Optal the fastest-growing FinTech firm in Europe

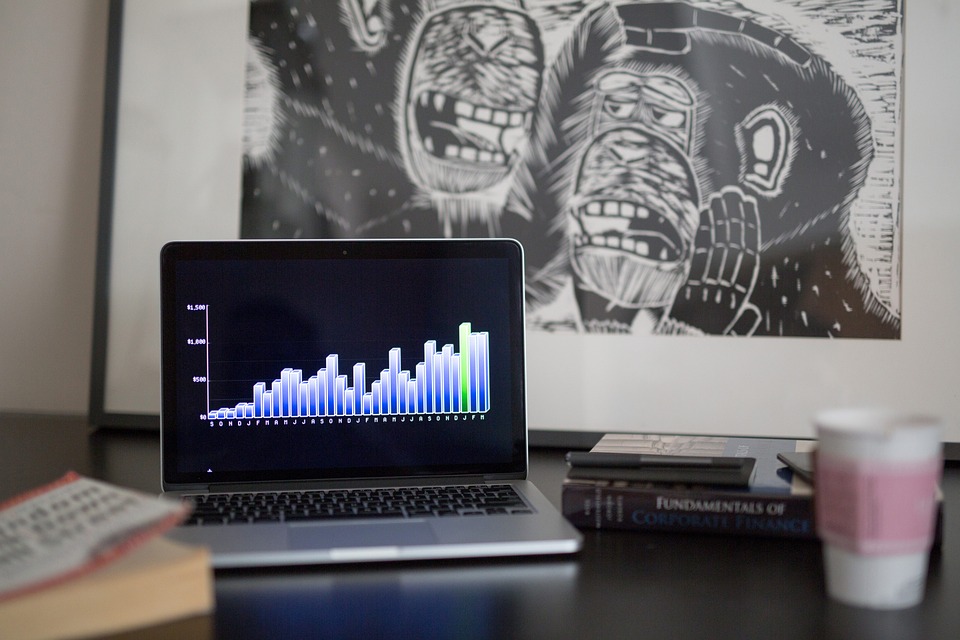

Optal was recently named Europe’s seventh fastest growing company and the only FinTech specialist in the top 10 of a prestigious new 1,000-strong list compiled by the Financial Times. The

Optal was recently named Europe’s seventh fastest growing company and the only FinTech specialist in the top 10 of a prestigious new 1,000-strong list compiled by the Financial Times. The

Small businesses shift from hiring experts in ‘traditional’ fields to taking on specialists for the digital world like cybersecurity and new payments technology. According to research from Barclaycard, UK SMEs

FIS and Cardtronics have announced plans to integrate FIS Cardless Cash access across Cardtronics’ ATM fleet in the United States. FIS Cardless Cash, which leverages the FIS Mobile Banking app,

OT-Morpho has announced the creation of the market’s first complete range of biometric payment cards, a range which reinforces payment security. It can also help governments distribute social benefits, knowing

Barclays’ blockchain team was set up in 2014, with a brief to look at different kinds of experimentation with digital ledger technology. Isabel Cooke, Barclays’ Blockchain Research & Development Delivery

Fiserv has earned Certified status for information security by the Health Information Trust (HITRUST) Alliance. Fiserv is one of the first organizations to achieve a HITRUST certification via the SOC2+

PayPoint has announced a new partnership with Robin Hood Energy. The UK’s first local authority owned energy supply company has implemented PayPoint’s integrated payments platform, MultiPay, giving customers the choice

Citizens Bank is partnering with Bottomline Technologies to deploy a market-leading online and mobile banking platform for its Commercial and Business Banking clients. The new platform is designed to manage

In six months’ time, the second Payment Services Directive (PSD2) will be implemented in the UK. Some of the key areas that will have to be considered in the impact

Saxo Payments Banking Circle has commissioned new research into the barriers facing merchants that want to trade globally. The findings, in a new white paper – Cross Border Payments for

Cambrist Ltd, one of Ireland’s newest break-through, Fintech start-up companies, and PerfectCard DAC, Ireland’s first authorised eMoney institution and a leading provider of incentive and gift card solutions, are pleased

UK’s leading PayTech community brings together six regulators from across the EU, to discuss which Home State is right for businesses post-Brexit, should passporting no longer be possible. London, UK. 3rd July

By Tony Craddock, Director General, The Payments Association A year on from Bacs joining the The Payments Association, I’m pleased to have been invited to write a few words about

New Paysafe whitepaper reveals five strategies to achieve international e-commerce success and adhere to regulations and compliance LONDON, 26 June 2017 – Paysafe, a leading global payments provider, has today released a

To download your full pre-publication copy of the Jury Report, visit here. Here is our Executive Summary of the report, written from the Payments Association member’s perspective rather than the

The Payments Association’s Women in PayTech has signed HM Treasury’s Women in Finance Charter. The charter is a commitment by HM Treasury and signatory firms to work together to build

Project Europe’s upcoming ‘Passport to the Regulator’ event in October has created interest amongst regulators in EU jurisdictions. Having confirmed five regulators at the event, a regulator from a Western

