Trust Payments teams up with Snappy Shopper

Trust Retail, part of the Trust Payments Group and one of the UK’s leading EPOS suppliers has teamed up with the fastest-growing home delivery app serving convenience stores, Snappy Shopper,

Trust Retail, part of the Trust Payments Group and one of the UK’s leading EPOS suppliers has teamed up with the fastest-growing home delivery app serving convenience stores, Snappy Shopper,

Ubiquity has announced the publication of a whitepaper aimed at helping European fintech scaleups leverage outsourcing to adapt to fast-changing market conditions. With Europe’s fintech industry experiencing profound transformation over

Daniel Holden explains the meaning and significance of unified commerce and why it is vital to the customer experience.

Trust Payments, the disruptive leader in frictionless payments and value-added services for merchants, today announces the opening of a sixth UK office in Haverhill, Suffolk – which will be a key

About An EU-based international payment firm has inked a deal with a global leader of payment technology innovations: the agreement will enable the European company – in the process of

Trust Payments has become the latest member of the 30% Club, a global campaign led by Chairs and CEOs taking action to increase gender diversity at board and executive committee

Project highlights End-to-end design and migration of the on-premise applications in 2.5 months using AWS for banking Advanced collaboration and smooth delivery with DevOps AWS migration Safeguarded business continuity and

Russel Fernandes, head of product for card present payments at Trust Payments shares his 11 tips to make sure companies get the most out of their point-of-sale (POS) systems.

Successful businesses know that success relies on putting the customer at the centre of everything they do, but sometimes this aim gets lost in the day-to-day running of the business.

FMPay, the independent fintech company known for its out-of-the-box financial products and services, is proud to announce the relaunch of its website, FMPay.me. Four years on from start up FMPay

Watch Now – https://www.bottomline.com/uk/resources/eu-commission-sct-inst-mandate-choose-most-efficient-strategy-maximise-benefitshttps://www.bigmarker.com/the-paypers1/EU-Commission-Mandate-SCT-Inst-How-to-choose-the-most-efficient-strategy-and-maximise-on-the-benefits The EU Commission’s proposed mandate will make instant payments universally available in euros within six months after said proposal is approved. We have no set date

Read Now – https://www.bottomline.com/uk/resources/aite-matrix-payment-hub-vendors This Impact Report explores some key trends within the payments hub and infrastructure market. It discusses how technology is evolving to address new market needs and challenges.

Watch Now – https://www.bigmarker.com/the-paypers1/EU-Commission-Mandate-SCT-Inst-How-to-choose-the-most-efficient-strategy-and-maximise-on-the-benefits The EU Commission’s proposed mandate will make instant payments universally available in euros within six months after said proposal is approved. We have no set date

Digital Payments Group (DPG), a market-leading Payments Issuing Processor, is partnering with Netcetera, an international expert in secure digital payments. This partnership benefits the global DPG banking customers from Netcetera’s

