W2 And Vizolution Announce Strategic Partnership

Vizolution and W2 have announced they have formed a strategic partnership to integrate W2’s range of customer due diligence solutions into Vizolution’s customer experience technology suite.

Vizolution and W2 have announced they have formed a strategic partnership to integrate W2’s range of customer due diligence solutions into Vizolution’s customer experience technology suite.

Even though it is hard to put a figure on the potential scale of virtual currency misuse, given the size of the market, it is no real surprise over the concern that unregulated systems could offer the anonymity needed for criminals to use virtual assets to launder their profits. At that point, regulators were duty bound to step in and the EU’s Fifth Money Laundering Directive (5MLD) now means that virtual currency exchanges and custodian wallet providers are subject to the same regulatory requirements as other financial services covered by the preceding 4th directive.

Three in four shoppers (76%) admit local high streets need support while four in five (80%) are shopping with local small businesses as much or more frequently since lockdown lifted, both in person and online

Despite this support, the next three months are crucial to the survival of two fifths (42%) of small businesses

Visa has partnered with grassroots initiative Totally Locally to sponsor Fiver Fest from 10th – 24th October and together they are calling on consumers to divert £5 of their weekly spend to support local businesses in store or online

Small businesses undoubtedly play a significant role in communities across Ireland but they have also been some of the hardest hit by the negative impact of Covid-19. Insights from the “Visa Back to Business” study have revealed that almost 1 in 5 Irish small to medium enterprises (SMEs) believe that their future viability is at risk due to the commercial impact of COVID-19. Despite these concerns, the study also revealed that consumers across Ireland do really value independent businesses in their community with 63%1 of consumers admitting to wanting to support small businesses.

RegTech specialists launch Kompli-Outsource™ to help regulated entities complete comprehensive customer onboarding

No Badge? No Problem.

Join us at our 3D stand for a virtually replicated tradeshow experience with swag, info and more – but from the comfort of your own seat.

26.10.20 – 29.10.20.

Coming soon: We’re arranging a star-studded line up of industry greats, we’re concocting carefully crafted content and we’re sourcing superb swag.

For one afternoon only, receive a generous dose of high value payments entertainment. For CTOs, COOs, CFOs, Product Managers. If you like payments, this is what you should be doing on an early December afternoon.

No decks. No awful webinar platforms. Just pure payments discussion. The theme this year: Where’s the hidden cost in payments?

Eversheds Sutherland’s banking and finance team has appointed Ian Tetsill as Head of Debt Finance Strategy.

ISO 20022 is the globally accepted format that improves the quality and structure of financial messages, provides rich data with each transaction, enabling everything from enhanced analytics to status tracking, sanction checking and automated invoice reconciliation – all whilst delivering an improved experience for end customers.

However, many banks and financial institutions have underestimated the complexity of the necessary changes of the migration as the transition isn’t just a simple upgrade of process. Existing infrastructure and legacy systems are not sophisticated enough to deal with the speed of integration and transition required.

Read this article to find out more

In this blog we discuss how Indirect Agency represents a real opportunity for previously excluded financial institutions. By offering real-time payments without compromising on speed, spend, performance and resources, it builds their customer base and challenges traditional players in the market. Making real-time payments accessible to everyone increases competition. It allows smaller banks and companies to enjoy the 24×7 faster payment rails for account-to-account payments. This access is made possible by using API Connectivity, which enables all users to send and receive money instantly through any digital channel.

Fraudsters have the upper hand

How to break the cycle

An innovative lending solution from financial infrastructure provider, Banking Circle, has been named as a finalist in the 2020 Credit Awards category for Best Use of Technology – SME Lender.

Two technology leaders join forces: Giesecke+Devrient invests in Netcetera

Join a webinar of The Payments Association EU on the recent EU initiatives in Digital Finance

The COVID-19 pandemic has had a profound impact on all areas of society. The virulent nature of the disease has led to many changes in our daily lives and the payments industry has not been immune to the need for transformation.

Payments AssociationM’s latest Consumer Banking research uncovered five audience segments based on key behaviour patterns and summarises the motivations, attitudes, needs and expectations for each segmen.t These research insights will help the banking industry better understand the evolving needs of their customers and how to better serve them.

