Serpentine running club hits the ground running with Ordo’s Bank Transfer QR code solution

Ordo’s Point of Sale QR Code solution perfect for race day entry fees

Ordo’s Point of Sale QR Code solution perfect for race day entry fees

B2B cross border payment provider, Verto, has joined forces with Payments Bank, Banking Circle, to streamline international payments for its clients. Utilising the multi-award-winning Banking Circle Virtual IBAN solution, alongside access to Banking Circle’s local payment rails, Verto is addressing the pain points of complicated pay-ins and cross border payments.

Innovative all-in-one payment solutions provider and card issuer, Wallester, is providing its clients with more opportunities in more jurisdictions with multi-currency settlement accounts as a result of a new partnership with Banking Circle. Working with the ground-breaking Payments Bank, Wallester can now give its clients easy and efficient access to settlements accounts in 25 major currencies.

Nuapay confirms significant expansion in top European open banking markets.

The gaming industry is proving that the desired metaverse is one that is decentralized in terms of control but hyperconnected for easy transfer of value between platforms.

Having become accustomed to a plethora of units of value, and their extreme portability, today’s gamers will not welcome a centralized institution locking their value inside any particular system such as Facebook’s virtual world.

Flash forward where banks and digital banking make all units of value portable too… imagine:

– crypto into consumers’ digital wallets

– holding cash as central bank digital currency.

By 2030, 60% of global consumers will have made a transaction using a unit of value other than a fiat currency.

AccessPay add another big name to their growing list of collaborators, forming a new partnership with 3RP, who offer tailored Oracle NetSuite ERP consultancy services.

Open banking has gained strength over the past 18 months, ever since Europe began enforcing the Payment Services Directive 2 (PSD2). Now we are starting to watch similar initiatives pop up across the globe, all the way from Australia to Canada. But what about the (possibly biggest) payment market, the United States? Has PSD2 had any impact there, and can we expect a similar set of regulations to be implemented?

Virtual IBAN and corporate account provider, Monneo, is excited to announce the launch of its new card acquiring service. The development allows the company to offer a full payment ecosystem to its customers and represents a true end-to-end solution.

Reflective of Singapore’s position as a fintech hub, Transact365 has shifted its Asian headquarters from Hong Kong to Singapore as a very important base for its future growth. They are now in two of the world’s fastest growing markets for fintech, which is a prime position for their global expansion.

EML and Cadillac Fairview have innovatively transformed festive digital gifting.

The problem of online fraud has been around for decades, and has been steadily growing alongside the staggering growth of eCommerce. Combatting this problem requires a multi-faceted approach from merchants, the payments industry, law enforcement and ordinary people, and one recent development has been the launch of Strong Customer Authentication (SCA) across Europe as part of the Payment Services Directive 2 (PSD2) regulations.

Bottomline (NASDAQ: EPAY), a leading provider of financial technology that makes complex business payments simple, smart and secure, announced that it has completed the acquisition of Bora Payments Systems, enabling Paymode-X vendors to utilize straight through processing (STP) as a method of accepting virtual card payments.

James Richardson, Head of Market Development Risk and Fraud at Bottomline shares his thoughts on the importance of regulation when fighting fraud in financial institutions.

With cross-border ecommerce having grown by 35% globally over the last year with no signs of slowing down, how do PSPs address this explosion in demand?

In this article discusses the sharp rise in global/cross-border e-commerce and the need to offer a multi-currency solution for accepting payments for merchants.

With 2022 just around the corner, the payments industry in Fast-Growing and Emerging markets is already showing the signs of potential key trends for the next year. Nikulipe’s CEO Frank Breuss identifies three major trends he sees taking off in 2022.

Much has been written of late about how the metaverse will be the evolution of the internet as we know it. With the rebranding of Facebook (now Meta) the metaverse has been pushed into the limelight with organisations considering how they should tackle this global phenomenon. Part of this consideration for many is commerce, how will digital goods and services be paid for in the metaverse? What does this mean for traditional banks vs challenger banks?

PPS, an Edenred company, announces its partnership with UK-based ekko, an iconic climate-friendly debit card, app, and ecosystem that empowers consumers to make a difference in the fight against climate change. The partnership showcases PPS’ commitment to the enablement of the green finance movement.

