Disability Inclusion: The Next Frontier in Payments

We’ve made great strides to broaden access to payments options, including a number of niche products to address specific customer groups. But have we yet considered the accessibility of all

We’ve made great strides to broaden access to payments options, including a number of niche products to address specific customer groups. But have we yet considered the accessibility of all

AI has the potential to solve some of the biggest challenges faced by financial institutions. But how can we navigate this ever-evolving landscape to our advantage? From machine learning, and

As the status quo for the cross-border payments infrastructure evolves, the customer experience also needs to be factored in. From a customer perspective, the cross-border payment process was historically slow,

Cross-border payments are perceived as inherently high risk due to reliance on manual process and lack of transparency among the players. This has created knock on effects (slow, expensive and

Five payments pundits share their views on what should be in the Chancellor’s report and Autumn Statement. Moderator: Tony Craddock, Director General, The Payments Association Panellists: • Jana Mackintosh, Managing

While some progress has been made, there is still a strong opportunity for the payments sector to collaborate and innovate on solutions that work for at-risk and underserved populations to

The digital payments industry is now the backbone of the global economy. Unfortunately, it’s also a major target for fraud, money laundering and other financial crimes. With new AI technology

DIGISEQ recently commissioned Consult Hyperion to do a webinar on SCA PSD2, in this piece we address the issue of SCA (Strong Customer Authentication) in Passive Wearables. Rules are in

The world of digital currencies is upon us… New types of private money have exploded on the scene in recent years – from cryptocurrencies to stablecoins and beyond – but

A recent Forbes article stated that in the next 3-5 years, 76% of global banks predict that usage and customer adoption of open banking applications will increase by 50%. Open banking certainly

The battle between GDPR/data minimisation and fraud prevention is a tough one to navigate but there is widespread agreement that further collaboration on data is necessary to tackle financial crime.

The ubiquitous adoption of digital technologies and a huge uplift in e-commerce has resulted in unprecedented levels of online financial fraud. The UK alone saw a 71% increase from 2020

Fraud is a multi-faceted threat. From deliberate error to organised crime there is no one methodology that can be used to tackle all fraud typologies. If we accept this as the reality,

The world of payments is constantly evolving, offering consumers more choice and convenience. We have seen the rise of context-based payments, biometric authentication, wearables and mobile apps. In 2020, Amazon

Virtual payment cards have the potential to enhance and simplify the payment journey for consumers and companies. The opportunity to offer a seamless integrated payment process using virtual cards has

With more financial decisions now in consumers’ hands, the changing digital landscape and the global economic crisis we are facing it is the time for us to set a higher

The value of cross-border payments globally is estimated to increase from almost $150 trillion in 2017 to over $250 trillion by 2027. Cross-border payments sit at the heart of international

Have a look at our on-demand webinar with Bottomline experts & Adrian Jolly Consulting on the SWIFT Customer Security Programme (CSP).

Benefit from a real-time benchmarking comparison to your Banking & FI peers. Take this quick 8-minute survey over 17 easy questions to find out instantly!

Tune in to hear our expert line up of speakers discuss why CBDCs are an important part of the future and how we, as an industry, implement legislation to make

Since launching four years ago, Open Banking in the UK has been progressively gaining momentum. There are now over 5 million monthly active users, with 2021 seeing a 60% increase

The world is waking up to the importance of embedding sustainable practices in every part of society and business, and SDGs* currently represent vast investment opportunities, offering USD10 trillion in

