UK Payments fintech Ordo announces strategic distribution partnership with e-money platform, Contis

Tech partnership making the lives of countless SMEs easier – Ordo and Contis – a match amde in heaven!

Tech partnership making the lives of countless SMEs easier – Ordo and Contis – a match amde in heaven!

London, U.K. (October 5th, 2020) – Bottomline Technologies (NASDAQ: Payments AssociationY), a leading provider of financial technology that makes complex business payments simple, smart and secure, today announced a partnership with Dow Jones Risk & Compliance, that adds key data to Bottomline’s Anti-Money Laundering and Counter Terrorist Financing monitoring and screening capabilities, used to identify and thwart illicit transactions.

EML’s new FINLAB incubator has invested in Hydrogen.

Novalnet AG, a full-service Payment Provider, is partnering with Banking Circle, for faster and lower cost foreign exchange (FX) and settlement solutions for its 12,000+ customers around the world. Banking Circle is helping Novalnet to efficiently support its global clientele with local and cross border settlement at competitive rates and with faster reconciliation to help online merchants manage and maintain cashflow.

Allstar Business Solutions has today announced its partnership with major petrol forecourt retailer, Applegreen, that will see another 102 mainland UK fuel sites added to the Allstar network. Allstar fuel cards will now be accepted at all of Applegreen’s mainland UK locations from this month.

EML’s new FINLAB incubator has made its first investment in US FinTech disrupter Interchecks.

UNDER EMBARGO UNTIL 9AM OCTOBER 28 TH , 2020 The Fintech Power 50 launches the Fintech KICKSTART scheme to provide employment opportunities for young people. The Power 50 will act

GPS technology will power Lanistar’s polymorphic debit card as the fintech challenger seeks to capture the Millennial and Gen-Z market London, UK – 2nd November : Leading payments issuer

The London based E-Money solution for global citizens Privat 3 Money (P3) has selected leading anti-money laundering and intelligent compliance software provider Napier, to integrate enhanced transaction monitoring into the core P3 platform.

PPS, formerly PrePay Solutions and subsidiary of Edenred, has announced that it is powering the first card created by Yolt, the smart money app, following the companies recent launch of its contactless debit Mastercard. This partnership was formed thanks to PPS’ years of experience powering payments cards and Yolt’s desire to expand beyond the confines of the digital space and into the physical one.

The Payments Association challenges the Government’s changes to the payments landscape, alongside its recommendations London, United Kingdom. 21st October 2020: The The Payments Association, which promotes collaboration and innovation across

Currencycloud, the leader in providing B2B embedded cross-border solutions, and Tribe Payments, a tech company dedicated to deliver the future of payments technology across the ecosystem, have partnered to deliver complete transparency to foreign exchange costs charged on international card transactions, whilst also giving customers access to multi-currency wallets.

A panel of industry experts has selected Banking Circle’s SME lending initiative, delivered by Cardstream, as winner of the 2020 Tech Ascension FinTech Award for Most Innovative FinTech Solution.

Global Processing Services Continues International Growth with Visa Investment

Fredrik Neumann, Kathy Heath, and Clare Haskins have joined Konsentus in senior leadership roles as Financial Institutions across the EEA embrace Open Banking.

Wayne Mckenzie appointed Head of Business Development by xpate, bringing over 14 years of payments expertise to the up-and-coming fintech

Vizolution and W2 have announced they have formed a strategic partnership to integrate W2’s range of customer due diligence solutions into Vizolution’s customer experience technology suite.

Three in four shoppers (76%) admit local high streets need support while four in five (80%) are shopping with local small businesses as much or more frequently since lockdown lifted, both in person and online

Despite this support, the next three months are crucial to the survival of two fifths (42%) of small businesses

Visa has partnered with grassroots initiative Totally Locally to sponsor Fiver Fest from 10th – 24th October and together they are calling on consumers to divert £5 of their weekly spend to support local businesses in store or online

RegTech specialists launch Kompli-Outsource™ to help regulated entities complete comprehensive customer onboarding

Eversheds Sutherland’s banking and finance team has appointed Ian Tetsill as Head of Debt Finance Strategy.

