IDEMIA partners with ITSO to bring smart mobile ticketing in the UK

The technology is enabled by Google Pay, and supported by IDEMIA’s leading solutions, ensuring an instant, secure and seamless ticketing experience for passengers. Read more here.

The technology is enabled by Google Pay, and supported by IDEMIA’s leading solutions, ensuring an instant, secure and seamless ticketing experience for passengers. Read more here.

Modulr announced a new partnership with Sage, the market leader in cloud business management solutions, which serves almost 60% of the UK’s SMEs. Sage has come together with Modulr to

With the human and monetary cost of financial exclusion higher than ever, the The Payments Association has set out ambitious plans to widen access to – as well as improve

By Kevin McAdam, VP Card Services & Global Strategy at Global Processing Services and Project lead for the International Trade Project at the Payments Association. In the past year, GPS has

Project Inclusion has published a thought leadership piece on how the Payments Association and the wider payments industry can widen access and improve the quality of financial products available to

Project Financial Crime published a white paper which calls for the UK financial services industry to do more to face down the threat posed by money laundering and payments-related financial

The next Project Futures workshop will be held on Thursday 4th April and will be focused on using data to drive payments and Data proliferation. If you would like to

Project International Trade has published a thought leadership piece on the transformation of the payments landscape in India and its potential market growth. Penned by Kevin McAdam, project lead of

The Payments Association is delighted to announce the new Benefactor behind the Payments Association’s Project Payments in Commerce, The Chargeback Company. The project, formerly called Project Retail, under its new

Project Regulator represented the Payments Association at the FCA’s Brexit Briefing this month. Representatives from the project team championed the perspective and concerns of Payments Association members at this round

NEW YORK, LONDON, DUBAI, MEXICO CITY, 15 January 2019 – Volante Technologies Inc., a global provider of software for accelerated end-to-end payments processing and financial message integration, today announced that

Read the case study on how Fire is helping GRID get an innovative solution that complemented their product offering and supported their commitment to excellence: a simple to use, fast and

Read the fire case study on how Buymie were seeking a solution to help with distributing, managing and controlling the funds that their contracted shoppers use to purchase groceries here.

Kompli-Global has positioned itself in the top of the RegTech Top 100.

Barclays is turbo-boosting the New York arm of its Rise accelerator and introducing an investment pool of £10 million for each cohort to go through the programme. Read more here

Lloyds Bank is looking at a £750 million annual saving in tech spend as it plots a move to a new core banking platform from tech startup Thought Machine. Read

BRD enhances their mobile application within Europe via Coinify’s in-wallet trading solution. Read more here

Wirecard, along with our Partners: B4B Payments, Curve, Glint, Marq Millions, MuchBetter and PCT have been shortlisted for this year’s Card and Payments Awards. Now heading into its fourteenth year,

WEX Corporate Payments, London – December 2018. WEX announces two new senior appointments within the Netherlands. Since heading up the WEX office in Europe, Vice President Anant Patel has

PrePay Solutions (PPS), Europe’s leading digital banking and payments provider, has enabled functionality for current account service providers, Coconut, to launch a limited company accounting and invoicing product. The powerful

Fiserv has struck a $22 billion, all-stock deal to buy First Data, creating a payments and fintech behemoth. Read more here

