if you could help us promote our landing page: https://landing.modulrfinance.com/cards-week-2022-mb

All details are above and I have attached 2 social images that you can use but please let me know if you have any question 😊

The global fintech will enable full ecommerce payment transactions for the first time.

The EML powered CoinJar Card represents a defining moment for the U.K.’s crypto space.

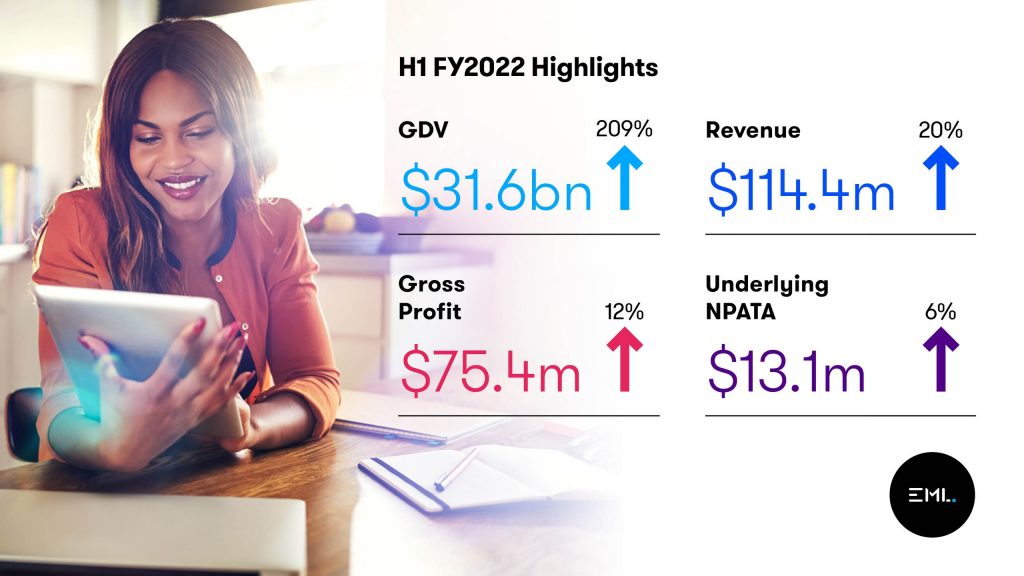

EML releases record-breaking Interim Results.

Chargebacks911, the first global company fully dedicated to mitigating chargeback risk and eliminating chargeback fraud, today announces the appointment of financial services and sales expert, Robert Hoover who takes on the role of Vice President of Business Development, concentrating on Chargebacks911 strategic merchant accounts.

BCB Group, Europe’s leading provider of business accounts and trading services for the digital asset economy, today announced the launch of BCB Yield, a product that lets customers earn a return on both fiat or crypto funds.

Ethical bankers are one of the fastest growing financial tribes in the world, with some of the loudest voices. How do banks continue to innovate to meet customers evolving demands and also engage and attract the emerging financial consumer segment of ethical bankers?

Swiss neobank Entris Banking has selected US fintech Bottomline for its SaaS-based payments platform. Entris Banking acts as a transaction bank and payment hub to more than 40 small and mid-sized banks in Switzerland.

Full reserve stablecoins will revolutionise the stablecoin market. ARYZE Digital Cash is the closest thing to a CBDC without it being issued by a central bank. Learn more about how ARYZE is planning to revolutionise the entire payments industry, using their full-reserve stablecoin as a main component of this worldwide strategy.

The Ordo Open Banking payments platform already supports white label billing, paying by instalments, QR code PoS and eCommerce.

New for 2022 is Enhanced Account Verification and Variable Recurring Payments.

FLEETCOR UK today announces that it has made a follow on investment into Mina, the cloud-based digital software platform that simplifies home charging and payments management for commercial fleets with electric vehicles.

The exponential growth in e-commerce and the impact of the pandemic have fuelled the rise of ‘Buy Now Pay Later’ (BNPL), making it one of the biggest retail trends in 2021. This is set to continue in 2022, with new players entering the market and new partnerships and acquisitions being established.

BNPL has largely been driven by consumer appeal, easy availability and the promise of no interest and no fees – if payments are made on time. It is popular across all demographics for different reasons but has especially gained traction among millennials and Gen Z consumers as a means of financial empowerment. For consumers, it provides an easily accessible method of borrowing, instant gratification, a flexible returns policy and the ability to manage finances by spreading the cost of purchases over an agreed period.

