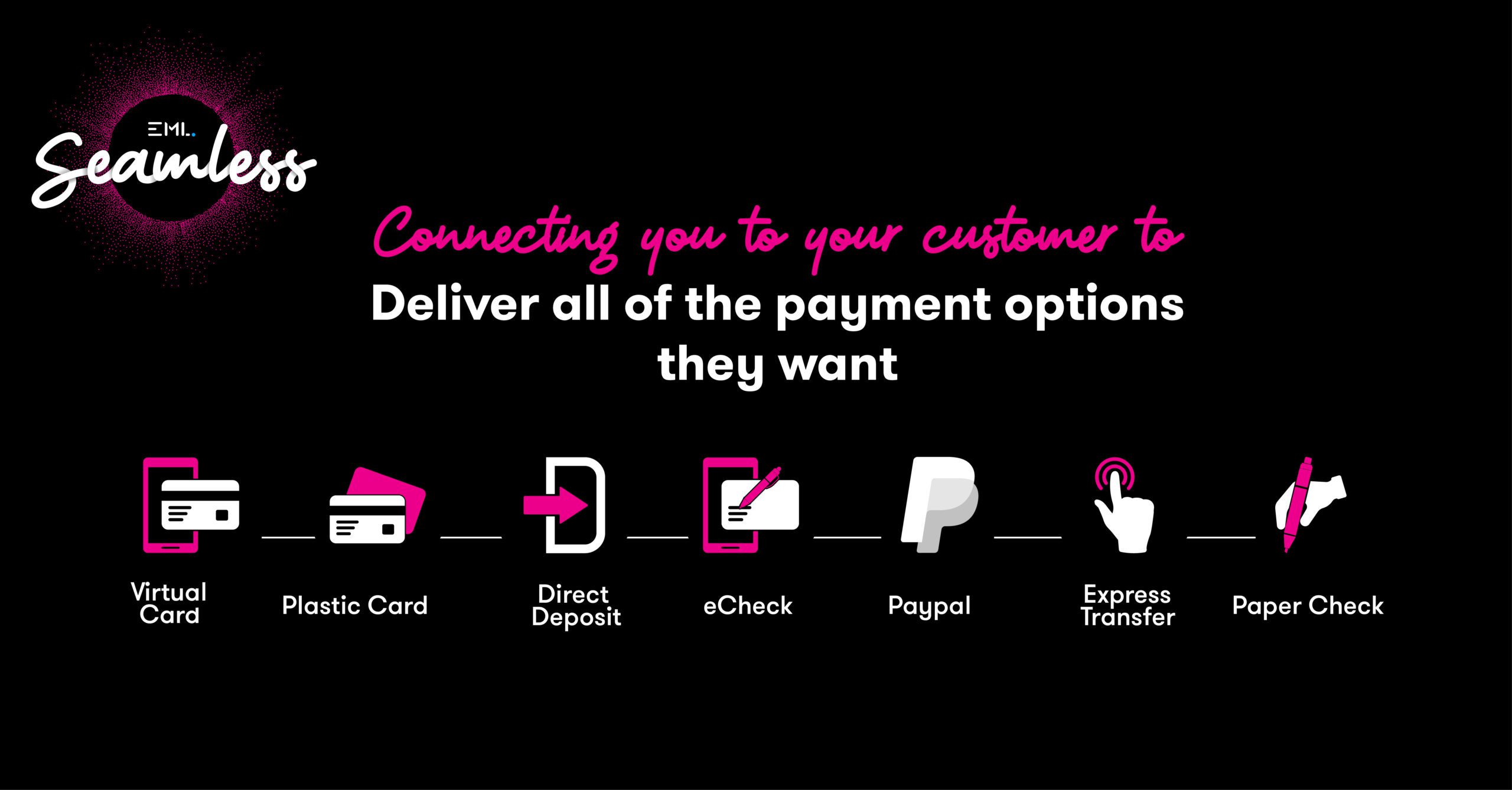

EML Launches A Radically Simple Digital Payout Platform – Seamless

Seamless from EML enhances the customer experience with instant refunds or disbursements.

Seamless from EML enhances the customer experience with instant refunds or disbursements.

Driven by the COVID-19 pandemic, the battle for talent is increasing for companies and organisations – forcing them to rethink their recruitment and retention strategies. In this session – the first of two webinars focused on ‘The Great Resignation’ – Banking Circle and industry experts discuss how recruitment is changing within the current landscape, whether the power really is shifting from employer to employee, and what financial services businesses should be doing to ensure that they attract the best talent.

