Veriff’s Fraud Industry Pulse Survey uncovers the true cost of payments fraud

The payments space is facing a surge in online fraud, with almost 90% of business leaders reporting that online fraud is costing them up to 9% of their annual revenue

The payments space is facing a surge in online fraud, with almost 90% of business leaders reporting that online fraud is costing them up to 9% of their annual revenue

PSD3 updates PSD2 to enhance electronic payment services, merging payment and e-money institutions, regulating digital marketplaces, clarifying delegated authentication, and detailing open banking API requirements

Ayruu has partnered with Edenred Payment Solutions to use virtual cards for streamlined B2B payments across France and Europe, enhancing payment efficiency, security, and cash flow management

Fintech firms must leverage personalized and secure communication tools, like SMS and chat apps, to build consumer trust and enhance customer experience, as demonstrated by successful partnerships with reliable providers.

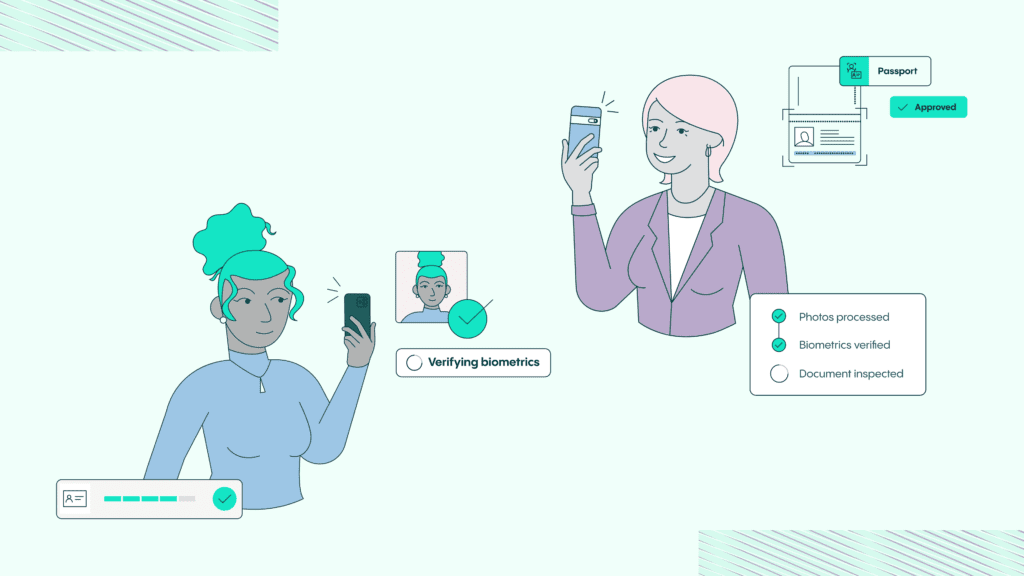

Veriff’s 2024 Fraud Index highlights that nearly half of consumers encountered payment fraud last year, underscoring the critical need for enhanced biometric security in online payments.

Globally, B2B travel transaction volumes are projected to reach $1.7 trillion by 2027 with the APAC (Asia Pacific) region in the lead as the fastest-growing market expected to reach $480

Unveiling the complexities and optimisation opportunities in the card payments industry’s operational landscape.

American Express has launched ‘Plan It’ – a new offering for the UK market that allows credit Cardmembers to pay off purchases on their statement, or a portion of their monthly bill, in instalments.

In the first half of 2023, UK Finance reported authorised push payment (APP) fraud losses amounting to £293.3 million, with the total number of APP cases increasing by 22%. The nature of authorised push payment (APP) fraud was harrowing – victims were willingly initiating and authorising payments into controlled accounts, often driven by criminal manipulation or misinformation.

2023 research by American Express reveals that late payments are a significant challenge for UK finance professionals, driving a shift towards digitizing B2B payments to improve efficiency and cash flow.

Since 2019, the UK’s banking sector has been refunding customers who become victims of authorised push payment (APP) scams, causing heated debate among industry professionals who believe the responsibility should lie elsewhere.

This year, rules laid out by the Payment Systems Regulator (PSR) in 2023 will come into force. The rules stipulate that both the sending and receiving firms should hold equal liability when reimbursing fraud victims in most cases. The rules have received widespread criticism from insiders and industry bodies alike. UK Finance has hit out at the PSR’s rules, which avoid the mention of Big Tech in the conversation.

The financial world is rapidly evolving, driven by changing consumer needs and technological advancements. The Buy Now, Pay Later (BNPL) sector is experiencing a remarkable rise in Europe and is

London, UK. 11th January 2024: Edenred Payment Solutions, an Edenred company and one of Europe’s market-leading payments service provider, has been selected by UK e-money provider, thinkmoney, to upgrade its card

27% of UK SMEs are owed between £5,000 and £20,000 in unpaid invoices Over half (55%) of SMEs say that late payments have increased over the course of 2023 31%

The financial sector has long been a bastion of stability and reliability. However, where technology evolves at a breakneck pace, the financial sector stands at a critical juncture. In light

As regulatory thinking evolves, firms must ensure that any current or planned use of AI complies with regulatory expectations. As financial services firms digest FS2/23, the joint Feedback Statement on Artificial

