Ozone API, Open Future World, and UK Finance are delighted to announce the winners of the world’s first variable recurring payments hackathon. The six week event, sponsored by Accenture, Mastercard, Volt and Worldpay from FIS, was an opportunity for developers, banks, payment initiation service providers and tech platforms to demonstrate potential use cases and propositions that open banking VRPs can deliver.

Over 100 participants registered for the Hackathon and developed some great entries for the five categories of challenge: Sweeping, Subscriptions, Retail, B2B payments and Other.

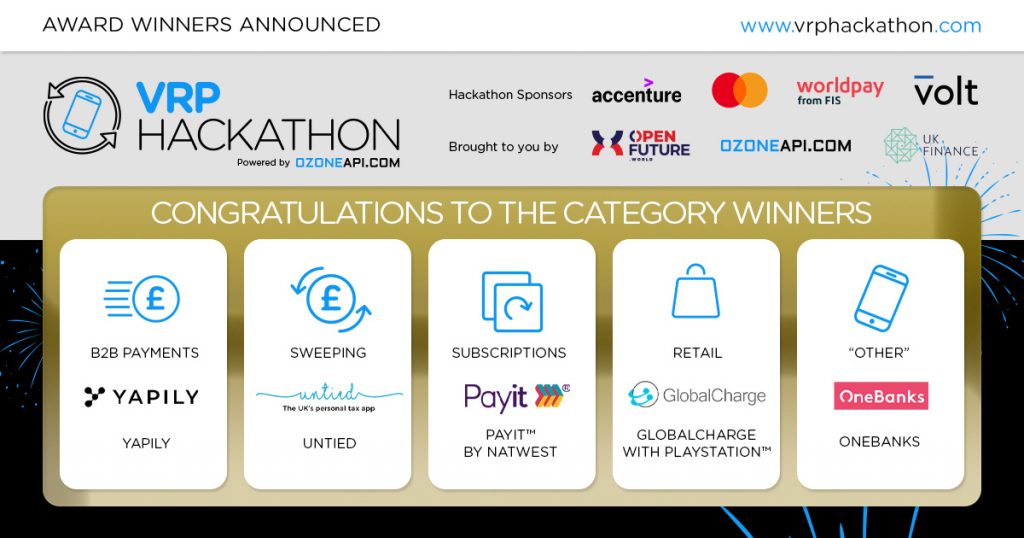

The winners for each category are:

Sweeping: Untied. Already a pioneer of account-to-account (A2A) tax payments from their personal tax app, Untied’s concept focussed on helping customers save for tax payments using their existing calculator combined with VRP, to sweep payments and ensure they are in a position to make the payment.

Subscriptions: Payit™ by NatWest. Their submission showed how VRPs could be used to prevent vulnerable gamers overspending on in-game purchases, with an added feature of allowing a parent to pre-authorise limited expenditure for a child.

Retail: GlobalCharge with PlayStation™ who presented VRP as an open banking alternative to ‘card on file’ payments – a good example of adding to open banking payments functionality to make it a more viable alternative to cards.

B2B payments: Yapily with a strong use case to help SMEs collect payments faster.

‘Other’: OneBanks who plan to introduce cardless cash withdrawals in their kiosks. The idea combines the trend of digitalisation, the ‘phone as wallet’ and the wastefulness of plastic cards with the reality of continuing demand for cash and its role in financial inclusion.

The full judging panel at the event consisted of Accenture’s Amit Mallick, FDATA Global’s Ghela Boskovich, Innovate Finance’s Janine Hirt, Mastercard’s Jim Wadsworth, NatWest Group’s Stephen Wright, Open Future World’s Nick Cabrera, Ozone API’s Chris Michael, UK Finance’s Jana Mackintosh, Volt’s Steffen Vollert and Worldpay’s Charles Damen.

Quotes

Jana Mackintosh, Managing Director, Payments and Innovation, UK Finance: “Open banking has an exciting future and the winners of the Hackathon show exactly why. Thanks to the creativity and innovation of the entrants, we have been shown how open banking can benefit everyone from businesses to gamers, and solve customer problems from accessing cash, paying tax and collecting payments on time. As the work around open banking continues, UK Finance will continue to provide our support and we look forward to seeing more use cases come to light showing how it can improve our everyday life.”

Huw Davies, Chief Commercial Officer, Ozone: “Open banking payments have really started to scale in 2021, but there is potential for so many more use cases to be unlocked and variable recurring payments will be a major catalyst.

We’ve talked about it for a long time in the industry, but there’s nothing like real examples to bring the conversation to life, and that was the objective of the VRP hackathon. It’s been amazing to see the level of engagement and the winning propositions really show the art of the possible!”

With variable recurring payments, consumers can authorise a third party to make payments from their bank account on a continuing basis. VRPs are widely expected to bring added impetus to the trend towards open banking payments. The Competition & Markets Authority (CMA) is introducing a requirement for the UK’s largest banks to enable VRPs.

For more information, visit vrphackathon.com

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.