Konsentus acquires Open Banking Europe from PRETA

Konsentus has acquired Open Banking Europe S.A.S. from PRETA.

Konsentus has acquired Open Banking Europe S.A.S. from PRETA.

Okay wants to make the payment process as smooth as possible, specifically when it comes to customer authentication. While this is just one part of the payment process that can introduce friction, it is often where checkout abandonment occurs. In this post, we’ll try to describe some of the options that we’ve seen in the market regarding frictionless payments, including their strengths and weaknesses.

One of the great innovations of the modern age is the ability of eCommerce to connect businesses, merchants, and consumers all across the world. Not only has this opened up new opportunities for businesses and consumers alike, but also it has expanded the realm of what is possible for small and medium enterprises on the global stage. And here we start with the interesting part of the current topic.

The global economy is expected to begin the process of recovery from the 2020 pandemic throughout 2021 and an integral part of that will be the payments industry as well as virtual IBANs and digital banking.

Analysts see five major trends on the horizon for 2021 in how things will change for the payments industry and digital banking services including enhanced automation to more robust identity verification as well as an authentication technology.

Over the last few years, Okay has gone through both security certifications and penetration testing. While they represent two uniquely different processes, each has greatly improved our product’s security, code quality and architecture. In this post, we discuss the importance of each, as well as what we’ve learned along the way.

Now, in 2021, and with the Brexit negotiations in their rearview mirror, the EU market is looking to digital banking solutions to help address problems of inequality, sustainability, and supporting a circular economy.

Indeed, the future of the market in Europe is not only digital but digital banking, in particular, will play a huge role in bringing about the social transformations and member-state cohesion needed to build economic resilience and growth for the future.

What are some of the major forces driving the corporate banking digitization process? What are the factors and trends behind some of the most seismic moves in recent years in this otherwise quite conservative industry? What are the main key-topics we should have on our radar in order to stay ahead of our business competitors and be the first to learn what would be the next

“big thing”?

Not only is the extension of digital banking services and digital payments solutions integral to the growth of mobile and online marketplaces, but also it is central to the monetary revolution taking place right now with cryptocurrencies and the rise of a cashless economy. We have identified three major movements in digital banking that could shape how the next several years play out, from enhanced payments processing to the integration of new consumer blocks into the financial system.

Will our smart devices be able to implement the necessary security measures to keep up with an ever-increasing digital marketplace? If so, which ones will reign supreme? In this article, we reflect on an age-old question of iPhone vs Android device, well worth considering by all financial industry players, big or small.

Case Study discussing how Konsentus Verify enabled specialist online bank Knab to provide safe and secure open banking services to their customers without the support of a large development project team or investment in additional infrastructure.

Alternative financial solutions provider VIALET has selected Moorwand as the issuer and BIN Sponsor across Poland, Spain, Lithuania and Latvia for its new credit product.

Customers are presented with a wealth of payment methods daily, so Moorwand has created a new series where our team will delve into the different types available. First up: Prepaid Cards

Radar Payments launches Tap to Phone, making it easier for sellers to use their mobile devices to accept payments and offer enhanced customer experience.

