RT2: A strategic transformation for UK payment providers

RT2 modernises UK payments with ISO 20022, enhanced access, APIs & real-time resilience—enabling innovation, new entrants & a dynamic ecosystem.

RT2 modernises UK payments with ISO 20022, enhanced access, APIs & real-time resilience—enabling innovation, new entrants & a dynamic ecosystem.

xpate has become the first non-bank in Latvia to gain direct SEPA access via the central bank’s EKS system, marking a milestone for fintech infrastructure access in Europe.

PEXA has received FCA approval as an authorised payment institution, supporting its upcoming UK sale and purchase launch and expanding its digital property services.

PXP has launched a new all-in-one POS solution, enabling merchants to accept a wide range of payments quickly and securely with no integration needed.

As digital payments outpace plastic, UK banks must modernise card infrastructure or risk losing relevance to faster, cloud-native challengers.

Over the past few years, cloud infrastructure and microservices architecture have emerged as the key disruptors of the payments landscape—driving unprecedented efficiency, fault-tolerance, transparency, manageability and cost-effectiveness. System modernisation enables

AI is reshaping the fight against payment fraud, prompting financial leaders to adapt with smarter tools, better data, and cross-sector collaboration.

Integrating digital payments is becoming easier with tools that reduce technical complexity, enhance security, and support a wide range of platforms.

Embedded finance and multi-banking give corporates greater control, new revenue streams, and stronger networks—unlocking value beyond traditional banking.

PXP partners with Snowflake to deliver real-time data insights for merchants, combining advanced analytics with payment platform innovation.

Shape and PXP partner to deliver a turnkey payments solution for ISOs, ISVs, and Payfacs, combining automation, customisation, and scalability.

Mastercard and Thought Machine expand their partnership to modernise banking with cloud-native core and payment solutions.

Chargebacks and fraud are rising, causing financial losses and operational strain for businesses navigating digital transactions.

Discover how Mitto’s CRM integrations enable customer engagement across SMS, WhatsApp, and Viber.

European banks must embrace digital transformation and fintech partnerships to stay competitive and compliant.

UPI is transforming cross-border payments, boosting India’s global digital payment reach.

PXP’s survey finds 64% of UK and US merchants view payment technology as a strategic growth driver.

PXP research reveals the payment preferences, priorities, and frustrations of more than 4,000 consumers across the UK and US

PXP has teamed up with direct booking solutions provider Net Affinity, enabling hotels to streamline reservations and payments.

Global payment platform, PXP, has forged a new strategic partnership with digital solutions platform Xolvis.

Seamless payment orchestration simplifies multi-provider management, optimises acceptance rates, and boosts conversions.

Dialect and Synalogik partner to provide combined APP fraud prevention and customer management solutions for the payments sector.

Operational resilience is crucial as FCA and EU regulations push firms to guard against disruptions and cyber threats.

Payments in 2025 will be shaped by AI, instant payments, CBDCs, embedded finance, and sustainability.

KPMG’s report shows payments modernisation is accelerating across finance and retail, driven by innovation and demand.

Monavate’s API-first platform offers flexible and scalable payment solutions tailored to business needs.

OTP Group used Iliad Solutions’ t3 platform for seamless payment migration, ensuring accuracy and supporting digital transformation.

Launching a card product can boost business success, but simplicity, clear goals, and the right partnerships are key to a seamless rollout.

Payments firms must streamline technology after acquisitions to boost agility and compete amid disruption.

Quality Engineering is transforming digital banking, enabling seamless innovation, operational continuity, and future-proofing in a rapidly evolving landscape.

BPC’s report, “Next-Generation Card Processing,” highlights the rapid growth of challenger processors, driven by cloud-native technology and innovation, outpacing incumbents.

PXP Financial and Phos by Ingenico partner to offer a SoftPoS solution for contactless payments on Android devices without additional hardware.

