Committee scrutiny: Navigating the UK’s cash transition

As cash use declines, UK regulators push for inclusive payment systems to protect vulnerable groups and ensure access across all demographics.

As cash use declines, UK regulators push for inclusive payment systems to protect vulnerable groups and ensure access across all demographics.

Industry leaders discuss the evolving innovations and challenges shaping the future of payments.

Firms throughout the payments world have set net zero targets and put decarbonisation at the centre of new sustainability strategies. But what is actually being done?

Central bank digital currencies (CBDCs) are exciting many in the digital assets world, but what can these mean for those who are less engaged and on the fringes of financial services altogether?

The “Redefining Community Finance: Unlocking Pathways to Financial Inclusion” whitepaper by the Payment Association provided crucial insights and recommendations emphasising the need for enhanced innovation and support for the community

The financial struggles of UK adults highlight the vital role and challenges of community finance institutions in promoting financial inclusion.

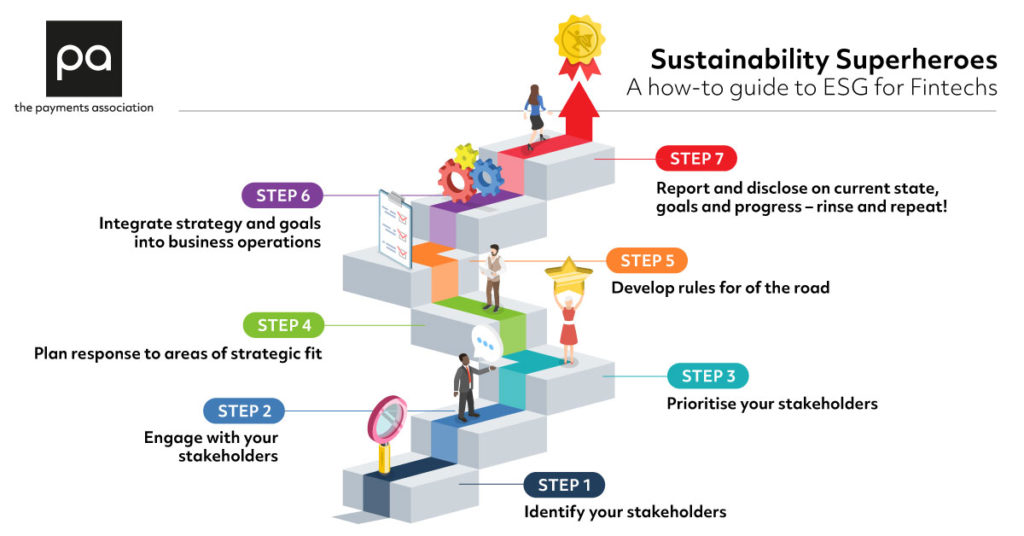

Discover how The Payments Association’s ESG Working Group is addressing the challenges and solutions for effective environmental, social, and governance initiatives within the payments industry.

In a speech in April 2024, Simon Stiell, Executive Secretary of the United Nations Framework said the next two years are “essential in saving our planet”. Steill laid out a

At PAY360, video interviews with industry leaders highlighted the evolution of payment technologies, ESG integration, and digital accessibility.

Exploring how the payments industry can innovate to mitigate the UK’s cost of living crisis, this article highlights fintech’s role in aiding the newly underserved towards financial resilience and inclusivity

The year 2023 was significant for ESG in finance. As COP 28 brought the year to a close, The Payment Association’s ESG Working Group look ahead to key themes likely to dominate the payments ESG agenda in 2024.

Christien Ackroyd explains how the ethical grade concept works, covering best practices, benefits, and which banks are getting it right.

