PAY360 2022 – A Thought Leader’s Crystal Ball View

What does the future of digital financial services hold? Hear from industry leaders on their top predictions for the years ahead. Join the session and learn how to best plan

What does the future of digital financial services hold? Hear from industry leaders on their top predictions for the years ahead. Join the session and learn how to best plan

The regulatory pressure on payments firms continues to grow year-on-year. In 2022, we can expect to see a particular focus on some key areas such as customer communications, Anti-money laundering

The last two years have brought a lot of transformation to the lending landscape. On our next virtual panel we explore what the lasting impact has been on alternative lending and what the outlook for working capital finance future is.

Mastering the most advanced information technologies to process disputed transactions, FIS has implemented its innovative dispute management CBK solution in major banks, processing and service centers, managing claims for over 100 million cards all around the world.

Driven by the COVID-19 pandemic, the battle for talent is increasing for companies and organisations – forcing them to rethink their recruitment and retention strategies. In this session – the first of two webinars focused on ‘The Great Resignation’ – Banking Circle and industry experts discuss how recruitment is changing within the current landscape, whether the power really is shifting from employer to employee, and what financial services businesses should be doing to ensure that they attract the best talent.

Download The Payments Association Insights webinar to find out key findings of the recent research around the Green Paper – “A New Era For Money” and hear our senior expert

This session explores the vast potential of Artificial Intelligence in the payments space and how AI can help you unlock revenue growth opportunities, minimise operating expenses, improve customer experience and

This session explores the Corporate Card Payments landscape and identifies the key strategies for future success.

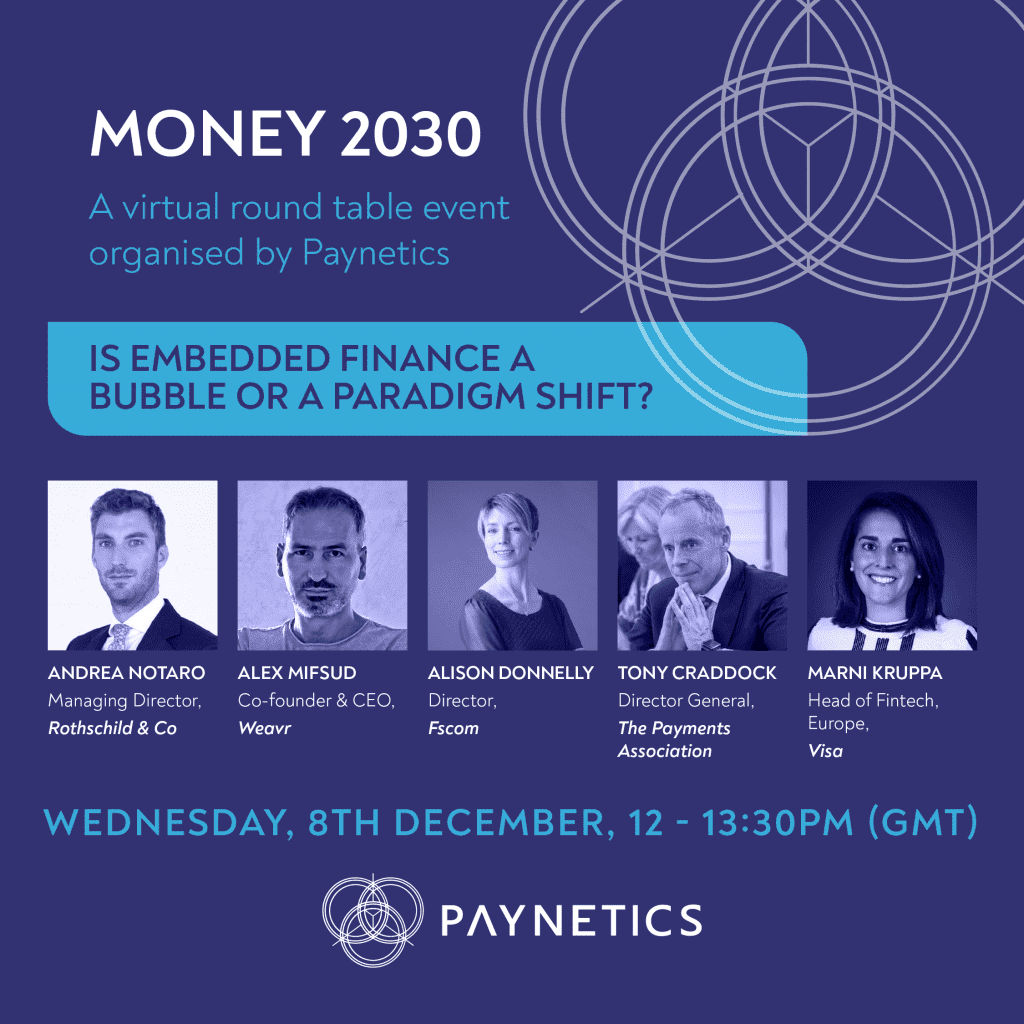

Fintech and trusted payment service provider Paynetics is hosting its third roundtable on the future of fintech, held virtually via Zoom on the 8th December, from 12-1:30PM (GMT).