This book provides an overview and practical examination of key areas of payments law and regulation in the EU and UK, as well as introductions to analogous legal regimes in the United States, Hong Kong, Singapore and sub-Saharan Africa. It is an important resource for lawyers and compliance officers in the payments sector. For more information go to https://www.e-elgar.com/shop/isbn/9781839107979

PAYMENT’S disruptor DigiDoe has won a place on a prestigious scale-up programme backed by the Major of London, which will help the London-based startup expand internationally. It comes as DigiDoe’s co-founders closed the second tranche in an initial institutional investment round with just under £1m in fresh funding. It gives the business a 12-month runway to develop its proprietary software, hire key personnel and expand in to Europe and the US.

Until recently, banks didn’t need to change, until the digital evolution unfolded and customers began to expect innovation and immediacy.

It’s natural for banks and fintechs to view one another as competitors. However, a partnership between these two types of entities unlocks immense benefits.

The global pandemic has caused an acceleration in the adoption of new payment methods such as BNPL and Crypto but to what extent depends on geographical region.

Crown Agents Bank: Transforming Cross-Border Payments through Digitalisation (Podcast)

New paper advocates for closer public-private collaboration to advance exploration of a digital currency in the UK, before a real-world pilot of ‘digital pound’ (dSterling)

Virtual IBAN and corporate account provider Monneo, has formally announced its partnership with Kantox, a global leader in currency management automation software. The partnership will give Monneo’s customers additional flexibility when managing outgoing payments.

allpay Limited are delighted to have been awarded a contract by Herefordshire Council for the delivery of its Shop Local campaign.

The Hereford-based company secured the contract following an open procurement process to produce prepaid cards – keeping the council’s own spending within the county. As part of the £1.35 million project, every household in Herefordshire can apply for a prepaid card before January 31st 2022, loaded with £15 to spend as part of a major campaign to help the county’s local and independent traders.

When considering the top examples of disruptive technology set to transform businesses in 2022, the metaverse and blockchain no doubt rank high in the minds of most people. While these technologies will have a profound and enduring impact on society, we should not let this overshadow the impact certain B2B platforms are having in actively transforming businesses. Global payment gateways and payment services providers (PSPs) are deploying new payment technologies to ensure merchants can access new markets once considered out of reach…

Biller, an AI-driven Buy Now Pay Later (BNPL) company focused on business invoices, is set to join the Banking Circle ecosystem of financial services and applications. After closing of the acquisition, Biller will operate as an independent sister company in the Banking Circle ecosystem.

ECOM21 Conference, organized by our esteemed Payment Organisation member DECTA in collaboration with Deloitte and Mastercard, is back!

Don’t miss a chance to #MeetDECTA and others at ECOM21 on 7-8 April 2022 in Riga, Latvia.

By using our gateway solution, merchants can now access new opportunities in India without having to form local payment partnerships or establish an Indian company. This move ensures merchants have access to over one billion Indian-based consumers enabling them to pay faster in a familiar way.

This launch in India is the first in a series of big market expansions planned for 2022. Having already expanded into Europe, Asia and Australia, our payment gateway system ensures merchants of all sizes and sectors can access fast-growing markets seamlessly and quickly.

Nium and FINCI announce partnership to strengthen payment services internationally

The partnership will enable FINCI to provide quicker and more cost-effective pay-outs to key markets in Europe and APAC

Nium, a leader in global payments and card issuance for businesses, today unveiled its predictions report for 2022, examining the latest trends in regulation, crypto, travel, and global payments.

Explore Nium’s seven predictions across three key areas including:

Regulation: Regulators are taking notice of new payments methods such as cryptocurrencies and Buy Now, Pay Later methods

Travel: As travel returns to pre-pandemic volumes, the industry will look to fintech to drive revenue

Global Payments: New technology infrastructure is the emerging theme across major industries; payments particularly will transform to cater to evolved consumer behavior.

All financial services firms in the UK are required to carry out risk assessments for Anti-Money Laundering (AML) and Countering Terrorist Financing (CTF). Yet a survey of AML audits reveals that some firms do not have risk assessments, and many that do, fail to record the rationale they adopted when arriving at their risk assessment.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.