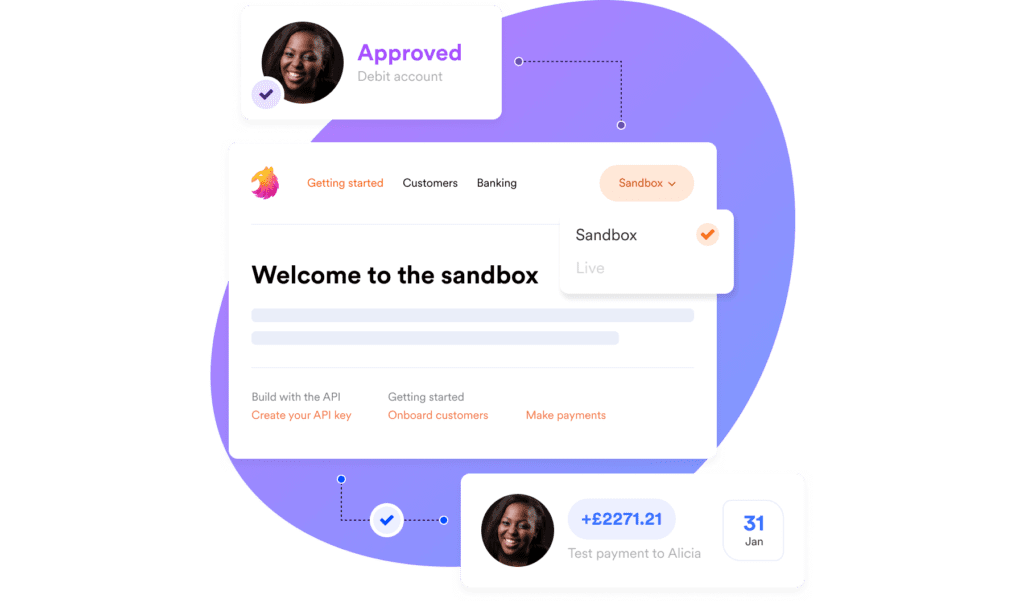

London, March 7th, 2023 – Today, Griffin announced that it has been authorised as a UK bank subject to restrictions. The company is now officially in mobilisation – a huge milestone in its journey from

ISO 20022 has been written about and reported on extensively across the industry. We are facing the largest migration to a single message standard ever. Not only is CBPR+ moving

FLEETCOR® UK, a leading global business payments company, has acquired Mina, a cloud-based digital electric vehicle (EV) re-charging software platform. After a successful investment and two-year partnership, the acquisition provides

PEXA, the fintech behind the world’s first digital property exchange process, has today confirmed that Shawbrook has become the first bank in the UK to begin transacting remortgage cases on

Be recognised as an industry leader at the most important payments awards – The PAY360 Awards. Nominations are now open for 2023 awards. You have until 17 February to submit your entry.

London, November 22, 2022 – Today, BaaS (Banking as a Service) fintech Griffin announced that its sandbox environment has officially moved out of beta. Free, unlimited sandbox access is now available

London, November 10, 2022. Today, UK BaaS (Banking as a Service) fintech firm Griffin and global FS OS (Financial Services Operating System) 11:FS Foundry announced a new partnership to help businesses actualise the benefits of

Accounts Receivable represents one of the largest assets on every company’s balance sheet. So, why are so many companies managing their largest asset with manual processes

As more organisations move to a cloud-based payments platform, the decision on whether to opt for a private or public cloud will depend on what is most cost effective for a firm.

ZUG, April 6, 2022—Arf, the first compliant cross-border payment network running on stablecoins, announced the upcoming launch of its innovative product, Arf Credit. Arf Credit will provide an instant working

Ontario launch marks the next step for payment experts after successful US expansion. PXP Financial Inc., the US subsidiary of PXP Financial Ltd., an expert in global acquiring, payment, fraud

allpay Ltd, a leading UK payment specialist, has renewed its place on the Consortium Procurement (CP) framework, which is the commercial arm of the Northern Housing Consortium (NHC).

With over 115 clients utilising the framework, allpay have been on this framework since 2010, and is delighted to continue this relationship.

In a recent article on The Fintech Times, Ian Kerr, a Director of Business Development for Episode Six, discussed why crypto and DeFi isn’t just a fad, but something that will remain for a long time. If banks do not respond to it, they will face the consequences in the future.

Now, banks can offer their customers a secure, passwordless authentication experience that removes the reliance on passwords, one-time-PINs and additional mobile apps.

– What is Behavioral Biometric Analysis?

– What is a BionicID™?

– What makes Revelock’s BionicID™ solution unique in fraud prevention?

– How can BionicIDs™ be used to stop Impersonation and Manipulation attacks?

– What is BionicID™ analysis best suited for?

– Does BionicID™ data collection or analysis impact the User Experience (UX)?

– Introduction

– Deep fakes

– SIM swap scams

– SMS OTP fraud

– Session hijacking via RATs

– Originality is key

– Introduction

– Reducing false positives and negatives

– Know Your User

– Automating fraud response

– Conclusion

TrueLayer, Europe’s leading open banking platform, today announced that Mariko Beising has joined the firm as its new Head of Payment Partnerships, bringing a decade of experience, most recently at Klarna where she led partnerships with Payments Services Providers (PSPs).

