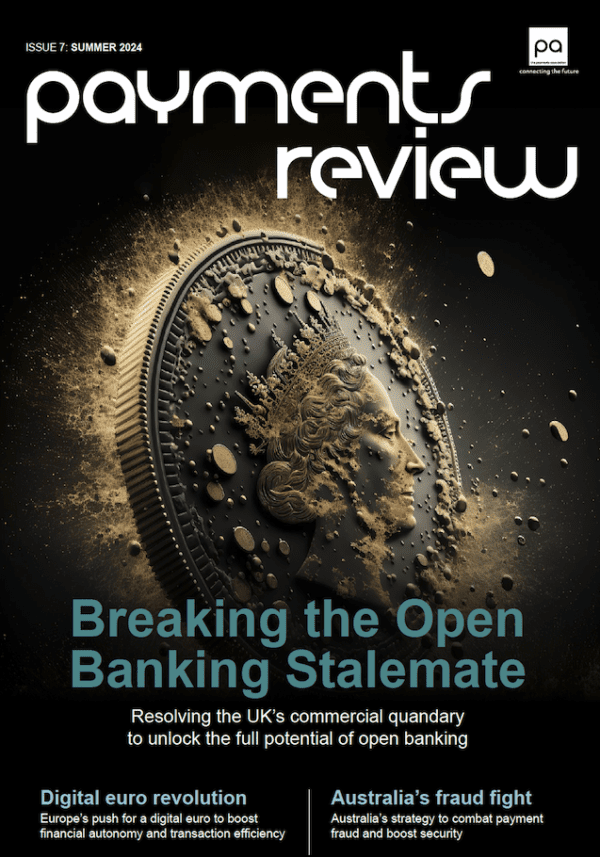

Stay up to date on the latest developments in the payments industry from the UK, Europe and beyond, with Eversheds Sutherland’s quarterly bulletin, Payment Matters.

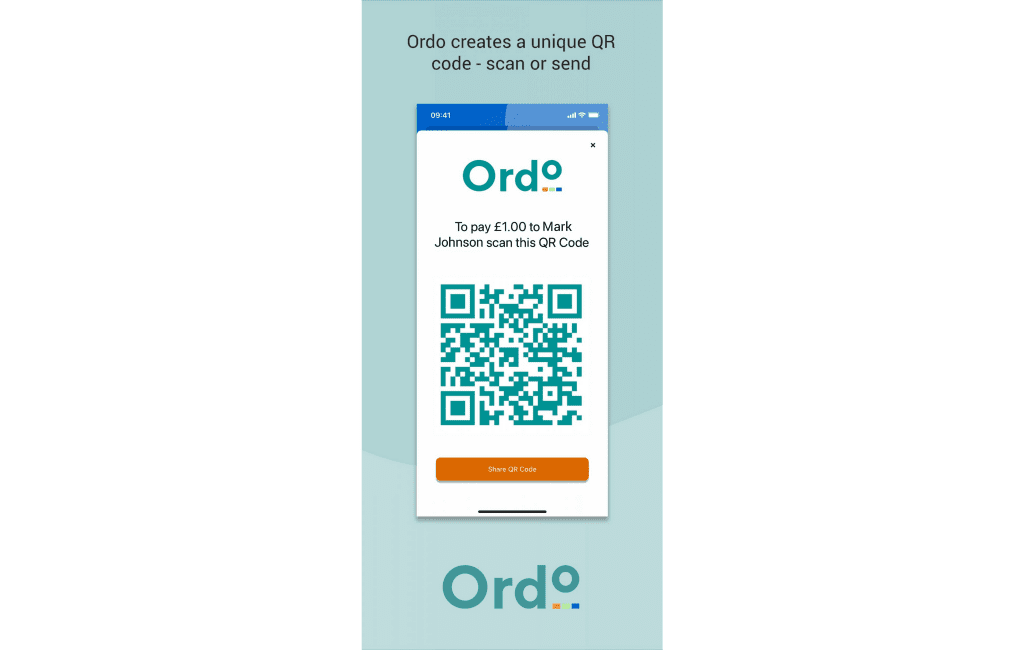

In the latest edition, they discuss: significant developments in the UK’s plans for Open Banking and Open Finance; continued focus on the effectiveness of the revised payment services directive (PSD2); the Contingent Reimbursement Model (CRM); newly introduced for payment initiation service provider (PISP) payments, and the recent review published by the Lending Standards Board (LSB); and the success of Instant Payments in the Netherlands, and the drive for eurozone coverage, backed by the European Central Bank.