Sara West appointed to the W2 Board of Executive Directors

Newport, Wales 01/02/2019– W2, a provider of SaaS, B2B software solutions and services is very pleased to announce the appointment of Sara West to the Executive Board of Directors. Sara

Newport, Wales 01/02/2019– W2, a provider of SaaS, B2B software solutions and services is very pleased to announce the appointment of Sara West to the Executive Board of Directors. Sara

Improving the customer experience in banking is simpler than banks think. Brian McLaughlin, Chief Experience Officer at Bottomline Technologies, on improving the customer experience.

In the last three or four years, social media (SM) giants such as Facebook, Twitter, and Snapchat have harnessed high levels of user trust and engagement to tap into the growing SM

K Wearables has launched its contactless payment K Ring with ABN AMRO in the Netherlands, linking the ring direct to ABN AMRO issued bank cards. The contactless payment wearables are

Konsentus today announced that they have been selected by Mastercard to deliver Third Party Provider (TPP) identity and regulatory checking solutions, as part of Mastercard’s new suite of Open Banking

Vitesse Company Overview: Vitesse is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuance of e-money and is registered as a Money Transmitter with

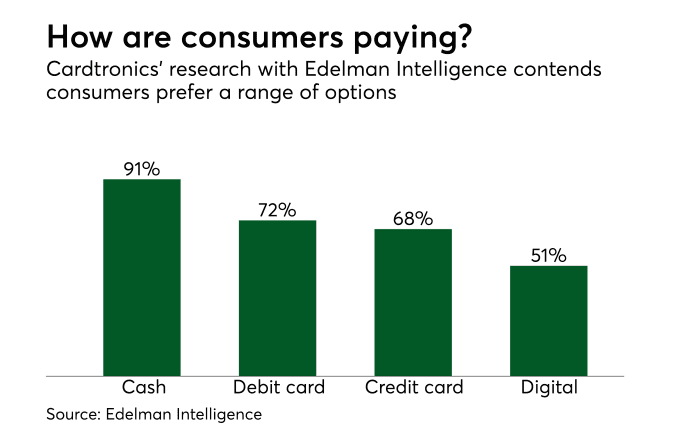

According to Peter Hazou, Director of Development for Microsoft’s World Wide Financial Services Industry Group, the industry is at a pivotal moment and the success of financial services organizations “depends on how

A new generation of bank customers is bypassing physical branches and banking via the web almost entirely in favor of completing transactions and accessing services from their mobile devices. Read

Millionaire American rapper Snoop Dogg, a.k.a. Calvin Broadus, has become a minority shareholder in the Klarna, which offers buy-now-pay-later services at 100,000 retailers in Europe and across the U.S. Read the

Paybase dived straight into 2019 by hosting their 2nd Collaborative Workshop. Their supportive community for platform businesses is definitely growing, stay tuned for information on their third workshop in March!

Project Regulator responded on behalf of the Payments Association and its members to the PSR’s consultation on the general directions of implementing Confirmation of Payee. This response highlights the perspectives

Project Women in PayTech held its largest Women in PayTech event to date. The event, held at the Post Office headquarters in Moorgate, hosted inspirational keynote discussions on how to

The Payments Association is delighted to announce the new Benefactor behind the Payments Association’s Project Banking Access, Galileo Processing. The project, formerly called Project Rome, under its new specification will

The Payments Association is delighted to announce that FICO have renewed their support as a Benefactor behind Project Futures. Project Futures provides thought leadership on new innovations and technological developments,

Project Inclusion has received a response from Guy Opperman, Parliamentary Under-Secretary of State at the Department of Work & Pensions, following on from the letter published in December. The response

The activities of Project Financial Crime were promoted on Consult Hyperion’s podcast series. Championed by project lead Jane Jee, the podcast highlighted where technology can help the payments industry meet