Financial technology (fintech) has been visibly evolving in front of our eyes ever since banks went online. With an increasingly cashless society, apps and platforms have been created to help us better understand and manage our finances, while new banks have been created that offer us a slicker experience.

SHARE

TWEET

POST

COPY

Have you ever wondered what makes a bank a 21st century bank? A small hint; it isn’t the ginormous rigid and extremely expensive mainframes, it isn’t the systems that have to shut down every night for maintenance, and it definitely isn’t the glued-by-hope hollowed out cores.

The list can go on and on. What a good 21st century bank needs is security, scalability, flexibility, availability, and adaptability. So, where do you get it all, nicely packed and with a bow on top at a low cost?

At Cybertonica we Trust in Transaction. We make systems to make trust and frictionless commerce safe and secure for businesses and consumers. We know that outdated rules and operations occasionally introduce almost Kafka-like situations and thought it would help us to see the end customer and merchant point of view.

So we decided to collect stories from the people in our network and customers as well as their clients telling us how their e-commerce is going in this period – both the nightmares and the nice surprises.

We asked them to tell us about their online shopping experiences during the lockdown to paint a vivid picture for the merchants. From surprise champagne deliveries to account takeovers, we have some good stories lined up for you!

Today, PPS is announcing its partnership with France-based payment expert and card provider for teenagers, Vybe.

Due to the systems in place across France when it comes to banking and owning your own account, around five million teenagers (between 13 to 18 years old) have been left with no access to financial services.

This is a problem that Vybe aims to solve and is working with PPS to make it happen, thanks to the company’s well-tested technology infrastructure and PPS-powered Mastercard virtual cards.

Press release regarding Ordo Accounts package integration & Codat

It is expected that the volume of #InternationalPayments will grow in the upcoming years. However, those #FinancialInstitutions that do not adapt to the changes in the current landscape may miss this opportunity against the big players. How to be prepared? Our Karen Penney, VP of Payment Products, shares her views.

With the financial pressures from COVID-19 still unclear for many, new research commissioned by payments provider, PayPoint, throws the spotlight on small adjustments landlords and lettings agencies could make to help tenants manage their finances during this uncertainty and beyond.

Judopay, a leading mobile-first payments provider, today announces its partnership with Mastercard, which will further increase Judopay’s network with a direct route to Mastercard’s Payment Gateway Services global acquiring ecosystem.

Entersekt, a leader in device identity and omnichannel authentication, has announced a strategic partnership with ndgit, a Munich-headquartered open banking platform provider. The agreement makes Entersekt’s state-of-the-art strong customer authentication and smart messaging solutions available on the ndgit Marketplace, where financial services providers can access a carefully curated set of fintech products in a secure hosting environment.

IDEMIA launches its Global Fintech Accelerator Card Program to support FinTechs and neobanks in their card issuance process.

Entersekt, a leader in device identity and omnichannel authentication, today announced a partnership with NuData Security, a Mastercard company. This agreement allows the fintech to tightly integrate NuData’s behavioral analytics solution NuDetect with the Entersekt Secure Platform.

For Good Causes clients are taking the fight back to COVID-19, with an alternative approach to celebrating Christmas 2020.

Steve Wilks describes a campaign that means companies can feel good about Christmas, and feel good about helping others feel better about it too.

I am delighted to be joined by Mikko Ohtamaa (tech freelancer), Steven Borg (VP of Finance at Gnosis) and George McDonaugh (KR1) for a discussion about DeFi on Thursday 1 October 2020 at

xpate CEO Mike Shafro has been appointed Ecommerce Advisor to help shape future of Industra Bank

British fintech Currensea is today launching a first-of-its-kind open banking debit card for small businesses, enabling them to make international transactions through their existing bank account without any of the charges and with low fees competitive with the leading challenger banks.

Following a record number of applications, Banking Circle has been awarded two prestigious awards in the 2020 Juniper Research Future Digital Awards. The innovative financial infrastructure provider was awarded the Lending Platform Platinum Award for Banking Circle Lending, and a Gold Award for Banking Platform Innovation.