An innovative lending solution from financial infrastructure provider, Banking Circle, has been named as a finalist in the 2020 Credit Awards category for Best Use of Technology – SME Lender.

Two technology leaders join forces: Giesecke+Devrient invests in Netcetera

Today, PPS is announcing its partnership with France-based payment expert and card provider for teenagers, Vybe.

Due to the systems in place across France when it comes to banking and owning your own account, around five million teenagers (between 13 to 18 years old) have been left with no access to financial services.

This is a problem that Vybe aims to solve and is working with PPS to make it happen, thanks to the company’s well-tested technology infrastructure and PPS-powered Mastercard virtual cards.

Press release regarding Ordo Accounts package integration & Codat

With the financial pressures from COVID-19 still unclear for many, new research commissioned by payments provider, PayPoint, throws the spotlight on small adjustments landlords and lettings agencies could make to help tenants manage their finances during this uncertainty and beyond.

Judopay, a leading mobile-first payments provider, today announces its partnership with Mastercard, which will further increase Judopay’s network with a direct route to Mastercard’s Payment Gateway Services global acquiring ecosystem.

Entersekt, a leader in device identity and omnichannel authentication, has announced a strategic partnership with ndgit, a Munich-headquartered open banking platform provider. The agreement makes Entersekt’s state-of-the-art strong customer authentication and smart messaging solutions available on the ndgit Marketplace, where financial services providers can access a carefully curated set of fintech products in a secure hosting environment.

IDEMIA launches its Global Fintech Accelerator Card Program to support FinTechs and neobanks in their card issuance process.

Entersekt, a leader in device identity and omnichannel authentication, today announced a partnership with NuData Security, a Mastercard company. This agreement allows the fintech to tightly integrate NuData’s behavioral analytics solution NuDetect with the Entersekt Secure Platform.

xpate CEO Mike Shafro has been appointed Ecommerce Advisor to help shape future of Industra Bank

British fintech Currensea is today launching a first-of-its-kind open banking debit card for small businesses, enabling them to make international transactions through their existing bank account without any of the charges and with low fees competitive with the leading challenger banks.

Following a record number of applications, Banking Circle has been awarded two prestigious awards in the 2020 Juniper Research Future Digital Awards. The innovative financial infrastructure provider was awarded the Lending Platform Platinum Award for Banking Circle Lending, and a Gold Award for Banking Platform Innovation.

Leading payments issuer processor, Global Processing Services (GPS), announces its appointment of three C-level executives: Richard Hodgson as Chief Financial Officer, Shaun Puckrin as Chief Product Officer, and Jerome Gudgeon as Chief Technology Officer.

The new hires bolster the executive leadership team of GPS, the payments processing partner for some of the most well-known and successful fintechs on the market, including Revolut, Starling Bank and Curve, as the business drives its global expansion plans forward beyond Europe and APAC. It’s also a great sign of confidence for the fintech sector.

Press Release GPS to further engage the wider Payments Association community to drive innovation and collaboration in the payments industry London, UK. 6th October, 2020. The The Payments Association is delighted to announce

Press Release The new training alliance aims to provide specialist compliance and skills training For payments a fintech businesses London, UK. Monday 28th September, 2020. The The Payments Association is delighted