Project International Trade is delighted to announce Scott Abrahams, Senior Vice President at Mastercard and Payments Association Advisory Board member, as the new Project Mentor. Project International Trade encourages the

DIGITAL DISRUPTOR SIGNS UP TO DIRECT DEBIT The UK’s first bank built exclusively for tablet and smartphone users has turned to popular payment method Direct Debit to boost its offering

LONDON, Jan. 9, 2019 /PRNewswire/ — Vanilla®, a global open-loop gift card brand offered exclusively by InComm, today announced the launch of a new product line with its partner PrePay Solutions Ltd., Vanilla Go,

ATLANTA, Dec. 12, 2018 /PRNewswire/ — InComm, a leading prepaid product and payments technology company, today announced it has partnered with digital banking alternative Revolut to offer their prepaid cards at wilko stores, the retail chain at

What factors are reshaping the future of global payments? Let us know in this survey Have your voice heard by taking part in this year’s survey: Reshaping the global payments

ATLANTA–(BUSINESS WIRE)–Entersekt, an innovator in mobile-first fintech solutions, today announced the addition of digital identity and business development expert Jennifer Singh to assist in strategic business development. Singh’s appointment comes

Compass Plus, an international provider of retail banking and electronic payments software to processors and financial institutions, has announced that SINNAD, a leading GCC third-party payment service provider based in Bahrain,

At the end of November 2018, one of the largest private banks in Azerbaijan – Unibank completed the migration of its personalisation centre from several third-party solutions to an in-house card personalisation

IDEMIA, the global leader in Augmented Identity, is very proud to announce that CloudCard+, a Strong Customer Authentication solution, based on mobile and biometrics, has been recognized as a winner

LONDON, 9 January 2019: International payments company Moorwand has announced that it is launching the first pre-paid corporate and consumer cards to be issued in the UK in partnership with

No signature strip and it will degrade in waste. Innovative new card from leading digital bank challenger coming early this year London, 3rd January 2019: Cashplus, the leading digital banking

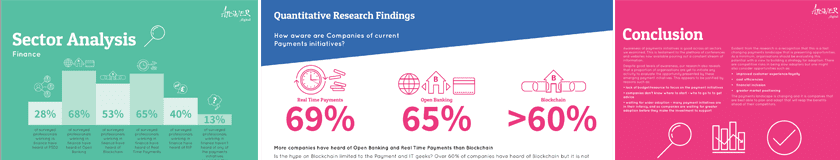

The UK payments landscape is shifting significantly. Mobile technology, Real Time payments, blockchain, PSD2 and Open Banking are all bringing disruption to the Payments world. This white paper analyses the impact

Find out more about Request to Pay at our Centre of Excellence website, a one stop shop for all things Request to Pay. Learn about Request to Pay by viewing

At this moment of time we are seeing the UK payments landscape shifting significantly. Mobile technology, real time payments, blockchain, PSD2 and Open Banking are all bringing disruption to the Payments

(Get 15% discount on the Forum using code PAY15) The Center for Financial Professionals have interviewed a few speakers ahead of their 2nd Annual Payments Forum 2019. Here is a

The payments industry is a rapidly advancing sector with a range of regulatory changes on the horizon. Given the fundamentals of the payments industry on the banking industry as a

London – 11 December, 2018 – Pay.UK’s Faster Payments team is today announcing the official launch of the anti-fraud Mule Insights Tactical Solution (MITS) following a successful pilot by participants

Jane discusses how AML systems are a powerful tool to help protect against fraud in the system, and help big banks better address issues of potential risk. Read more here.

