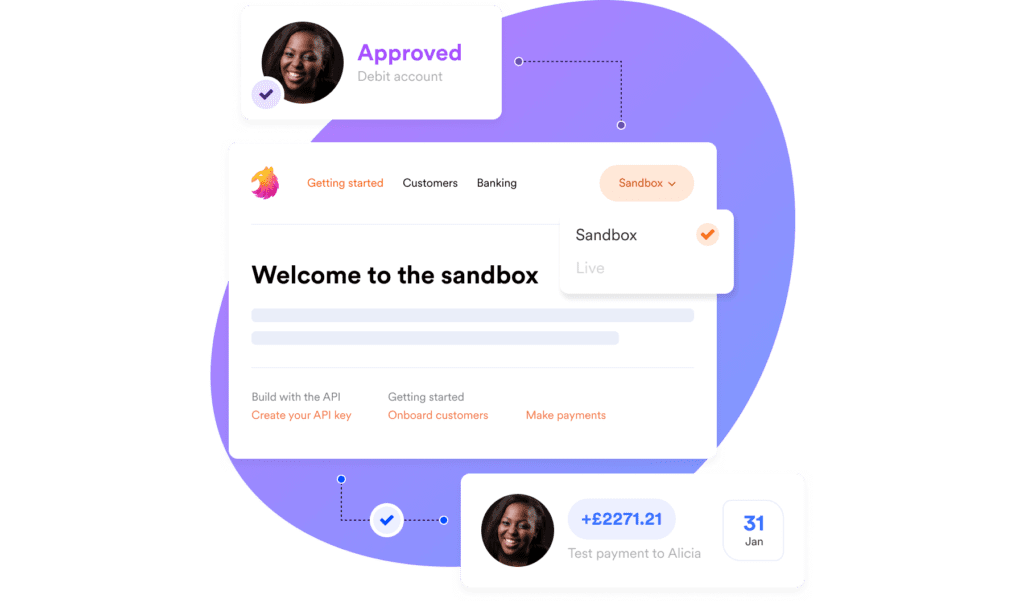

London, November 22, 2022 – Today, BaaS (Banking as a Service) fintech Griffin announced that its sandbox environment has officially moved out of beta. Free, unlimited sandbox access is now available to all fintechs and brands that want to build a prototype or experiment on Griffin’s platform.

“We aim to lower the barriers to entry for fintechs and brands building embedded finance products, and launching our sandbox is an important step forward,” David Jarvis, CEO and co-founder of Griffin said. “Our open platform will make it simple and accessible for engineers or product managers to start building without financial commitment, sales calls, NDAs or long wait times.”

ProMEX, a Hong Kong-based digital marketplace for trading physical commodities for cash or stocks, is one of the first companies to use Griffin’s sandbox. ProMEX was searching for a platform on which they could build a prototype version of their app for the UK market. They found that most platforms were built on outdated tech and required upfront fees and long wait times. They were able to access Griffin’s sandbox environment instantly, and discovered that the technology backbone was a great fit for their app’s technical and functional requirements.

Through Griffin’s sandbox, ProMEX were able to build a complete prototype of their app, which included customising KYC workflows, testing the decision

accuracy of identity checks, creating mock customer bank accounts, and simulating payments between buyers and sellers.

“As a fintech in the early stages of UK expansion, we sought a platform that would provide an open and collaborative iteration process. By building and testing our MVP on Griffin’s sandbox, we have significantly reduced the time and resources needed to build our UK app, allowing us to focus on launching the product, and driving adoption in the UK market,” Guido Glowania, CSO of ProMEX said.

Read the full case study here.

Engineers can test and develop proof of concepts using Griffin’s full-stack BaaS platform and financial crime prevention tools, either by integrating directly against the API or using the intuitive dashboard.

Currently, the sandbox allows users to simulate:

Griffin is currently seeking authorisation to become a bank with the PRA and the FCA. Upon Griffin’s authorisation, fintechs will be able use the platform to build and launch regulated financial services apps quickly.

“The industry is starving for a banking partner that can break down barriers to entry for emerging fintechs and let innovators build and launch at speed,” Stephen Chandler, Managing Partner at Notion Capital said. “The launch of Griffin’s sandbox is a critical step in becoming the bank you can build on.”

Griffin is developing the infrastructure to power the next wave of fintech innovation. Created by experienced Silicon Valley founder-engineers and led by a team of banking and technology experts, it recently closed a $15.5 million funding round led by Notion Capital and launched its first BaaS product, Verify, which helps fintechs manage risk, automate KYC and KYB checks, and streamline customer onboarding.

To start using the sandbox, go to app.griffin.sh/register on your browser and sign up.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.