Challenges in digital banking for the SMB space: a US perspective

How does SMB market look like in the US? Learn not only about this in our latest episode with Anthony Strike from SteadiPay!

How does SMB market look like in the US? Learn not only about this in our latest episode with Anthony Strike from SteadiPay!

Vacuumlabs, the global provider of full-stack fintech solutions, and strategic management consultants Manifesto Growth Architects recently hosted a market-and delivery-focused virtual event, Banking 2021, that brought together key industry players to speak to critical challenges across the banking industry’s new competitive landscape. What are the 5 key takeaways?

Are high street banks effectively taking opportunity of their customer base and provide them sufficient services such as investments, trading or saving?

How to provide 30 million SMBs access to sophisticated financial products, and drive innovation? That’s the question SteadiPay asked, as it finds ways to bring modern Fintech offerings to this underserved market.

Since the 2008 financial crash, the rise in technology companies looking to help us make better decisions in our finances, using data and sometimes easier to navigate apps than our traditional banks, has created a host of so-called FinTechs emerging into the market.

Which of these FinTechs could help you?

– Introduction

– Evolution of Ransomware

– Beyond Windows

– Financial and Banking Sector

– Vulnerabilities and Malware

– Conclusions

– The Now: Rise of digital banking to cause further online banking fraud

– The New: Increase in new account fraud

– How can we stop these types of attacks as we enter 2021?

– Conclusion

The payments platform continues its successful start to 2021 with landmark announcement that sees it establish its role as a pivotal player in the cross-border payments space

If your goal is to service the largest percentage of market users, respect must be given across all accessibility levels. But what is a reliable solution for non-smartphone users? In this post, we review our remote dial option as a reliable PSD2 SCA fallback.

