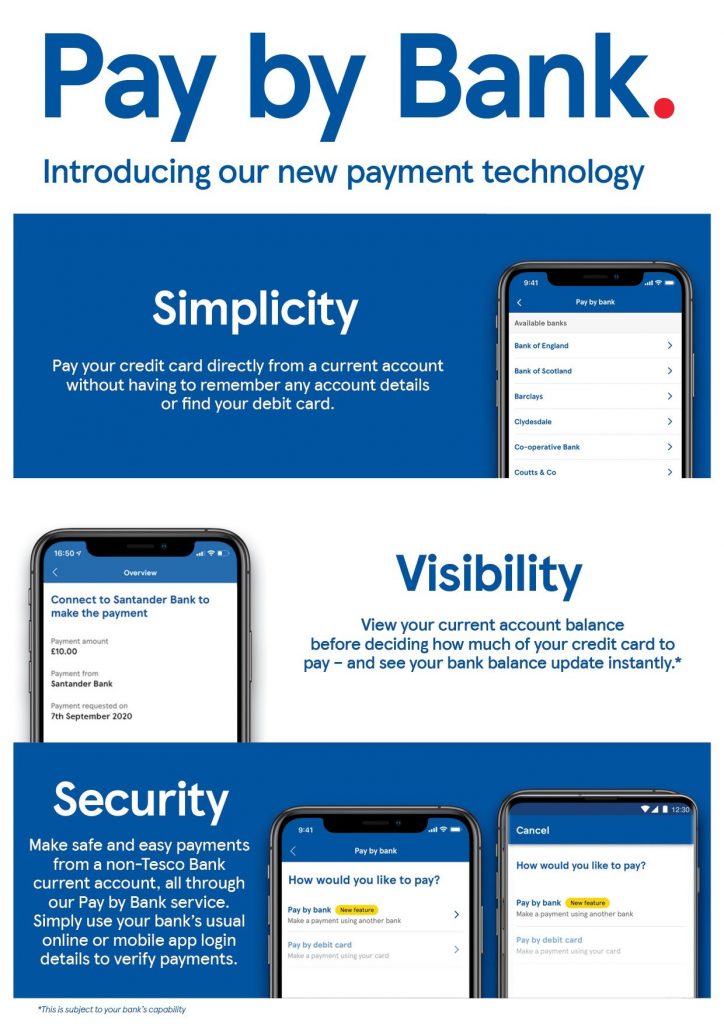

Tesco Bank rolls out Mastercard Open Banking Connect™ to its 2.6 million cardholders

First UK bank to use open banking to enable credit card holders to pay their balance Tesco Bank is to become the first UK bank to introduce new technology that

First UK bank to use open banking to enable credit card holders to pay their balance Tesco Bank is to become the first UK bank to introduce new technology that

Mastercard and PFS partner with the Government of Jersey on the Spend Local cards Every Jersey resident will receive a £100 Spend Local pre-paid Mastercard Innovative approach paves the way

