PayPoint extends ATM cashback offer

Welwyn Garden City, 5 March 2018: PayPoint have now extended their ATM cashback offer to all retailers who switch to a PayPoint ATM. The offer gives

Welwyn Garden City, 5 March 2018: PayPoint have now extended their ATM cashback offer to all retailers who switch to a PayPoint ATM. The offer gives

International payments executive, Karim Ahmad, appointed as Chief Product and Transformation Officer; Daniel Kornitzer moves into Chief Business Development role London, UK – April 3,

Comprehensive Sodexo Study Finds Gender-Balanced Management Teams Perform Better on Key Business Objectives. Sodexo, world leader in Quality of Life Services, has found that teams

TRMI v3.0 also includes one of the broadest fixed income and sovereign debt coverage in the marketplace NEW YORK – Thomson Reuters, through its partnership with MarketPsych

Qatar Duty Free becomes first Airport Retailer in MEA to introduce Alipay Hamad International Airport ranked the world’s fourth ‘Best Airport for Shopping’ at the

Data from Saxo Payments Banking Circle reveals that delays in payment settlement times and reconciliation challenges hit cash flow www.bankingcircle.com London, February 2018 – With

The clock is ticking! The deadline for the General Data Protection Regulation is fast approaching. In May 2018, companies will be required by law to

Since the launch of the SCT Inst rulebook in November 2017, many more banks are live and offering real-time payments to their customers, with most

The collaboration has created a full-service bank account that combines banking and accounting for freelancers, self-employed people and small businesses. 7th February 2018, London, UK – PrePay

Ramparts welcomes Karen Griffin to our team. We are delighted to welcome Karen Griffin, who joins our legal and fiduciary teams in Gibraltar as our

London and Sydney: Global Processing Services (GPS), part of Rt. Hon. Lord Mayor of the City of London’s UK Business delegation to Australia and New

Client demand has driven deVere Vault, the multi-currency e-money app, to launch Companion Cards, it has today been confirmed. Users of deVere E-Money’s trailblazing app

Cybertonica, an Artificial Intelligence fraud management technology company which utilises Machine Learning to reduce basket drop-off and increase conversion for all transaction platforms, has appointed Olaf Hofmann as

If it wants to achieve its long-term goals, the UK’s new Office for Professional Body Anti Money Laundering Supervision has to make both the regulatory

London, 5th February 2018: Her Majesty’s Swiss Government is delighted to announce the third UK Fintech Mission to Switzerland which, because of its past success,

Paysafe’s peer to peer payment service supports the underserved LONDON, 6 February, 2018 – Paysafe, a leading global payments provider, has launched Skrill Send Direct, a

Faster lower-cost cross border settlement for Paysafe clients www.bankingcircle.com London, February 2018 – Paysafe Group Limited, a leading global payments provider, has joined Saxo Payments

A scheme launched by Allstar Business Solutions will help small and medium businesses reduce their fleet service, maintenance and repair (SMR) bills. A recent report revealed that economic pressures

Banking Circle supports Payments Association FinTech Regulation Helpline www.bankingcircle.com London, 11th April 2018 – The The Payments Association, with the support of its Benefactor, Saxo

By Neil Harris (Advisory Board member at The Payments Association & CCO at Global Processing Services) Declining real wages, increased income volatility, the squeeze on

[vc_row type=”in_container” full_screen_row_position=”middle” scene_position=”center” text_color=”dark” text_align=”left” overlay_strength=”0.3″][vc_column column_padding=”no-extra-padding” column_padding_position=”all” background_color_opacity=”1″ background_hover_color_opacity=”1″ width=”1/1″ tablet_text_alignment=”default” phone_text_alignment=”default”][vc_column_text] By Tony Craddock, Director General, The Payments Association Or, ‘What the

London, 29th May 2018 – According to new research commissioned by ground-breaking financial utility, Saxo Payments Banking Circle, SMEs are facing potentially fatal challenges in

Leading virtual currency platform provider, Coinify, welcomes Hans Henrik Hoffmeyer to solidify their market position Coinify ApS, an established global virtual currency platform offering blockchain

Coinify has recently experienced a growth spurt where we have welcomed a talented group of experts from various industries to join our team and help

As part of our company’s growth, we are expanding our current business offering with compliant corporate brokerage services for virtual currencies, with bitcoin and ether

May 15, 2018 (Copenhagen, Denmark) In light of the recently launched brokerage service for corporate clients, Coinify is pleased to present the first collaboration. In this

Konsentus, a RegTech company which facilitates checking the regulatory status and eIDAS Seal Certificates of Third Party Providers, along with the issuing of access tokens

With the vast majority of e-money and payment institutions successfully re-authorised, let’s take a look at how the FCA intends to monitor this growing population

With all the excitement around re-authorisation, the ban on credit card surcharges and the new payment services activities, the less headline grabbing regulatory changes introduced by the second payment

This week, NatWest announced that it has teamed up with British mobile phone retailer Carphone Warehouse to trial a new online shopping system that lets customers pay

The end of this month marks 10 years since Rihanna’s single, Take a Bow, reached number 1 in the UK singles charts. Although I know a

Mastercard expands investment in Europe to further power the expansion of FinTechs, helping them reach scale at speed May 17th, 2018 – Mastercard today announces