Following Transact365’s recent entry into the Indian market, they are now expanding their coverage and able to provide payments solutions in Latin America. The move enables cross border and local e-commerce transactions through bank transfers and a large number of local payment methods.

Hi there,

We are trying to promote our Cards Week on-demand content that we produce last December with experts such as Visa, TagNitecrest and Zumo and I was wondering if you could help us promote our landing page: https://landing.modulrfinance.com/cards-week-2022-mb

All details are above and I have attached 2 social images that you can use but please let me know if you have any question 😊

The global fintech will enable full ecommerce payment transactions for the first time.

The EML powered CoinJar Card represents a defining moment for the U.K.’s crypto space.

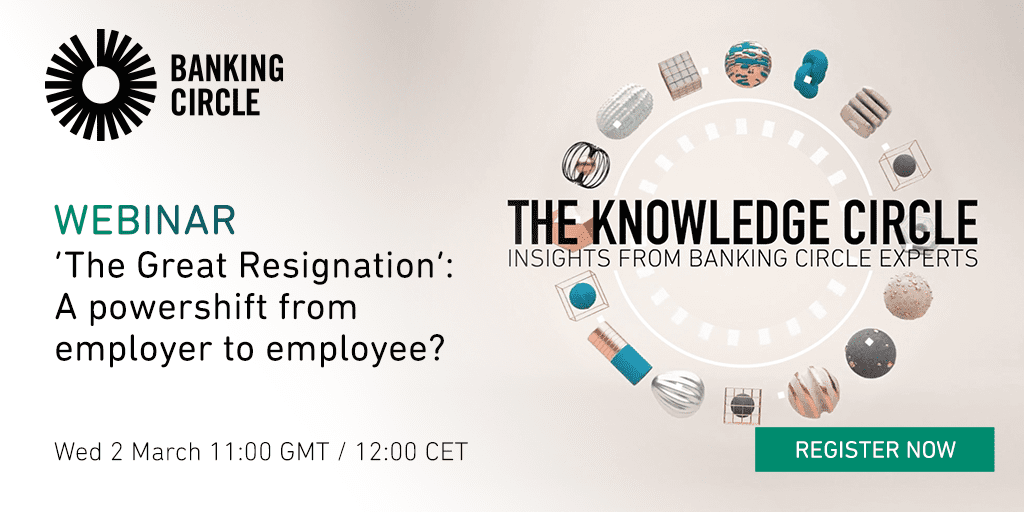

EML releases record-breaking Interim Results.

Chargebacks911, the first global company fully dedicated to mitigating chargeback risk and eliminating chargeback fraud, today announces the appointment of financial services and sales expert, Robert Hoover who takes on the role of Vice President of Business Development, concentrating on Chargebacks911 strategic merchant accounts.

BCB Group, Europe’s leading provider of business accounts and trading services for the digital asset economy, today announced the launch of BCB Yield, a product that lets customers earn a return on both fiat or crypto funds.

Ethical bankers are one of the fastest growing financial tribes in the world, with some of the loudest voices. How do banks continue to innovate to meet customers evolving demands and also engage and attract the emerging financial consumer segment of ethical bankers?

Swiss neobank Entris Banking has selected US fintech Bottomline for its SaaS-based payments platform. Entris Banking acts as a transaction bank and payment hub to more than 40 small and mid-sized banks in Switzerland.

Full reserve stablecoins will revolutionise the stablecoin market. ARYZE Digital Cash is the closest thing to a CBDC without it being issued by a central bank. Learn more about how ARYZE is planning to revolutionise the entire payments industry, using their full-reserve stablecoin as a main component of this worldwide strategy.

