Curve Announces Cashback for a YEAR with its New Referral Scheme

Existing Curve customers can now receive 1% cashback for 30 days on every successful referral

Existing Curve customers can now receive 1% cashback for 30 days on every successful referral

Travel Direct Debit Card Currensea partners with Singapore Airlines in first-of-its-kind offering

FxPro, the truly global broker, has partnered with Currencycloud, a leading provider of B2B embedded cross-border solutions, as part of a new offer of flexible and convenient e-money solutions in the form of its new business – BnkPro.

https://bit.ly/37gzhbv

Universo, one of Portugal’s leading financial institutions, is using Token’s open banking payments platform to enable customers of its Cartão Universo credit card product to easily load funds onto their accounts with a click of a button. This new open banking partnership marks the first of its kind for Universo.

On 14 July, Marion King, Director of Payments, NatWest took part in the 2nd webinar in NatWest’s Banks 45 Series. Joining Marion on the panel was Gerard Lemos, Independent Chairman

Monneo, a virtual IBAN and eCommerce bank account provider, has announced its new Multicurrency merchant settlement solution. This unique solution enables acquirers to receive and distribute settlements to their merchants through the Monneo platform. The service will help make transactions across borders and currencies easier and quicker, which is vital for acquirers that operate in different verticals.

Many acquirers, PSPs and Payment Facilitators face challenges when distributing funds to merchants across borders, and this unique service will help make settlements easier and quicker to send out. This is yet another example of how fintech innovation is helping to solve problems relating to cross border payments and underbanked eCommerce verticals.

Manchester FinTech Accesspay has made three senior hires as part of ambitious growth plans to double headcount in 2021.

The deadline for the 6th Anti-Money Laundering Directive (6AMLD) is rapidly approaching — currently, it is set for June 3rd. That said, the question of whether 6AMLD’s measures are clear and robust enough to combat the ever-growing problem of money laundering remains.

Marius Galdikas, CEO at ConnectPay, has taken the opportunity to overview how the AML regulatory framework has changed over the years, starting with the first Anti-Money Laundering Directive. He has also outlined what to expect in the near future, as some challenges regulators have yet to outline as possible threats.

We are extremely proud to announce our expansion to the United States with Paysafe Group & Mastercard as a partner of their Digital Doors program.

SimplyPayMe will from now on empower & enable American SMBs by allowing them flexibility in getting paid and the ease of running their business, all within one single application.

We are also working with banks and digital partners to help them serve their SMBs better, giving them the option to offer SimplyPayMe as a value-added service or as a white label.

Demand for cash injections from alternative finance providers shows no signs of abating, as such, lenders must embrace innovation to improve their business finance offering. Read @Currencycloud’s blog to discover how APIs are the future of invoice finance. https://bit.ly/3wEqwCr

Ordo wins Open Banking Expo #PoweroftheNetwork Award 2021!

Moorwand is pleased to announce their latest partnership with Payme Swiss. Moorwand will be providing issuing, BIN Sponsorship, and digital banking services to Payme Swiss to help revolutionise card and wearable payments, across Europe, for predominantly affluent and high-net-worth individuals (HNWI).

This 2021 report summarises a survey taken by over 200 payments professionals across the banking, financial, fintech and corporate sectors. It provides an overview of the payments landscape, explores the key findings, and provides insight into the various elements that had an impact on failed payments throughout 2020.

PSD2 is a hot topic for the UK market. How can we tackle it?

We take a look at challenges and solutions for the UK payment ecosystem in complying with PSD2 requirements.

With PSD2 now live in most European countries, being 5 months past the December 31, 2020 deadline, the UK is next, as the deadline for March 2022 is approaching. In order for the cardholder and merchant to properly adopt additional authentication without abandoning the transaction, the main focus is eliminating as much friction as possible. Testing data¹ from merchants such as Amazon, Google and Microsoft has shown that although Strong Customer Authentication has been enabled for most of the UK ecosystem, it is still grappling with several issues. Examples of this are relying on Risk Based Authentication for lower challenge rates, issuer readiness on latest protocols, issuer latency and lastly confusion on what exemptions to properly utilize.