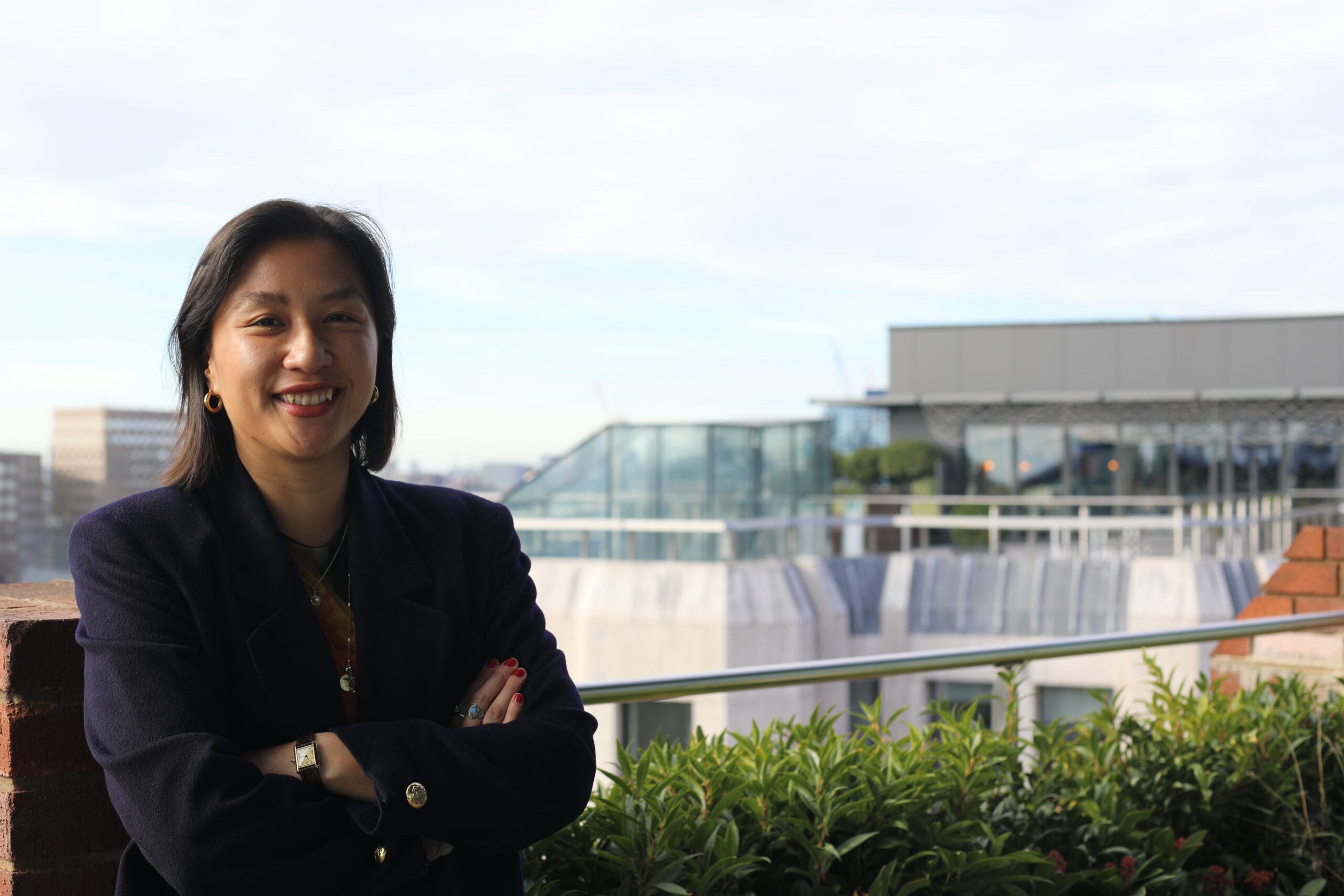

Born in New Zealand, trained lawyer Cheyenne Datuin speaks to Payments Review about how she got into the payments industry and why London is an attractive city for working in fintech.

Environmental, social and governance (ESG) values are here to stay, thanks to consumer and investor demand for greater transparency and social responsibility from businesses.

Tyler Pathe speaks to Crown Agents Bank on why the industry should integrate ESG into top-level decision-making and businesses that don’t will find the price is getting higher.

How the sector can empower consumers to choose eco-friendly payment options

Charles Radclyffe explores why technology might not be the universal force for good it has always assumed to be and why the sector should be thinking about technology governance to mitigate and manage potential harms.