Paysend, the card-to-card pioneer and international payments platform, reaches 5 million customers globally in under 5 years and is ranked the third fastest growing technology company in the UK by Deloitte, thanks to 14,498 per cent growth.

Looking back over the last 18 months in the payments industry, it’s hard to recall a more turbulent time certainly in the last decade or so, but as always, out of chaos comes opportunity…

B4B Payments (B4B), a leading global provider of card issuing solutions for businesses, is set to join the Banking Circle ecosystem to complement the Banking Circle Payments Bank, providing accounts, payments and issuing to Payments businesses, Banks and Corporates. The deal is now going through the regulatory approval process. After closing of the acquisition, B4B will operate as an independent sister company of Banking Circle.

These changing times have certainly made life ‘interesting’ for mainstream banks. Recent events have seen a marked growth in the digitisation of financial services and the emergence of crypto currencies as payment mechanisms have introduced another digital variable to the banking equation. There is a challenge to mainstream banks to step up to remain relevant in this changing world and to leverage their own trusted brand. Banks can avoid costly transformation and choose new incremental models with the right supporting payments technology.

PPS and ViaBill join forces to bring BNPL to shoppers in-store and online.

PPS was appointed as the issuer and processor for ViaBill, Europe’s leading Buy Now Pay Later (BNPL) solution, which facilitates end users to a greater access to flexible forms of credit.

PPS will be acting as BIN Sponsor, Card Issuer and Transaction Processor, and also integrating Apple and Google Pay to offer ViaBill’s customers further flexibility in payments.

The Future of Competitive Advantage in Banking & Payments. The results are in from 311 banking & FI players across Treasury, Fraud, Operations, Product & C-Suite in 34 countries globally

Facebook recently announced that they were changing their name to Meta. The main reason? To “recast the company’s public image from battered-social-network to tech innovator, focused on building the next generation of online interaction”. Will this move have an impact on the future of global payments? Will these payments take place within virtual reality? Is there another trend that better predicts the future? Let’s take a look.

AccessPay are proud to announce a new partnership with Anthesis, experts in ERP software, consultancy, and managed services.

Effective immediately, the partnership speaks to the continuing growth of both businesses and the ongoing relevance of workflow modernisation through ERP systems and banking automation.

Nikulipe’s CEO Frank Breuss was invited to speak on CNBC Africa to discuss the tremendous growth potential of the e-commerce industry and the challenges faced by Emerging markets like Africa.

There’s an invisible force that inhibits companies from growing, competing, and reaching long-term goals:

Stress.

Stress can plague businesses, especially in the fintech and payment industries where there’s a constant demand for change and innovation. This pressure can spread severe anxiety throughout the ranks of an organization. When teams are constantly stressed, their productivity and communication decline.

Team development and resilience toolkits can help companies cultivate low-stress environments — even in fast-moving, competitive fintech industries like payment.