Your payments infrastructure could be costing you more than you realise. Using multiple providers costs time, costs cash and, more importantly, costs customers. Which is why we’re talking to clients who have moved away from traditional banking and moved towards Fintech-as-a-Platform. We’ll also be joined by Mat Megens, Founder & Chief Executive Officer from HyperJar for a fireside chat on their ‘journey’ to success, powered by Modulr.

The event will cover:

o BaaS vs FaaS: What’s the difference and what do you need to build financial products customers love?

o The key challenges faced by companies that offer payment or bank-like services

o How to avoid business inefficiencies by using a joined-up Fintech-as-a-Service partner (such as… well, Modulr)

Register here: https://landing.modulrfinance.com/scaling-a-fintech-with-modulr-baas-0

Our Webinar on “How can Open Banking pave the way to Open Finance?” was hosted on the 21st of October 2021. Our expert speakers discussed the challenges and opportunities of the implementation of Open Banking, what the future landscape may look like, the growth of Open Banking globally and what might be the key drivers for a broader move towards open finance and open data.

– Introduction

– What is physical biometrics?

– What is behavioral biometrics?

– What is the difference between using physical and behavioral biometrics when authenticating users?

– Behavioral biometrics aid PSD2 compliance

– Webinar: Behavioral Vs Physical Biometrics: the ultimate showdown in digital banking

Our Hot Topic Webinar on digital currencies was hosted on the 22nd of September 2021. Our expert panelists explored the benefits and challenges of adopting distributed ledger technology as the

Our Hot Topic Webinar in partnership with UK Finance and Latham & Watkins was hosted on the 26th of August 2021. With market and technology changes continuing to shape the

As part of our projects initiative, we have partnered with Project International Trade and Payments Association Benefactor Global Processing Services (GPS) to discuss the challenges, learnings, experiences & opportunities for navigating the landscape of growing your business across multiple regions or territories.

How can your bank or building society avoid the payments transformation sinkhole?

Join us and our guest speaker Chris Jones, Managing Director PSE Consulting, on the 20th July to learn:

How customers experience your brand through your payments experience

How to fast track payments technology

What can de-rail your digitisation

Book your spot today and make getting payments right easier for your financial institution https://landing.modulrfinance.com/how-to-avoid-the-payments-transformation-sinkhole-epa

Invitation for EY’s upcoming Payment Services and E-Money Safeguarding Industry update on 13 July at 10am BST

Payments Association members can receive an exclusive 20% discount when purchasing their tickets for the Dark Money Conference 2021!

This session explores the next step to making e-commerce more secure whilst level setting the knowledge playing field on why this is the time for tokenizing e-commerce and why we need to solve the ‘manual card entry’ problem with ‘Click to Pay’.

Modulr Pulse, our quarterly insights event, is back on July 20th for a discussion about ‘How to avoid the payments transformation sinkhole’.

Getting payments right is increasingly tougher for established financial institutions so we have brought along a consultant who regularly manages payment transformation projects, to give their advice on how to avoid the various pitfalls and sinkholes.

Register for the event and secure your place today: https://landing.modulrfinance.com/how-to-avoid-the-payments-transformation-sinkhole-epa

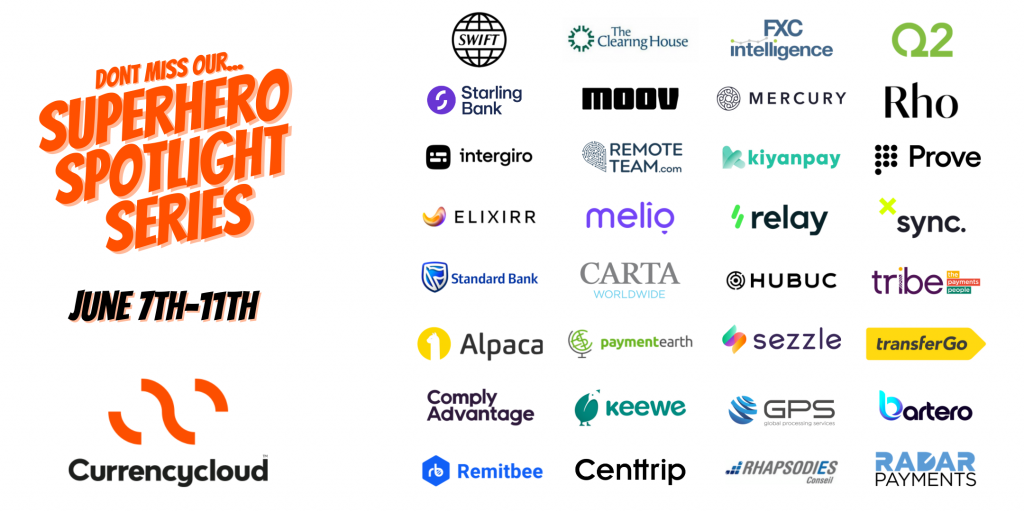

We are really excited to shine the spotlight on some of the best-known brands in #Fintech during our Superhero Spotlight Series.