Project Inclusion commends the UK government for the appointment of Guy Opperman as the UK’s first Minister for Financial Inclusion. Project Inclusion has extensively lobbied parliament and peers in the

Members from the Project International Trade team met with representatives from City of London Corporation who focus on FinTech sector engagement for Exports & Investment. The meeting focused on the

Project Media will be hosting a guest blog with the blogging content being circulated amongst the Payments Association’s media contacts. Project Media would like to extend an invitation to all

Project Regulator submitted a response on behalf of Payments Association members to the PSR on the implementation of PSD2. The response was developed following a survey sent out to Payments

The results of Project Rome’s survey on access to banking services and termination of banking services have been published. The results were launched at Money20/20 in Copenhagen and highlighted the

Project Retail will be hosting the Retail PayTech on Wednesday 5th July at the St. Pancras Renaissance Hotel in King’s Cross. This free retailer-only seminar will provide valuable insight into

JCB joins major PayTech players as a Patron of The Payments Association Global innovator connects with thriving network of over 100 payments organisations to foster growth in European market London,

UK’s leading payments community lobbied for new ministerial role to end financial exclusion London, UK. 19th June 2017. The Payments Association, the UK’s leading payments community, today commends the UK

Contis, the leading provider of alternative banking, has opened a complete bank and card payments offering to its clients and their customers, delivering the full core payment needs for both

The new and completely redesigned website offers visitors richer insight into the Company’s products and solutions in Africa and European markets. 19th June, 2017 Tola Mobile, a mobile payment service

Data released by Barclaycard as part of its quarterly Contactless Spending Index shows that ‘touch and go’ payments is now the preferred way to pay among British shoppers, with spending

Overall the key drive/point of the session from the FCA’s perspective was to garner input in to their consultation process. They were taking the points/questions posed on board in that

London, 07/06/17 – AEVI and Moroku today announced a partnership to bring their all-in-one small merchant POS software Marrakash to AEVI’s Global Marketplace; a B2B app store for smart Point

IDEMIA, the global leader in trusted identities for an increasingly digital world, today announces its partnership with JCB, the leading international payment network in Japan, to introduce the future of

FLEETCOR Technologies, Inc. (NYSE:FLT), a leading global provider of commercial payment solutions, announced today the signing of an agreement with Wal-Mart Stores, Inc. (NYSE:WMT) relating to two payment initiatives. Read more here.

IDEMIA, the global leader in trusted identities for an increasingly digital world, today announced the milestone of 1 million MOTION CODE online transactions with Société Générale. Read more here.

Naples, FLA – November 21, 2017 – ACI Worldwide (NASDAQ: ACIW), a leading global provider of real-time electronic payment and banking solutions, today announced expanded cloud-based omni-channel payment capabilities through a licensing agreement

A few months ago, FinTech Profile interviewed our Chief Commercial Officer, Alan Nagle. Alan joined Cybertonica in May 2017 and his responsibilities are tied to Marketing/Sales Strategy/Budget, commercial agreements, the product interface, product design

Mexican payment service provider, NetPay, famed for their innovative approach to transaction services, is leading the way in transforming the checkout experience for their restaurant merchants with the launch of NetPay’s SMART

On 21st November, Cybertonica organised #HackersGonnaHack in partnership with Cisco, The Payments Association and University College London at the post accelerator workspace IDEALondon. The event brought together 8 speakers from the industry and academia to discuss the Real

allpay Limited took home the award for Best Prepaid Card Solution at the Payments Awards last night. In addition to the win, they were also runners up in the Best

Congratulations to Cybertonica’s Market Development Manager Melike Belli, featured in the Innovate Finance Women in FinTech Powerlist for the second year in a row! Innovate Finance, the membership organisation representing the UK’s global FinTech community, included 370

NEW YORK, November 16, 2017 — American Express today announced the introduction of blockchain-enabled, business-to-business cross-border payments. The American Express® FX International Payments (FXIP) business is working with Ripple, provider of

27 November 2017:London, UK – Leading international payments platform, Currencycloud, has appointed Tanya Ziv as its new Chief Compliance Officer and Money Laundering Reporting Officer (MLRO). Read more here.

Organisations across the country are being encouraged to take advantage of a free, online marketing toolkit to help promote and increase Direct Debit sign-up rates. The toolkit provides a range

LONDON — November 21, 2017 – “Stop sending us letters when we pay late and start texting us.” That was a resounding message from UK consumers in a new survey on lender

Consumer spending growth slowed to 2.4 per cent year-on-year in October which, with inflation at 3 per cent, equated to a contraction in real terms. Brits cut back across the

The MeetFintech by Arkea Banking Services gathered for one evening many actors from the Fintech Industry. 30 companies attended and came from all over Europe to Paris for the Fifth

In a survey by Barclaycard earlier this year, it was discovered that small-to-medium enterprises are more afraid of cybercrime than of Brexit. That comes as no surprise, really. At this

London, 5th December 2017 – Saxo Payments Banking Circle, the ground-breaking B2B financial utility supporting banks and FinTechs, has achieved $50 billion volume growth since it started taking the first

London, UK, December 2017 – Global Processing Services (GPS) is pleased to announce its agreement with new client Glint, who are reintroducing gold as money, enabling customers to store, exchange,

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.