For decades – centuries even – businesses had one goal: maximise profits for shareholders. Whether these shareholders were a single capitalist or thousands of shareholders, the goal was always to grow as large as possible as quickly as possible. Although laws covering anything from child labour to emissions curtailed companies’ ability to be truly amoral, history is filled with examples of companies circumventing those laws.

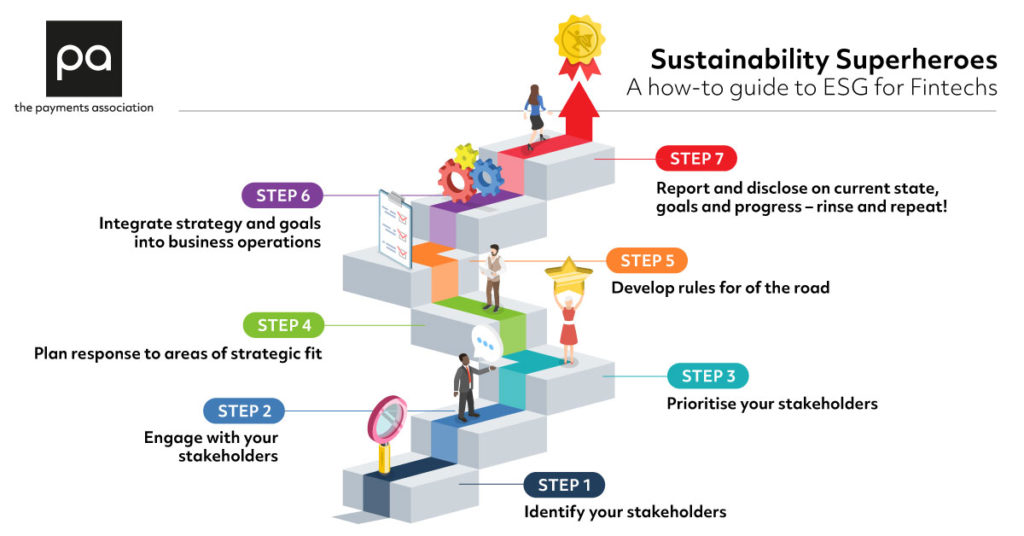

Today the game has changed. Companies are integrating Environmental, Social and Governance (ESG) into their companies at a deep level, often launching the company with a social goal that is just as important as profit. To measure and guide this change, The Payments Association commissioned a whitepaper into the ways that FinTech companies are integrating social and sustainability goals into their long-term planning and day to day operations.

FinTech is an industry with great potential to uplift people and an equally large potential to harm them. Dealing directly with a customer’s finances and data can allow them to revolutionise people’s lives or diminish the finances that they rely on, and their potential to do good or ill doesn’t stop there. As the report outlines, a company can have a wide range of stakeholders, both internal (employees, investors) and external (customers, suppliers, and the community at large.) Each of these might have sub-sets with opposing goals – management might want to maximise productivity by putting in extra hours but lower-level workers will want a better balance of their work and life, for example. Identifying these shareholders is vital to an ESG project, and understanding their needs is the first step to aligning your company in order to reach your goals.

Progress is already being made

To give us a view of the progress being made in the FinTech industry, we asked our members about their current ESG progress in terms of data privacy, social justice, sustainability and governance, although we acknowledge that there is far more to running an ethical company than we could possibly cover in a short survey.

The results were extremely encouraging:

FinTech is of course a very progressive industry in general, and most of its companies tend to be young, in both the age of the founders and the age of the staff, but even with this structural advantage these numbers and the others found in the survey are extremely encouraging. They show that a majority of companies in the sector aren’t just paying lip service to the idea of ethical business but making it a part of their operations at every level.

ESG and ‘stakeholder capitalism’ are clearly moving beyond being buzzwords, and much of the scepticism around them has long since evaporated. We are seeing that in the most progressive parts of the business world ethical principles are as commonplace as health and safety guidelines, but far more transformational when applied by companies who deal directly with the finances of millions of people around the world.

In business, the innovations in the most progressive businesses, ranging from open plan offices to four-day work weeks, tend to trickle down into the rest of the economy. ESG is likely to be the same, and FinTech is an industry that is ideally placed to lead that transformation. The companies working in the sector are extremely diverse and young, but each one has the potential to become the next Klarna or Revolut, and from there influence thousands of other companies. It is an exciting time to be part of the FinTech community as it continues to become a force for good in the world.

To download a copy of the ‘Sustainability Superheroes: a how-to guide to ESG for FinTechs’, please visit: https://bit.ly/3aMVS4o

And to download the on demand webinar “Linking profit and purpose – embedding sustainability in the payments ecosystem”, please visit: https://thepaymentsassociation.org/webinar/linking-profit-and-purpose-embedding-sustainability-in-the-payments-ecosystem/

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.