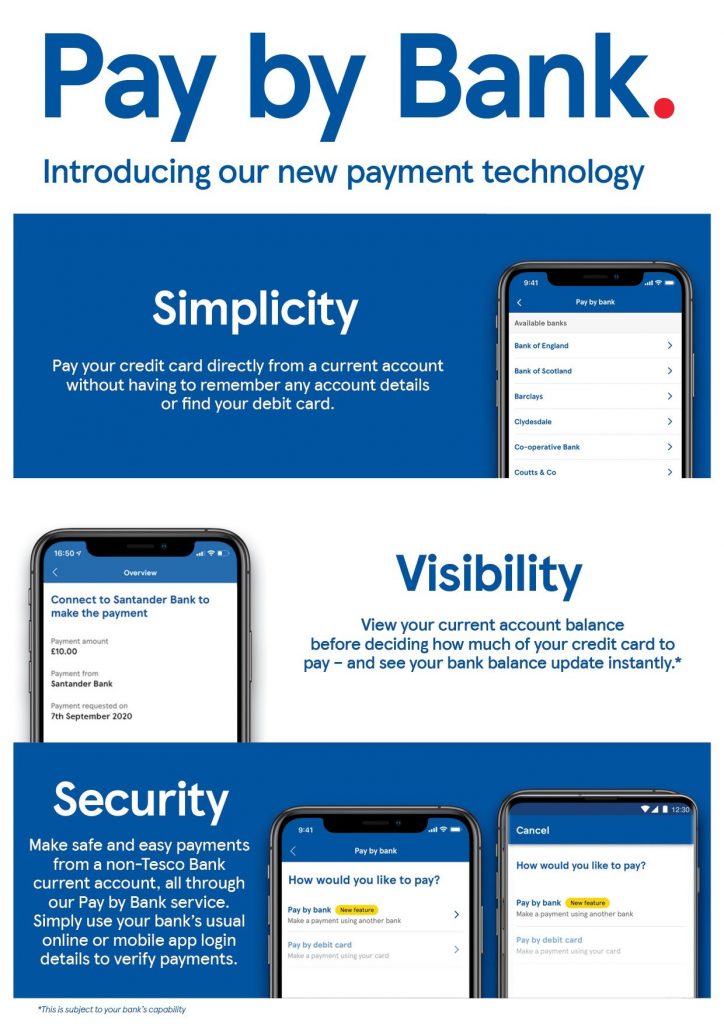

First UK bank to use open banking to enable credit card holders to pay their balance Tesco Bank is to become the first UK bank to introduce new technology that

Mastercard and PFS partner with the Government of Jersey on the Spend Local cards Every Jersey resident will receive a £100 Spend Local pre-paid Mastercard Innovative approach paves the way

Financial infrastructure provider, Banking Circle, has been named Best E-Commerce Initiative for its Banking Circle Marketplaces solution in the 2020 PayTech Awards.

Netcetera is Mastercard’s exclusive 3-D Secure testing partner to help retailers and other businesses ensure they are ready to comply with PSD2. Mastercard and Netcetera, the market leader for 3DS and EMVCo associate, are supporting merchants to improve their transactions and conversion rates. This is the first time that merchants are able to run tests in their live online shops.

Accomplished CFO and COO, Suraj Badlani, joins the international technology platform to lead corporate development and finance

Kompli-Global, the leading RegTech AML specialist, has announced today that it that it is ensuring corporate entities do not fall victim to potential fraud and money laundering, as it unveils Kompli-Reveal™, a screening solution harnessing augmented intelligence (AI) and human expertise, to provide the most up-to-date information on their client bases.

Radius Bank, the best online US bank of 2020*, and Currencycloud, the leader in providing B2B embedded cross-border solutions, have partnered to offer Radius clients the ability to send money to more than 180 countries.

Following increased customer demand for international wire transfers for both their own clients and their Banking-as-a-Service partners, Radius sought to find a solution that could be quickly integrated. Using Currencycloud’s APIs means Radius Bank can send outgoing payments to international destinations they were unable to reach before on behalf of their clients.

Modulr is the first non-bank or building society to join the Confirmation of Payee service.

Confirmation of Payee allows users to check if the payment details they’ve entered for a person or business match the details held by the recipient’s bank.

This provides reassurance that payments are being sent to the right recipient and protects Modulr customers from certain types of payment fraud.

UK-based end-to-end accounts and payments solutions provider Contis has forged a partnership with global payments platform Currencycloud.

Through this partnership, Contis can now offer foreign exchange and international money transfer services to its clients and account holders.

EML and Laybuy are working together on Buy Now Pay Later (BNPL).

– Challenges facing the industry in stopping online banking fraud

– Decision criteria utilized to determine a winner across technology attributes and future business value drivers

– Reasons Buguroo was selected as the clear winner across all determining criteria

Financial infrastructure provider, Banking Circle, is tackling the compliance and reconciliation issues often faced in global B2B payments with its new Payments on Behalf of (POBO) and Collections on Behalf of (COBO) solutions.

EQ (“Equiniti Group plc”), an international technology-led services and payments specialist, is delighted to announce that its business payment platform has a new name, EQPay.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.