Welcome to the ‘I told you so’ years

A recent Financial Times Focus report revealed how banks may be on the brink of extinction. Technology, customer focus and a real social purpose can still save them.

A recent Financial Times Focus report revealed how banks may be on the brink of extinction. Technology, customer focus and a real social purpose can still save them.

Blue Train Marketing’s latest blog details the necessary steps that you must follow when creating a fintech brand name. From competitor research to your brand’s purpose, you must take it all into consideration.

Exploring the huge rise of Buy Now Pay Later solutions, and what it means for the industry and the consumer.

Exploring the growth of Banking as a Service – and what it means for the industry.

Embedded Finance has become one of the hottest issues in the fintech space. The term was coined by Angela Strange at VC firm Andreessen Horowitz who also asserted that in the future “every company will be a fintech company” because every company will be able to embed financial services. But does that really mean every company will be a fully-fledged fintech company just because they have embedded financial services? Vicki Gladstone, Moorwand CEO, doesn’t think so.

Kani is now integrated with many of the world’s payments data processors – this, combined with its data and processor-agnostic approach, and the fact that Kani can easily and quickly ingest data from the multiple processors, banks and BIN sponsors that payment and fintech companies work with, makes onboarding and working with Kani fast and efficient. Raw data files in different formats can be imported and reconciled in just a few minutes, and parsed into much more understandable reports.

A dynamic landscape and the unprecedented pace of change make for an exciting and demanding marketplace, increasing the need for Capacity, Cost, and Competition. James Hodgson and Tim Tor from NatWest talk with Chris Peck of Bottomline and Teresa Connors of Payment Matters about the effectiveness of partnerships and collaborations and the difference it makes in better-serving customers.

Bottomline, a leading provider of financial technology that makes business payments simple, smart and secure, announced the latest API-based payments tracking service for banks worldwide, integrating SWIFTgpi data. The gpi data is captured on behalf of Bottomline clients and is integrated into their payments workflow, which simplifies and unifies the API access points.

The fintech industry is ultra-competitive and growth-oriented by nature. Even during the height of the pandemic, a time of suppressed economic activity, fintechs not only prevailed but also expanded operations and improved access to financial services across the globe.

As the world continues adapting to the pandemic, sales growth for the financial services industry has even more room to run. Payments, wealth management, asset exchanges — consumers expect these activities to be digital. They have an expanding appetite for new features and product differentiation, spurring even more competition and growth among fintech firms.

Long story short, it’s a good time to be in the fintech space.

But what happens when fintechs, like payment providers, grow too fast?

Your payments infrastructure could be costing you more than you realise. Using multiple providers costs time, costs cash and, more importantly, costs customers. Which is why we’re talking to clients who have moved away from traditional banking and moved towards Fintech-as-a-Platform. We’ll also be joined by Mat Megens, Founder & Chief Executive Officer from HyperJar for a fireside chat on their ‘journey’ to success, powered by Modulr.

The event will cover:

o BaaS vs FaaS: What’s the difference and what do you need to build financial products customers love?

o The key challenges faced by companies that offer payment or bank-like services

o How to avoid business inefficiencies by using a joined-up Fintech-as-a-Service partner (such as… well, Modulr)

Register here: https://landing.modulrfinance.com/scaling-a-fintech-with-modulr-baas-0

The era of expensive, unadaptable legacy banking systems is coming to an end. In the 21st century, the ability to innovate rapidly is the single most important factor for growth. Learn how to reduce risk and increase agility, flexibility and speed to market by taking your core banking platform to the cloud.

Leading dispute technology specialists, Chargebacks911, announces the appointment of fintech workhorse and strategic leader, David Jimenez, as Chief Revenue Officer (CRO).

The payment expert continues its successful US growth with its latest acquirer partnership

New Nium API-based Crypto-as-a-Service platform is the first to allow financial institutions to integrate popular crypto capabilities into their financial applications, including the ability to buy, sell, and hold the most popular digital assets; future service elements will allow for stablecoin wallets, as well as crypto acceptance

Nium also expands its comprehensive suite of global Banking-as-as-Service solutions, adding card issuing capabilities in the U.S.

