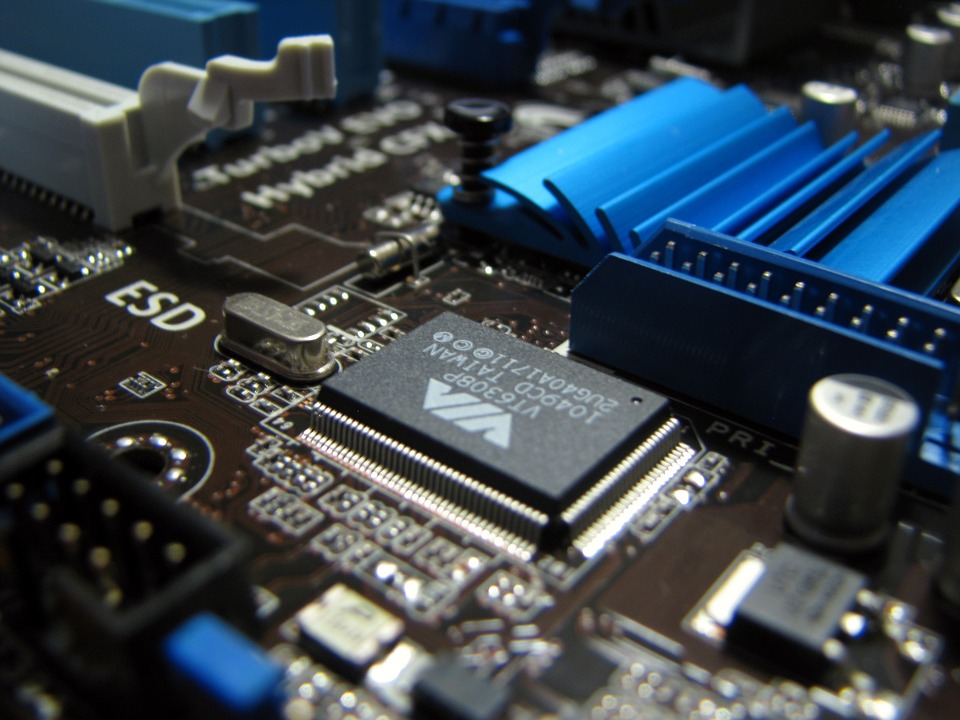

Barclaycard – SMEs more afraid of cybercrime than Brexit

Small businesses shift from hiring experts in ‘traditional’ fields to taking on specialists for the digital world like cybersecurity and new payments technology. Read more here.

Small businesses shift from hiring experts in ‘traditional’ fields to taking on specialists for the digital world like cybersecurity and new payments technology. Read more here.

W2, the Global AML, age and identify verification provider, has launched a new dashboard which supports all of their services, offering customers faster and improved search functionality. Read more here.

Kompli-Global has developed a tool to help companies deal with the more time-consuming customer due diligence challenges of the 4th Anti-Money Laundering Directive (4th AMLD). The 4th AMLD, which came

Nick Kennett, Chief Executive, Financial Services & Telecoms, Post Office Ltd, comments on the FCA’s findings regarding the overdraft market as part of its review of the high-cost short-term credit

Bottomline Technologies has launched the 2nd edition of its annual report, the UK Business Payments Barometer: Payments for a new economy, which reveals that fraud and the need for greater

The results of Paybefore.com’s survey of best challenger banks has just been announced with APS’ Cashplus voted best challenger bank. Read more here.

TGI Fridays, Oracle and Mastercard have announced the launch of Bar Tab at their Leicester Square location, with plans to deploy the app to 80 additional TGI Fridays locations in

Winner of an international call for tenders, Edenred has been selected by the International Air Transport Association (IATA) as one of its partners, to develop and manage the new generation

Now live with its first customer, innovative Dublin-based fintech company Cambrist is proceeding with plans to disrupt the way foreign exchange is managed in the card payments industry. Cambrist recently

Mastercard has unveiled the Digital Evolution Index 2017, an in-depth look at technology adoption and the state of digital trust around the world. Read more here.

ACI Worldwide electronic payment and banking solutions, has announced the official opening of its new Timişoara, Romania office. Read more here.

The findings from the latest Financial Stability Board (FSB) underlines the ongoing challenges faced by businesses, when trading internationally, reinforcing the findings produced in Saxo Payments White Paper Cross Border

A public debate over the future of Bitcoin and its transaction capacity, often referred to as the ‘Bitcoin Scaling’ debate, has now been going on among the various actors in

Telit, a global enabler of the Internet of Things (IoT), together with OT-Morpho, a world leader in digital security & identification technologies, announced today that the companies are partnering together

AEVI and Epos Now have announced a partnership to bring customizable, cloud-based POS systems to AEVI’s Global Marketplace, the B2B app store for smart business management. This collaboration will allow

Thames Card Technology has completed a project with Tesco to launch the UK’s first contactless loyalty card programme. With 66% of global shoppers enrolled in loyalty programmes (Nielsen) and cardholders

Finastra today announced that its UK-based service bureau (formerly part of D+H) has been awarded the SWIFT Shared Infrastructure Program (SIP) version 2 for 2016 label. It is the first