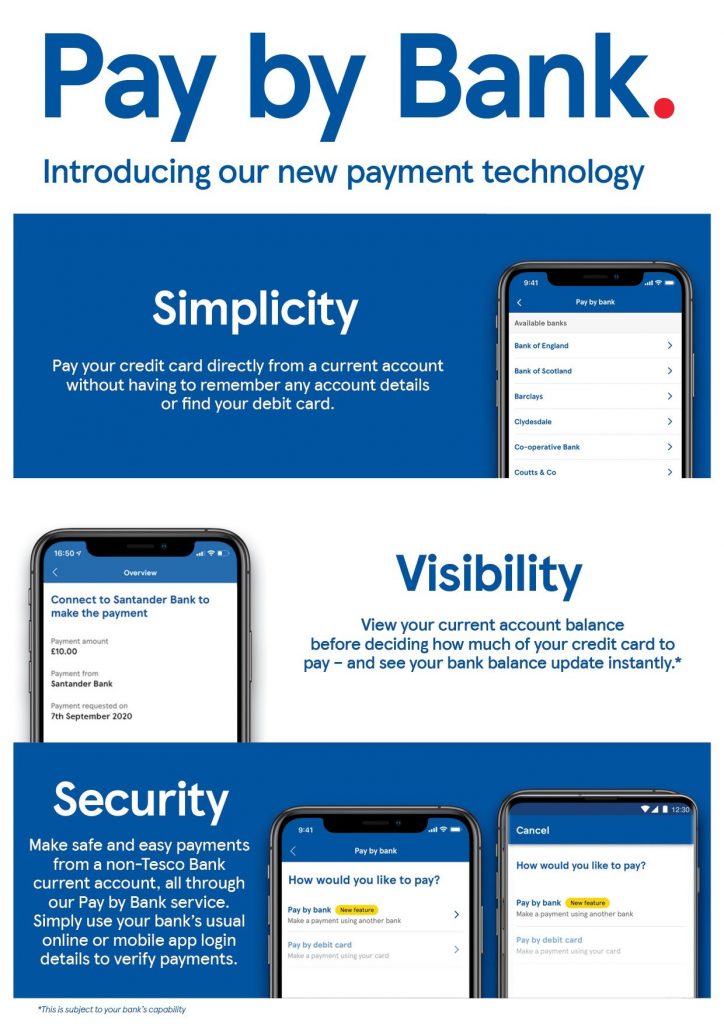

Throughout September OpenTable and Mastercard will be celebrating Dine Local, a month-long homage to dining out, with more than 200 restaurants offering special offers to diners across the UK and

Square and Mastercard bring card payments to the Falkland Islands’ small businesses Launching today as part of London Tech Week, Square, Mastercard and the Falkland Islands Government will announce a

As more companies move their core operations online, the questions of data privacy and data security and how to handle them from an institutional standpoint as well become even more critical for successful business growth.

Across the world, traditional banking is transforming into something else entirely and the full outline and scope of the future of the industry, while not yet fully understood, already presents some amazing opportunities for firms looking for an edge, business innovation and revenue growth.

Agile businesses adapt to the times, providing the market with needed services as they arise as well as new opportunities. This second aspect, helping clients realize new opportunities, is increasingly displacing the traditional model of banking facilitated capital allocation.

Few people have questioned whether e-commerce was the way of the future when it came to retail and shopping, but even fewer have asked what this brave new world will look like.

After all, as everyone moves online, other factors will play critical and distinguishing roles in determining who the winners and losers are from the e-commerce online future.

Grab your morning coffee and join us as we reveal insight from our flagship research of 2020. You’ll be joined by peers in the payments community as we uncover the latest opportunities and use-cases in the industry.

Date 1st October 2020 Time 09:30 – 10:30

Book your place → https://landing.modulrfinance.com/cost-of-hidden-inefficiencies-epa

Netcetera is Mastercard’s exclusive 3-D Secure testing partner to help retailers and other businesses ensure they are ready to comply with PSD2. Mastercard and Netcetera, the market leader for 3DS and EMVCo associate, are supporting merchants to improve their transactions and conversion rates. This is the first time that merchants are able to run tests in their live online shops.

EML and Laybuy are working together on Buy Now Pay Later (BNPL).

Ben Agnew brings a wealth of B2B events experience to lead the team at the UK’s premier payments industry member body London, UK. 1st September, 2020. The The Payments Association

Relying on a single provider for essential banking services can be catastrophic for your fintech. So how can you ensure to keep the payment tap on and payments flowing in the times of crucial failure of your banking provider

FORM3 is delighted to announce it has raised $33 million in a strategic investment round with new investors Lloyds Banking Group, Nationwide Building Society and VC 83NORTH.

Following our Series B funding round in November 2018, Form3 has trebled in size and increased its annual recurring revenue by 160%.

The funding will strengthen Form3’s market-leading cloud-native payment technology, building significant functional enhancements, and accelerating our global expansion plans in existing and new markets.

Michael Mueller, Chief Executive Officer at Form3 said, “Our latest equity round is a testament to our growth and maturity in delivering highly secure, best in class technology for major financial institutions globally.”

Interview with the CEO of Accomplish Financial, Guy el Khoury Director General of the The Payments Association Tony Craddock speaks with Guy Raymond El Khoury, CEO of Accomplish Financial, a

Blue Train’s Jeff Banks joined Gert Scholts, from The Best Sales Coach, for a chat on the success that can be achieved when Sales and Marketing teams work together in fintech collaboration.

We are pleased to announce that we are now 1 of 7 non-banks to have secured an e-money license from the Dutch Central Bank.

Mike Laven says of the recent news, “Covid-19 has accelerated the rush towards digital payments and Europe represents a tremendous opportunity for Currencycloud. The Netherlands possesses the perfect blend of factors to support our expansion in the EU…”

Trust Payments has established a new UK operations hub in Harrogate, with the opening of a new office on Station Parade which will create 10-15 new jobs in Harrogate by the end of the year.