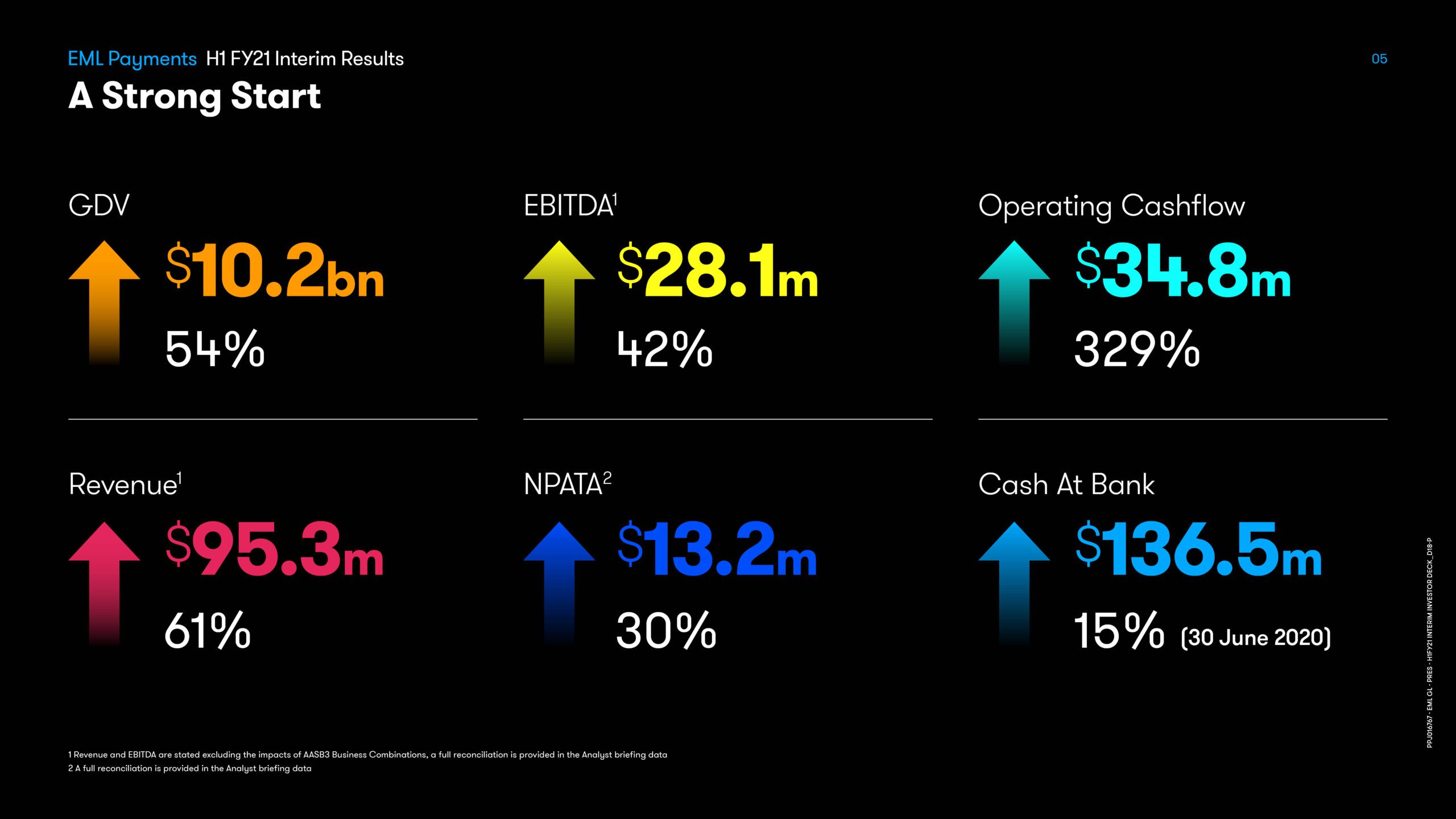

EML Payments Limited (ASX: EML) is pleased to release its FY21 Interim Report.

Join in this webinar from Finextra, held in association with Bottomline Technologies, to hear the discussion on the following areas with industry experts:

– Why have the G20 become so focused on cross-border payments today?

– What are the most attractive ways to modernise the cross-border payments operation?

– What impact does trapped liquidity bear on the cost of cross-border payments?

– How does Visa-Swift interoperability enable greater service options and value?

– What role do technology enablers play within this network?

– What are the key benefits of the GPI and Visa B2B Connect solutions?

– Can networks succeed alone or is collaboration the new model?

How do Financial Institutions in EMEA Migrate to ISO 20022, Hit Deadlines & Create New Business Opportunity?

ISO 20022 is predicted to support 80% of volume and 90% of the value of high-value transactions and SWIFT has mandated that ANY financial institution that processes SWIFT messages must be able to receive and process ISO messages by the end of 2022.

Bottomline, a leading provider of financial technology that makes complex business payments simple, smart and secure, unveiled expanded corporate treasury capabilities as part of its integrated Payments and Cash Lifecycle Platform. The platform empowers financial managers to optimize cash, liquidity and working capital with a unified solution combining payables, receivables, and treasury management, delivering greater visibility and control throughout the end-to-end cash lifecycle.

Bottomline and Strategic Treasurer release the results of the 2021 Treasury Fraud & Controls Survey. This is the 6th annual survey between the long-time collaborators, whose research partnership also includes the annual B2B Payments Survey.

Beam launches new service, to bring instant and secure payments to WooCommerce merchants via Open Banking. Leveraging Nuapay’s payments platform, Beam is aiming to help UK businesses save £100k over the next year.

The partnership enables Beam to provide Open Banking payments to its clients on WooCommerce – the open-source e-commerce plugin for WordPress – bringing online and omnichannel retailers the benefits of faster, more secure and cost-efficient payments.

Banking Circle, the cross border payments expert, has identified an issue affecting some financial institutions handling cross border transactions from the UK to the EU. It seems Brexit has caused a number of EU banks to increase their fees for receipt of SPayments Association local payments in EUR from GB IBANs.

Recently acquired by Mogo Inc., Modern Issuer Processor Carta Worldwide continues international fintech growth with Japanese market expansion

Leading payments provider Paynetics is delighted to share a selection of major milestones in its international growth journey from 2020. The e-money institution has released a new video celebrating its latest appointments, acquisitions, client wins, partnerships, events, launches and more from the last 12 months.