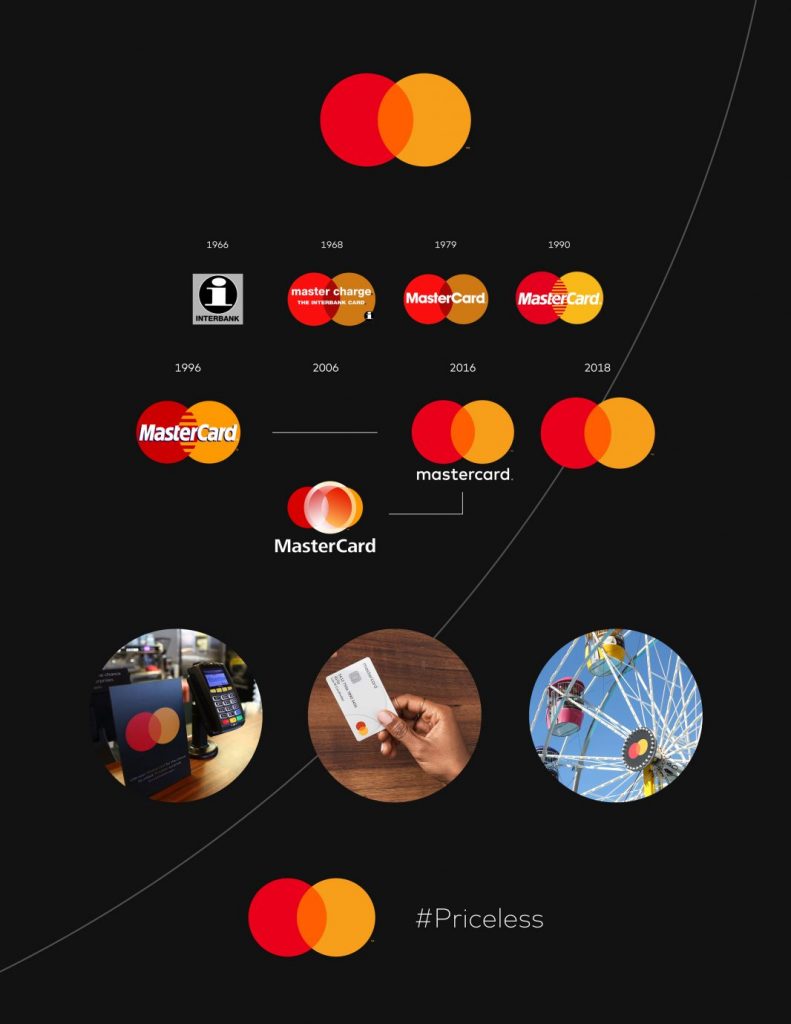

Mastercard today announced that it is dropping its name from its iconic brand mark in select contexts. The interlocking red and yellow circles, referred to as the Mastercard Symbol, will

Payment innovation will take center stage in Cyprus this coming April with the central theme: Innovation in a Disruptive Digital Economy. QUBE EVENTS is host to the International 6th

Nitecrest are pleased to launch our new-to-market degradable ECO PVC adding to our long established ECO Collection including paper board substrates offering clients environmentally friendlier options for gift, loyalty and

Newport, Wales 01/02/2019– W2, a provider of SaaS, B2B software solutions and services is very pleased to announce the appointment of Sara West to the Executive Board of Directors. Sara

Vitesse Company Overview: Vitesse is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuance of e-money and is registered as a Money Transmitter with

Paybase dived straight into 2019 by hosting their 2nd Collaborative Workshop. Their supportive community for platform businesses is definitely growing, stay tuned for information on their third workshop in March!

Listen to the podcast here

Paybase CEO Anna will be speaking about how Paybase is raising the bar of what payments can and should do at the MPE in February in Berlin.

Anna Tsyupko, CEO, Paybase spoke to Katia Lang, CEO TFT about her drive for enabling platform and crypto businesses to succeed through Paybase’s API-driven solution. Read the entire interview

Download it here

Better customer service, cleaner user interfaces, simpler language, spending insights and even gambling blocks…digital banks or ‘challenger banks’ as they are commonly referred to, have taken the UK banking market

Whether you call them cryptocurrencies, cryptoassets or virtual assets, these tokens and their underlying technology, Distributed Ledger Technology (DLT), remain at the forefront of regulators thoughts, often operating in an

PYMNTS’ Karen Webster talks with Dewald Nolte, CCO at Entersekt. Listen to the interview here

I remember a conference almost a year ago. Bitcoin (and other cryptocurrencies) had started its major run; everyone was excited. In the panel discussions, the bitcoin proponents were talking about

In the last three or four years, social media (SM) giants such as Facebook, Twitter, and Snapchat have harnessed high levels of user trust and engagement to tap into the growing SM

A new generation of bank customers is bypassing physical branches and banking via the web almost entirely in favor of completing transactions and accessing services from their mobile devices. Read

Paysafe, a leading global payments provider, has announced a strategic partnership with Visa, confirming its status as a Principal Member of the card scheme. Through the new partnership Paysafe is

As part of its ongoing commitment to support female entrepreneurs, Visa (NYSE: V) is launching a global initiative – She’s Next, Empowered by Visa – to encourage women small business

Visa (NYSE:V) today announced a new offer from Yelp (NYSE: Yelp) to bring exclusive advertising benefits to U.S. small and medium-sized businesses (SMBs) that use a Visa Business credit or debit card

