Regulatory spotlight: Payment services and sales staff remuneration

Firms must navigate complex payment service regulations and the often-overlooked EBA Guidelines on Remuneration Policies to ensure compliance and foster fair customer outcomes.

Firms must navigate complex payment service regulations and the often-overlooked EBA Guidelines on Remuneration Policies to ensure compliance and foster fair customer outcomes.

As the climate crisis unfolds around us, going green has never been more pertinent, or more prevalent. Industries from fashion to construction are being transformed by a drive towards sustainability,

With big tech entering the banking space, payment firms need to be at the forefront of changing the ‘software sabotage’ culture to ensure consumers and those in the supply are protected as well as reducing e-waste.

Be recognised as an industry leader at the most important payments awards – The PAY360 Awards. Nominations are now open for 2023 awards. You have until 17 February to submit your entry.

In order to receive 3D Secure messages, process said messages, and authenticate card users, issuing banks must deploy Access Control Servers (ACS). To ensure that transaction integrity is never compromised, the Okay software works in parallel to prevent attacks and protect user information during confidential transactions. The process looks a little something like this:

Compliance, requirements, deadlines, oh my! By now you should have a comprehensive overview of what to be aware of as PSP. As such, it is time to wrap up the topic of SCA compliance. In this article, we cover how Okay uses security evaluations to fine-tune our product as well as how we can help you meet SCA PSD2 RTS compliance standards.

Compliance. A scary term for any payment service provider (PSP) in a world of increasingly stricter regulations and requirements. To make it a little less scary, we are opening the PSD2 RTS Compliance door to extract some key points of interest. Read on for the fundamental requirements PSPs should be aware of if issuing cards or e-money payments and why said requirements are necessary.

One of the more vexing problems of the modern age when it comes to international business is that regulatory regimes often do not keep pace with technological innovation.

Nonetheless, novel solutions to B2B cross-border business have emerged in the form of virtual IBANs, financial instruments that drive the innovation economy and enable new, powerful business models.

Here we have outlined three ways that virtual IBANs are transforming the way companies do business locally and abroad:

When it comes to digital banking and compliance, robust KYC practices not only prevent fraud and financial losses but also strengthen a firm’s ability to conduct business with confidence.

This is typically because of the four key elements of strong KYC practices that make sure firms know who they’re doing business with and what to expect from that relationship.

We’ve identified the four essential elements of effective compliance in KYC practices for digital banking in order to show you how they help improve the competitiveness of businesses of any size or scale:

The year 2020 saw many of the innovations and prognostications of analysts come true as contactless payments and digital banking solutions drove the field of Fintech innovations. Looking ahead, however, 2021 could be the year that consolidates much of this growth and prepares the economy for the next stage of digitization.

We at Monneo have identified five major trends that we think are driving the Fintech innovations in digital banking, in 2021 and beyond:

The digital banking era is upending traditional payment solutions and transforming the global financial industry in the process. And this is on both the corporate and consumer level with changes in payments solutions reaching into every facet of the international economy.

These innovations in digital banking are not only enabling increased efficiencies and expediting capital flows at a rate previously unthinkable but also are leading the way in changing the dynamic and level of depth of the business-customer relationship.

The reason why re-enrollment is so sensitive is simple: when you do an app-based strong customer authentication (SCA), the user has already been authenticated on the device. This means that it is possible to check the ‘possession’ factor using a device fingerprint from before.

If a customer has a new device, and has an existing device registered to their account, we recommend using SCA to enroll. A typical way to do this would be to use a QR code that the user can scan from one device to another. In the case where there are no existing devices linked to an account, we recommend that the customer go through a full “know your customer” (KYC) procedure in order to re-enroll their new device.

One of the ways we’ve helped our customers strengthen their re-enrollment process is to implement a mechanism known as ‘magic link’. A magic link is a link received through a semi-secure channel that authorises the customer to use a particular device. Using a link like this can be practical, as the re-enrollment procedure might be stretched out over time.

Interested in hearing more about Magic Links? Be sure to read the full article at okaythis.com/blog.

Okay has been running compliance audits since 2016. What did it look like back then compared to today? Are two channels for SCA really needed? This week we briefly explore the changing security environment of mobile phones related to identity verification.