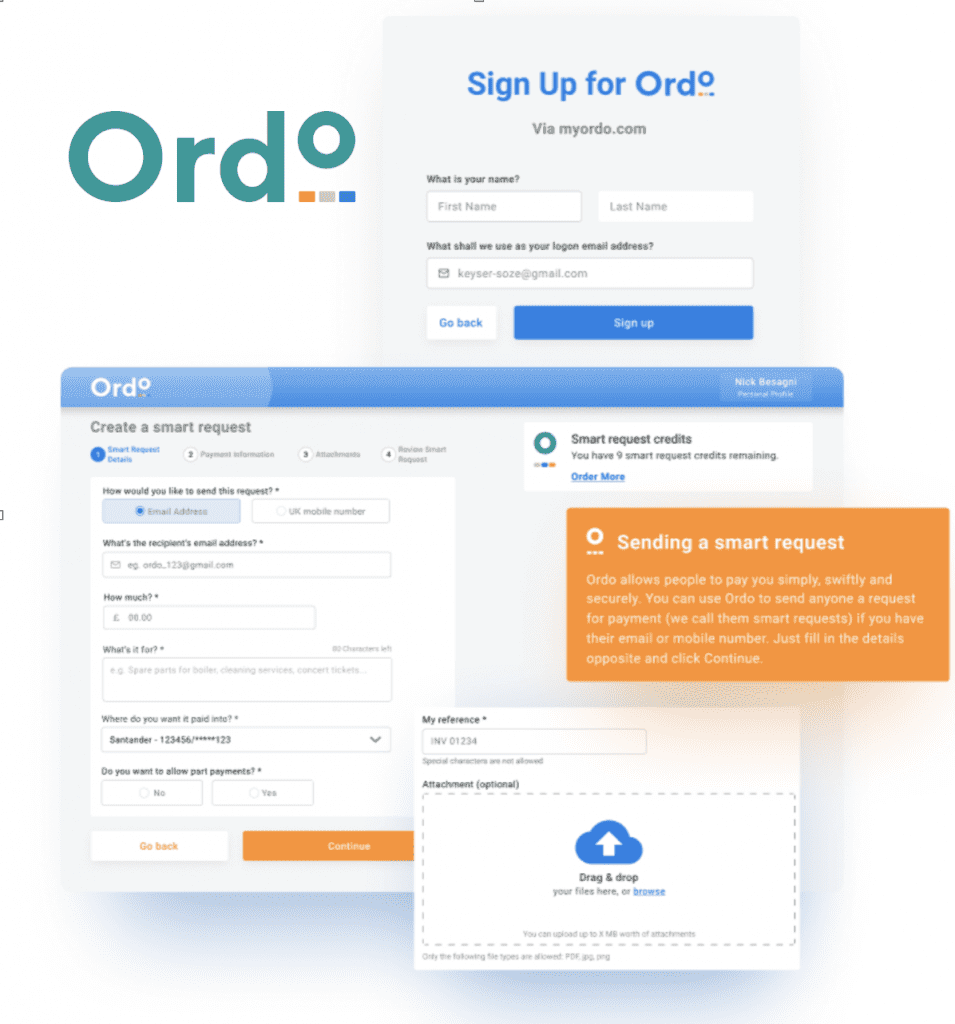

The Ordo Open Banking payments platform already supports white label billing, paying by instalments, QR code PoS and eCommerce.

New for 2022 is Enhanced Account Verification and Variable Recurring Payments.

FLEETCOR UK today announces that it has made a follow on investment into Mina, the cloud-based digital software platform that simplifies home charging and payments management for commercial fleets with electric vehicles.

The exponential growth in e-commerce and the impact of the pandemic have fuelled the rise of ‘Buy Now Pay Later’ (BNPL), making it one of the biggest retail trends in 2021. This is set to continue in 2022, with new players entering the market and new partnerships and acquisitions being established.

BNPL has largely been driven by consumer appeal, easy availability and the promise of no interest and no fees – if payments are made on time. It is popular across all demographics for different reasons but has especially gained traction among millennials and Gen Z consumers as a means of financial empowerment. For consumers, it provides an easily accessible method of borrowing, instant gratification, a flexible returns policy and the ability to manage finances by spreading the cost of purchases over an agreed period.

This book provides an overview and practical examination of key areas of payments law and regulation in the EU and UK, as well as introductions to analogous legal regimes in the United States, Hong Kong, Singapore and sub-Saharan Africa. It is an important resource for lawyers and compliance officers in the payments sector. For more information go to https://www.e-elgar.com/shop/isbn/9781839107979

PAYMENT’S disruptor DigiDoe has won a place on a prestigious scale-up programme backed by the Major of London, which will help the London-based startup expand internationally. It comes as DigiDoe’s co-founders closed the second tranche in an initial institutional investment round with just under £1m in fresh funding. It gives the business a 12-month runway to develop its proprietary software, hire key personnel and expand in to Europe and the US.

Until recently, banks didn’t need to change, until the digital evolution unfolded and customers began to expect innovation and immediacy.

It’s natural for banks and fintechs to view one another as competitors. However, a partnership between these two types of entities unlocks immense benefits.