In the post-pandemic world, where digital commerce has become the default, all kinds of financial service innovators are looking for new ways to add value for customers and to monetise these enhanced experiences, even when banking isn’t their core business. Here, digital leaders provide insider tips on how to get ahead.

Download the full report here: https://landing.modulrfinance.com/leaders-and-laggards-part2-report-0

Allstar Business Solutions, the UK’s leading fuel management company, has announced it’s partnership with leading electric vehicle (EV) charging infrastructure provider, EB Charging, to improve access to – and the availability of – electric charging points for fleet operators across the UK.

– Introduction

– Poor hygiene & Persistent threats – ‘perfect storm’ of online fraud

– Customers expect Banks to Know Your User

– Fraud Fighting Collective – Fraud Fusion Centers

– Overwhelmed with Alerts, Automation is key

– Clear ‘risk calculation’ – Frictionless First

– No silver bullet – but there are best practices

– Introduction

– What is BionicID™ analysis best suited for?

– Does BionicID™ data collection or analysis impact the user experience?

– Does BionicID™ data collection/analysis comply with SCA/PSD2?

– Does BionicID™ data collection/analysis (behavioral biometric digital identity) comply with GDPR?

– Introduction

– Physical vs. Behavioral Biometrics

– What is a BionicID™

– What makes Revelock’s BionicID™ solution unique in fraud prevention?

– What makes Revelock’s BionicID™ more accurate than other behavioral biometric solutions?

BPC, the global leading payment solution provider, has announced that Diners Club Peru has selected its commerce suite as part of its innovation program. Diners Club Peru is the third acquiring network in Peru, owned by Banco Pichincha Peru, part of the Pichincha Holding Group headquartered in Ecuador.

How can your bank or building society avoid the payments transformation sinkhole?

Join us and our guest speaker Chris Jones, Managing Director PSE Consulting, on the 20th July to learn:

How customers experience your brand through your payments experience

How to fast track payments technology

What can de-rail your digitisation

Book your spot today and make getting payments right easier for your financial institution https://landing.modulrfinance.com/how-to-avoid-the-payments-transformation-sinkhole-epa

Sibos 2021 Discover Perfect Pitch Flyer Sibos 2021 sees the second edition of the Discover Perfect Pitch competition, a challenge with a twist giving fintechs from around the globe the

SWIFT Hackathon for 2021 View the SWIFT Hackathon 2021 flyer This year, we are challenging the community and wider ecosystem to harness the power of AI & machine learning to

Award-winning fintech charity, and Payments Association member, Pennies has joined forces with Systopia, (point of sale and payment solutions for the foodservice sector) – to help drive digital “micro-donations” for UK charities, from businesses with on-site hospitality.

It is becoming ever more apparent that ‘Big Tech’ players are looking to service a slice of the financial services sector. What does this mean for the industry and the banks that service it today?

Entersekt and Netcetera implement the first FIDO authentication in payments for Pluscard.