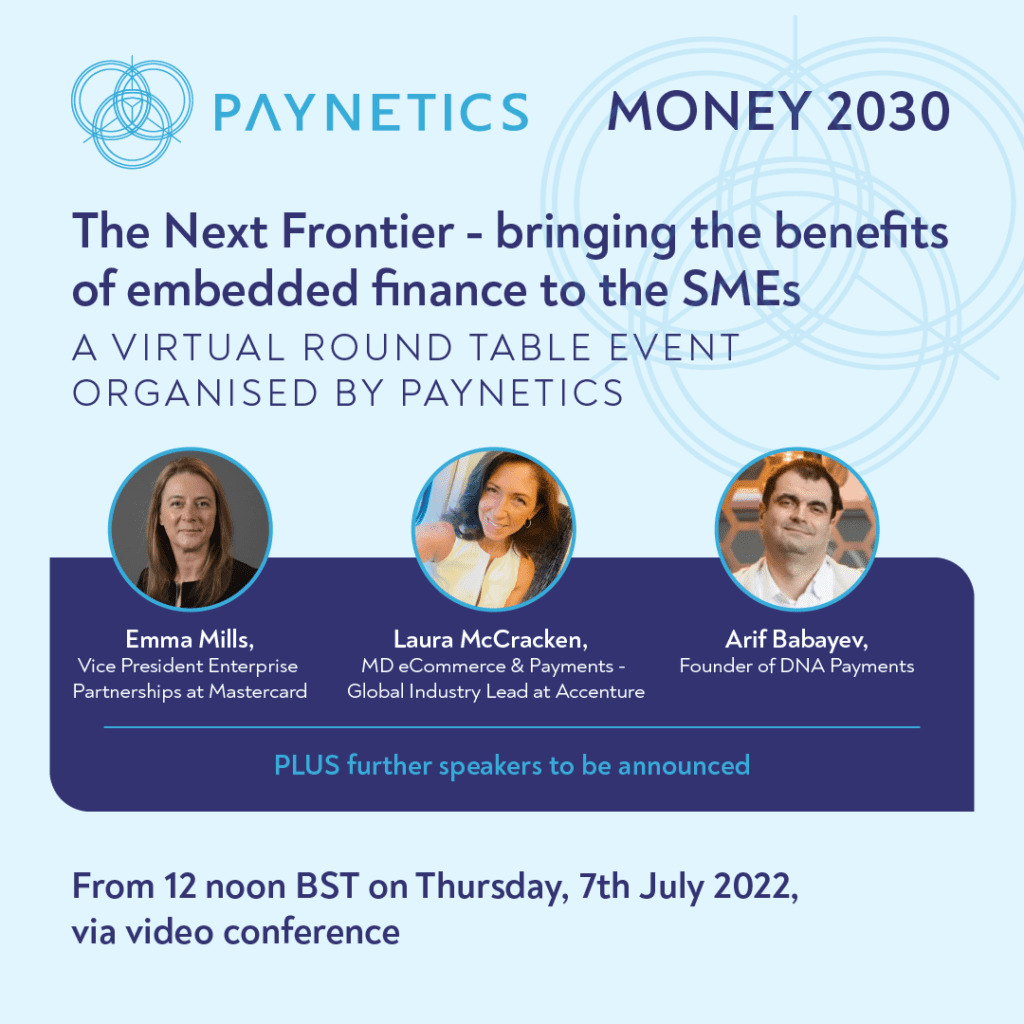

Fintech and trusted payment service provider Paynetics is hosting its fourth roundtable on the future of fintech, held virtually via Zoom on Thursday, 7th July 2022, from 12:00 to 1:30pm BST. Sign up on their website.

Download this webinar to learn how your business can carry out a more thorough KYC check, meaning you can protect yourself against the rise in financial criminals and fraudsters. Speakers

Arf Co-Founder Kazım Rıfat Özyılmaz and Faisal Khan discussed this topic in a fireside chat on April 28th. The insightful discussion covers the impact of digital assets in terms of

Upgrading the UK’s interbank payments infrastructure to align it with a growing digital agenda is an increasing necessity, and through The New Payments Architecture this project is well underway with many banks and Fintechs now in the process or assessing its impact.

But with this new way of organising the clearing and settlement of payments being at the forefront of payment innovation, a conversation is emerging around the types of access model and settlement models that will be supported.

Hear our senior experts discuss the complexity of a rapidly changing industry, the main opportunities and challenges facing payments with a focus on regulation, compliance, customer centricity, competition, choice of

Hear our panel of speakers discuss unleashing the power of technology to seize new opportunities and answer the following questions: How to profitably integrate change? Does AI have the potential

Hear from Paul Roe, Head of Department for Payments Supervision, James O’Connell, Senior Manager: Banking, Payments and Insurance Authorisations and Helene Oger-Zaher, Payments Policy Manager of the FCA on the

Malintha Fernando, Head of Digital Experience and Accessibility, HSBC talks about how making digital banking accessible is not only the right thing to do, but it will also keep your

What does the future of digital financial services hold? Hear from industry leaders on their top predictions for the years ahead. Join the session and learn how to best plan

The regulatory pressure on payments firms continues to grow year-on-year. In 2022, we can expect to see a particular focus on some key areas such as customer communications, Anti-money laundering

The last two years have brought a lot of transformation to the lending landscape. On our next virtual panel we explore what the lasting impact has been on alternative lending and what the outlook for working capital finance future is.

Mastering the most advanced information technologies to process disputed transactions, FIS has implemented its innovative dispute management CBK solution in major banks, processing and service centers, managing claims for over 100 million cards all around the world.

Driven by the COVID-19 pandemic, the battle for talent is increasing for companies and organisations – forcing them to rethink their recruitment and retention strategies. In this session – the first of two webinars focused on ‘The Great Resignation’ – Banking Circle and industry experts discuss how recruitment is changing within the current landscape, whether the power really is shifting from employer to employee, and what financial services businesses should be doing to ensure that they attract the best talent.

Download The Payments Association Insights webinar to find out key findings of the recent research around the Green Paper – “A New Era For Money” and hear our senior expert

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.