Anna Tsyupko is the CEO and co-founder of the B2B payments company, Paybase. They provide the most flexible payment solution for platform businesses – such as online marketplaces and gig/sharing economy

W2 welcomes newest Commercial team member, Teresa Affinito and new Head of Product, Ben Preston-Marriott. W2 are very excited to announce that we have been listed as a RegTech 100

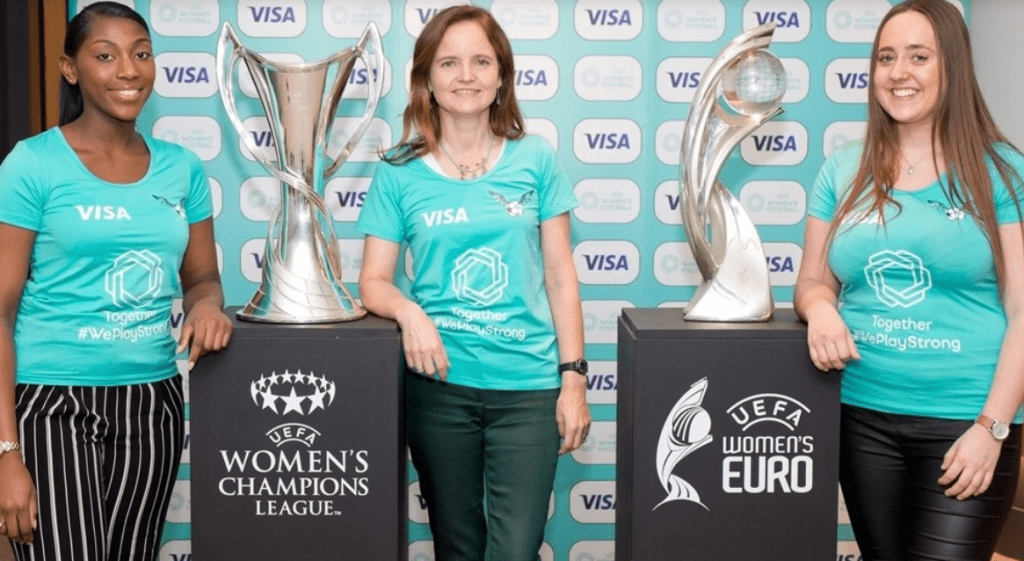

Visa will build upon success of 2018 FIFA World Cup Russia™ to bring more one-of-a-kind experiences to football fans globally Expanded presence will include new women’s football events across Europe,

(COPENHAGEN, December 14, 2018) – Coinify ApS, an established global virtual currency payment platform, has successfully acquired BetterCoins, a fast-growing virtual currency broker founded by Mads Johan Eberhardt, a serial entrepreneur

Cybertonica’s Technical Advisor and Director for Partnerships and Training, Dr. Ekaterina Safonova, wrote an abstract on payment fraud prevention and management for The PayTech Book. Launched by Wiley and FINTECH Circle, The

Paybase hosted the Sharing Economy UK festive networking event last night! It’s great to see the success platform businesses have had this year and hear the exciting plans they have

It’s that time of year again. I’ve had a chat with my colleagues at Consult Hyperion, gone back over my notes from the year’s events, taken a look at our

At Visa, we believe in acceptance everywhere – from the pitch to the boardroom. It’s because of this, that we’re proud to announce our ground-breaking partnership with UEFA to support

Tuesday, February 05, 2019, 04:00 PM Greenwich Mean Time Join ACI and SWIFT to hear first-hand how they are creating and monetizing new customer propositions, rapidly launching new products and

Job Description – Business Admin & Marketing Intern Who We Are? Cybertonica is a state-of-the-art FinTech business based in London’s Old Street area in the heart of Cisco Innovation Hub, IdeaLondon.

Konsentus, a RegTech solutions business who facilitate checking the regulatory status of Third-Party Providers enabling Financial Institutions to be PSD2 open banking compliant is pleased to announce the launch of

All Bahraini banks moving quickly to comply with Central Bank’s adoption mandate; 11 banks already connected via single open banking API in regulatory sandbox 12th December 2018 – Signalling the

UEFA has announced a landmark multi-year partnership with Visa. The global payments technology company becomes the first ever UEFA sponsor dedicated to women’s football, following the unbundling by UEFA of

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.