Episode Six is transforming the buy now, pay later (BNPL) landscape, by putting control in the hands of card issuers versus the acquirer or other third parties. For the first time, issuers can implement changes at the account level in real-time. To understand why this is important, we take a look at the interest in BNPL and how it works.

Moorwand, a payments solution provider, today revealed that issuing tops the list of services that fintechs outsource, with mobile wallets and customer communications coming second and third respectively. Read the full announcement to see the top ten services fintechs outsource, as found in the latest research from Moorwand.

Entersekt adds BankID to its secure platform to support digital identity priorities

Ordo and Certua are integrating Ordo’s open banking payments capability with Certua’s embedded finance platform to better serve the needs of businesses and their end customers with novel financial services.

FxPro, the truly global broker, has partnered with Currencycloud, a leading provider of B2B embedded cross-border solutions, as part of a new offer of flexible and convenient e-money solutions in the form of its new business – BnkPro.

https://bit.ly/37gzhbv

Demand for cash injections from alternative finance providers shows no signs of abating, as such, lenders must embrace innovation to improve their business finance offering. Read @Currencycloud’s blog to discover how APIs are the future of invoice finance. https://bit.ly/3wEqwCr

I hope you are well and enjoying the sunshine! I have a story here from Judopay that you may be interested in covering?

Judopay, a leading mobile-centric and fully cloud based payments provider, today announces that, alongside partner Nuvei, the technology providers will enable a seamless and touch free mobile payment experience for customers at KFC restaurants throughout Spain.

The deal will enable KFC to shift its strategy to focus on providing its customers with an omnichannel experience; Judopay and Nuvei’s innovative solutions provide optimised processing speeds and transaction approvals at scale, delivering effortless payment experiences across all channels.

Ordo wins Open Banking Expo #PoweroftheNetwork Award 2021!

This 2021 report summarises a survey taken by over 200 payments professionals across the banking, financial, fintech and corporate sectors. It provides an overview of the payments landscape, explores the key findings, and provides insight into the various elements that had an impact on failed payments throughout 2020.

It is becoming ever more apparent that ‘Big Tech’ players are looking to service a slice of the financial services sector. What does this mean for the industry and the banks that service it today?

Ordo is making payments right – providing Open Banking enabled solutions that mean businesses can securely and simply collect payments from their customers, instantly. No hidden fees. No hassle. No worries.

Okay is mainly concerned about security and Strong Customer Authentication. However, that doesn’t prevent us from taking part in industry conferences or being a member of industry groups. In this blog, we take a look at a few of the hot topics that have been on the discussion table over the past year, with some insight as to where they may be headed.

Award-winning Banking-as-a-Service platform, Contis, is pleased to announce the appointment of Andy Lyons as Managing Director of Banking Solutions. Andy brings a wealth of experience in retail and corporate banking to boost Contis’ banking division and cement its position as the European leader in Banking-as-a-Service (BaaS).

TrueLayer, Europe’s leading open banking platform, today announced the launch of a new approach to account ownership checks with its Verification API.

As part of Currencycloud series of interviews that explores the nature and evolution of embedded finance we invited Laurel Wolfe, Vice President of Marketing at Mambu, and former Klarna, to deep dive into how Buy-Now, Pay-Later and embedded lending, a subset of embedded finance, is changing how retailers and payments providers serve their customers.

Modulr Pulse, our quarterly insights event, is back on July 20th for a discussion about ‘How to avoid the payments transformation sinkhole’.

Getting payments right is increasingly tougher for established financial institutions so we have brought along a consultant who regularly manages payment transformation projects, to give their advice on how to avoid the various pitfalls and sinkholes.

Register for the event and secure your place today: https://landing.modulrfinance.com/how-to-avoid-the-payments-transformation-sinkhole-epa

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.