Three key things the UK can do to continue leading the way on fintech – innovation, inclusion and partnerships. Article by Jill Docherty, Head of Business Development, UK&I, Visa.

Compliance, requirements, deadlines, oh my! By now you should have a comprehensive overview of what to be aware of as PSP. As such, it is time to wrap up the topic of SCA compliance. In this article, we cover how Okay uses security evaluations to fine-tune our product as well as how we can help you meet SCA PSD2 RTS compliance standards.

Compliance. A scary term for any payment service provider (PSP) in a world of increasingly stricter regulations and requirements. To make it a little less scary, we are opening the PSD2 RTS Compliance door to extract some key points of interest. Read on for the fundamental requirements PSPs should be aware of if issuing cards or e-money payments and why said requirements are necessary.

Fintech is a market that is in many ways defined by specialism. The first fintech disrupters took aim at specific services and through technology reduced costs, improved the experience, and boosted accessibility. In this article, Moorwand CCO Luc Gueriane speaks to Financial IT about why fintech specialists need fintech specialists to succeed and scale.

Launching a payments business in Europe requires every founder to understand their market. That means doing customer research, scoping out competitors, and – perhaps the trickiest of them all – navigating the regulatory environment. In this payment guide, Moorwand breaks down three of the key regulations you need to know about when thinking about launching a business in Europe.

ekko partners with Paynetics UK to power fintech arm of new app that is turning the tide on climate change

Paynetics’ sister company phos, the fintech behind the leading software point of sale (POS), has partnered with Nordics fintech innovator maxaa to give merchants access to a complete and affordable digital payments solution.

In this payment guide, the Moorwand team break down the three key payments regulations a founder needs to know about when launching their new card programme.

One of the more vexing problems of the modern age when it comes to international business is that regulatory regimes often do not keep pace with technological innovation.

Nonetheless, novel solutions to B2B cross-border business have emerged in the form of virtual IBANs, financial instruments that drive the innovation economy and enable new, powerful business models.

Here we have outlined three ways that virtual IBANs are transforming the way companies do business locally and abroad:

When it comes to digital banking and compliance, robust KYC practices not only prevent fraud and financial losses but also strengthen a firm’s ability to conduct business with confidence.

This is typically because of the four key elements of strong KYC practices that make sure firms know who they’re doing business with and what to expect from that relationship.

We’ve identified the four essential elements of effective compliance in KYC practices for digital banking in order to show you how they help improve the competitiveness of businesses of any size or scale:

The year 2020 saw many of the innovations and prognostications of analysts come true as contactless payments and digital banking solutions drove the field of Fintech innovations. Looking ahead, however, 2021 could be the year that consolidates much of this growth and prepares the economy for the next stage of digitization.

We at Monneo have identified five major trends that we think are driving the Fintech innovations in digital banking, in 2021 and beyond:

The digital banking era is upending traditional payment solutions and transforming the global financial industry in the process. And this is on both the corporate and consumer level with changes in payments solutions reaching into every facet of the international economy.

These innovations in digital banking are not only enabling increased efficiencies and expediting capital flows at a rate previously unthinkable but also are leading the way in changing the dynamic and level of depth of the business-customer relationship.

The reason why re-enrollment is so sensitive is simple: when you do an app-based strong customer authentication (SCA), the user has already been authenticated on the device. This means that it is possible to check the ‘possession’ factor using a device fingerprint from before.

If a customer has a new device, and has an existing device registered to their account, we recommend using SCA to enroll. A typical way to do this would be to use a QR code that the user can scan from one device to another. In the case where there are no existing devices linked to an account, we recommend that the customer go through a full “know your customer” (KYC) procedure in order to re-enroll their new device.

One of the ways we’ve helped our customers strengthen their re-enrollment process is to implement a mechanism known as ‘magic link’. A magic link is a link received through a semi-secure channel that authorises the customer to use a particular device. Using a link like this can be practical, as the re-enrollment procedure might be stretched out over time.

Interested in hearing more about Magic Links? Be sure to read the full article at okaythis.com/blog.

Join Modulr on 11th May at 10 am for the launch of this quarter’s industry pulse on payments – Leaders vs Laggards: The Race to Escape the Payments Dilemma.