Form3 to provide SEPA Instant, Credit Transfer and Direct Debit connectivity for Klarna’s 150m active customers across more than 500,000 merchants. Form3, the cloud-native account-to-account platform, is delighted to announce

Due to a dwindling economy, higher inflation and a cash-starved population, retailers are facing a tough battle from the standpoint of acquiring new customers or retaining the existing ones. Adding

With over 50 leading brands including Aldi, Asda, Ikea, Primark, Amazon and Currys, HyperJar’s innovative service offers up to 15% cashback Alex Preece, CEO and founder of Tillo, and Nicola

American Express releases new research revealing that UK businesses are investing in modernising their payment systems to boost efficiency and protection against fraudulent activity. The new study surveyed financial leaders

Jonathan Tyce speaks to Nexi’s Tommaso Jacopo Ulissi on how the paytech firm is driving innovation in the sector and what this could mean for the use of digital currencies.

Since the introduction of Pix, Brazil’s instant payment system, the country has become a powerhouse for digital payments.

In an ever-evolving digital landscape, where online banking and digital payment methods are on the rise, it’s crucial to remember that not everyone has fully embraced this shift. At allpay

Smartphones have sparked a demand for digital financial services (DFS), particularly among millennials. With 6.92 billion smartphone users worldwide, the number doubled in less than a decade. The COVID-19 pandemic

eCOM Tokenizer of G+D and Netcetera to secure online shoppers’ privacy and boost e-commerce businesses. Tuesday, 26 September – GPE (Global Payment Europe) and the e-commerce payment expert, Netcetera, are

Chargebacks are a pain point for merchants which can sap revenue, cause reputational damage and in extreme cases lead to the loss of processing privilege. Yet their existence underpins consumers’ confidence in using their cards, providing recourse against fraud and unscrupulous sellers.

As we navigate the new normal, the banking services landscape across the European Union (EU) has observed a paradigm shift. The current economic scenario presents several challenges that require effective

To support merchants during the cost-of-living crisis, retail finance providers must prioritise the end-user’s needs. New tools that focus on matching loans to a customer’s affordability help to do just

Join fscom’s Director, Alison Donnelly, and Associate Director, Heather O’Gorman, as they provide detailed information on protecting customers’ funds and the latest on the FCA’s expectations of payment and e-money

Delivering excellent customer support can be a significant differentiator for fintech companies. In the digital age, where customers are expecting instant and effective support, a great customer experience can set

Understanding Consumer Spending How it Can Help You Provide Better Payment Solutions As the world continues to develop digitally, many businesses have been realigning their payment platforms to cater to

Ready to transform your telco and unlock new revenue opportunities? Discover how the telecommunications industry can revolutionise its business model by embracing digital financial services and banking. Download the comprehensive

Aleksander Tsuiman, at Veriff, explains why he believes remote identity verification can help businesses keen to adopt or build their own use of cryptoassets without the common security risks associated

American Express has announced a new partnership with Request to Pay focused fintech startup, Bluechain to help streamline the supplier payment process for small and medium sized enterprises (SMEs). Invoice

The rebrand of PPS and Edenred Corporate Payments to Edenred Payment Solutions was unveiled at Money2020 today, marking the next step of the business’s evolution as it strives to empower

With more and more young people using BNPL as a payment option, Monica Eaton of Chargebacks 911 explores the benefits and risks of using this type of lending to make purchases.

Embedded finance is changing the face of the fintech and payments industries, with transactions projected to exceed US$7 trillion by 2026, but the real winners will be small businesses.

PEXA Pay, the first deferred net settlement scheme launched in the UK in collaboration with the Bank of England since 2008, are beginning to increase transaction volumes for Residential and

Trust Payments, the disruptive leader in frictionless payments and value-added services for merchants, is delighted to announce the signing of a strategic agreement with the Discover® Global Network that will increase

ConnexPay, the first and only payments technology company that integrates payments acceptance and issuance inside a single platform, announces a partnership with Payouts Network, an industry leader in financial technology.

DECTA, a global payment processing company, announces a new partnership with UnionPay International (UPI) a major global card scheme. In accordance with this partnership, DECTA is approved as a registered

Consumers favor financial institutions that offer modern authentication methods to secure their data and transactions In the first half of 2022, in the UK alone, fraud cost financial institutions (FIs)

29th March, London: Paymentology, the leading global issuer-processor, has joined forces with Wio Bank PJSC, the region’s first platform bank, to power its innovative banking model with customer-centric card payment

Self-proclaimed payments geek, Dan Baker, head of payment rails product at J.P. Morgan, speaks to The Payments Association’s Kate McKenzie about the evolving payments landscape.

Paymentology, the leading global issuer-processor, and Mexico’s leading financial service provider Fondeadora, today announce a strategic partnership to expand payment services in Mexico and are among the first to bring

Having led companies through transformation, Monika Liikamaa (Enfuce) and Filippa Jennersjö (OKQ8) share their dos and don’ts for companies who are at a point where their legacy systems and mindset and the change in

While current accounts are not profitable for banks, having loyal customers allows them to cross sell other products and services it offers

1st February, London: Paymentology, the world’s first truly global issuer-processor, has joined forces with cloud-native core banking platform 10x to provide pre-integrated credit and debit card issuing and processing. The partnership sees Paymentology’s

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.