Whenever a transaction was made, One Point Universal co-founder Jack Cui or his colleagues would be called by their bank to personally sanction the transaction. This was proving to be extremely time-consuming and complicated. Worse, their clients weren’t getting their funds in the time that One Point Universal had promised: integrity and transparency are very important to One Point Universal’s founders.

The bank wasn’t nearly flexible enough, it was very old-fashioned, complex, expensive, and slow.

In early 2021 One Point Universal looked for a new partner. They chose Currencycloud.

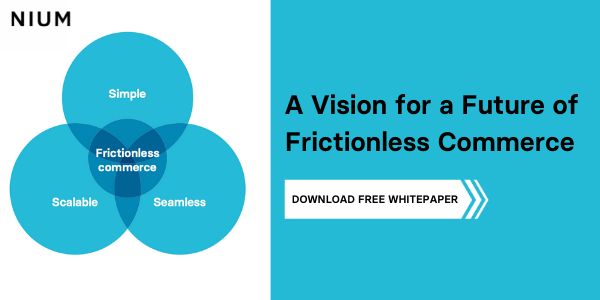

The future of frictionless commerce is here. How can we remove friction and complexities from global commerce that hold progress back? Learn in this whitepaper why our experts believe Simple, Seamless, and Scalable are the pillars of a successful future of payments.

Back in January, CEO Fabien Ignaccolo wrote a post on our 2021 predictions for SCA. Among the predictions was a future PSD3 enabling SCA for the non-banking industry, as well as an expectation for a renewed focus on Digital Identity. While PSD3 is still on the horizon, there has actually been more of a significant movement in the eID sphere.

By integrating with Currencycloud’s Spark APIs, FinTech DynaPay Ltd was able to achieve dynamic growth in just 12 months; having grown five-fold in terms of team size, revenue and customers.

A fascinating new report, Fraud and Chargebacks in Travel, has been launched by merchant dispute specialist Chargebacks911, in conjunction with industry thought leader and travel research firm, Airline Information. It offers merchants a thought-provoking look at the substantial scale of the challenge that chargebacks present to the industry and proposes solutions for mitigating chargeback threats and payment fraud events.

Contactless card payments have boomed since the onset of Covid-19 and 15 October marked yet another milestone with shoppers able to spend £100 per transaction with a tap of their card.

In this Dear Luc article, Luc Gueriane discusses why are people so divided about the £100 contactless limit?

Head over to Fintech Futures to read the full article: https://www.fintechfutures.com/2021/10/dear-luc-why-are-people-so-divided-about-the-100-contactless-limit/

Planet, a global integrated payments leader, has announced it’s been selected by Champneys to provide a fully integrated suite of Hospitality payments services on a single all-in-one platform across its UK luxury hotels, health spas and resorts.

Radar Payments launches a standalone service for tipping and gratuity that can be deployed by financial institutions to help reward hospitality staff and other workers for their services.

Banks can use Tippay™ as a standalone app available in their business client outlets and to partners for more tipping convenience. The service enables banks to reach new potential customers while generating additional revenues by taking a minimal fee on every tip registered.

Global payments provider, Sokin, looks to grow brand in US with innovative marketing partnership with the Miami Dolphins – it’s first NFL team and step into North America.

As a fintech leader, what does ownership mean to you?

It’s a prominent topic these days, especially as payment providers (and the broader fintech industry) shift to remote settings and home offices. Leaders and employees must adapt during times of change. Encouraging and proliferating ownership was already difficult before this seismic shift. Now it’s an even taller task.

Are your employees taking ownership over their responsibilities and designated projects?

