The Payments Association’s Riccardo Tordera and Robert Courtneidge examine what the latest government consultations could mean for the UK payments sector.

HM Treasury (HMT) and the Bank of England launched two consultations in February: one on future regulation for cryptoassets, and the second on the possible introduction of a digital pound.

The Treasury has confirmed it will continue to be guided by a set of core design principles that could inform legislation. These include:

At The Payments Association, we welcome the Treasury’s approach because through these core design principles, the UK can quickly achieve its ambition of becoming a global hub for cryptoassets technology, especially after being behind the curve in getting regulation in place for this new sector, like the EU did with MiCA.

This is crucial if the UK is to remain competitive in this jurisdiction at a global level, and as it had been in the first fintech wave (2008 to 2014).

As Andrew Griffith MP, economic secretary, said during an evidence session to the Treasury Select Committee in January: “Proportionality is a great word when it comes to financial services regulation, because there is a very good understanding of the risk.

“In each case, we should be collectively seeking to find the right balance that is proportional to the risk being taken. We do not like ‘one size fits all’, because that will often not be a suitable response to the risk at the riskiest endeavours.

“Equally, we do not try to eliminate risk from the system by crucifying some of those smaller, more nimble actors that do not pose the same systemic risk.”

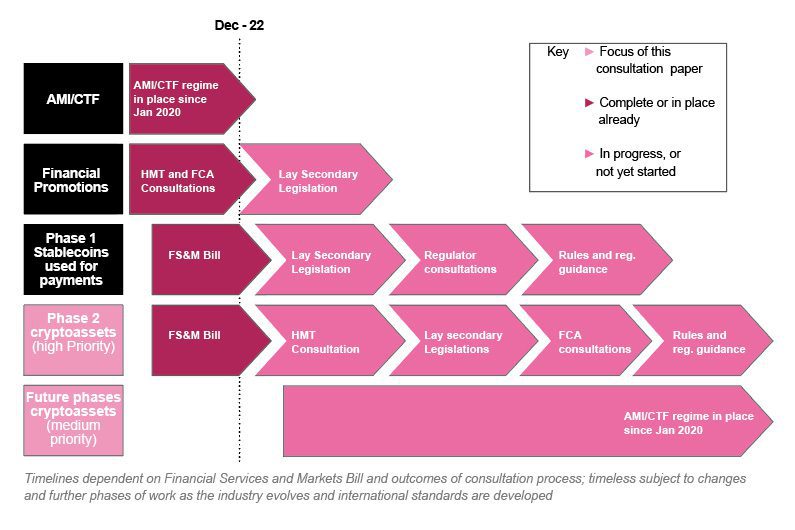

As stated in the consultation, HMT is proposing a phased approach for regulating cryptoassets in the UK.

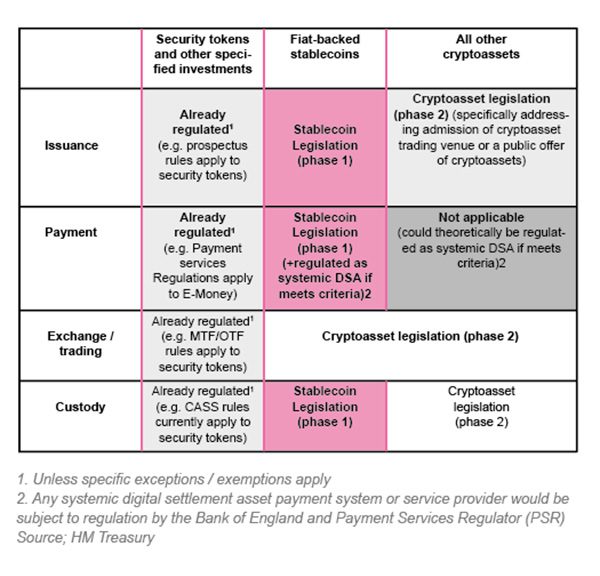

In phase one, the government will look at amending the Financial Services and Markets Bill 2022 (FS&M) in order to allow regulation of fiat-backed stablecoins, which are used for payments, to be introduced. The regime will address issuance and custody activities relating to fiat-backed stablecoins as well as payment-related activities.

In phase two, the government’s intention is to introduce a regime to regulate broader cryptoasset activities, such as the trading of and investment in cryptoassets. Phase two will focus on targeting the activity areas associated with a higher degree of risk from a consumer and overall market perspective as well as greater opportunities to support the UK’s growth agenda.

Jointly with the Bank of England, the Treasury is also consulting on the creation of a digital pound, as “a potential new form of digital money for use by households and businesses for their everyday payments needs”.

The Payments Association is glad that policy makers seem to be listening to our views, which we have been advocating for in various ways from attending the APPG Crypto & Digital Assets to informal conversations with government bodies and regulators. It means we are now moving away from the concerns expressed by the House of Lords Economic Affairs Committee Report (January 2022) that claimed looking at CBDCs was “a solution in search of a problem”.

And that’s because, both the Bank of England and the Treasury are now looking at the having a digital pound as an opportunity to provide a “platform for private sector innovation” that promotes more choice and competition. This, as chancellor Jeremy Hunt and Andrew Bailey, Bank of England governor, wrote in the forward to the consultation, will be a vital step to “positioning the UK to act decisively by introducing a digital pound, shall we decide to do so”.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.