Leading payments issuer processor, Global Processing Services (GPS) has announced that it will be sponsoring findexable’s Fintech Diversity Radar, the world’s first global platform gathering progressive data to understand women’s impact and contribution to the digital economy.

Cybertonica, the advanced fraud and risk management provider, has appointed Carl Clump to its Board to lend his strategic and managerial expertise to the expanding business.

With its modern alternative approach to banking, U Account is helping to deliver greater financial inclusivity with a solution, powered by Modulr, that’s designed to help those underserved by traditional banks to improve their financial wellbeing.

Banker turned fintech investor bolsters Curve Board, ahead of expansion into US, deeper push into Europe and launch of Curve Credit

Luxembourg-based financial infrastructure provider Banking Circle, a partner of Payments businesses and Banks, has joined the Verband der Auslandsbanken in Deutschlan (VAB) which is the Association of Foreign Banks in Germany.

Rob Shore, Group CFO at EML, is very excited about the company’s 3-year Accelerator strategy.

The rise in technology companies looking to help us make better decisions in our finances has created a host of so-called FinTechs emerging into the market. But what is the right solution for you?

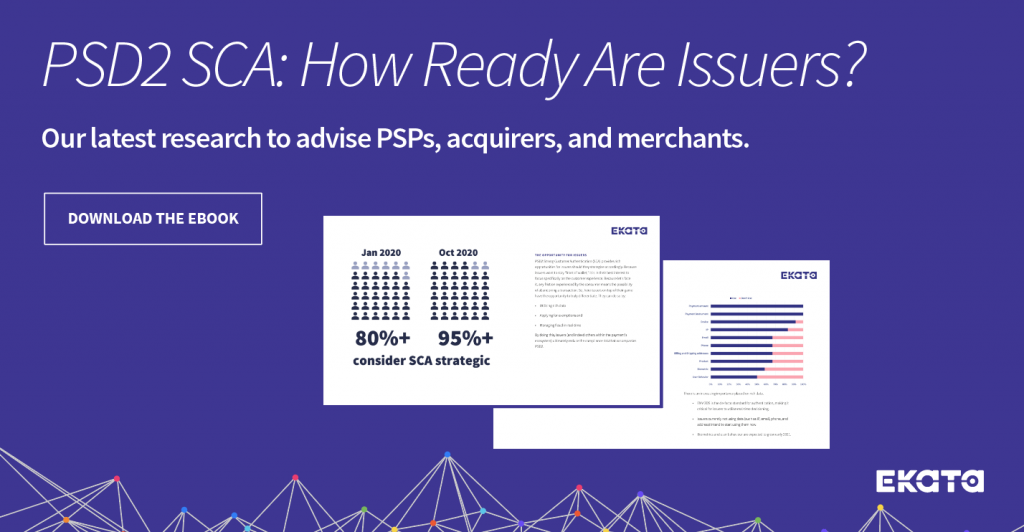

Ekata surveyed over 500 issuers & platforms. Download our ebook which aims to inform merchants of issuer readiness findings and future updates.

HIPS Payment Group Ltd, a provider of innovative and cost-effective e-commerce and mobile payment solutions, and licensed bank, Banking Circle, which delivers ground-breaking financial infrastructure for Payment businesses and Banks, today announced their partnership, which enables Hips to offer settlement with domestic payment rails.

Allstar Business Solutions Limited, the UK’s leading fuel management company, announces its new partnership with Gronn Kontakt, an electric vehicle (EV) charging company owned by Statkraft – Europe’s largest producer of renewable energy. The deal means that Allstar adds a further 47 charging sites and 110 charge points to the multi-branded Allstar One Electric network.

Fintech firm Curve adds former President of Samsung’s Global Strategy Group Cuong Do to its Board

Trust Payments has appointed Tom Pilling as Chief Risk Officer (CRO) responsible for overseeing the group’s risk management framework as it expands in key sectors and geographically into UK, EU and the US.

PPRO, the global provider of local payments infrastructure, is working with Banking Circle, the ground-breaking financial infrastructure provider, to enhance the PPRO service offering, supporting PSPs working with cross border e-commerce merchants. The partnership underlines the effectiveness of Banking Circle as a next-generation provider of mission-critical infrastructure for online cross border payments.