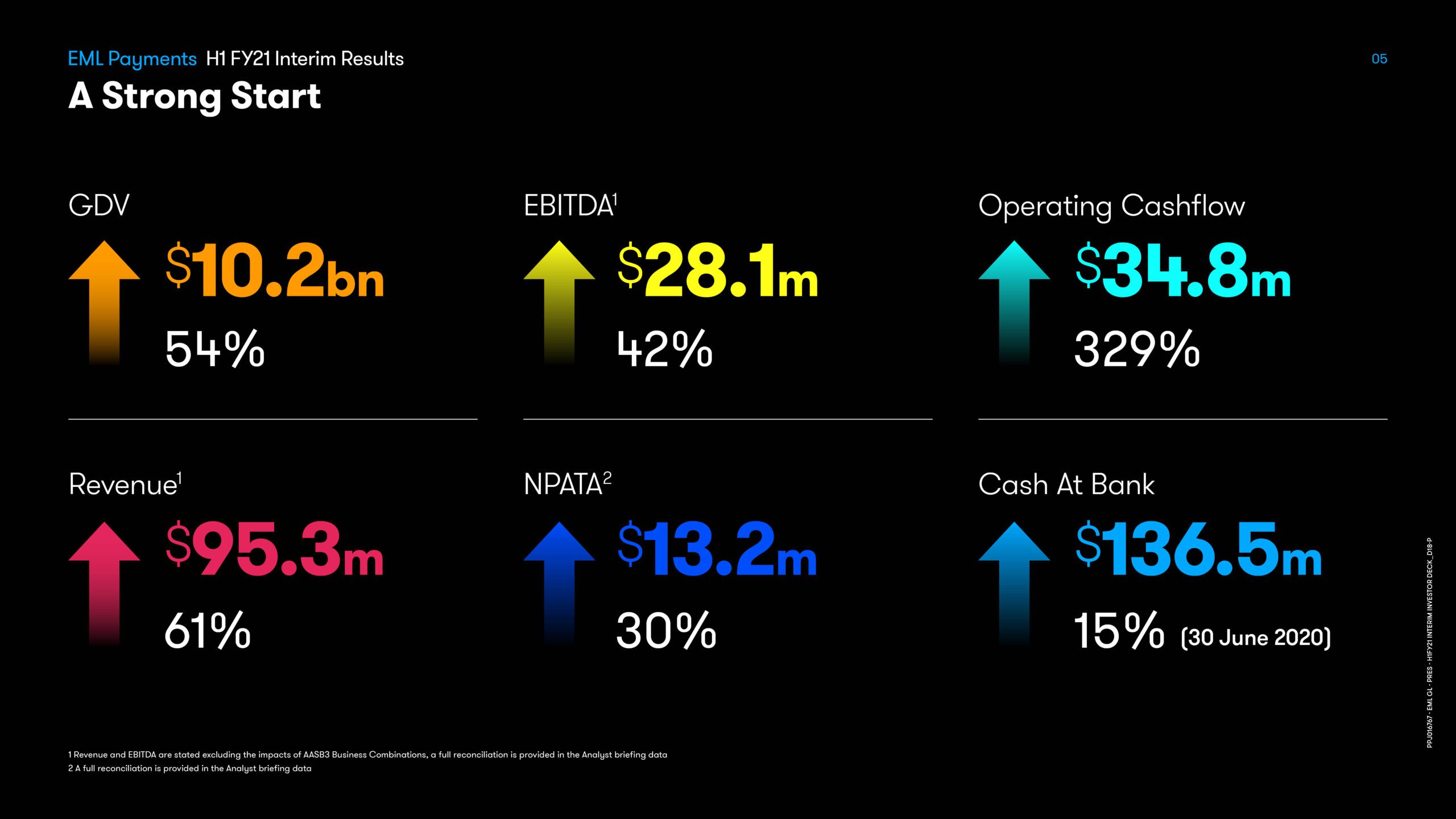

PFS has been fully integrated into EML.

We have spoken a lot about strong customer authentication (SCA) over the past year. However, the regulation has technically been in effect since mid-September of 2019. Now well into 2021, it is time for all European countries to fully enforce the updated SCA regulations. Let’s take a look at some of the deadlines.

Close to a quarter of a million people around Ireland received a Perx Reward from their boss while working from home last year.

Okay wants to make the payment process as smooth as possible, specifically when it comes to customer authentication. While this is just one part of the payment process that can introduce friction, it is often where checkout abandonment occurs. In this post, we’ll try to describe some of the options that we’ve seen in the market regarding frictionless payments, including their strengths and weaknesses.

One of the great innovations of the modern age is the ability of eCommerce to connect businesses, merchants, and consumers all across the world. Not only has this opened up new opportunities for businesses and consumers alike, but also it has expanded the realm of what is possible for small and medium enterprises on the global stage. And here we start with the interesting part of the current topic.

The global economy is expected to begin the process of recovery from the 2020 pandemic throughout 2021 and an integral part of that will be the payments industry as well as virtual IBANs and digital banking.

Analysts see five major trends on the horizon for 2021 in how things will change for the payments industry and digital banking services including enhanced automation to more robust identity verification as well as an authentication technology.

Over the last few years, Okay has gone through both security certifications and penetration testing. While they represent two uniquely different processes, each has greatly improved our product’s security, code quality and architecture. In this post, we discuss the importance of each, as well as what we’ve learned along the way.

Now, in 2021, and with the Brexit negotiations in their rearview mirror, the EU market is looking to digital banking solutions to help address problems of inequality, sustainability, and supporting a circular economy.

Indeed, the future of the market in Europe is not only digital but digital banking, in particular, will play a huge role in bringing about the social transformations and member-state cohesion needed to build economic resilience and growth for the future.

What are some of the major forces driving the corporate banking digitization process? What are the factors and trends behind some of the most seismic moves in recent years in this otherwise quite conservative industry? What are the main key-topics we should have on our radar in order to stay ahead of our business competitors and be the first to learn what would be the next

“big thing”?