Payments Giant EML is Creating a Better Tomorrow Through its Commitment to Reducing the Use of Plastic Cards in the Communities it Serves Worldwide by 50%.

The COVID-19 pandemic and the expected economic downturn will definitely shape the global fintech landscape. The fintech scene in Hungary is still in its early days but it has been growing rapidly over the last few years. We hopped on a Zoom call with some of them to learn how they deal with the current situation and hear their thoughts and predictions about the upcoming trends, challenges, and potential opportunities.

At Cybertonica, we believe that the success of our business depends on our diverse and multinational teams. We decided consciously focus on building both a more diverse management team and engineering group back in 2016.

Recently we’ve been lucky to be able to grow our team and bring nine new people aboard. Cybertonica now comprises 12 nationalities and more than 40% of our workforce are women. We’re pleased with the progress that we’ve made since the start of our business and want to thank all our partners and supporters!

In this blog post we tell our journey towards the gender parity in our organisation and compare it to the fintech industry average.

As brick-and-mortar firms come under increasing market pressure, eCommerce business models are starting to appeal to a larger segment of the global population and it is so for solid reasons. For one, they’re not only more nimble and agile firms when it comes to meeting customer demands and adapting to the market but also they are the first to take advantage of the latest innovations in B2B eCommerce solutions like virtual IBANs.

~70% of consumers have considered switching to technology-led banking products. Whether you’re an incumbent or a challenger how do you stack up against cutting edge technology and design? Well that’s where our new 5-week audio/eBook series comes in – sign up today to learn How to Build a Better Bank.

As the collapse of the Wirecard empire is making us all too aware, relying upon one banking provider for your business is not only a disaster waiting to happen but also it could be terminal for your business. The fintech company which is one of the biggest European payment processors and financial service providers is now in the spotlight.

We will now analyze the facts behind why is that so and what are the potential market consequences.

Recent trends in the online skill games industry bode well for its future and that’s not just because of the wider acceptance of online gaming.

The growth in the skill games business can primarily be attributed to virtual IBAN advancements and the ease with which international transactions take place. Not to mention last the recent shift en masse to online entertainment because of the novel coronavirus.

What are the Top 2020 Trends? B2B eCommerce is projected to be the area of the largest eCommerce growth from 2020 to 2025. In 2020 the global revenue in B2B eCommerce is anticipated to be two times bigger than the one from B2C sales.

COVID-19 has a far-reaching effect on the global economy. It’s a fact. Companies are struggling to understand the full impact on businesses and how best to react to the new reality. ECommerce is one of the few areas currently showing signs of growth despite the overall economic breakdown.

In light of recent developments, we now have more questions than ever about the impact Brexit will have on businesses in terms of future development, certainty, and stability.

It may become harder to do business with long-standing partners, both for UK and EU businesses, with new barriers to trade and finance looking set to come into place.

The fintech industry is no stranger to a crisis. The financial crash in 2008 gave rise to fintech darlings such as Funding Circle, Seeders and TransferWise; and over the last

Starling Bank is the only challenger bank to record more app downloads in May than the year before, thanks to a tv ad starring a shed and lockdown loans for

Opinion: Going cashless might be convenient for many, but for others, it risks causing misery. The COVID-19 pandemic has become a catalyst for change, with what we once considered ‘normal’

The Payments Association, who represent 130+ members from across the payments industry, wishes to thank the CBI for inviting it to contribute to its research into Economic Stimulus policies to

Compass Plus has announced that it has teamed up with AWS to utilise the latest advancements of cloud-based deployment. The vendor of payments software and payments processing services has been

The novel coronavirus outbreak that originated in Wuhan, China, in November of last year has since ignited a global pandemic that could permanently change the way business is conducted.

Not only that but, as with every economic crisis, there will be definitive winners from the aftermath of the economic fallout and these companies will help shape the future of e-Commerce in the USA/EU.

While many analysts could never have anticipated the impact of the novel coronavirus pandemic on the world economy, there is a general consensus about what firms can do now and moving forward to build resilience against future “black swan” events such as the one currently roiling world markets.

When it comes to the future of banking and finance, forward-thinking firms are exploring the benefits of digital innovations, such as virtual IBANs and digital banking services.

The new Dos and Don’ts for any business looking to attract and keep new international customers.

Standing still is going backwards. That’s true for every business at all times, but especially in the harsh economic realities of 2020. A long-predicted downturn hit, ignited by the coronavirus pandemic, and no sector is free from its impact. But there are still opportunities out there, especially for online merchants looking to grow.

