Shoppers in Europe are finding 94% of European e-commerce websites’ checkout pages inadequate, which forces shoppers to abandon their purchases. To enhance the checkout experience, the right solutions must be put to use.

Although e-commerce in Europe is booming, shoppers are experiencing issues with a majority of popular e-commerce websites. As much as 94% of e-commerce websites in Europe have flawed checkout pages, compared to last years’ 58%. Issues like the limited number of popular payment methods offered and lengthy checkout processes force European shoppers to abandon their carts. To enhance the cross-border online shopping experience, suitable local payment options should be one of the priorities.

Issues that cause high shopping cart abandonment are linked with shoppers’ experience during checkout. 21% of shoppers in Europe abandon their purchase if the checkout takes longer than one minute, while 15% leave their online shopping cart when their preferred payment method isn’t available.

These numbers could grow even higher, as the newly formed habits of shopping online have become a part of a daily routine for many European consumers, including the Baltics. 50% of Lithuanians and 74% of Latvians have started shopping online more frequently in 2021. The share of bank card payments made online in Estonia was up to 14%, compared to only 3% five years ago, showing the growing popularity of online shopping in the country. Frank Breuss, CEO, and co-founder of Nikulipe, a Fintech company creating and connecting Local Payment Methods to access Emerging and Fast-Growing Markets, notes that the right local payment methods could solve the issues appearing in the majority of e-commerce checkout pages.

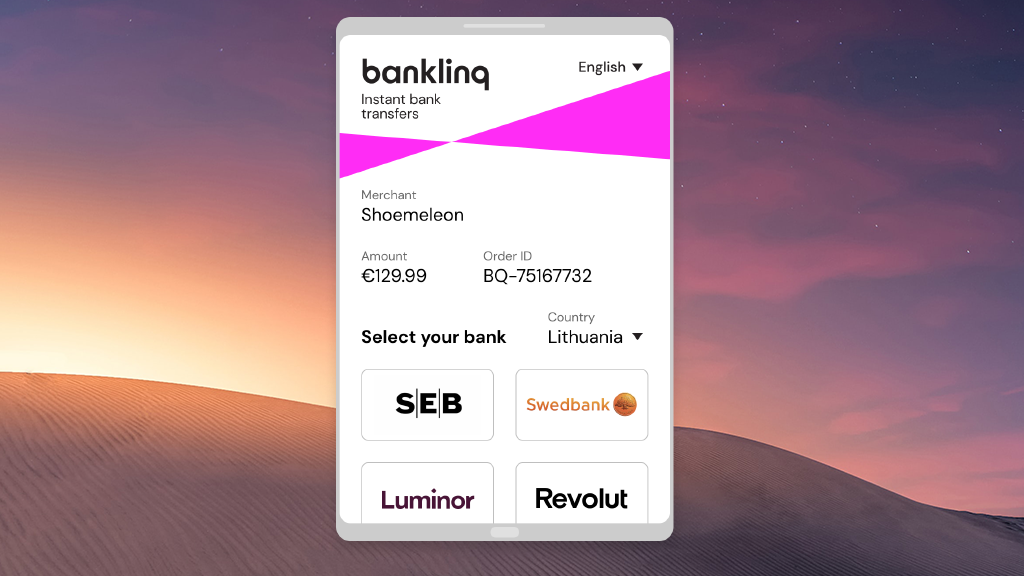

“It all comes down to the right mix of payment methods the merchants offer their target group,” explains Breuss, who recently introduced a local payment option for the Baltics, banklinq. “The preferences in Lithuania, Latvia, or Estonia, for example, are very different from those in Poland or Germany. The same goes for the target customer base: a very young customer base might have a preference for a certain selection of payment methods, which is different from what a very broad customer base prefers.”

Breuss notes, however, that while it’s important to offer a selection of the right payment methods, at the same time it is key to offer not too many of them. Confronting a buyer with a large number of options and payment brands to choose from increases the likelihood of purchase abandonment.

Additionally, existing solutions for combating these issues do not always tend to encompass both, the consumer experience at the online checkout, and simplicity and efficiency for the merchants themselves.

“Consumers shouldn’t be forced to think, but have made their shopping experience as easy as possible. That’s why one-product-type solutions, capturing a large number of shoppers’ favorite banks under one button, help to better optimize e-commerce for shoppers and merchants alike. For example, when creating ‘banklinq’ we wanted to integrate a larger number of payment options, so we included challenger banks, which are growing in popularity.”

As more and more shoppers include online shopping in their daily routines, the issues appearing in the majority of popular e-commerce websites’ checkouts lessen customer experiences while shopping. While the issues of lack of suitable payment options and long checkout processes are persistent, they can be solved with suitable payment solutions, which encompass favorite payment options of target markets and customer base.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.