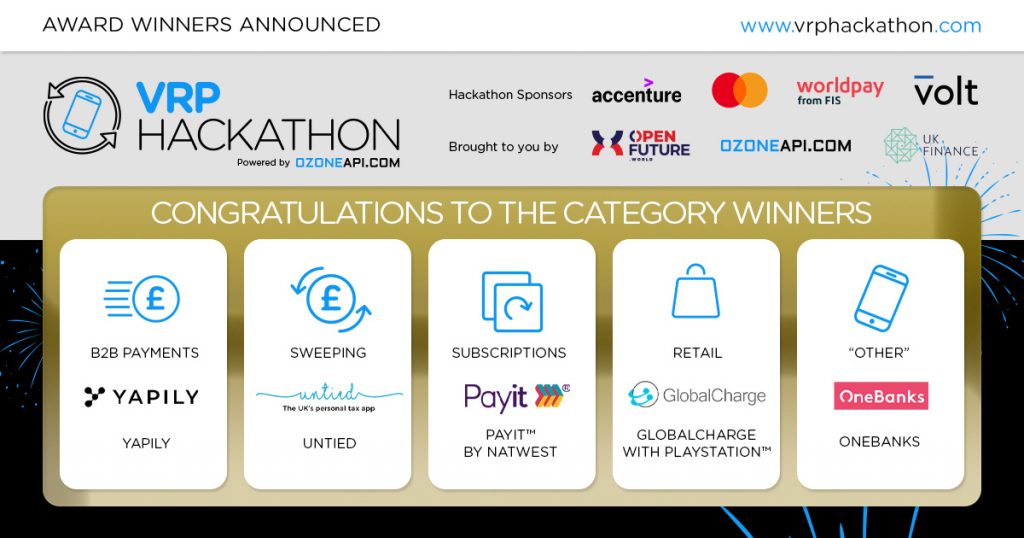

Ozone API, Open Future World, and UK Finance are delighted to announce the winners of the world’s first variable recurring payments hackathon. The six week event, sponsored by Accenture, Mastercard, Volt and Worldpay from FIS, was an opportunity for developers, banks, payment initiation service providers and tech platforms to demonstrate potential use cases and propositions that open banking VRPs can deliver.

Online retailers storing credit card data for the sole purpose of facilitating further purchases will likely need to obtain consumer consent.

Currencycloud announces that they we are working with Fintech start-up Lightyear Financial.

Nick Cheetham, Currencycloud’s Chief Revenue Officer says, “Lightyear are true innovators in the field who now have a cross-border solution embedded in their offer: opening up global markets to even first-time European investors.”

Find out more here: https://bit.ly/3nlPZ28

Suits me has migrated away from previous provider Contis. By utilising PPS’ technology and licenses for issuing cards and e-money, Suits Me is now able to offer services including Debit BIN, Mastercard Settlement, Banking Service, BACs In, CHAPs In, Direct Debit, Direct Debit Indemnity Claim and PayPoint cash load.

As part of their co-operation and co-investment in Planet, a leading provider of integrated payments, Advent International (“Advent”) and Eurazeo have today acquired Datatrans AG (“Datatrans” or “the Company”) and will now co-own the company.

The new investment will support the Company’s position as the market leader in secure online payments and enable Datatrans to expand into new European markets and deliver new innovative uses for its PCI Proxy platform across Retail, Gaming and Digital services throughout North America and Europe.

EML.CON Global airs November 18 and 19.

FIS UK Pace Pulse Report 2021. How British lives have changed, including changing attitudes and behaviours around payments, banking and finance, in response to the global outbreak of COVID-19.

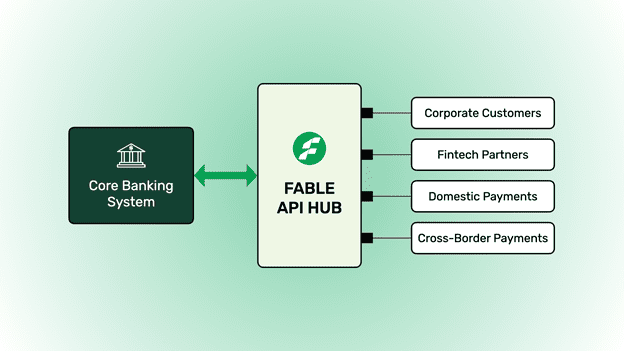

Banks all over the world publish their APIs for their corporate customers which allows them to take advantage of the financial products offered within their own ERP environments. Whilst this provides a great customer experience, it does incur costs given the high resources required from both parties to make this a success.

Fable’s API Hub makes open banking adoption easier, affordable, and interoperable for your customers – but how has Fable got this right?

Read more about Fable’s work to bring banks closer to their customers giving them back control of their own cross-border transactions

LONDON, United Kingdom – Paynetics, the regulated e-money services provider, has partnered with ClearBank to offer real-time payment and innovative banking services to customers.

12th October 2021, – LONDON, United Kingdom Paynetics, a regulated e-money services provider, today announced it has secured Visa Ready certification, which enables partners to build and launch payment solutions that meet Visa’s global standards. Securing this status marks a significant moment in Paynetics’ mission to make payments simple everywhere.

B2B Payments bank, Banking Circle, has joined the Danish national intraday clearing system. Through Banking Circle as a direct clearing participant, Payments businesses and Banks can now pay out and collect payments locally in Denmark on behalf of their customers more quickly and at lower cost than via traditional cross border payment methods. This will enable e-commerce businesses around the world to tap into the growing Danish market.

fscom’s Senior Manager of Fincrime, Fred McDowell shares what elements make up a valuable MLRO Report. He also gave valuable context and practical suggestions as to the content that you might consider under each section.