Payments, Payments, Payments newsletter providing informed insights into the UK’s payment landscape – read, subscribe and share at: www.northeypoint.substack.com/welcome

The future is coming at us a lot more quickly than anyone anticipated. In light of the novel coronavirus and the pandemic it caused, keeping up with the technological advancement seems to be a top priority in most industries.

While many market analysts fingered digital banking as the wave of the future, nearly everyone is shocked at how fast these trends have accelerated in the past couple of months.

Tony Craddock, Director General of the The Payments Association, spoke with ARYZE, to talk through some of the biggest payments developments taking place due to COVID-19 and how involved parties

Mastercard (NYSE: MA) today announced it has entered into an agreement to acquire Finicity, a leading North American provider of real-time access to financial data and insights. The purchase price is US$825 million, and Finicity’s existing shareholders have the potential for an earn-out of up to an additional $160 million, if performance targets are met.

During RSA Conference 2020, Yubico interview Guido Ronchetti, XTN’s CTO, about the challenges related to PSD2 and open banking.

Banks are shutting down tens of thousands of accounts every year due to suspected fraud; on average, Santander closes down 24,000 accounts each year, and just under half of all those are suspected mule accounts – a huge proportion.

When we’re on the subject of malware and cyber attacks, we usually focus our attention on cybercrime as a totally unknown, uniform entity. Nevertheless, cybersecurity specialists, such as buguroo’s team, are always mindful not only of the codes used to develop computer viruses, but also of the processes adopted to implement campaigns and the targets they were aimed at. It is these three elements that provide a lot of clues as to who may be behind them.

New account fraud, also known as Account Opening Fraud or Online Account Origination Fraud, is when fraudsters use stolen or synthetic identities to open new bank accounts, with a view to maxing out their credit limits before disappearing into thin air, usually within 90 days.

Xwebinar is an on-demand webinar series focused on cyber threats and fraud topics. This episode talks about one of the most common threats: Account Takeover also knows as ATO.

For the second consecutive year, XTN is listed as Representative Vendor in Gartner’s Market Guide for Online Fraud Detection.

The Summer of Payments series brings you everything you’d ever want to know about UK, EU & card payment schemes as well as the latest and greatest in payments technology in five 30 minute entertaining doses.

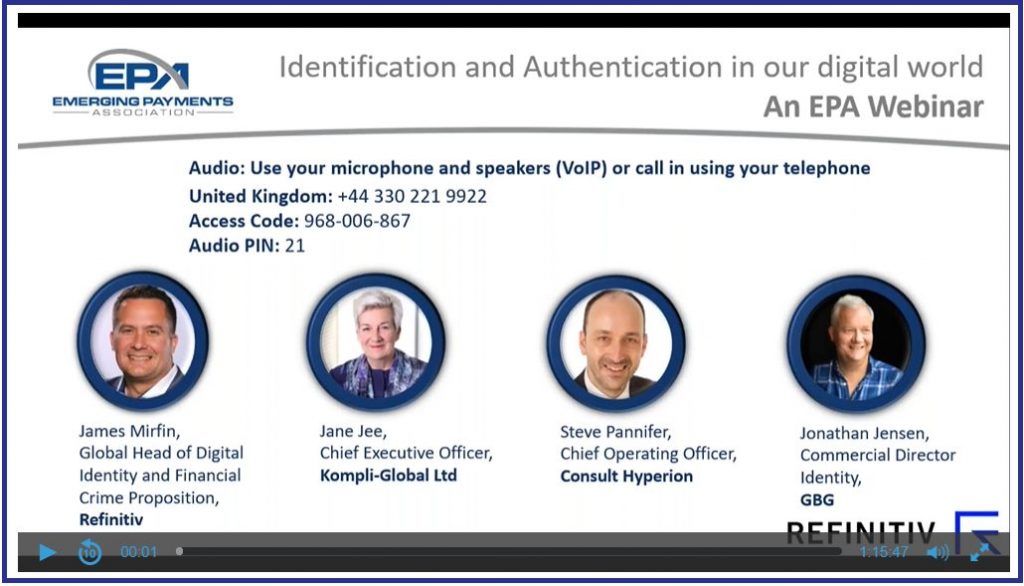

The Payments Association’s panel of digital identity experts discuss project financial crime’s latest whitepaper: ‘The Payments Association’s Guidebook to Digital Identification and Authentication’ View the On Demand version This whitepaper

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.