London-headquartered Global Processing Services (GPS), the Global API-first payment technology platform, powering the world’s leading fintechs, including Revolut, Curve, Starling Bank, Zilch, WeLab Bank and Paidy, today announces it has raised over US$300 million from Advent International (“Advent”) and Viking Global Investors (“Viking”).

The new investors and subsequent funding will provide deep payments and fintech experience to accelerate technology investments in product innovation and continued expansion in 48 countries across Europe, Asia and the Middle East.

The investment follows a strategic investment from Visa in October 2020.

GPS is a company at the heart of fintech’s global expansion, powering leading fintechs, digital challenger banks and embedded finance providers through its API-first payment technology.

To date GPS has:

Issued 190 million physical and virtual cards

Processed more than 1.3 billion transactions on its cloud-based platform

Expanded into APAC and MENA

Integrated with 95 issuer partners and operates programmes for a client base across the globe

Powered today’s leading fintechs, including Revolut, Curve, Starling Bank, Zilch, WeLab Bank and Paidy

Secured strategic investment from Visa, a long-term partner of GPS

Established a new regional centre of excellence in United Arab Emirates (UAE) having been selected as one of its preferred issuer processors in Asia-Pacific and the MENA region

Please see below for full press release for further information.

Let me know if you have any questions.

Kind regards,

Becky

PPS, an Edenred company, today announces its partnership with UK-based Sprive, the first of its kind mortgage overpayment app designed to help homeowners become mortgage free faster and save interest.

– Introduction

– First Party Fraud

– Second-Party Fraud

– Third-Party Fraud

– Why each type of fraud can be difficult to detect

– Combatting these diverse crimes

– Introduction

– What is physical biometrics?

– What is behavioral biometrics?

– What is the difference between using physical and behavioral biometrics when authenticating users?

– Behavioral biometrics aid PSD2 compliance

– Webinar: Behavioral Vs Physical Biometrics: the ultimate showdown in digital banking

– Introduction

– Collaboration with start-ups

– CaixaBank, a leader in innovation

Leading payment organisations came together to celebrate innovation in the financial sector last night at the Emerging Payments Association’s (EPA) 14th annual Emerging Payments Awards (EP Awards) ceremony.

The latest study from Banking Circle has revealed the new challenges faced by CIOs and CTOs working in Banks and FinTechs. The insight from the Payments bank for the new economy found that more than half have skills gaps in their organisations that could hold them back from capitalising on the latest technology, seriously undermining their post-COVID recovery.

Shoppers in Europe are finding 94% of European e-commerce websites’ checkout pages inadequate, which forces shoppers to abandon their purchases. To enhance the checkout experience, the right solutions must be put to use.

OneFor has selected Moorwand’s to provide issuing, acquiring and digital banking services

Covid-19 changed many things, including the security landscape. Remote work and the onslaught of digital services that accompanied it brought a digital transformation the world was not expecting. While it has affected the way people work in many positive ways, it has also led them to be more vulnerable to cyber attacks. To minimise this risky exposure and establish a new benchmark for protection, it’s time companies dig deep into the conversation of future-proof security.

Diversity has become the new normal in fast evolving industries like payment & fintech. Next to the obvious types of diversity, what if you had a metric to select the optimal people for your team, and the role you want them to play in the team no matter what their cultural or hard skill related background is?

When developing or growing a dynamic team in a fast-growing company, considering the optimal interpersonal strength profiles and finding the optimal balance, can be a catalyst to improve the team’s performance. Within the Fintech industry, the ever changing environment demands team members to grow and develop their interpersonal skills in order to achieve targets in a seamless and effective manner.