Not only is the extension of digital banking services and digital payments solutions integral to the growth of mobile and online marketplaces, but also it is central to the monetary revolution taking place right now with cryptocurrencies and the rise of a cashless economy. We have identified three major movements in digital banking that could shape how the next several years play out, from enhanced payments processing to the integration of new consumer blocks into the financial system.

Will our smart devices be able to implement the necessary security measures to keep up with an ever-increasing digital marketplace? If so, which ones will reign supreme? In this article, we reflect on an age-old question of iPhone vs Android device, well worth considering by all financial industry players, big or small.

Case Study discussing how Konsentus Verify enabled specialist online bank Knab to provide safe and secure open banking services to their customers without the support of a large development project team or investment in additional infrastructure.

Customers are presented with a wealth of payment methods daily, so Moorwand has created a new series where our team will delve into the different types available. First up: Prepaid Cards

EML Payments Limited (ASX: EML) is pleased to release its FY21 Interim Report.

With its modern alternative approach to banking, U Account is helping to deliver greater financial inclusivity with a solution, powered by Modulr, that’s designed to help those underserved by traditional banks to improve their financial wellbeing.

Rob Shore, Group CFO at EML, is very excited about the company’s 3-year Accelerator strategy.

The rise in technology companies looking to help us make better decisions in our finances has created a host of so-called FinTechs emerging into the market. But what is the right solution for you?

Trust Payments has appointed Tom Pilling as Chief Risk Officer (CRO) responsible for overseeing the group’s risk management framework as it expands in key sectors and geographically into UK, EU and the US.

Every business from sole traders to large corporations are always on the lookout for ways to save time and money.

With the big banks’ monopoly on providing financial services now broken by FinTechs and new players in the Open Banking space, the choice of alternatives has never been more exciting – and maybe a little confusing for newcomers.

The 6th Anti-Money Laundering directive (6AMLD) came into effect on the 3rd December 2020 and must be implemented by regulated businesses by 3rd June 2021. After the 5th AMLD introduced so many fundamental changes to the regulatory landscape, most notably introducing a focus on ultimate beneficial owners and strengthening the need for a Know Your Business offering, will the 6th be so impactful?

The EU has not at this point, granted the UK and GDPR equivalency status. We continue to hope that this, or a trade agreement is in place before the 31st. However, we have in place with our EEC clients standard contractual clauses under which we facilitate data transfers.

A new set of Standard Contractual Clauses (SCC) have been drafted, and the consultation period for these closed on the 10th December 2020.

Digital banking is not only the future of banking but also it is allowing for new business segments to emerge and for smaller companies to compete on a more level playing field with major competitors. We’ll explain what they are and how they are making such a massive impact on the financial landscape of today.

The COVID-19 pandemic is changing the way businesses conduct themselves online as well as customer expectations about what they can do. In other words, shopping has moved from the retail space to anywhere a consumer has a smartphone and digital banking is among the greatest business innovations that have enabled this brave new world.

Disruption is a buzzword that is often bandied about in the media for one reason or another but rarely do we take time to consider what it actually means in the marketplace.

To watch that in action, we need only look as far as banking and how banking as a service, or BaaS, is changing the landscape of the once-staid financial industry forever.

With so much change coming to commerce and B2B payments, it is often hard to spot the trends of the future when you’re dealing with so much change here and now. That’s probably easier said than done, especially considering the dual track of digital banking and the traditional banking system that has underpinned much of global commerce over the past several decades.

It is a great honour that Susan Brown the founder of Zortrex is nominated in the category Fintech, Cybersecurity, Susan Brown: To stand next to all the other professional semi finalists, is just amazing. You have all supported me 1 way or another by either liking my articles, or posting news about the major breach news, I just cannot thank you all enough. AccelerateHer has always had the initiative that Scotland Can Do approach.