In one of our most recent webinars this month, fscom’s Director Alison Donnelly and Senior Managers, Dipesh Patel and Dane Pedro JP, tackled the most common questions that come up in their daily work with clients who are seeking authorisation in the UK.

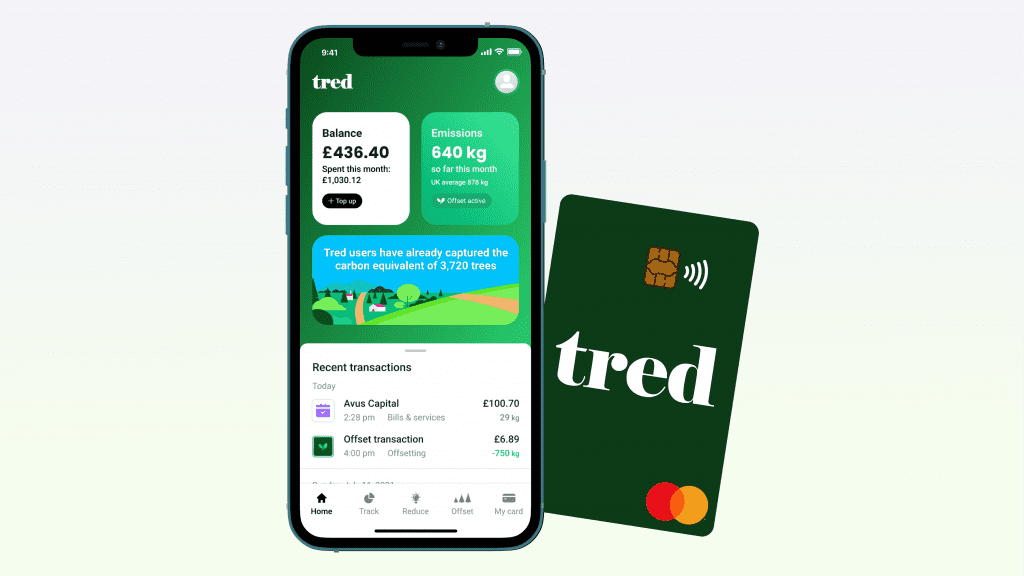

Green fintech Tred has announced that their UK green debit card launch will be with Mastercard, enabled by Nium’s card issuing service.

In anticipation of their upcoming launch, and to celebrate this announcement, they’ll be planting 10,000 trees with Mastercard as part of its Priceless Planet Coalition, launched last year with a firm commitment to plant 100 million trees by 2025.

London corporate team represents leading digital cross-border payments platform in achieving a post-money valuation of US$5 billion.

Latham & Watkins advised Zepz, formerly WorldRemit, on raising US$292 million in new primary financing and achieving a post-money valuation of US$5 billion. Zepz is a digital cross-border payments platform operating two market-leading brands (WorldRemit and Sendwave, acquired in 2021), with over 11 million users across 150 countries.

The round includes new equity investors Farallon Capital among others, as well as backing from existing investors Leapfrog, TCV, and Accel.

The Latham team was led by London corporate partners Mike Turner and Shing Lo, with associates Katie Kaplucha and Sam Peacock.

Did you know one of Modulr’s most popular platform features is card issuing?

So much so, we’ve decided to celebrate cards with our first ever Cards Week.

Join us from Monday 29.11 – Friday 03.12 for five succinct sessions over five days where you’ll have the opportunity to hear the latest innovations in card issuing from industry innovators at Visa, TagNitecrest and Zumo.

Register here: https://bit.ly/3GP4wen

PXP Financial Inc has announced a partnership with leading provider of integrated payment processing and technology solutions Shift4, as PXP expands its capabilities in the US market.

While some may say m-commerce has simply piggybacked on the overall e-commerce “boom”, this really isn’t the case: m-commerce has actually overtaken desktops, the traditional king of e-commerce, to become the reigning form of online payments. Yet a mobile-first world has some implications for issuers when it comes to payments – let’s dig in.

E-commerce growth is predicted to reach the pre-pandemic level by the end of this year. However, Fast-Growing and Emerging regions remain excluded from access to global e-commerce due to prevailing constraints on cross-border shopping.

Fintech and trusted payment service provider Paynetics is hosting its third roundtable on the future of fintech, held virtually via Zoom on the 8th December, from 12-1:30PM (GMT).

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.