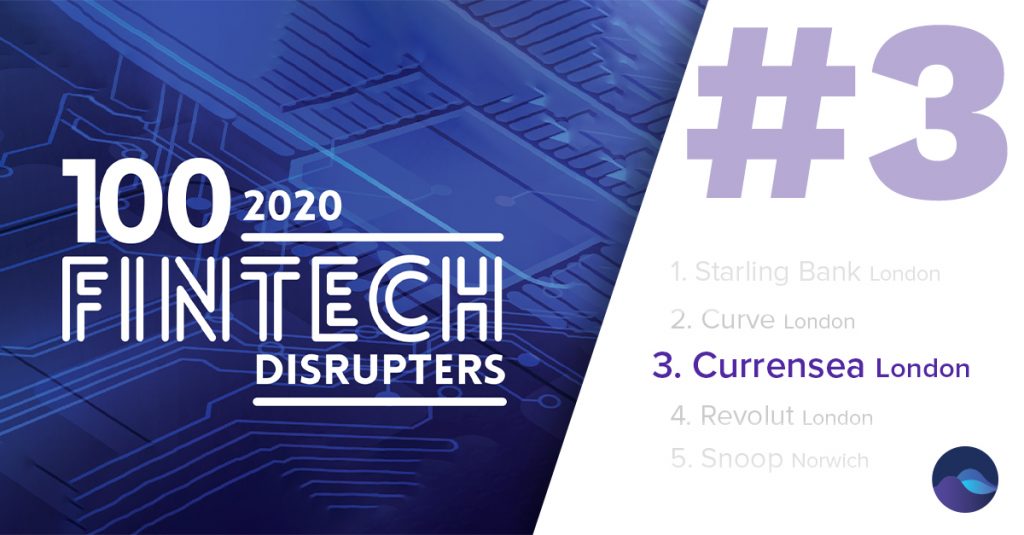

We’re delighted to announce that Currensea been placed 3rd among 100 UK companies in BusinessCloud’s 100 FinTech Disrupters list for 2020.

Michal Smida, the founder and CEO of Twisto was a guest on our podcast series Inside the Vacuum and had an exciting conversation with Marcel Klimo around building the next generation of financial services.

Sometimes a fintech company needs to build a new critical feature under time pressure, which can become a very stressful moment for the CTO and Head of Delivery. Thanks to their current development velocity and estimation of the work, they know there is no physical way to build that feature with the capacity they have available. Maybe if they push their developers to the brink of exhaustion, they might be able to do this. This shouldn’t be the way to achieve goals, but rather only to deal with emergencies.

Future-proof your bank with cloud-native tech

How Thought Machine is helping established banks to transform their core platforms

Why deploying your bank to the cloud is very different from using a cloud-native core banking engine

Explore the digital payment market and trending super apps in Southeast Asia with Brano Vargic from Home Credit Vietnam

Financial technology (fintech) has been visibly evolving in front of our eyes ever since banks went online. With an increasingly cashless society, apps and platforms have been created to help us better understand and manage our finances, while new banks have been created that offer us a slicker experience.

How an Australian fintech love brand was born

Payment security taken to a new level

A peek into Indian fintech market and effective solution for accepting payments.

This is the time that will define the thinkers, movers, and shakers who will shape the rest of this century.

Is the European Union going to be the first major global economy to embrace the digital economy advancements, all the benefits it brings forward, and all the digital banking solutions that are coming along the evolution of tech services? What will the EU Single Digital Market bring up on the business horizon?

The transition to an almost purely digital economy is speeding up with every passing year and that is in part due to the leaps and advances in technology that are changing the way we live and conduct business.

The Payments Association EU releases its seminal whitepaper on the European Payments Landscape, it offers a general overview of the current European Payment dynamics and evolutions.

Moreover, the whitepaper provides comparison elements between the different parts of the European Union while putting the European situation in perspective with other continents.

Certainly, the Payments Association EU whitepaper is an essential reading for anyone eager to have a general glimpse over the payment landscape in Europe as well as for payment professional requiring in depth information’s over specific areas.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.