The global pandemic has caused an acceleration in the adoption of new payment methods such as BNPL and Crypto but to what extent depends on geographical region.

Crown Agents Bank: Transforming Cross-Border Payments through Digitalisation (Podcast)

New paper advocates for closer public-private collaboration to advance exploration of a digital currency in the UK, before a real-world pilot of ‘digital pound’ (dSterling) London, UK – 9 February

Virtual IBAN and corporate account provider Monneo, has formally announced its partnership with Kantox, a global leader in currency management automation software. The partnership will give Monneo’s customers additional flexibility when managing outgoing payments.

allpay Limited are delighted to have been awarded a contract by Herefordshire Council for the delivery of its Shop Local campaign.

The Hereford-based company secured the contract following an open procurement process to produce prepaid cards – keeping the council’s own spending within the county. As part of the £1.35 million project, every household in Herefordshire can apply for a prepaid card before January 31st 2022, loaded with £15 to spend as part of a major campaign to help the county’s local and independent traders.

When considering the top examples of disruptive technology set to transform businesses in 2022, the metaverse and blockchain no doubt rank high in the minds of most people. While these technologies will have a profound and enduring impact on society, we should not let this overshadow the impact certain B2B platforms are having in actively transforming businesses. Global payment gateways and payment services providers (PSPs) are deploying new payment technologies to ensure merchants can access new markets once considered out of reach…

Biller, an AI-driven Buy Now Pay Later (BNPL) company focused on business invoices, is set to join the Banking Circle ecosystem of financial services and applications. After closing of the acquisition, Biller will operate as an independent sister company in the Banking Circle ecosystem.

ECOM21 Conference, organized by our esteemed Payment Organisation member DECTA in collaboration with Deloitte and Mastercard, is back!

Don’t miss a chance to #MeetDECTA and others at ECOM21 on 7-8 April 2022 in Riga, Latvia.

By using our gateway solution, merchants can now access new opportunities in India without having to form local payment partnerships or establish an Indian company. This move ensures merchants have access to over one billion Indian-based consumers enabling them to pay faster in a familiar way.

This launch in India is the first in a series of big market expansions planned for 2022. Having already expanded into Europe, Asia and Australia, our payment gateway system ensures merchants of all sizes and sectors can access fast-growing markets seamlessly and quickly.

Nium and FINCI announce partnership to strengthen payment services internationally

The partnership will enable FINCI to provide quicker and more cost-effective pay-outs to key markets in Europe and APAC

Nium, a leader in global payments and card issuance for businesses, today unveiled its predictions report for 2022, examining the latest trends in regulation, crypto, travel, and global payments.

Explore Nium’s seven predictions across three key areas including:

Regulation: Regulators are taking notice of new payments methods such as cryptocurrencies and Buy Now, Pay Later methods

Travel: As travel returns to pre-pandemic volumes, the industry will look to fintech to drive revenue

Global Payments: New technology infrastructure is the emerging theme across major industries; payments particularly will transform to cater to evolved consumer behavior.

All financial services firms in the UK are required to carry out risk assessments for Anti-Money Laundering (AML) and Countering Terrorist Financing (CTF). Yet a survey of AML audits reveals that some firms do not have risk assessments, and many that do, fail to record the rationale they adopted when arriving at their risk assessment.

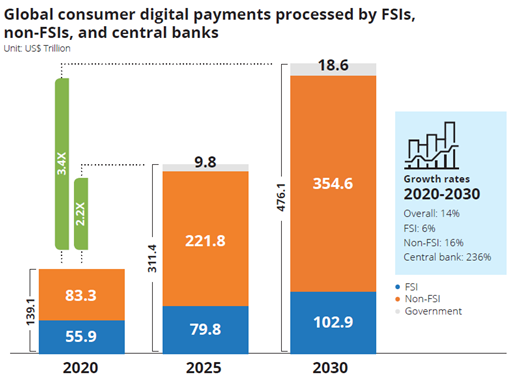

According to a new study by IDC Financial Insights commissioned by Episode Six, a payments technology company, 74% of consumer payments will be handled by non-traditional financial service institutions (FSIs) by 2030.

The IDC InfoBrief, Future Ready Payments Technology Reshapes the Playing Field for the Industry, highlights that while the payments world is changing FSI paytech is not, pushing lucrative consumer payment volumes to non-FSIs.

