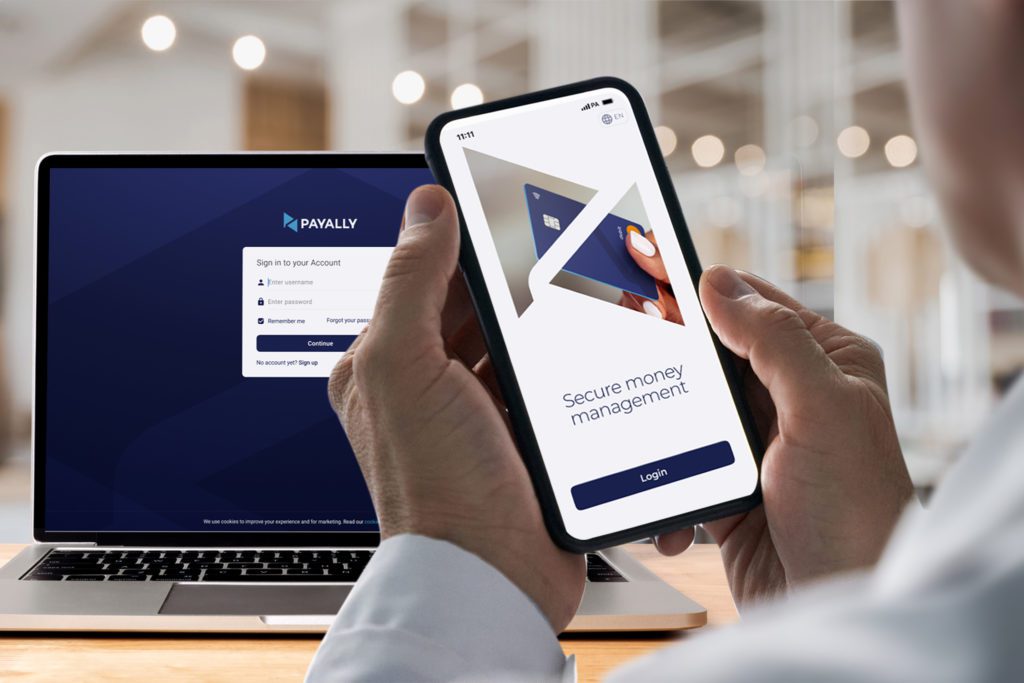

PayAlly Launches New Portal and Mobile App

24 May 2023, London. New Look. Advanced client experience. Same reliability and efficiency. In continued effort to provide exceptional financial services, PayAlly launches the latest version of their web-based portal