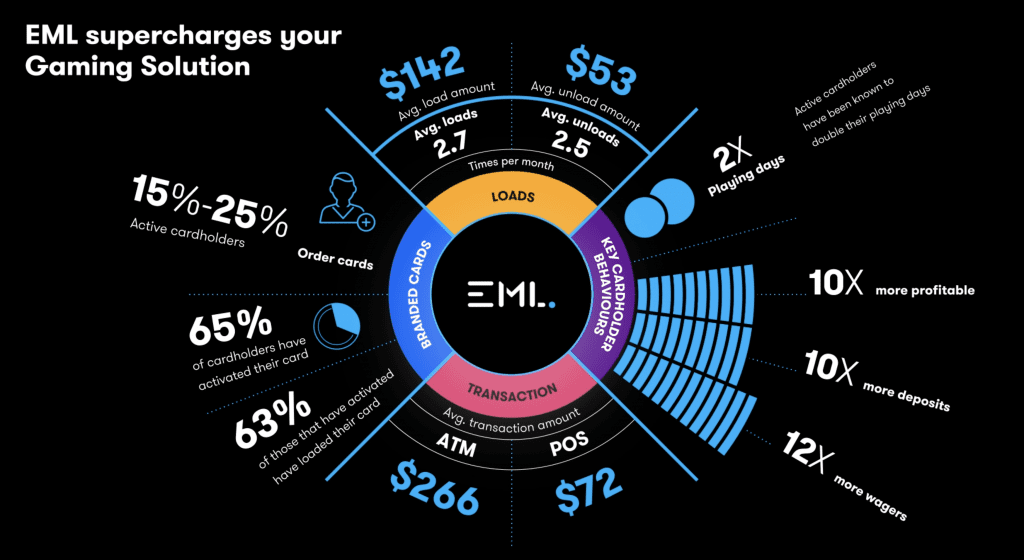

EML is excited to exhibit at Global Gaming Expo (G2E) In Las Vegas from October 5 to 7.

EML closes the deal to acquire Sentenial.

The award-winning global payments processor sets up regional hub to promote its innovative offering throughout MENA, led by ex-Majid Al Futtaim payments expert, Arnav Rath, as Head of Region

Fintech charity Pennies has attracted 40 leaders from across payments and technology, retail, and hospitality to help accelerate and strengthen the ubiquity of its pioneering micro-donation movement.

Wintermute, one of the largest players in the global digital asset markets, has today announced a partnership with BCB Group, Europe’s leading provider of business accounts and trading services for the digital asset economy. Wintermute has also integrated with BLINC, BCB’s global payments network, and one of the first real-time payment networks of its kind to allow free, real-time transactions across fiat and digital currencies, enabling participants to settle instantly in any of the currencies supported, with no limits.

allpay Ltd, a leading UK payment specialist, has renewed its place on the Consortium Procurement (CP) framework, which is the commercial arm of the Northern Housing Consortium (NHC).

With over 115 clients utilising the framework, allpay have been on this framework since 2010, and is delighted to continue this relationship.

It’s time for another monthly #DearLuc, payments agony uncle, with Moorwand CCO Luc Gueriane and FinTech Futures! This week a fintech founder has asked about Buy Now, Pay Later (BNPL) and how they can get a piece of the action. Luc describes some of the key considerations to keep in mind when a card programme provider is looking to add BNPL to their service.

Latest raise led by Tiger Global Management LLC with participation from global payments technology firm Stripe. Funding to accelerate the global rollout of TrueLayer’s payments network, with a focus on instant and recurring payments.

In a recent article on The Fintech Times, Ian Kerr, a Director of Business Development for Episode Six, discussed why crypto and DeFi isn’t just a fad, but something that will remain for a long time. If banks do not respond to it, they will face the consequences in the future.

Monneo, regulated by the Financial Conduct Authority (FCA), a virtual IBAN and corporate account provider, has enlisted cryptocurrency exchange Coinbase, in a move that will enable payment of invoices in a range of cryptocurrencies. The new service will be available for B2B invoice settlement and is supported by two of Monneo’s partner banks.

Leading dispute technology specialist, Chargebacks911, today announces the appointment of Ex Accertify Head of Dispute Manager, Jennifer Lichner, as SVP of Operations.

Now, banks can offer their customers a secure, passwordless authentication experience that removes the reliance on passwords, one-time-PINs and additional mobile apps.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.