Consumer protections: how do open banking payments compare?

In this blog post Jack Wilson, Head of Policy & Regulatory affairs at TrueLayer, examines the security and protections provided by open banking when buying online.

In this blog post Jack Wilson, Head of Policy & Regulatory affairs at TrueLayer, examines the security and protections provided by open banking when buying online.

A major study reveals how banks and building societies are responding to the post-pandemic world.

A world where digital commerce has become the default and customers expect their services, including payment processing, to be real-time and traceable 24/7.

Multi-award-winning issuer processor Global Processing Services, behind digital banking giants Revolut and Starling Bank, ends the 2020 awards season on a high, winning Best Processing Programme at the Card and Payments Awards against Marqeta and PPS

With more and more fintech start-ups cropping up with shiny new card programmes, it’d be all too easy to assume launching one yourself would be counterproductive. But owning a card programme comes with a whole host of benefits, regardless of the competition, and it’s never been easier to launch one. Discover the benefits of starting a card programme for your customers in Moorwand’s payment guide.

Thames Technology is delighted to launch its new ELEMETAL range of high-quality metal payment cards, offering the ultimate in style and sophistication for premium banking customers.

With regulators increasing their focus on compliance, pressure on financial institutions of all sizes to have compliant open APIs is growing. To help simplify the delivery of high-performing APIs, Ozone has launched the Open Finance Hub.

The Bank of England and the UK Treasury have announced a Central Bank Digital Currency (CBDC) Taskforce to coordinate the exploration of a potential British CBDC. But how could a digital Pound actually work? As it happens, this is something that Consult Hyperion knows rather a lot about. Apart from our work on the first British central bank digital currency (Mondex) back in the 1990s, our work on the first population-scale mobile money scheme (M-PESA) in the 2000s and our work on the most transformational contactless payment roll-out (Transport for London) in the 2010s, our practical experience across implementation platforms means that we understand the architectural options better than anyone.

In this training session, featuring fscom Director of Financial Crime Philip Creed and Chainalysis Account Executive Jed Sibley, you will learn more about the latest in cryptocurrency regulation in the UK and Ireland, as well as getting a first-hand insight into some of the recent high profile cryptocurrency-related fincrime cases.

Trust Payments announced it has entered the Nordic market via two initial strategic partnerships. The company has partnered with Global Sales Partner (GSP) to deploy omnichannel solutions into the market, as well as with POS ONE, a leading cloud-based, hardware agnostic integration solution for merchants needing multiple channels to market.

Sokin becomes the Official Payments Partner of Everton Football Club, scoring a multi year deal.

Curve launches new crowdfunding round to enable its 2m+ customers to be part of the super app’s exciting growth journey. Potential investors can now pre-register to receive early access to the campaign ahead of its public launch. New crowdfund follows Curve’s successful £72.5m Series C fundraise. Funds will be used to support product innovation and Curve’s expansion into the US and deeper into Europe

EML is honoured to be part of a new framework now available to quickly and efficiently set up voucher schemes to support citizens in the United Kingdom.

Vista Bank Group in West Africa has chosen Radar Payments for its processing activities and to drive digital payment adoption in the region. The solution will include SmartVista’s card issuance and lifecycle management, payment switching, ATM and point-of-sales management as well as providing digital channels such as mobile banking and e-wallet; personalised to both retail and corporate clients.

The Wirecard scandal 2020 shook the Fintech community and created a lot of questions for the industry regulators in Germany – thousands of people lost their jobs and client operations all over the world were disrupted.

But as we all know, in the middle of difficulty there is always lies opportunity. So we decided to act – this is a blog article that tells a story of how Gain The Lead came to be.

Tink and American Express are partnering to improve the onboarding process for prospective card members in Europe, by using open banking technology to instantly verify identity, income and account information.

In this blog, fscom’s Dipesh Patel discusses the Temporary Permissions Regime (TPR) for EEA firms, the communication of timeframes from the FCA and the proposed changes to the approach document in CP21/3.

In this blog, Blue Train Marketing delve into the transformation of video marketing, its increase in popularity and the pandemics impact. They reveal some tips and tricks on how to improve your video content whilst restrictions are still in place.

fscom’s Greg James looks at the proposed changes to strong customer authentication (SCA); one of the most contentious regulatory developments introduced by the second Payment Services Directive (PSD2). Greg breaks down the changes into those that will generate the most conversation and those that are simply explicit confirmations in existing guidance.

Ordo now partnering with Payment Service Providers to transform #paymentsprocess with end-to-end, Open Banking Solutions that deliver the perfect alternative to card schemes, including eCommerce and QR code Point of Sale solutions.