Over the course of the pandemic, PPS’ HR Director, Corinne Williams, has worked tirelessly to deploy a pioneering strategy to ensure the safety of the company’s 250 strong workforce over the last year, with various processes in place to roll out homeworking through tailored kits and a top-class well-being programme. All of this to ultimately continue to maintain its high level of operations for some of today’s leading brands that are changing the face of financial services as we know it.

The recipe for success in the e-commerce business is much the same as any other entrepreneurial endeavor except it comes with many opportunities for growth and leverage that physical businesses don’t have.

Online business may be the future of many markets, and for good reason. From scalability of immediately needed resources to cost-effective innovation and optimization, we have identified five key elements of success for e-commerce business in the modern age:

E-commerce businesses can’t put enough of a premium on online cybersecurity and protection against threats. Not only can malicious actors steal data and commit fraud, but they can also completely undermine a customer’s confidence in your business.

To avoid costly fraud and cyber threats, we’ve found five primary areas of focus that e-commerce businesses need to keep in mind as they move forward in the online market:

As part of a European Union mandate called the Revised Directive on Payment Services, or (PSD2), merchants operating in the EU economic zone must use payment service providers within the European Economic Area that offer what is known as strong customer authentication.

This is also sometimes referred to as the SCA requirement or the PSD2 compliance. In essence, this directive ensures that transactions occurring within the EU’s economic territories make use of multi-factor authentication in order to verify a buyer’s identity.

The promises of the European Union single market, while not full borne out in the reality of the business world, where the same are actually still far from the dream promised when it comes to the virtual single market. What does this mean?

In other words, the European Union might act as a single market when it comes to monetary issues and beyond, but the EU single digital market is hampered and its growth restricted by a myriad of factors including various compliance regimes and the logistical mastery needed to make it all work.

If your goal is to service the largest percentage of market users, respect must be given across all accessibility levels. But what is a reliable solution for non-smartphone users? In this post, we review our remote dial option as a reliable PSD2 SCA fallback.

We have spoken a lot about strong customer authentication (SCA) over the past year. However, the regulation has technically been in effect since mid-September of 2019. Now well into 2021, it is time for all European countries to fully enforce the updated SCA regulations. Let’s take a look at some of the deadlines.

Close to a quarter of a million people around Ireland received a Perx Reward from their boss while working from home last year.

Okay wants to make the payment process as smooth as possible, specifically when it comes to customer authentication. While this is just one part of the payment process that can introduce friction, it is often where checkout abandonment occurs. In this post, we’ll try to describe some of the options that we’ve seen in the market regarding frictionless payments, including their strengths and weaknesses.

One of the great innovations of the modern age is the ability of eCommerce to connect businesses, merchants, and consumers all across the world. Not only has this opened up new opportunities for businesses and consumers alike, but also it has expanded the realm of what is possible for small and medium enterprises on the global stage. And here we start with the interesting part of the current topic.

The global economy is expected to begin the process of recovery from the 2020 pandemic throughout 2021 and an integral part of that will be the payments industry as well as virtual IBANs and digital banking.

Analysts see five major trends on the horizon for 2021 in how things will change for the payments industry and digital banking services including enhanced automation to more robust identity verification as well as an authentication technology.

Over the last few years, Okay has gone through both security certifications and penetration testing. While they represent two uniquely different processes, each has greatly improved our product’s security, code quality and architecture. In this post, we discuss the importance of each, as well as what we’ve learned along the way.

Now, in 2021, and with the Brexit negotiations in their rearview mirror, the EU market is looking to digital banking solutions to help address problems of inequality, sustainability, and supporting a circular economy.

Indeed, the future of the market in Europe is not only digital but digital banking, in particular, will play a huge role in bringing about the social transformations and member-state cohesion needed to build economic resilience and growth for the future.

What are some of the major forces driving the corporate banking digitization process? What are the factors and trends behind some of the most seismic moves in recent years in this otherwise quite conservative industry? What are the main key-topics we should have on our radar in order to stay ahead of our business competitors and be the first to learn what would be the next

“big thing”?

