fscom – A new year; a new payments landscape?

To some, 13 January and the implementation of the second Payment Services Directive (PSD2) will be a significant milestone in their business’s path. They will be joining the community of

To some, 13 January and the implementation of the second Payment Services Directive (PSD2) will be a significant milestone in their business’s path. They will be joining the community of

Project Rome has published a thought leadership piece on the transposition of regulation 104 and regulation 105 from PSD2 and their impact on banking access. The article, penned by Andrea

The opening of a brand new Post Office on New Oxford Street in London has marked a new milestone for the Post Office in the UK’s capital. Read more here.

Most of the payments predictions I’ve read for 2018 say, ‘This year we’ll see more collaboration in payments’. A glib statement, but not so easy in practice. No app can

Project Media has raised the profile of the Payments Association and its members with coverage across Bankless Times, PaymentsCompliance, Finextra, Fstech, and Global Banking & Finance among others. The activities

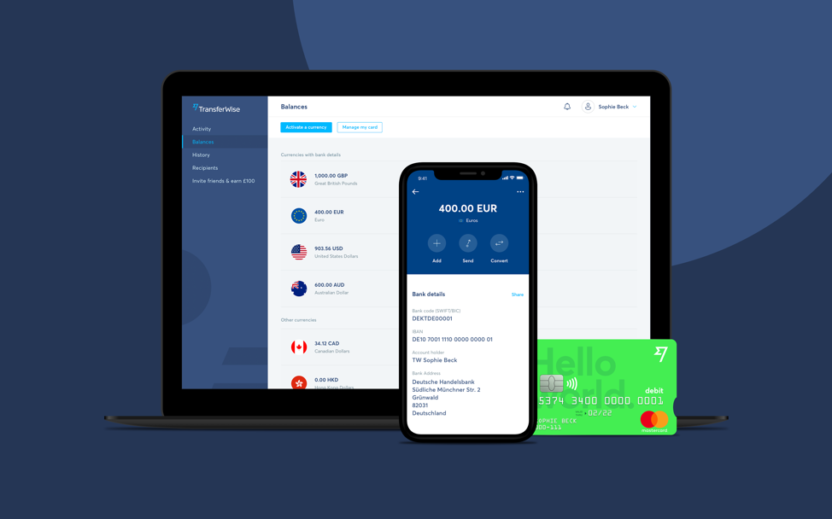

Money transfer innovators TransferWise introduce a borderless account, with real time debit payments. Last week, global money transfer company TransferWise announced the launch of the first truly multi-country/multi-currency “borderless” account.

London, United Kingdom – The The Payments Association welcomes Visa as a Benefactor as well as the lead sponsor of its flagship annual conference, PAY360. Visa is also supporting the

Project Futures has announced the dates for its next workshop which will focus on new technologies that will drive digital business. The next Project Futures workshop will be held on

Project International Trade, with the support of its Benefactor Banking Circle, has launched a new membership category called Payments Association ScaleUp Membership for early stage FinTech and PayTech companies. Payments

Project Women in PayTech will be launching a LinkedIn group to provide a platform for mentorship, networking, and facilitate discussion on barriers to women within the payments industry. This private

Atlanta, Ga. (January 23, 2018) – InComm, a leading prepaid product and payments technology company, today announced it has significantly expanded the already extensive list of gift card brands it offers its retail

Project Women in PayTech will be hosting an event on Wednesday 28th February – titled ‘Shaping the ‘gender agenda’ in PayTech’. This free event is open to both women and

Oslo, Norway, 25th January 2018 – Signicat, the first and largest identity assurance provider in the world, has secured phase two funding from the EU’s Horizon 2020 programme, the framework

The activities of Project Inclusion were represented and championed at a recent Bacs event; titled ‘The Consumer Conundrum – ensuring effective representation in financial services’. The Project Inclusion team, in

Project Regulator has received a response from the Open Banking Implementation Entity (OBIE) in response to the open letter published in May. The response, penned by Imran Gulamhuseinwala, recognises the

Project Inclusion has called upon the payments industry to do more to reduce the number of financially excluded individuals in the UK. In a Hot Topic Briefing on Social Sustainability

No policy change coming in 2018 promises to disrupt the payments industry more than the Revised Payment Services Directive, or PSD2. Read more here.