As the cost-of-living crisis takes its toll, more vulnerable groups are at risk of not receiving the support and help they need to access financial services.

Financial exclusion in the older population continues to rise and businesses must work together to find solutions that can help this group transition as payments become more digital.

Nikulipe’s Frank Breuss discusses the correlation between a country’s GDP and its accessibility to digital financial services, which suggests fintechs are key to financial inclusion in emerging markets.

As technology continues to advance, fintech companies are becoming more prevalent, highlighting a greater need for diversity and inclusion. Women, in particular, have been underrepresented in fintech, but allpay Limited

The fintech industry is celebrating International Women’s Day in March. This year’s theme is ‘embracing equity’. It’s no secret, however, that the fintech industry has a diversity problem that needs

With consumer spending likely to fall over the next two years, the payments sector must be innovative to grow and serve the most financially vulnerable groups.

Miranda McLean from the European Women in Payments Network (EWPN) examines how the culture has changed for women in the payments, but argues why more needs to be done in what is still a traditionally male-dominated sector.

Be recognised as an industry leader at the most important payments awards – The PAY360 Awards. Nominations are now open for 2023 awards. You have until 17 February to submit your entry.

Project Inclusion, led by Josh Berle of Mastercard, showcased the best fintechs offering sustainable and inclusive payments products in 2022 to energise the industry towards better practices. The team engaged

Payments firms have the potential to unlock transaction data to infer a lot about global ESG impacts and drive real change across environmental, social and governance goals. Carbon accountability is coming and companies need to choose a strategy.

When it comes to supporting customers through the cost of living crisis, it seems the payments sector has faded into the background and innovation has stalled. Project Inclusion intends to turn that around.

The payments industry is in a unique position to develop solutions that can help retailers and customers with the cost of living crisis.

Companies wanting to expand into Africa should look at how neo-bank Kuda and mobile payments platform OPay have successfully penetrated the Nigerian market and overcome regulatory hurdles.

As consumer concerns rise about their finances, essential and non-essential spending, and managing their outgoings, the payments industry can create solutions that include clearer communication, personalisation, and transparency, especially around credit terms.

For decades – centuries even – businesses had one goal: maximise profits for shareholders. Whether these shareholders were a single capitalist or thousands of shareholders, the goal was always to

Fintech charity Pennies has attracted 40 leaders from across payments and technology, retail, and hospitality to help accelerate and strengthen the ubiquity of its pioneering micro-donation movement.

Multi-award-winning issuer processor Global Processing Services, behind Revolut and Starling Bank, selects Victoria House at the heart of London’s Knowledge Quarter to base its brand-new global headquarters.

For e-commerce and contact centre payments, cards have been the only payment option but are costly to businesses and increasingly difficult to use for consumers. Open banking regulation and technologies has created new options for businesses

Award-winning fintech charity, and Payments Association member, Pennies has joined forces with Systopia, (point of sale and payment solutions for the foodservice sector) – to help drive digital “micro-donations” for UK charities, from businesses with on-site hospitality.

Moja Ride, an Ivorian startup providing a reservation and cashless payment system for transport services in Abidjan, today announced it has partnered with O-CITY, powered by BPC for its next phase of digital innovation and future expansion.

Blue Train Marketing’s latest blog piece explores the adoption of green marketing and details 5 green marketing strategies you can take on board to make your business more eco-friendly!

PPS are the payments and banking provider behind Talenom’s new banking service for SMEs. This partnership will enable financial services to be embedded into Talenom’s emerging SME solution ‘Accounting Alex’.

As a result of working with PPS, small businesses that use Talenom’s ‘Accounting Alex’ service will now be able to set up a bank account in minutes and enable savings on fees by more than 50%.

We are really excited to shine the spotlight on some of the best-known brands in #Fintech during our Superhero Spotlight Series.

A week-long event packed with articles, research reports and LinkedIn and YouTube live streamed interviews with over 30 of Fintech’s finest superheroes.

Register for the agenda: https://bit.ly/3ySP2lL and keep an eye out for reminders of the #livestream sessions.

#Payments #Banking #FintechSuperhero

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.