Not only is the extension of digital banking services and digital payments solutions integral to the growth of mobile and online marketplaces, but also it is central to the monetary revolution taking place right now with cryptocurrencies and the rise of a cashless economy. We have identified three major movements in digital banking that could shape how the next several years play out, from enhanced payments processing to the integration of new consumer blocks into the financial system.

Will our smart devices be able to implement the necessary security measures to keep up with an ever-increasing digital marketplace? If so, which ones will reign supreme? In this article, we reflect on an age-old question of iPhone vs Android device, well worth considering by all financial industry players, big or small.

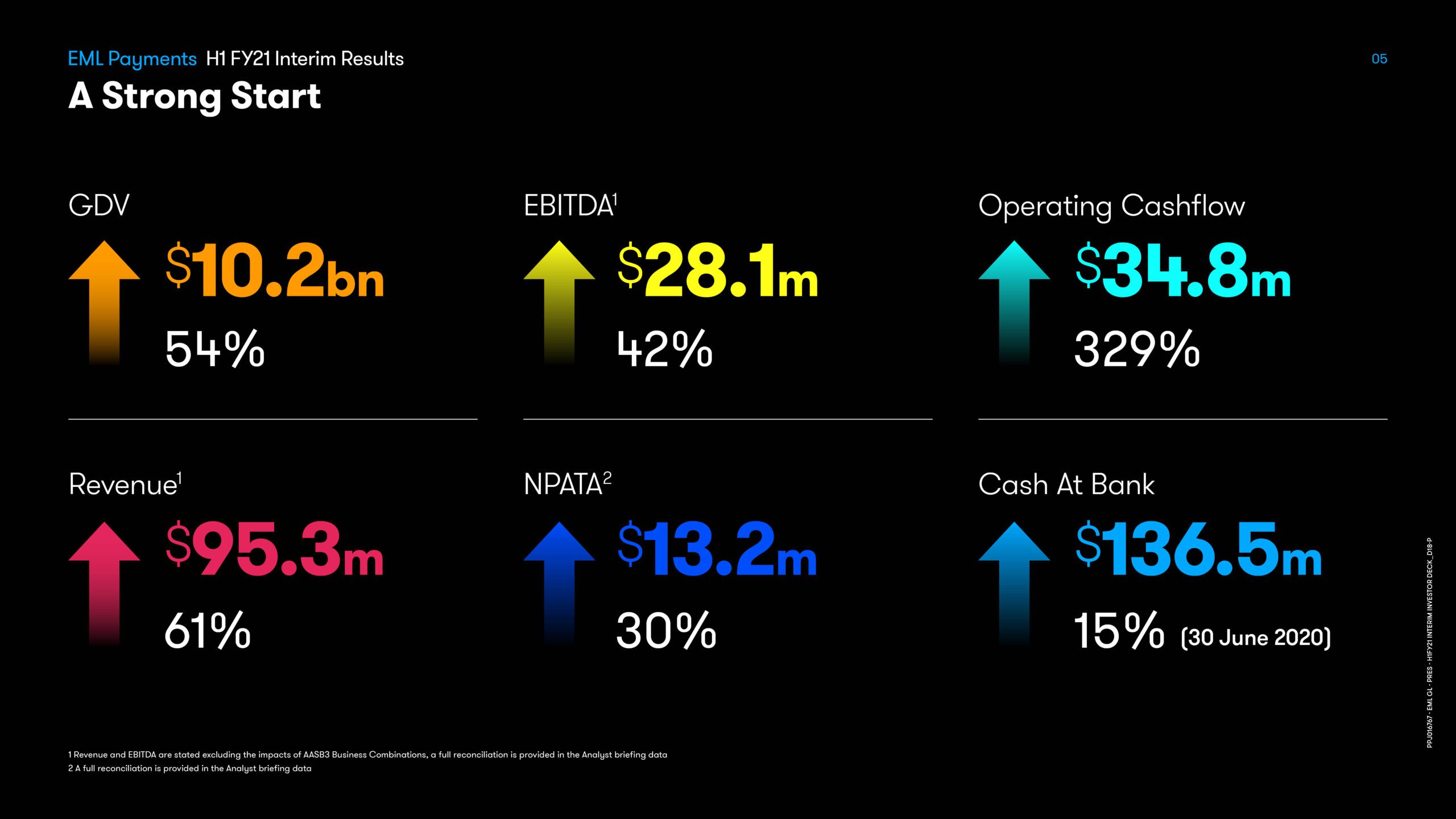

EML Payments Limited (ASX: EML) is pleased to release its FY21 Interim Report.