Trust Payments is proud to announce its recognition as one of the “Best Companies to Work For” in several categories in the UK.

The payments group has received several employee-recognition awards, including one of the top 30 Financial Services firms to work for in the UK, as well as regional awards in London and Wales. It also received a 1 Star rating signifying ‘very good’ levels of workplace engagement.

Join us in this insightful webinar, with a range of experts in the mobile payments, cards and risk space, to learn how payments are changing, and how mobile applications can help strengthen authentication and improve your customer experience – all at the same time.

Banking Circle, the payments specialist, has reported a significant uplift in payments flow and clients a year after it launched its Banking Licence.

EML expands its connection with Fupay beyond Australia into a true growth collaboration.

Join VIXIO’s upcoming webinar on May 20 with guest speakers from Gemini, Mackrell.Solicitors and the European Parliament to discuss how payments firms can balance innovation with crypto regulation.

A KPMG Private Enterprise report on Venture Capital investment in UK scaleup businesses in the first three months of 2021

https://home.kpmg/uk/en/home/insights/2021/04/investment-in-uk-innovators-soars-to-record-level-in-first-quarter-of-2021.html

Trust Payments announced it has expanded into Ireland. The payments technology group will open an office in Dublin city centre as it seeks to benefit from local talent and rapid growth in the country’s FinTech sector.

The new PXP research report ‘The COVID-19 Effect on European E-Commerce and Retail’,

explores UK and European consumer attitudes to the future of retail shopping.

Open banking platform Tink partners with payments technology provider Tribe for open banking payment initiation and account check services.

Blog post below –

https://tink.com/tink-tribe-payments-partnership/?utm_content=165197139&utm_medium=social&utm_source=linkedin&hss_channel=lcp-2735919

Thames Technology is delighted to announce its partnership with ekko, the latest member of Mastercard’s Priceless Planet Coalition, as it becomes the first fintech globally to use Thames Technology’s recycled plastic debit cards.

Sokin Enterprise has addressed the issue of traditional payments burdening users with high and hidden fees by creating a seamless cross-boarder payments ecosystem. Focused on facilitating speedy transfers and transparent fees for both consumers and businesses.

Three key things the UK can do to continue leading the way on fintech – innovation, inclusion and partnerships. Article by Jill Docherty, Head of Business Development, UK&I, Visa.

EML and Frollo have made financial history with the announcement of the EML Nuapay product suite.

On April 19th, the Bank of England published a policy for the use of omnibus accounts with the central bank’s real-time gross settlement (RTGS) system. The announcement has been greeted with enthusiasm by providers of virtual currency and blockchain-based payments, which see the new system as clearing a path towards direct participation in central bank settlement.

:Marcus Hughes, director of business development at Bottomline Technologies, told VIXIO that the policy brought a “tremendous clarity which wasn’t there before, and I think this will become a blueprint for other central banks”.

Confirmation of Payee, a new overlay service mandated by the UK’s payments regulator, adds an extra layer of security to ensure payments are sent to intended recipients. CoP now rolls out beyond the UK’s six largest institutions. LHV and The Access Bank UK are early adopters through Bottomline.

Today, PPS, a banking and payment provider, announces that they will be powering a new B2B banking service for SMEs in Finland with accounting company Talenom. The brand new partnership will enable financial services to be integrated into Talenom’s emerging SME solution ‘Accounting Alex’ to modernise banking for SMEs in Finland.

Compliance, requirements, deadlines, oh my! By now you should have a comprehensive overview of what to be aware of as PSP. As such, it is time to wrap up the topic of SCA compliance. In this article, we cover how Okay uses security evaluations to fine-tune our product as well as how we can help you meet SCA PSD2 RTS compliance standards.

Compliance. A scary term for any payment service provider (PSP) in a world of increasingly stricter regulations and requirements. To make it a little less scary, we are opening the PSD2 RTS Compliance door to extract some key points of interest. Read on for the fundamental requirements PSPs should be aware of if issuing cards or e-money payments and why said requirements are necessary.

Join our upcoming webinar on May 11 to hear how fintech partnerships are driving innovation in payments in 2021.

Ambitious Danish fintech Blocser and top UK card manufacturer allpay.cards are ready to let ‘Butterfly’ take flight.

allpay.cards are providing their unique end-to-end card manufacturing solution to Blocser who are launching an app, with a payment card, to support the ever-growing number of UK gig economy workers.