For consumers, increased trust and ease of use are key to driving mass adoption of Conversational Commerce and unleashing its potential June 4, 2018 – Mastercard

First example of a Mastercard service made possible by the integration of Vocalink and its real-time payments capabilities London, June 6th 2018: Mastercard today confirmed

Atlanta, USA, June 13, 2018 – Entersekt, an innovator in push-based authentication and app security, has opened a new office in Atlanta to support the company’s

German consultancy describes Entersekt product as a “state of the art solution” London, United Kingdom, April 12, 2018 — Entersekt, a leader in next-generation digital banking security,

London, 18th June 2018 – Miranda McLean, VP of Marketing at ground-breaking financial utility, Saxo Payments Banking Circle since its launch, has been appointed to

Investment will accelerate the growth of GPS and drive its international expansion plans – GPS is the tech powerhouse behind the most exciting digital banks,

Europe’s largest capacity card manufacturer, Nitecrest, are pleased to announce two new Sales Directors will be joining the Group’s retail, commercial and banking divisions. Barry

Brussels, 25 June 2018 – The SWIFT Community is to universally adopt the gpi service, in a move which will see all 10,000 banks on SWIFT’s

Paysafe has completed the acquisition of iPayment Holdings, consolidating their place as one of the top five non-bank payment processors in the US. Read more

CEO Acquiring and Card Solutions, Andrea Dunlop, features on the cover of this month’s edition of UK Retail Banker from RFi Group. Read her thoughts

Programme Manager, BIN sponsor, Card/Wallet processor confused about how GDPR effects you, this simple info graphic outlines how it could and will have an impact

Small to medium size businesses (SMEs) are at the heart of a new multi-media advertising campaign launched by the Current Account Switch Service, which highlights

Saxo Payments Banking Circle co-founder and Chief Executive Officer, Anders la Cour, was invited to discuss the growth of Financial Utilities in the visionary Rebank

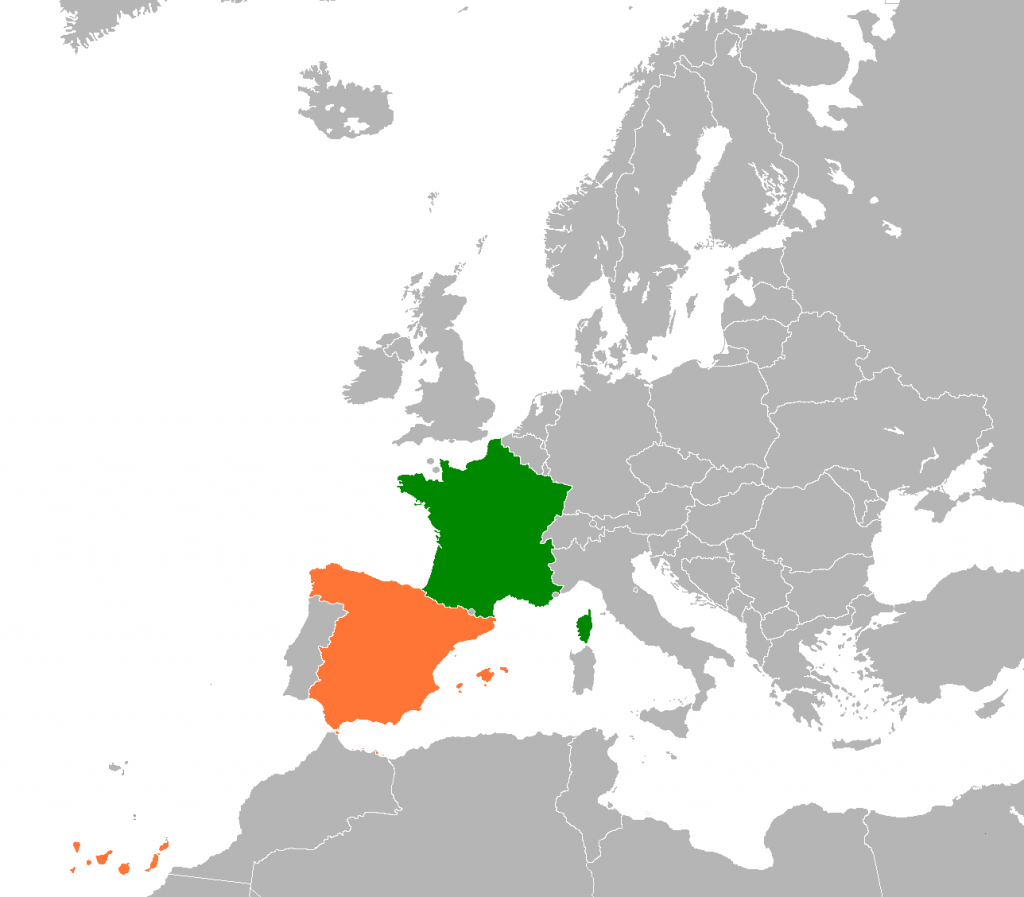

In response to consumer demand for identity verification services in France and Spain, W2 Global Data have now added these to the growing list of

W2 Global Data were one of a very small number of companies picked by Sky Betting & Gaming (SB&G) to participate in their prestigious 11-week

In recent months, many countries have rolled out real-time payments schemes. In the USA, The Clearing House launched their Faster Payments scheme in November 2017,

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.