Rob Shore, Group CFO at EML, is very excited about the company’s 3-year Accelerator strategy.

The rise in technology companies looking to help us make better decisions in our finances has created a host of so-called FinTechs emerging into the market. But what is the right solution for you?

Every business from sole traders to large corporations are always on the lookout for ways to save time and money.

With the big banks’ monopoly on providing financial services now broken by FinTechs and new players in the Open Banking space, the choice of alternatives has never been more exciting – and maybe a little confusing for newcomers.

2020 saw significant growth in digital payments with the pandemic as one of the key factors. Covid 19 and shifting consumer behaviours steered the move toward contactless options and Open Banking for a safe, efficient, and contactless alternative to traditional payment methods.

Discover how Account to Account payment providers like Nuapay have worked to enable seamless recurring payments for businesses to deliver a faster and more frictionless experience for their customers.

Explore key trends including subscription models powered by recurring payments and QR codes which are fast becoming a mainstream payment method.

Digital banking is not only the future of banking but also it is allowing for new business segments to emerge and for smaller companies to compete on a more level playing field with major competitors. We’ll explain what they are and how they are making such a massive impact on the financial landscape of today.

The COVID-19 pandemic is changing the way businesses conduct themselves online as well as customer expectations about what they can do. In other words, shopping has moved from the retail space to anywhere a consumer has a smartphone and digital banking is among the greatest business innovations that have enabled this brave new world.

Miroslava Betinova, Head of Strategic Sales at PPS, discusses the trends we’ll see in the fintech industry this 2021.

The future of global commerce could be a cashless society, many experts predict, and that puts the burden on financial institutions to make sure their customers’ data is secure and protected.

As digital banking rises to replace the more traditional industry, one phenomenon has arisen hand-in-hand with it and that is the use of biometric technologies.

The rise of digital banking has taken the traditional financial sector by surprise and for many good reasons. From pioneering the art of customer service online to using artificial intelligence to handle many of their operational tasks, digital banking is not just a glimpse of the future of finance. It is a peek into the future of the world of business itself.

The fast-changing world of digital business is one in which staying ahead of the competition is often as much about thinking outside of the box as it is anything else.

But that’s much harder than it might seem at first glance, especially for firms in highly-competitive environments.

The COVID-19 pandemic is nothing less than an inflection point for the global economy. From this point on, people will discuss business in terms of pre-COVID-19 and post-pandemic, and for good reason.

The global pandemic has initiated changes in the global supply chain that were slowly developing before but that are now becoming more prominent features of the landscape. Not only are companies pulling resources in towards the home base, but also they are recentering their businesses for the digital landscape.

The future of the FinTech industry might have more to do with a person’s individual biology than numbers and chips in the future, multiple reports indicate. Known as biometric technologies, this group of payments innovations remove the old pin systems and chips of old and replace them or augment them with fingerprint scanners and other biometric methods.

Another revolution is coming for the financial sector and this one could change the way that consumers and businesses conduct themselves forever.

Payments provider Contis and Open Banking platform Token partner to deliver new value in digital payments. When complete, Contis’ 250+ clients will be able to use Token’s AISP and PISP functionality to deliver Open Banking services to their end-customers through the Contis Platform.

And Token’s merchant, digital wallet and PSP customers will be able to perform account pay-outs and refunds via the Token platform using established payment rails, such as Faster Payments in the UK, SPayments Association and SPayments Association Instant across the EEA.

EML’s new FINLAB incubator has made its first investment in US FinTech disrupter Interchecks.

EML’s New FINLAB Incubator Will Immediately Benefit Two Disruptive Tech Brands.

With the financial pressures from COVID-19 still unclear for many, new research commissioned by payments provider, PayPoint, throws the spotlight on small adjustments landlords and lettings agencies could make to help tenants manage their finances during this uncertainty and beyond.

This is the time that will define the thinkers, movers, and shakers who will shape the rest of this century.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.