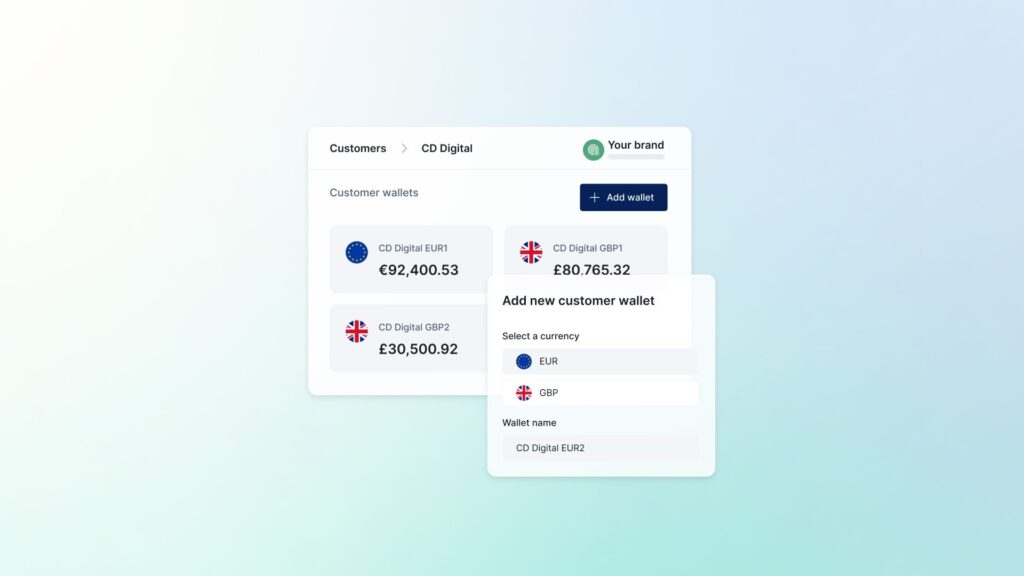

BVNK has introduced Customer Virtual Accounts, enabling fintechs and payment service providers to facilitate EUR, GBP, and stablecoin payments on a unified platform.

Tasc is an automated back-office platform that streamlines KYB/KYC, transaction monitoring, and dispute management for faster and more scalable operations.

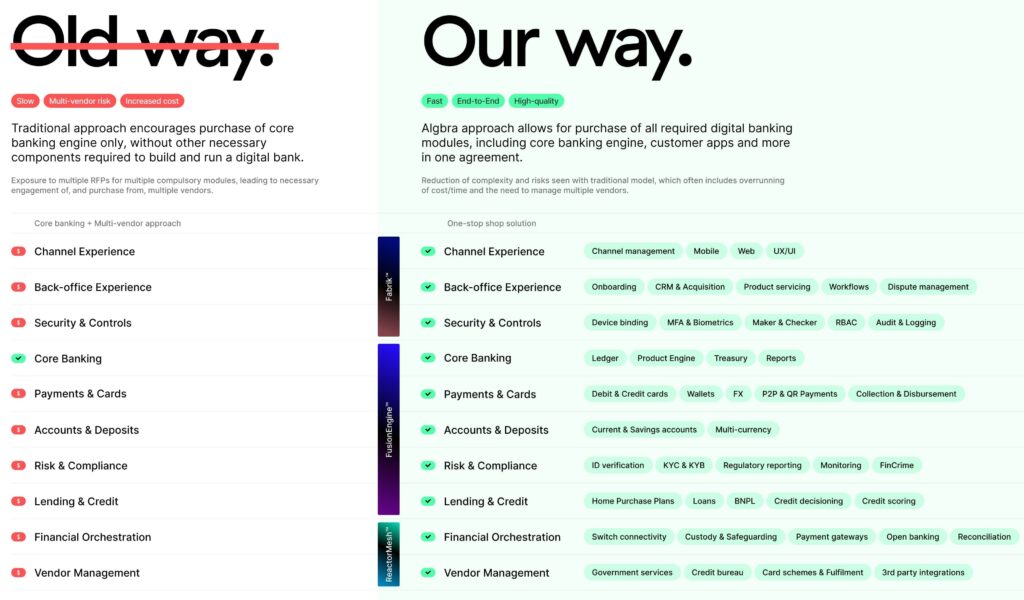

Algbra Labs’ fintech-as-a-service (FaaS) simplifies building digital financial platforms, cutting costs and time, as seen with Standard Chartered’s Shoal.

Payabl. has launched its new cloud-based, API-first Payment Accounts solution, enabling businesses to streamline financial management, reduce transaction fees, and facilitate instant, multi-currency settlements across borders.

PXP Financial’s new Partner Portal streamlines the merchant application process, enabling partners to focus on growth with faster, more efficient approvals.

PXP Financial joins Zebra’s PartnerConnect programme to enhance mobile payment capabilities, leveraging Zebra’s innovative solutions and global partner network.

PAYSTRAX and CatalystPay’s partnership exemplifies the power of collaboration in delivering efficient, secure payment solutions.

Navigating the complexities of global expansion in fintech requires strategic partnerships, innovative solutions, and a deep understanding of regional regulatory and cultural nuances.

Europe’s banks are enjoying a revival, but higher interest rates, bad loans, and tech challengers threaten to derail the recovery.

VE3 has been selected as a key supplier for the Payment Acceptance 2 Agreement by Crown Commercial Services for the provision of payment consultancy services.

Traditional finance is at a crossroads with the new digital frontier, and the rapidly evolving landscape of digital assets demands innovative custodial solutions. For banks, payment service providers, financial institutions and others that are either considering or already piloting digital asset projects, it’s imperative to understand the importance of an underlying custody infrastructure.

There isn’t much Head of Partnerships Wiliam Boocock doesn’t know about Starling Business Services (SBS). He’s been involved since 2017 and has supported growth both in SBS and across Starling

Software as a service (SaaS) has sparked a paradigm shift in the corporate domain in the past five years, revolutionising pivotal industries like finance, transactions, and insurance.

As the UK continues to try and place itself as a leader in the payments industry and fintech, maintaining a degree of pace, security and efficiency must remain a priority.

Technology, in any industry rarely fails to make its impact and improve nearly all aspects of the sector. Cloud-based banking is no different.

The flagship store of luxury pharmacy John Bell & Croyden is transforming shopper experiences with the installation of new checkout & inventory management technology from Trust Retail, part of the Trust

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.