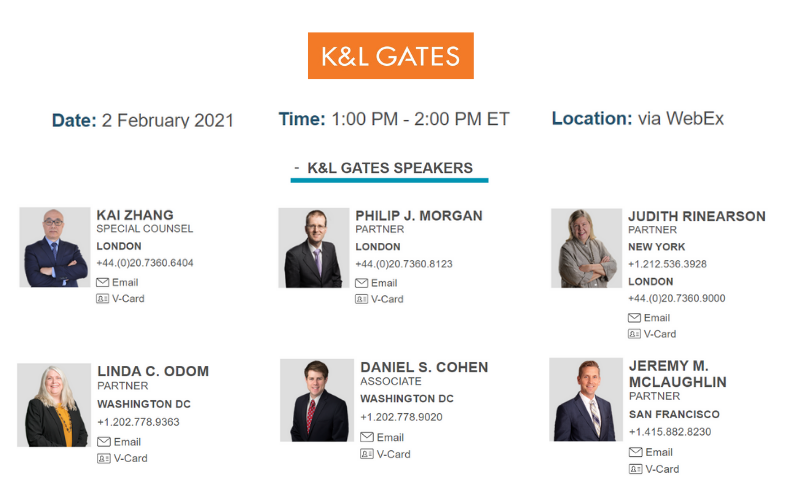

Join us for a cross pond webinar focusing on the enormous changes that are expected to impact payments in the US and UK featuring:

•In London, new K&L Gates Special Payments Counsel, Kai Zhang, and Partner, Philip Morgan.

•In New York, Partner and Global Fintech Co-Chair, Judie Rinearson.

•In Washington DC, Partner and Technology Law Specialist, Linda Odom, and Associate, Daniel Cohen.

•In San Francisco, Partner, Cryptocurrency and Fintech Lawyer, Jeremy McLaughlin.

Topics to be covered include:

•Expected changes to be implemented by the new US Democratic administration

•New leadership in the CFPB, SEC, OCC, and CFTC and what it means for banks and Fintechs

•UK and the implementation of Brexit with respect to payments and banking

•Anticipated changes in providing payment services to the UK and Europe

•The outlook for Fintech investment, Mergers and Acquisitions in the next 12 months on both sides of the pond

•What products and services are the winners and losers from these sweeping changes? Mobile apps? Traditional banking? Digital assets, stable coins and cryptocurrencies?

Press release announcing the Konsentus acquisition of Open Banking Europe from PRETA

Every business from sole traders to large corporations are always on the lookout for ways to save time and money.

With the big banks’ monopoly on providing financial services now broken by FinTechs and new players in the Open Banking space, the choice of alternatives has never been more exciting – and maybe a little confusing for newcomers.

The 6th Anti-Money Laundering directive (6AMLD) came into effect on the 3rd December 2020 and must be implemented by regulated businesses by 3rd June 2021. After the 5th AMLD introduced so many fundamental changes to the regulatory landscape, most notably introducing a focus on ultimate beneficial owners and strengthening the need for a Know Your Business offering, will the 6th be so impactful?

The EU has not at this point, granted the UK and GDPR equivalency status. We continue to hope that this, or a trade agreement is in place before the 31st. However, we have in place with our EEC clients standard contractual clauses under which we facilitate data transfers.

A new set of Standard Contractual Clauses (SCC) have been drafted, and the consultation period for these closed on the 10th December 2020.

Leading European Banking-as-a Service and payments provider, Contis, is delighted to announce its partnership with Pin4, an international fintech pioneering access to cash. This collaboration will enable account holders to access cash via their mobile phones which they can instantly collect at any enabled ATM, including any of 12,000 Cardtronics ATMs across the UK, without the need for a card or pre-registration.

On Wednesday 20 January at 4pm UTC, Ince hosted a webinar in cooperation with Lexology on the draft EU Markets in Cryptoassets (MiCA) Regulation. On

With half of consumers more likely to go cashless as a result of COVID-19 businesses can no longer shy aware from the concept of a digital-first business model. And as this focus shifts, the concept of identity intelligence has become a strategic imperative. In the GBG State of Digital Identity Report we dive into the digital accelerations, tomorrow’s threats and outline a blueprint for the next normal.

Addition of payment fraud prevention extends expertise in anti-money laundering and financial crime NEW YORK – Refinitiv has expanded its suite of risk and compliance products

Fintech and Payments Association member Paynetics AD has announced the appointment of Ian Clowes as chairman of Paynetics UK, as the regulated payment services provider continues to bolster its senior team.

Webinar | January & February 2021 View in browser As the UK’s transition arrangements with the EU draw to a close and the US beds

New data from Open Banking pioneer Nuapay, powered by Sentenial, has revealed that consumers are frustrated with the user experience when making card payments online. This follows recent findings that highlighted a raft of payment card security failings. The news comes as retailers ready themselves for the busy festive shopping season – an event that is even more important this year as businesses seek to plug pandemic losses.

2020 saw significant growth in digital payments with the pandemic as one of the key factors. Covid 19 and shifting consumer behaviours steered the move toward contactless options and Open Banking for a safe, efficient, and contactless alternative to traditional payment methods.

Discover how Account to Account payment providers like Nuapay have worked to enable seamless recurring payments for businesses to deliver a faster and more frictionless experience for their customers.

Explore key trends including subscription models powered by recurring payments and QR codes which are fast becoming a mainstream payment method.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.