SWIFT – The transformation of the European payments landscape

SWIFT white paper examines the drivers of payments transformation in Europe and looks at the challenges and opportunities for financial institutions Brussels, 17 October 2018

SWIFT white paper examines the drivers of payments transformation in Europe and looks at the challenges and opportunities for financial institutions Brussels, 17 October 2018

The ‘Monese Business’ account can be set-up in five minutes and comes bundled with personal banking in one simple-to-use app Now available to UK

NatWest has become the first bank to go live on Fusion LenderComm, a distributed ledger technology (DLT) platform for the syndicated loan market developed by

RegTech solution provider Konsentus has gone live with its cloud-based PSD2 open banking production service, which helps Financial Institutions (FIs) to comply with PSD2 open

5.1 million switches since launch of Current Account Switch Service Switching levels between 1 October 2017 and 30 September 2018 up 5 per cent on

London: 08th October 2018 – Contis, the award-winning banking and payments solutions provider, has announced the appointment of Andy Patton as its new Group Chief

Deal gives Contis access to Paze’s full suite of technology, including an AI-powered consumer lending system Acquisition follows Contis’ recent partnership with Visa to launch

Lacuna’s Senior Partner, who recently joined from Societe Generale where he has represented Societe Generale on the Board of both CHAPS & SWIFT UK Limited,

Banking Technology Awards recognise value of unique banking solution www.bankingcircle.com London, October 2018 – Banking Circle Virtual IBAN, the multi-award-winning bank account solution from Banking

Project Regulator has published an explainer document for consumers and early-stage businesses on the differences between banks, e-money institutions, and payments institutions. This explanatory document,

Demystifying emerging payments, from the Payments Association Thanks to Open Banking, there has never been a more exciting time for creators and consumers of financial

Project Inclusion supported the official launch of the Inclusion Signpost, the industry’s accreditation service for recognising financially inclusive products and solutions. The service, developed by

Project Financial Crime has commissioned Huntswood to deliver a report on how technology can tackle the risks, causes and impacts of payments fraud and financial

The next Project Futures workshop will be held on Tuesday 11th December at 9 am and will look at new innovations, the impact of identity

Project International Trade is delighted to announce and support the launch of Payments Association Asia – the Payments Association’s newest partner association. Launched at SIBOS

Project Regulator has partnered with the FCA to promote the launch of the FCA’s regulatory sandbox. The sandbox is open to authorised firms, unauthorised firms

Project Banking Access strongly encourages Payments Association members to get involved with the Bank of England’s upcoming RTGS Renewal Industry Update event. The ‘Plan-Analyse-Design’ phase

Project Women in PayTech is delighted to announce that the next Women in PayTech event titled ‘I Can’t Change Time, but Time Can Change Me’

FCRM provides real-time monitoring of transactions and automation of manual processes, allowing for a team restructure and freeing up employees’ time to enable them to

Global regulators are cracking down hard on failures by financial services companies to meet their anti-money laundering obligations. The UK is no exception – its

With US$2trillion laundered annually, money laundering is the biggest challenge in the payment industry. Payments are a key target for money launderers. A growing number

Highlights: New explainable artificial intelligence toolkit (xAI Toolkit) meets customers’ increasing demand for industry-leading artificial intelligence that business users can understand Boosts decision performance by

HIGHLIGHTS: UK losses fell 8 percent due to success battling card not present fraud Total card fraud losses across the 19 European countries studied grew

With less than 12 months to go until EU banks implement their strong customer authentication (SCA) solutions, project teams are facing tough decisions about the most important

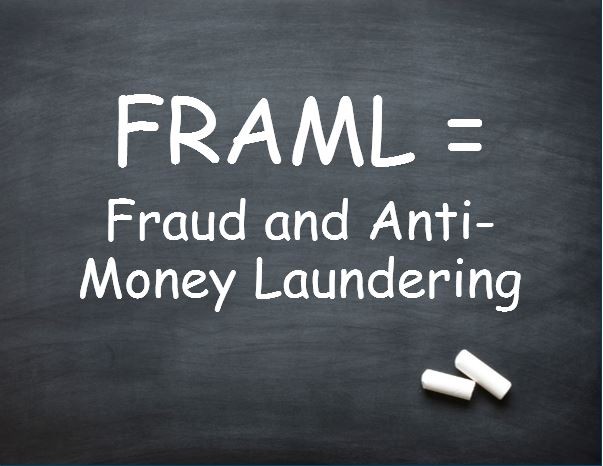

There has been another addition to the financial crime lexicon: FRAML stands for Fraud and Anti-Money Laundering. This simple term encompasses a very important trend,

Companies that are achieving outstanding results using analytics and decision management solutions from FICO are invited to submit nominations for the 2018 FICO® Decisions Awards.