We will discuss how leaders are overcoming their payments dilemma and overcoming the laggards as fintech fast-tracks innovations in a legacy ecosystem.

Secure your spot today: https://landing.modulrfinance.com/laggards-and-leaders-exclusive-launch-epa

National competent authorities have taken an ambiguous position on their enforcement deadlines for strong customer authentication — which has left the market unsure about how much flexibility there is, sources say.

Featured is one of Blue Train Marketing’s most recent blogs ‘QR Codes: A Secret History’. In this blog the writer, Jeff Banks, goes into detail of the history of QR Codes and how they are rapidly being adopted across the globe!

Okay has been running compliance audits since 2016. What did it look like back then compared to today? Are two channels for SCA really needed? This week we briefly explore the changing security environment of mobile phones related to identity verification.

The London based E-Money solution for global citizens Privat3 Money (P3), is pleased to announce the launch of its new Mobile App available for both Apple IOS and Android devices. This milestone is P3’s latest step to provide its global citizen clients a completely seamless user experience and ultimately greater control over their finances.

Apply to an open program for a faster, more efficient and successful go-to-market journey for Fintech innovation.

How to provide 30 million SMBs access to sophisticated financial products, and drive innovation? That’s the question SteadiPay asked, as it finds ways to bring modern Fintech offerings to this underserved market.

The Fintech for Fintech’s Kani Payments, specialising in payment reconciliation and reporting has announced hitting £5 billion reconciliation milestone and the appointment of three senior hires.

Getting paid is the cornerstone of any business. It doesn’t matter if you’re an educator, retailer, tradesperson or tech entrepreneur. The one uniting factor between you is that you need to get paid if you want your business to thrive, or even just to survive.

But managing cash flow in business isn’t always easy. Especially when there are so many disruptive factors at play.

That’s why SimplyPayMe has developed a payment solution that allows small businesses to invoice clients and process payments whenever, wherever and however they like.

Give it a try for yourself and sign up for free now! https://simplypayme.com/

Free Subscription. No Obligation. No Hardware

Simon Fairbairn, Head of Professional Services EMEA, Terminals, Solutions & Services at Worldline, looks at why Android payment devices are on the rise and what this innovation will mean for merchants and estate owners.

Over the course of the pandemic, PPS’ HR Director, Corinne Williams, has worked tirelessly to deploy a pioneering strategy to ensure the safety of the company’s 250 strong workforce over the last year, with various processes in place to roll out homeworking through tailored kits and a top-class well-being programme. All of this to ultimately continue to maintain its high level of operations for some of today’s leading brands that are changing the face of financial services as we know it.

Brian Hanrahan explores the current climate, with COVID-19 leading to significant economic downturn, shedding light on how holdbacks from acquirers are becoming more prevalent.

Learn how Nuapay’s Account-2-Account payments, funds are delivered in real-time as no acquiring bank is required to facilitate payments. This means no more holdbacks, giving businesses in at-risk sectors the breathing room they need to survive in challenging economic conditions.

Rush has partnered with EML Payments to deliver its prepaid Mastercard card.

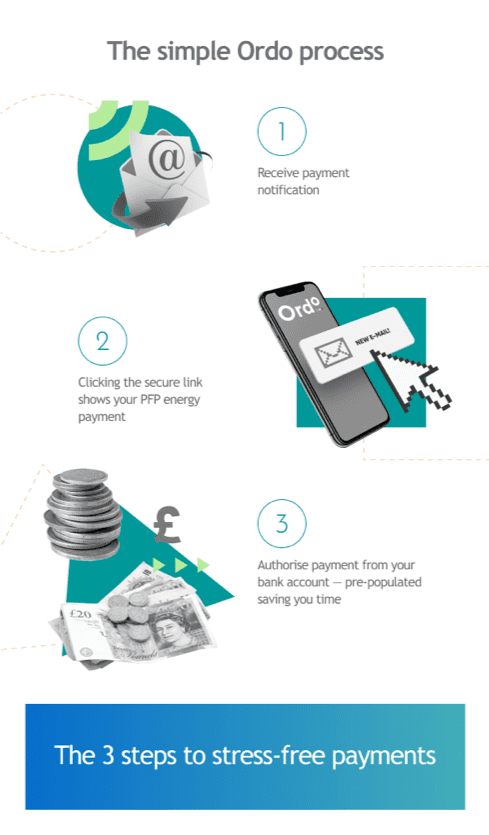

Ordo is on a mission to make paying and getting paid easy, helping everyone control their finances, from large enterprises to small businesses and consumers. Using Open Banking technology, Ordo has digitised the process from buying goods or a service, invoicing, payment, reconciliation and confirmation to make it seamless for business and easy for payers.