The insurance industry may historically have been largely hidebound by legacy IT, but digital transformation is bringing of new opportunities to better meet changing customer demand, as well as boosting

allpay Limited, the UK’s leading payment specialist, has helped the NHS Business Services Authority (NHSBSA)– an arm’s length body of the Department of Health – to reduce administration time and

David Craig, president of Thomson Reuters’ Financial & Risk business is delighted to be recognized this year as number #7 in the top 40 global leaders in financial technology, rising

Discover is offering a free service that monitors risky websites known to illegally sell or trade personal data and alerts Discover cardmembers if their Social Security numbers are found. In

An omni-channel payments strategy is key to creating a seamless customer experience for 79 percent of merchants and retailers, per new benchmark data, “2017 Global Payments Insight Survey: Merchants and

With London Fintech Week 2017 showcasing the exceptional talent and innovation within the City, one of the founders of Fintech, Cashplus (through its parent company Advanced Payment Solutions Ltd) has

Tola Mobile announced a collaboration with Phonovation, an interactive SMS and voice services company, that allows players to instantly purchase Xbox and PlayStation games, season passes and gift cards via

Payments AssociationM Systems have announced that it has been named censhare’s first Global Premium Partner. Through the partnership, Payments AssociationM and censhare clients can manage digital assets and product information

The Paybase team have produced this jargon-busting guide to ensure that when FinTech (or more precisely the world of eMoney) comes up in conversation, you can confidently stand your ground.

The UK’s smaller businesses are facing a total bill of £2.16 billion to chase overdue payments, according to Bacs Payment Schemes Limited (Bacs), the company behind Direct Debit and Bacs

Valitor, a global leader in Fintech payment service provision has announced the acquisition of Chip & PIN Solutions, one of the UK’s most innovative card based payment providers. The move

Silicon Valley analytics firm FICO has announced that its new release of the FICO® Enterprise Security Score quantifies the breach risks introduced by 4th parties — a partner or vendor’s

With more and more banks scrapping proprietary hardware for cloud-based solutions, Payment Cloud Technologies have looked at three of the key benefits of banking in the cloud. Read more here.

The latest figures for the Current Account Switch Service show that almost 4 million (3,986,630) successful switches have taken place since the service launched in 2013. Read more here.

WEX’s first annual ‘Payments Pulse’ survey reveals more than three-quarters of responding CFOs agree payments providers should offer more innovative technologies. The data uncovered five key trends… Read more here.

London is the second largest financial centre in the world and financial services is the largest industry in the UK, therefore it is logical to expect the financial services industry

Today on FinTech Profile we speak to Alan Nagle CCO of Cybertonica. Cybertonica use Machine Learning and Artificial Intelligence in combination with analytical, big data and statistical models to reduce basket

Project Regulator hosted a panel discussion at the Payments Association’s Hot Topic Briefing in July. The panel, titled ‘GDPR: an opportunity or just more regulation’, discussed how GDPR will work

Project Retail ran the third Retail PayTech Forum event in July. The retailer-only event, held at the St. Pancras Renaissance Hotel, hosted over 40 attendees provided keynote talks on retailer

Following extensive work and activity from the project team, the Payments Association’s Project Rome commends the Bank of England in finalising a framework that extends direct access to RTGS accounts

The Payments Association’s Women in PayTech is developing an active partnership with Women in Payments. This partnership will allow Payments Association members to tap into a wide-ranging mentorship program and

With 40 % of tickets already taken, Project Europe’s upcoming ‘Passport to the Regulators’ briefing has proved to be of keen interest among the payments community. Regulators from Cyprus, Denmark,

Project Inclusion, in collaboration with the Payments Association’s Project Media, will be launching a series of interview pieces with individuals championing the message of financial inclusion within industry and government.

Project International Trade has partnered with the Department for International Trade to promote ‘The Route to Trading with the USA’. The event, held on Thursday 31st August at a Central

The Bank of England is announcing today that a new generation of non-bank payment service providers is now eligible to apply for a settlement account in the Bank’s RTGS system.

I had an interesting discussion with a few members of the The Payments Association recently and we discovered what seems to be a gap in our collective vocabulary. It started

The concept of Artificial Intelligence (AI) or machine learning or deep learning has been around for decades. Pioneers have thought about the use of machines for hundreds of years and

LONDON, 21 November, 2017 – Paysafe, a leading global payments provider, has been named winner of two high profile payments awards in the UK at the prestigious ‘UK Payment Awards’ event last week.

Newtown, PA – November 14, 2017 – Payments AssociationM Systems, Inc. (NYSE: Payments AssociationM), a leading global provider of digital platform engineering and software development services, and Kronos Incorporated, a leading provider

LONDON, Nov. 20, 2017 (GLOBE NEWSWIRE) — Whilst Downing Street recently claimed that Theresa May remains confident in agreeing an exit deal with Brussels, UK Brexit Secretary David Davis is

Contracts for differences (CFDs), including financial spread bets, with cryptocurrencies as the underlying investment are increasingly being marketed to consumers. These products are extremely high-risk, speculative products. This warning is

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.