Revelock Forms New Advisory Board to Advance Fight Against Online Bank Fraud

Brings together prominent industry experts in digital identities, threat intelligence, fraud and financial crime prevention

21 April 2021 – Revelock, the pioneer in behavioural biometric-based online fraud prevention formerly known as buguroo, today announced the formation of the Revelock Advisory Board, as part of its ongoing mission to reverse the rising tide of online bank fraud.

Comprising some of the industry’s most respected experts in digital identities, threat intelligence, payments technology, fraud and financial crime prevention, the new Advisory Board brings invaluable external perspective to Revelock, gained both in the technology industry and at world-renowned financial institutions. The newly-formed Board bolsters Revelock’s ability to proactively protect banks, fintechs and their own customers from the growing volume of ever-more sophisticated online fraud attempts.

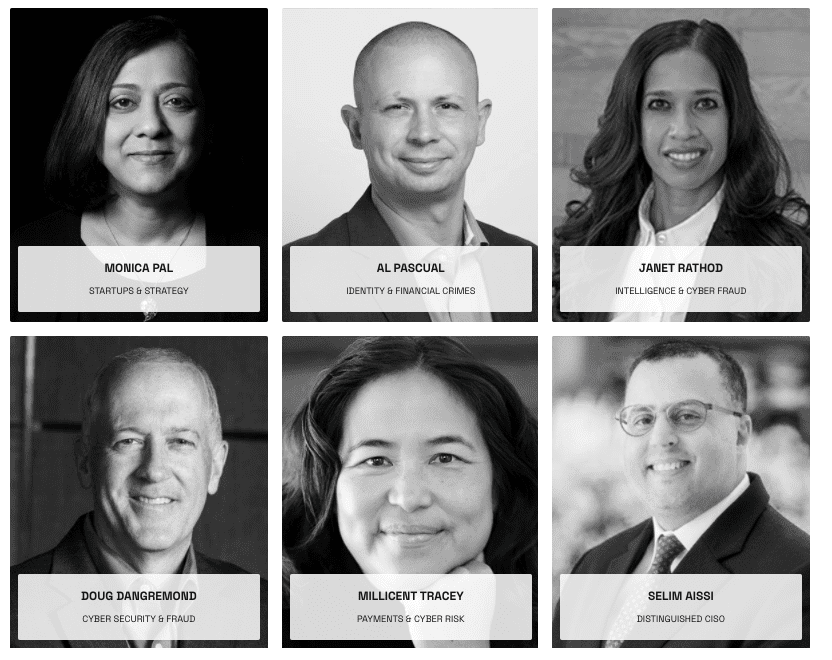

Joining the Revelock Advisory Board as founding members are:

Monica Pal: Pal is a serial entrepreneur and has held co-founder, CEO and CMO roles at cyber intelligence, cyber security, big data and enterprise software start-ups in Silicon Valley. After a decade in Apple R&D, she was instrumental in growing scale-ups such as 4iQ, Aerospike, Alienvault (acquired by AT&T) and enCommerce (acquired by Entrust). Pal is an active diversity and inclusion campaigner, serving on the executive board of How Women Lead and fund advisor to Limited Partner in How Women Invest. She takes the position of Revelock Advisory Board Chair.

Selim Aissi: Dr. Aissi is a renowned security expert, a Founding Board Member of the National Technology Security Coalition (NTSC), on the Advisory Board for VC firms and technology companies, and was named CISO of Year in 2019. He holds over 100 patents and was co-author of the book Security for Mobile Networks and Platforms. He has been the SVP and CISO of Ellie Mae for the past 6 years, where he runs its overall information security programme, including operations, engineering, GRC, third-party-risk, and business continuity. Prior to this, Selim was VP of Global Information Security at Visa, where he transformed Visa’s information security practice into becoming the market standard and was responsible for leading company-wide initiatives, including the overall security of Visa Checkout, Apple Pay, and Visa’s Data Protection Programme. He has also held senior positions at Intel Corporation, General Dynamics, General Motors, and Applied Dynamics International.

Janet Rathod: Rathod is a cybersecurity leader in the US financial industry, with experience in perimeter defence, cyber fraud, anti-money laundering, log management and intelligence analysis. She previously spent 16 years in the FBI, and was a member of the Senior Executive Service. While at the FBI, she governed the intelligence programmes for 56 Field Offices. She also oversaw cyber and counterintelligence analysts at the Washington Field Office.

Doug Dangremond: Dangremond brings over 30 years of experience in the technology industry successfully leading diverse teams from sales, marketing and operations within both the public and private sector. He currently serves as Chief Revenue Officer for Constella Intelligence, formerly 4iQ and, prior to that, was SVP of Threat Intelligence for LookingGlass Inc. He has also been President of Cyveillance and has held leadership positions for both F500 companies and startups, including AT&T, Unicom, Neustar, Command Information and Anixter International.

Millicent Tracey: Tracey is a financial services product management executive with 20 years’ experience assisting public fintech companies and startups develop B2B payments strategies. From leading strategic growth initiatives, advising on digital payments transformation and delivering innovative technology solutions, Tracey specialises in understanding financial fraud risks and developing risk mitigation strategies. She also brings invaluable governance experience through her advisory work with corporate and nonprofit boards, including audit and finance committees.

Al Pascual: Pascual is a prominent expert in digital identities, authentication and fraud. Co-founder of Breach Clarity, the data breach intelligence provider acquired by Sontiq, he has also served as Head of Fraud & Security for Javelin Strategy & Research. Pascual has extensive frontline experience of fighting fraudsters, gained during tenures at FIS, Goldman Sachs and HSBC.

“I’m immensely excited to welcome the six founding members to the Revelock Advisory Board,” said Pablo de la Riva, CEO & Founder, Revelock. “Together, they have a wealth of knowledge and experience gathered at leading financial institutions, as well as at some of the most dynamic and innovative companies in the cybersecurity space. Their complementary backgrounds and diverse outlooks will play an instrumental role in furthering our mission to proactively stamp out bank fraud.”

Revelock is advancing the fight against fraud by leveraging behavioural biometrics and hybrid AI. Its newly launched Revelock Fraud Detection Response (FDR) platform, enables banks and other financial services providers to create and continuously verify a BionicID™ digital fingerprint for each and every customer. This granular ability to “Know Your User”, together with Revelock’s unique capabilities to automatically detect and respond to fraud attempts, provides category-defining fraud protection without impacting the customer experience.

About Revelock:

Revelock enables financial services and fintech companies to reveal and respond to online identity impersonation & manipulation attacks without hindering the customer experience. Protecting more than 50 million banking customers worldwide, the Revelock Fraud Detection & Response (FDR) Platform combines behavioural biometrics, network and device assessment with hybrid AI and Deep Learning to create a BionicID™ and continuously Know Your User (KYU), spot bad actors and mitigate risk regardless of the type of attack.

From new account creation and from login to logout, across every interaction, Revelock non-intrusively detects behavioural and environmental anomalies while protecting customers from RATs, zero-day malware, bots and social engineering attacks. Revelock Active Defense capabilities give Fraud Fusion Centre analysts full control over automated risk mitigation and Revelock Pre-emptive Defense enables analysts to use Revelock Hunter to discover and disrupt mule networks and previously undetected compromised accounts.

Revelock Solutions prevent Account Takeover (ATO) and provide continuous behavioural biometric risk assessment and silent stepped-up authentication (MFA) to prevent New Account Fraud (NAF), Card Not Present Fraud (CNP / 3D Secure) and comply with PSD2/SCA.

For more information visit www.revelock.com

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.