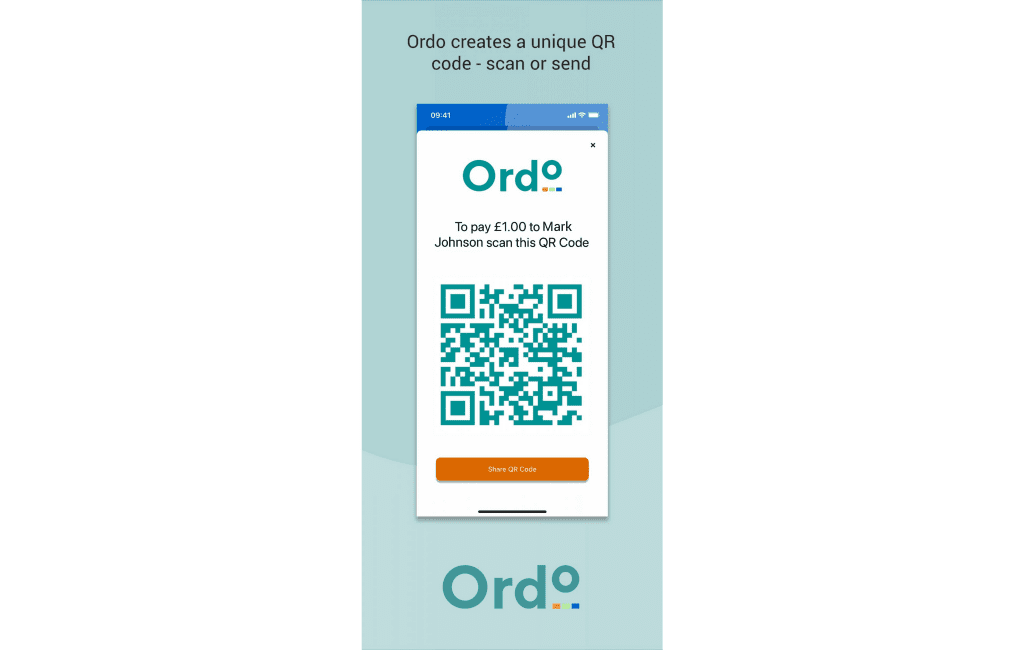

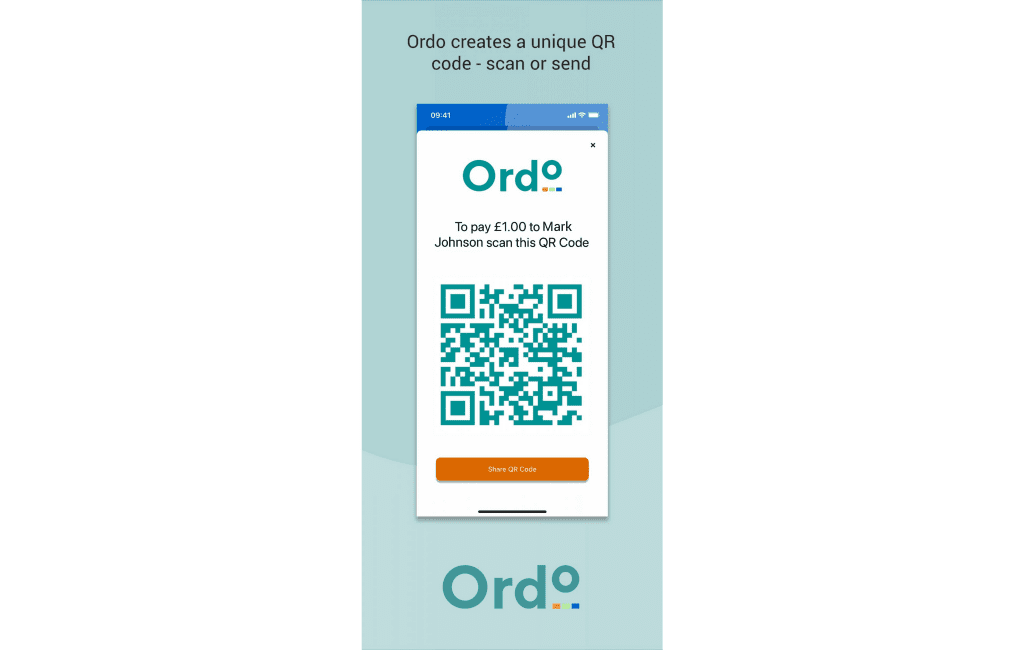

Ordo is making payments right – providing Open Banking enabled solutions that mean businesses can securely and simply collect payments from their customers, instantly. No hidden fees. No hassle. No worries.

Moja Ride, an Ivorian startup providing a reservation and cashless payment system for transport services in Abidjan, today announced it has partnered with O-CITY, powered by BPC for its next phase of digital innovation and future expansion.

This guide takes you through some of the innovations and trends taking place in payments, including how different sectors responded to the challenges of Covid-19; why business-to-business payments are ripe for innovation and changes in regulatory landscape that will impact payments in the future.

It is important to remember that even before COVID-19, the planet was in a state of emergency. So with the finance industry focusing on recovery, resilience, and longevity as we come out of lockdown, should sustainability and the environment be top of the agenda as well?