It’s a harsh truth that while data and technology in the fraud business abound, true domain expertise is a scarce resource. Meet Andy Procter, one of

In this digital era, we’re used to booking our ticket, but often then have separate extras to consider, like choosing our seat, eating in-flight meals,

A Javelin Research & Strategy study commissioned by Verifi found that cardholder disputes and chargebacks generated $31 billion in financial losses in 2017, of which

The Chargeback Company`s COO Monica Eaton-Cardone looks at the evolution of the payment industry and the likely impact of ‘invisible’ payments More than a decade after it

The Challenge Accelerated Payments is helping SMEs across Europe gain access to working capital by providing an innovative invoice discounting solution. To provide a best

NEW YORK–(BUSINESS WIRE)–A consortium led by Blackstone (NYSE:BX) today announced that private equity funds managed by Blackstone (“Blackstone”) – together with Canada Pension Plan Investment

LONDON, NEW YORK, September 24, 2018 – The Financial & Risk business of Thomson Reuters continues to set the standard for KYC due diligence with the news

(COPENHAGEN and SAN FRANCISCO, September 4, 2018) Abra, the first and only all-in-one cryptocurrency wallet and exchange, has partnered with Coinify, the leading global technology

London – September 20, 2018 – Curve brings simplicity and better financial control to its users and now it also does it for those travelling

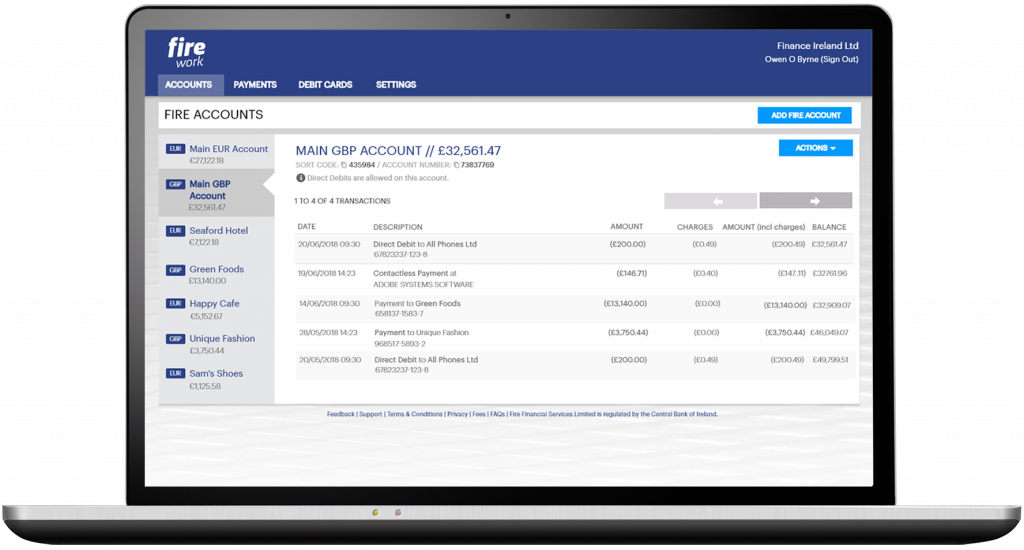

Konsentus, a RegTech solutions business, who facilitate checking the identity and regulatory status of Third-Party Providers enabling Financial Institutions (FIs) to be PSD2 open banking

More people are benefitting from using card payments than ever before. The number of credit cards being used globally has grown from 8.6 billion just

More information on Blue Train Marketing here.

1st October 2018, LONDON: Global Processing Services (GPS), the issuer processor enabling next-generation payment technology for banks, non-banks and Fintechs, today announced the appointment of Kevin

Open Banking has forever altered the banking sector throughout Europe and the United Kingdom. In this Q&A, ACI’s Dean Wallace looks at the opportunities for

Financial messaging network Swift is to give member banks deeper insights into their cross-border payment flows with the release of a ‘Business Intelligence gpi Observer

Lee Cameron has been appointed managing director for Fiserv in Europe, the Middle East and Africa. In this role, he will be responsible for business

Rejection of Theresa May’s Chequers proposal last week suggests that a ‘no deal’ exit from the EU in six months time, is looking more realistic

Global professional services firm, PricewaterhouseCoopers today announced the acquisition of KYC-Pro, a RegTech solution, from boutique financial services compliance firm, fscom, for an undisclosed amount. The

Nearly all BIN Sponsors in Europe have indicated they will push the regulatory responsibility for complying to the PSD2 open banking requirements down to their

More information about PayExpo here.

David G.W Birch is an author, advisor and commentator on digital financial services. He is a Global Ambassador at Consult Hyperion (the secure electronic

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.