Our Project Inclusion webinar sponsored by Mastercard was hosted on the 22nd of April 2021.

We were joined by a fantastic panel of expert speakers who answered some challenging questions on all things credit whilst dissecting the elephant in the room; is selling credit as sinful as it is often perceived? Is it inevitable that credit drives people into further debt? What makes some credit ‘good’ and some ‘bad’?

Highlights include:

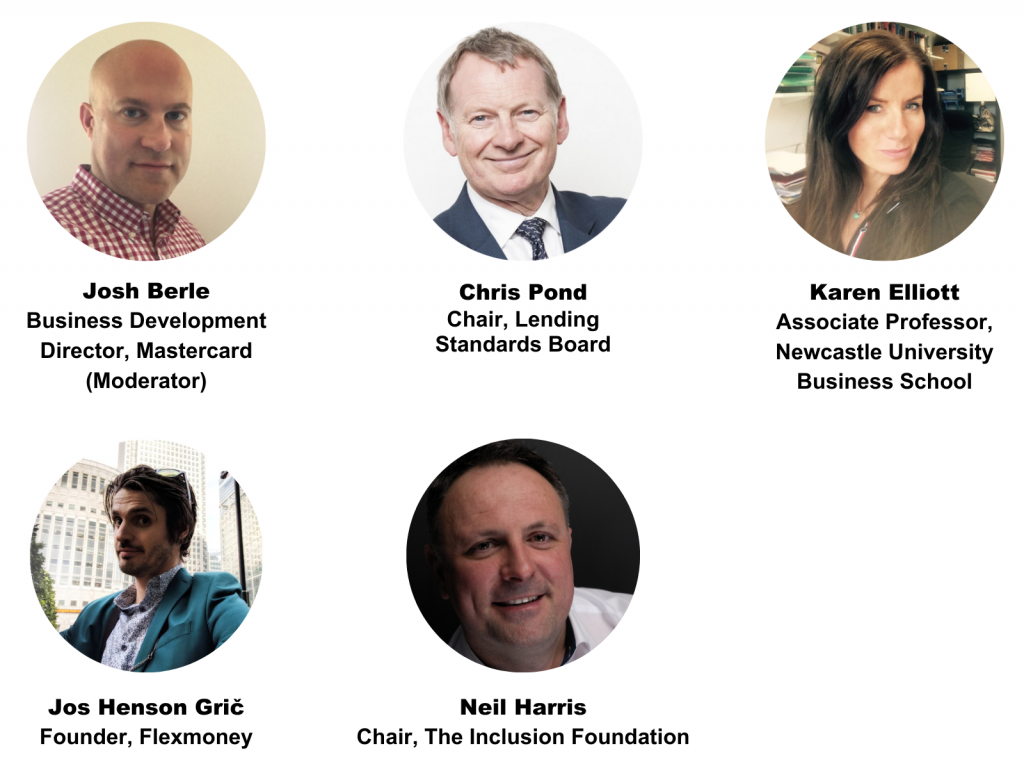

Speakers include:

“We need to unpack the ethics of how credit decisions are made by lenders through the use of AI. Today credit worthiness is largely decided by AI, manufactured by male engineers who code the algorithms with their own bias. There is an issue in diversity of credit access due to this.” – Karen Elliott, Associate Professor, Newcastle University

“Credit is not a sin and borrower data is meaningless without context. No lender would ever lend on the premise that applicants would not repay. We have to move on from the stereotype that all credit providers are predators.” – Jos Henson Grič, Founder, Flex Money

“Let’s get away from the moralist views of credit. 1 in 5 adults use an overdraft or high-cost loans, often to cover essential living expenses and 45% of households wouldn’t make it for 3 months without some form of borrowing facility. These people and their families would otherwise have to go without basic essentials: putting food on the table, paying the rent or to send their kids on a school trip.” – Chris Pond, Chairman, Lending Standards Board

“As a nation, the UK is the envy of the world. Not only do we have a progressive regulator focused on driving competition and security for the consumer; we have a government serious about social welfare reform. We are also the birthplace of the Fintech revolution and innovation like open banking. All of these makes the UK a beacon for financial inclusivity and provides huge opportunity for the Fintech community to improve lives.” – Neil Harris, Chair at The Inclusion Foundation

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.