Members of the Project Inclusion team met with Matt Hancock, Minister of State (Department for Digital, Culture, Media and Sport). Project lead Steve Shirley, Vice President of Public Sector at

Payments Association CEE hosted its second xCEEd conference in May. xCEEd 2018, the leading fintech conference for Central and Eastern Europe, hosted over 200 attendees and focused on the practical application

Project Media has raised the profile of the Payments Association this month with activities and insights from the The Payments Association being publicised in The FinTech Times, PaymentEye FinTech Finance,

London – The London office of global law firm K&L Gates LLP has strengthened its investigations, enforcement and white collar practice with the appointment of Paul Feldberg as a partner. He joins K&L

Visa has initiated pilots with Mountain America Credit Union and Bank of Cyprus of a new EMV dual-interface (chip- and contactless-enabled) payment card. The pilots will test the use of

TORONTO, January 30, 2018 – Thomson Reuters (TSX/NYSE: TRI) today announced that it has signed a definitive agreement to enter into a strategic partnership with Blackstone. As part of the transaction,

Project Futures held its first workshop on Wednesday 21st March. This interactive workshop, facilitated by Consult Hyperion, brought together twenty subject-matter experts and thought leaders in the payments industry and

Project Futures will publish the findings of its inaugural workshop at the Payments Association’s AGM on 1st May 2018. Th report articulates the workshop’s outputs; which explored the disruptive innovations

The results of Project Retail’s survey to retailers highlight that 80% of retailer respondents do not feel that their voice is heard when new payments regulation is proposed. The survey

Project Futures held its second quarterly workshop on Wednesday 18th July. This interactive workshop, facilitated by Consult Hyperion, brought together subject-matter experts and thought leaders in the payments industry and

As a region, the Nordics is viewed as front-runners in digital adoption and fintech innovations. Denmark, in particular, has often shown a will to adopt new technologies in both private

Project Futures will be hosting the first of its quarterly workshops on Wednesday 21st March. The interactive workshop will focus on identity and its role in managing fraud, and will

Project Media has raised the profile of the Payments Association and its members with coverage across Finextra, Mobile Payments Today, FStech, PaymentsSource, Payments Compliance, and The Paypers among others. The

Project Regulator hosted a Hot Topic Briefing on the New Payments Architecture, in conjunction with the New Payment System Operator (NPSO) and the Bank of England. The briefing addressed 40+

London 30 January 2018 – Today, leading payments provider Klarna has announced a partnership with Maplin – the UK’s number one specialist technology retailer. Maplin customers will now be able to

Just as the Wild Card Round is followed by the Divisional Round in the NFL playoffs, fraud and payments predictions are always followed by New Year’s resolutions. This year, in the

Today, we are pleased to announce that Stig Korsgaard has joined the organisation as Vice President, European Sales. Based in Denmark, Stig’s appointment will further drive the growth of Vocalink’s range

Payments Association Africa hosted an Payments Association Africa Awareness Day on Wednesday 21st and Thursday 22nd March. Hosted by James Redding, Director General of Payments Association Africa, Payments Association Africa Awareness Day

Project International Trade, with the support of its Benefactor, Saxo Payments Banking Circle, has launched a vital resource for early stage FinTech and PayTech companies. The Payments Association FinTech Regulation

Project Rome encourages all Payments Association members to respond to the Payment Systems Regulator’s discussion paper on data in the payments industry. The PSR are keen to understand how the

Project International Trade has launched a member’s survey on global markets and the challenges of trading internationally. This survey includes questions that encompass the markets the payments industry is currently

‘- In-app payments forecast to be worth $1.2 trillion across North America and Europe by 2020¹ – Businesses in 190 countries now offered rapid, simple mobile payments integration whilst retaining

Curve, the new app that connects your debit and credit cards to one Curve Mastercard, launched for UK consumers today. With over 50,000 people on the waitlist ahead of launch,

Project International Trade joined The Lord Mayor in a trade mission to Australia and New Zealand in February. Suresh Vaghjiani from the Project International Trade team accompanied the FinTech and

Project Regulator, on behalf of Payments Association, has written to the Open Banking Implementation Entity (OBIE) calling for the OBIE to amend the terms of the CMA’s framework so that

Project Retail hosted its third Retail PayTech Forum in November to discuss payments innovation and its implementation. The Retail PayTech Forum, held at the Montcalm Royal London House, brought together

LINK, the UK’s main cash machine network, has today announced a series of measures designed to maintain and rebalance the UK’s ATM network – shifting incentives from deploying ATMs in

(London and Copenhagen, 08.06.2018) Coinify, an established global virtual currency platform, has signed a long-term agreement with Cybertonica, a fast-growth AI technology offering cross-channel real-time risk and fraud solutions, to implement a

Iana Dimitrova, Group CEO & General Counsel of AKCE Group (holding company of Ozan), discusses the new payments regulatory landscape, the activities of the Payments Association, and how the payments

LONDON, May 21, 2018: B4B Payments, a leader in smart and flexible corporate expenditure solutions and Sage Spain, the multi-national accounting software and business services provider, have signed a strategic

Raiffeisen Bank will use new customer onboarding technology from analytic software firm FICO to increase its digital lending capabilities in Romania. FICO announced today that Raiffeisen — part of Raiffeisen

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.