Ordo has partnered with CGI, independent IT and business consulting services firm delivering an end-to-end portfolio of capabilities, from strategic IT and business consulting to systems integration, managed IT and business process services and intellectual property solutions.

Together they helped PFP energy, a not-for-profit energy company, or as they like to call it ‘Profit for Purpose’….a partnership with that warm fuzzy feeling.

Payment initiation is a new type of payment method made possible with open banking. Essentially, it works by letting customers connect to their banks and authorise a payment directly from their accounts. Here’s what that looks like, and what advantages it brings compared to other payment options.

Moneyou saw PSD2 as a key enabler of innovative banking services and planned to exploit all aspects of the new regulations to provide both market-leading functionality and value to their growing user base. Moneyou needed to find a way to build a compliant solution with minimum effort and impact on their systems and identified Konsentus as being the ideal partner to achieve this.

Click here to read the full article: https://www.konsentus.com/case-studies/moneyou-case-study/

Fintech and Payments Association member Paynetics discuss digitising loyalty and their latest partnership with promotional campaign leader Benamic to power a new, mobile first corporate card programme for the B2B market.

The recipe for success in the e-commerce business is much the same as any other entrepreneurial endeavor except it comes with many opportunities for growth and leverage that physical businesses don’t have.

Online business may be the future of many markets, and for good reason. From scalability of immediately needed resources to cost-effective innovation and optimization, we have identified five key elements of success for e-commerce business in the modern age:

E-commerce businesses can’t put enough of a premium on online cybersecurity and protection against threats. Not only can malicious actors steal data and commit fraud, but they can also completely undermine a customer’s confidence in your business.

To avoid costly fraud and cyber threats, we’ve found five primary areas of focus that e-commerce businesses need to keep in mind as they move forward in the online market:

As part of a European Union mandate called the Revised Directive on Payment Services, or (PSD2), merchants operating in the EU economic zone must use payment service providers within the European Economic Area that offer what is known as strong customer authentication.

This is also sometimes referred to as the SCA requirement or the PSD2 compliance. In essence, this directive ensures that transactions occurring within the EU’s economic territories make use of multi-factor authentication in order to verify a buyer’s identity.

The promises of the European Union single market, while not full borne out in the reality of the business world, where the same are actually still far from the dream promised when it comes to the virtual single market. What does this mean?

In other words, the European Union might act as a single market when it comes to monetary issues and beyond, but the EU single digital market is hampered and its growth restricted by a myriad of factors including various compliance regimes and the logistical mastery needed to make it all work.

Why Netflix, JustEat and Uber made your payments experience a whole lot harder

Aka Why Poor Payment Processes Are Hampering Customer Experience Transformation

Moorwand, the payments solution provider which aims to transform compliance into an enabler of innovation, has launched ‘Dear Luc’, a new payments agony uncle column with Fintech Futures.

The mobility industry needs a game-changer now more than ever and a great place to start would be to take online payments on your website.

Vacuumlabs has announced a global partnership with Thought Machine following the two firms’ successful cooperation in Asia.

From currency notes to cheques and then banking cards to completely virtual transactions— the payments industry has come a long way in the last 100 years. The progression in the payment industry has also fuelled growth across the industrial spectrum.

SMB market in the US has been neglected for a long and now there is a lot of space to serve it right. Find out how!

Fintech and trusted payments enabler Paynetics has partnered with Benamic, the global leader in promotional fulfilment, to develop its mobile first, digital corporate card programme.

3 reasons why you should consider offering credit to consumers

Open banking payments are new, but where this payment option is offered to consumers, adoption is skyrocketing. TrueLayer CEO & Co-Founder, Francesco Simoneschi, shares some data points which challenge the myth that open banking payments are not ready to go mainstream.

When building a new bank, is it advantageous to be already part of a much bigger established big bank, or might that actually hamper your progress?

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.