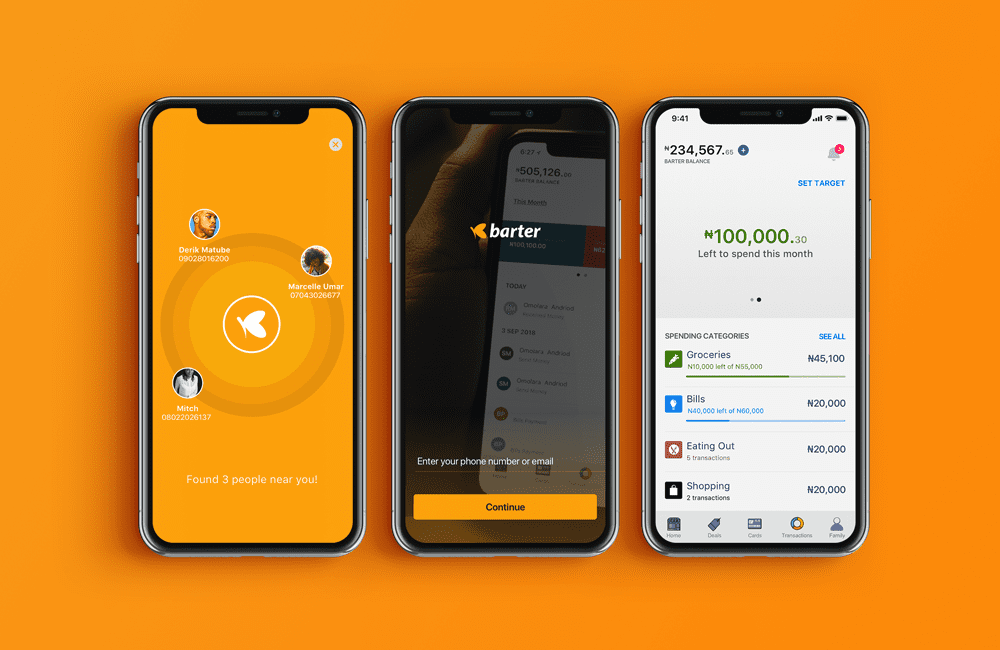

Fintech startup Flutterwave has partnered with Visa to launch a consumer payment product for Africa called GetBarter. Read the entire story here

Mobile ordering and hospitality guest engagement technology specialists wi-Q Technologies are pleased to announce that Judopay is the latest payment provider to join its growing global Partner Programme. Read the

UKGCVA Conference 2019 – The Future is Now UKGCVA Conference 2019 is just six weeks away – the flagship Gift Card Industry event of the year takes place over

UK-based fintech Arro Money has launched a crowdfunding campaign with plans to tackle the issue of financial exclusion in the UK and beyond. There are currently 1.5 million people in

Contis, the award-winning banking, payments and processing services provider is on a turbocharged growth mission for 2019, launching a new brand design, new website and initiating a hiring push for

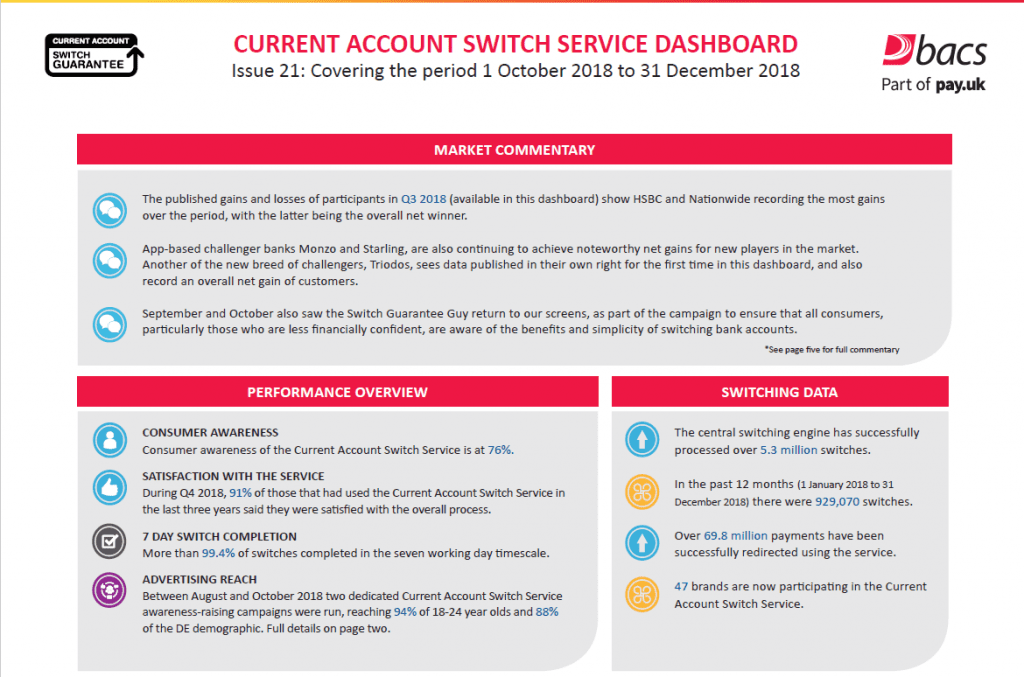

Over 5.3 million switches since launch of Current Account Switch Service Switching levels between 1 October 2018 and 31 December 2018 up 22 per cent compared to Q3 2018 Participant

Konsentus today announced that they have been selected by Mastercard to deliver Third Party Provider (TPP) identity and regulatory checking solutions, as part of Mastercard’s new suite of Open Banking

Millionaire American rapper Snoop Dogg, a.k.a. Calvin Broadus, has become a minority shareholder in the Klarna, which offers buy-now-pay-later services at 100,000 retailers in Europe and across the U.S. Read the

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.