Pre-pandemic, mobile wallets struggled to compete with the penetration rates of alternative – more embedded – payment methods. But then COVID happened and it caused the payments landscape to shift. But mobile wallets aren’t just for COVID, and here’s why…

Changes in digital payments due to the global pandemic are likely to carry over into next year and will have security implications. Visa’s Chief Risk Officer Diego Paul Fabara identifies five key developments that will impact the global payments ecosystem in 2021

Miroslava Betinova, Head of Strategic Sales at PPS, discusses the trends we’ll see in the fintech industry this 2021.

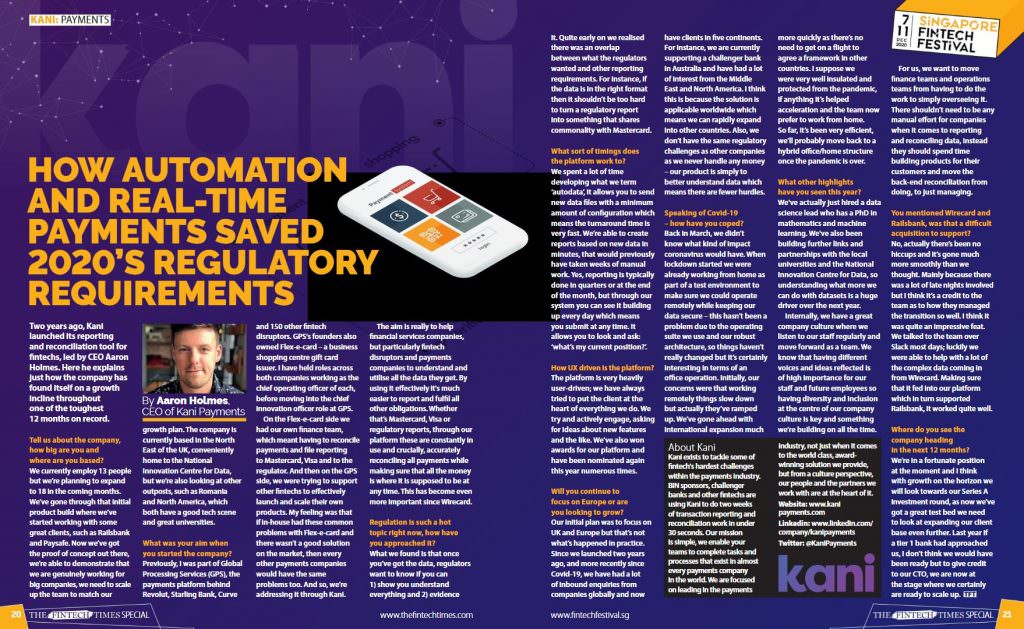

A discussion between COO of Railsbank and CEO of Kani Payments, focused on the importance of partnerships within the FinTech Industry.

An interview with Kani CEO Aaron Holmes

– Trust

– Safety

– Building trust and safety using behavioral biometrics

– Preventing fraud and maintaining mutual trust

– There has been an increase in fraud seeking to circumvent payments security

– Behavioral biometrics took steps towards becoming a foundational cybersecurity technology

– Fraud prevention in 2021 will become as much about response as detection

EML CEO Relishes Marching To The Beat Of A Different Drum in 2021.

The rise in cloud-based technology has paved the way for a whole new industry, fondly known as Software as a Service (SaaS). This global industry has resulted in a number of small businesses ‘accidentally’ importing goods from abroad, which can result in hidden foreign exchange costs.

To read the full article, visit:

https://www.konsentus.com/insights/is_there_a_need_to_standardise_technical_specification_for_open_banking_certificates/

To understand the impact of new technology innovations on fintech, Tribe Payments would like to find out the opinion of leaders within the sector through this this short survey for upcoming industry report

A gift card isn’t just for Christmas, it’s handy for a crisis too: reflecting on the small things making a huge difference

How people make payments have evolved greatly over the years. From cash, we have moved to paper cheques, to credit cards, to the current world of purely digital payment methods

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.