In the wake of the financial crisis of 2008, financial institutions increasingly turned to ‘de-risking’ – exiting relationships and limiting interaction with clients deemed high-risk – as a way to reduce their exposure. Join industry leaders Mitch Trehan, Banking Circle’s Head of Compliance and MLRO, and Philip Doyle, Group Director, Financial Crime, Revolut as they take a deeper dive into the topic. They will explore some key questions:

– How has de-risking impacted the industry?

– Why are institutions de-risking, rather than managing existing risk?

– Has de-risking by traditional banks created a vacuum for new players to fill?

– How is the regulatory landscape shifting?

– What’s next for the payments industry?

Fintech is a market that is in many ways defined by specialism. The first fintech disrupters took aim at specific services and through technology reduced costs, improved the experience, and boosted accessibility. In this article, Moorwand CCO Luc Gueriane speaks to Financial IT about why fintech specialists need fintech specialists to succeed and scale.

Launching a payments business in Europe requires every founder to understand their market. That means doing customer research, scoping out competitors, and – perhaps the trickiest of them all – navigating the regulatory environment. In this payment guide, Moorwand breaks down three of the key regulations you need to know about when thinking about launching a business in Europe.

Get to grips on the road ahead with Level 2 of the EU Sustainable Finance Disclosure Regulation (SFDR), coming into effect for financial market participants and financial advisors from January 1, 2022.

On Thursday 29 April at 1.30pm BST / 2.30pm CEST join Eversheds Sutherland’s international panel as they discuss the future for blockchain, crypto-assets and smart contracts in financial services, including: crypto-asset regulatory regimes and how they differ; custody, security, smart contracts and tokenization innovations; and how the technology is shaping change in process applications and efficiency savings.

Stay up to date on the latest developments in the payments industry from the UK, Europe and beyond, with Eversheds Sutherland’s quarterly bulletin, Payment Matters.

In the latest edition, they discuss: significant developments in the UK’s plans for Open Banking and Open Finance; continued focus on the effectiveness of the revised payment services directive (PSD2); the Contingent Reimbursement Model (CRM); newly introduced for payment initiation service provider (PISP) payments, and the recent review published by the Lending Standards Board (LSB); and the success of Instant Payments in the Netherlands, and the drive for eurozone coverage, backed by the European Central Bank.

ekko partners with Paynetics UK to power fintech arm of new app that is turning the tide on climate change

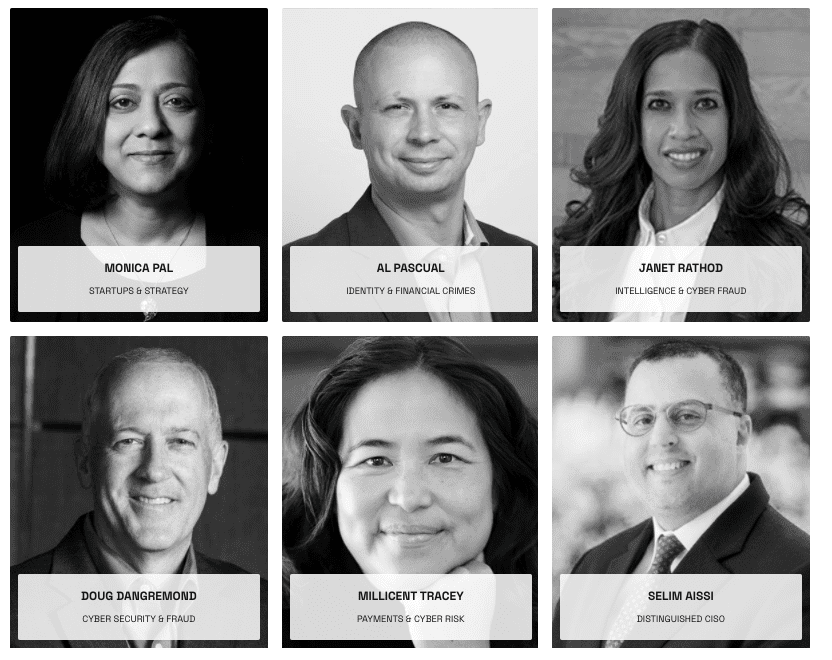

Revelock, the pioneer in behavioural biometric-based online fraud prevention (formerly buguroo) has announced the formation of its Advisory Board.

Six prominent industry experts – Monica Pal, Selim Aissi, Janet Rathod, Doug Dangremond, Millicent Tracey and Al Pascual – come together to bolster the company’s ability to proactively protect banks, fintechs and their own customers from ever-evolving fraud.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.