In this article, we break down the post-pandemic sustainability opportunities for the finance industry and speak to our partner ecolytiq about why the best time to focus on climate change was yesterday.

Global Processing Services (GPS), the multi-award-winning payments processing partner behind some of Britain’s biggest challenger fintechs including Revolut and Starling Bank, and Currencycloud, the experts simplifying business in a multi-currency world, have partnered to widen access to cross-border payments for financial institutions and fintechs, providing a passport to a post-Covid world.

Following extensive research, analysis and testing, Thames Technology are excited to announce that they have added a new HP Indigo 35K digital offset press to enhance their printing capabilities for financial and retail cards as well as associated packaging.

As part of Currencycloud series of interviews that explores the nature and evolution of embedded finance we invited Laurel Wolfe, Vice President of Marketing at Mambu, and former Klarna, to deep dive into how Buy-Now, Pay-Later and embedded lending, a subset of embedded finance, is changing how retailers and payments providers serve their customers.

Ordo collaborates with Siemens, along with CGI, to create a payment method that’s lower cost than direct debit, and has all the certainty of pre-payment without the hardship and hassle…only possible by Ordo’s Open Bankin capability

The Access Group has announced the launch of Access PaySuite, its new FCA authorised payment division that is focused on integrated payment experiences.

Modulr Pulse, our quarterly insights event, is back on July 20th for a discussion about ‘How to avoid the payments transformation sinkhole’.

Getting payments right is increasingly tougher for established financial institutions so we have brought along a consultant who regularly manages payment transformation projects, to give their advice on how to avoid the various pitfalls and sinkholes.

Register for the event and secure your place today: https://landing.modulrfinance.com/how-to-avoid-the-payments-transformation-sinkhole-epa

Trust Payments, the global unified payments group, has partnered with Zip, the first Buy Now, Pay Later provider to join its network of payment partners. The agreement means UK merchants using Trust Payments’ platform can offer Zip at check out and allow customers to pay over four interest-free instalments.

Most consumers are more than aware of basic payment solutions, especially after the pandemic struck their lives and their usual means of payment. Even before the new normal, many consumers were familiar with e-commerce and therefore, businesses were already used to accepting online payments on their websites or their apps. If these payments seemed pretty straightforward for consumers, technology now allows for more streamlined payment solutions that make it easier to take online payments on your website.

Manchester FinTech firm AccessPay is now listed on Sage Marketplace as first combined payments and cash management solution.

PPS are the payments and banking provider behind Talenom’s new banking service for SMEs. This partnership will enable financial services to be embedded into Talenom’s emerging SME solution ‘Accounting Alex’.

As a result of working with PPS, small businesses that use Talenom’s ‘Accounting Alex’ service will now be able to set up a bank account in minutes and enable savings on fees by more than 50%.

Partnership to provide users uninterrupted fraud protection throughout their entire online or mobile banking journeys based on digital onboarding with document verification and authentication with facial, periocular and voice recognition combined with behavior biometrics and behavior analytics.

The need for a new kind of fraud defence

– What we mean by Active Defence

– The problem Active Defence solves: Identity attacks and manipulation attacks

– Three capabilities to avert any ID attack

Partnership promotes an Active Defense approach to protecting financial institutions from online fraud attacks.

Sokin has agreed a three-year deal to support the club’s international payments and FX needs.

The new 2021 Chargeback Field Report, published by Chargebacks911, reveals that Covid-19 had a significant impact on the payments space. However, many of the trends observed were already underway years before the pandemic struck. There are opportunities for merchants—and other entities in the payments space—to improve procedures and eliminate risk. However, this will take a significant effort.

Here at Transact365 this past week we hosted a CEO Roundtable in partnership with the Payments Association. Take a look at some of the highlights from the session here.

Partnership between Revelock and Sionic promotes an Active Defense approach to protecting financial institutions from online fraud attacks

– Nearly 12,000 investors raised £9.9m in just 54 hours

– Fastest raise to hit £6m, setting a new Crowdcube record

– Surge in demand from customers and retail investors in race to £10m

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.