Online fraud is a growing scourge in the payments space, but biometrics-based security tools can help companies fight back – and customers are paying attention.

These are the key findings of Veriff’s Fraud Index 2024, a survey of 1,000 consumers from across the US and the EU that gathered diverse viewpoints across age groups, nationalities and genders.

Three major trends emerged from the survey:

- Fraud is on the rise

More and more online consumers are directly impacted by the rise of payment fraud. The survey shows that almost half of respondents – 47.8% – encountered such criminality in the 12 months from January 2023.

These results tally with the Veriff Identity Fraud Report 2024. That report, based on our in-house data, showed a 54% rise in overall attempted fraud between 2022 and 2023 for payments platforms.

- Fraud matters to consumers – and governs their choice of providers

Customers today will scrutinize a payment provider’s track record on fraud before using its services. It’s a huge priority, with 75% of respondents saying they check in on a company’s performance in fraud prevention.

Robust fraud prevention tools aren’t just nice to have – they’re now a key differentiator in the battle to build business. Our survey shows that consumers are willing to accept the time and effort needed to achieve cutting-edge security, with 64.1% indicating acceptance of a longer sign-up process involving using an ID document and a selfie.

- Customers see the value of biometrics

Passwords have long dominated the online security domain in the payments space. However, customers no longer see this method as being robust enough, and they are now looking elsewhere. Invariably, the path leads to biometrics.

Our survey found that 38.5% of respondents viewed facial recognition/biometrics as the most secure method of logging into an online service. This proportion was higher than the combined result for two longstanding approaches: one-time codes (20.5%) and passwords (14.1%).

Most respondents (60.5%) also expressed comfort with using facial recognition to access their accounts online; similarly, over half (51.6%) would be happy using IDs and selfies to confirm their identities when onboarding or logging back into a payments platform.

Building security and boosting business for payments providers

These results paint a clear picture. “In an increasingly dangerous online world, consumers pay careful attention to a provider’s track record in preventing fraud,” says Ira Bondar, Senior Fraud Group Manager at Veriff, “and they’re happy to embrace emerging security techniques like biometrics.”

At Veriff, we understand the security advantages of biometrics. The technology is key to our identity verification (IDV) tools, offering a crucial mix of convenience and security.

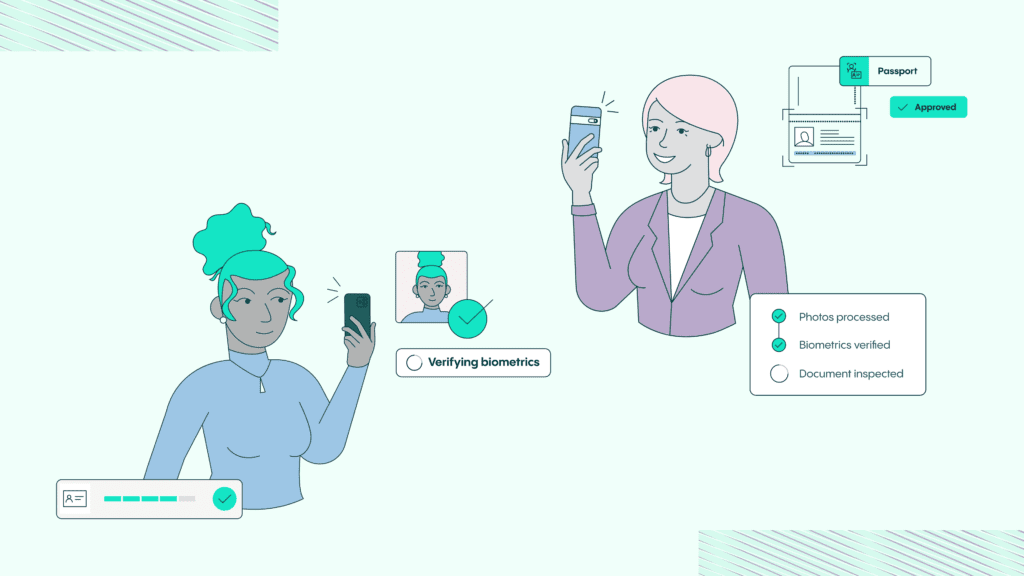

Built on a database of more than 11,500 document specimens from over 230 nations, our approach offers speed, convenience, and reduced friction through four easy steps.

- Take a photo of a government-issued ID

This can be completed on a device or platform of their choosing; Veriff supports iOS, Android, mobile web, and web SDK or API. Veriff guides users through the process, with our AI-based approach identifying document types automatically, reducing friction.

- Take a selfie

Our Assisted Image Capture tool immediately informs the user of any problems, helping them quickly correct them. We can detect liveness and realness without asking users to move unnaturally or follow complex instructions.

- Get a decision

The data is securely sent to Veriff, and our AI-powered IDV makes a decision in minutes.

- Onboard the customer

Through biometrics and AI, genuine users are onboarded faster. Your company can fight identity fraud while offering the perfect mix of security and accessibility.

For more data from the Veriff Fraud Index, download the report here.