A week-long event packed with articles, research reports and LinkedIn and YouTube live streamed interviews with over 30 of Fintech’s finest superheroes.

Register for the agenda: https://bit.ly/3ySP2lL and keep an eye out for reminders of the #livestream sessions.

#Payments #Banking #FintechSuperhero

Our fantastic panel of industry leaders and subject matter experts explores the changing financial crime and payment fraud market landscape, the emerging risks, current gaps and why digital identity is critical for future success.

In this training session, featuring fscom Director of Financial Crime Philip Creed and Chainalysis Account Executive Jed Sibley, you will learn more about the latest in cryptocurrency regulation in the UK and Ireland, as well as getting a first-hand insight into some of the recent high profile cryptocurrency-related fincrime cases.

Join us in this insightful webinar, with a range of experts in the mobile payments, cards and risk space, to learn how payments are changing, and how mobile applications can help strengthen authentication and improve your customer experience – all at the same time.

Join our upcoming webinar on May 11 to hear how fintech partnerships are driving innovation in payments in 2021.

In the wake of the financial crisis of 2008, financial institutions increasingly turned to ‘de-risking’ – exiting relationships and limiting interaction with clients deemed high-risk – as a way to reduce their exposure. Join industry leaders Mitch Trehan, Banking Circle’s Head of Compliance and MLRO, and Philip Doyle, Group Director, Financial Crime, Revolut as they take a deeper dive into the topic. They will explore some key questions:

– How has de-risking impacted the industry?

– Why are institutions de-risking, rather than managing existing risk?

– Has de-risking by traditional banks created a vacuum for new players to fill?

– How is the regulatory landscape shifting?

– What’s next for the payments industry?

This projects webinar discusses all things credit whilst dissecting the elephant in the room; is selling credit as sinful as it is often perceived? Is it inevitable that credit drives people into further debt? What makes some credit ‘good’ and some ‘bad’?

Day 4 of PAY360 Virtual Conference

Day 4 of PAY360 Virtual Conference:

Scaling Data for Impact – Watch this session and learn more about how Mastercard harnesses data to accelerate economic recovery and power a more resilient post-Covid-19 world.

Day 4 of PAY360 Virtual Conference:

Training Session Three: MT Global, Lessons learned – HMRC fined FX and Payments firm MT Global with a huge £23m fine, what are the lessons you should take from this.

Day 4 of PAY360 Virtual Conference

Training Session Two: Planning your own demise…Wind down planning – No one wants to plan for failure but the FCA is asking you to, this is what you need to know

Day 4 of PAY360 Virtual Conference

Brexit Update for payments – how should you as a payment’s firms be managing from the UK outwards and the EU inwards.

Day 4 of PAY360 Virtual Conference

Day 3 of PAY360 Virtual Conference

Day 3 of PAY360 Virtual Conference:

Hear from leading financial services startups the exciting new technology set to disrupt the payments industry in this fast-paced session. This session will focus on companies leveraging AI, machine learning and the blockchain, to tokenise data, democratise investing, combat fraud and drive operational efficiency.

Day 3 of PAY360 Virtual Conference:

Hear from our senior industry experts as they forecast what the future holds for the payments industry and catch their 3 predictions for the year ahead.

Day 3 of PAY360 Virtual Conference:

The world of payments is in a state of flux. Around the globe, novel technologies, evolving customer needs and new market entrants challenge the traditional payment paradigms. What is the real potential of DLT Applications for banking and payments? What will the industry need to focus on in the next 12 months? Should central banks introduce Digital Currencies as soon as possible?

Day 3 of PAY360 Virtual Conference

Day 3 of PAY360 Virtual Conference

The entrance of BigTechs in payment services has influenced the European payment market and society. What are the direct and indirect influences of BigTechs providing payment services on the European payment market?

Day 3 of PAY360 Virtual Conference

Day 3 of PAY360 Virtual Conference

Day 2 of PAY360 Virtual Conference

Day 2 of PAY360 Virtual Conference:

Hear from leading financial services startups the exciting new technology set to disrupt the payments industry in this fast-paced session. Today’s session will focus on companies empowering businesses with alternative payment solutions (in-store & online), helping them to get paid, manage expenses and prosper in the new normal.

Day 2 of PAY360 Virtual Conference:

Be the first to hear the results of primary research completed by the Payments Association into the increasingly important topic of customer disputes, the chargeback process and instances of double credits being issued for the same disputed transaction. Our expert panel of network, issuer, merchant acquirer and solution provider will discuss the topic, hear how COVID has amplified the problem, identify reasons for double credits and make recommendations for improvements to benefit all stakeholders.

Day 2 of PAY360 Virtual Conference

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.