Ingenico, a Worldline brand, has received certification by the Royal National Institute of Blind People (RNIB), the United Kingdom’s leading sight loss charity, for the accessibility and usability of its AXIUM DX8000 payment terminal by blind and partially sighted people.

With one more year behind us, it’s around this time that we usually assess the market to make predictions for what will come over the next year. Last year, at around this same time, we did just this: posting our predictions for 2021. But before we jump into looking at what 2022 will bring, we first want to review the predictions we made last year to see how accurate they were and what major trends we missed.

Frank Breuss, CEO of Nikulipe, sat down with Fortune, to discuss how mobile money is uniquely suited to Africa’s experience to bolster financial inclusion and e-commerce.

DIGIDOE, the UK-based startup which is on a march to revolutionise the world’s outdated payments infrastructure, has secured more than £850,000 from new investors. The initial funding round was closed early because of high levels of customer interest in DigiDoe’s unique next generation, fraud-inhibiting, multi-currency payments system. DigiDoe is the first company in the UK to offer biometrics-based payments to merchants without the presence of a card or phone.

It seems like every annual recap or outlook for the past ten years has mentioned “the year of data.” Ed Adshead-Grant, Director of Strategic Business Development, Bottomline talks on how data is the new “green energy” that drives customer relationships in financial services, and we’ve travelled from “big data” to “actionable data” to “open data” in short order.

Bottomline (NASDAQ:EPAY), a leading provider of financial technology that makes complex business payments and financial messaging simple, smart and secure, today announced that ENTRIS BANKING AG, a new Swiss customer, has selected Bottomline’s SaaS-based payment connectivity platform to provide customers with an enhanced, more flexible domestic and international payment experience.

BCB Group, Europe’s leading provider of business accounts and trading services for the digital asset economy, announced today that it has closed a Series A funding round co-led by Foundation Capital. This is the largest Series A funding round for a company in the blockchain industry in the UK.

New research from Codat has revealed SMBs’ strong appetite for the benefits of Open Finance, but regulation must prioritize the right data.

Currently, conversations on Open Finance focus on consumer-oriented datasets, like mortgages, investments. and savings, ignoring the most vital financial data to small businesses, their accounting and sales data.

This manifesto makes the case for a fresh approach to Open Finance that will benefit SMBs and their financial service providers, and in turn fuel economic growth. Download our report to find out more.

– NatWest brought Tink and Cogo together to launch a carbon tracking solution in their mobile banking app.

– The feature works by combining Tink’s financial data enrichment technology with Cogo’s proprietary platform to create carbon tracking insights for users.

– After a successful collaboration, Tink and Cogo joined forces to help more banks bring similar solutions to market.

Check out this recent Financial IT interview featuring Currencycloud’s Co-Founder & VP Strategic Partnerships, Stephen Lemon and ComplyAdvantage’s Founder and CEO Charles Delingpole as they discuss all things Fintech.

Watch the interview here: https://www.youtube.com/watch?v=XG9JlvilL10

In our latest industry report, we partnered with FinTech Futures and Informa Engage to survey more than 50 senior banking and payments professionals to learn how their firm handles payments and plans for operational enhancements in 2022.

The fintech industry is highly competitive, so sustainable differentiation is an absolute must if you want your business to emerge from the pack. That places an emphasis on superior capabilities, agile delivery, and calculated decision making. Hence why it’s so important to embed data insights into the commercial and product development processes.

Payments: One of the Most Dynamic Markets?

This report sets out our view of Five Key Trends that will take place over the next five years. It will show you the areas that your business will want to focus on and the impact these will have, helping you build a solid foundation for success. As leaders in the industry, we work across a wide range of industries, which is why we’re so well placed to advise you on yours.

DOWNLOAD THE REPORT NOW: https://bit.ly/3FqNnG4

EML Nuapay helps Cocoon deliver a smarter way for customers to pay for vehicle purchases.

Global Processing Services (“GPS”) announces the closing and upsizing of its latest fundraise at over US$400 million. Temasek the global investment company headquartered in Singapore, and MissionOG, a US-based growth equity firm, joined the over US$300m initial round, co-led by growth investors Advent International – through Advent Tech and affiliate Sunley House Capital – and Viking Global Investors.

Mobile payments in sub-Saharan Africa are predicted to grow by over 60% in the next 5 years, showcasing that Local Payment Methods like these are key for more expansive e-commerce opportunities.

Ordo partners with Pay360 by Capita to bring Open Banking payments to the public sector

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.