How Swift is moving the global financial industry towards instant and frictionless payments

Swift drives global interoperability and innovation, aligning with the UK’s National Payments Vision to enhance seamless, secure payments.

Swift drives global interoperability and innovation, aligning with the UK’s National Payments Vision to enhance seamless, secure payments.

As banks migrate to the cloud, they must strengthen security with AI, zero-trust, and continuous education to combat growing cyber threats.

Toqio partners with Visa to enhance corporate liquidity and efficiency by integrating financial services directly into business networks through embedded finance solutions.

PAYSTRAX and CatalystPay’s partnership exemplifies the power of collaboration in delivering efficient, secure payment solutions.

Entersekt has been recognised as a leading vendor and the highest-rated authentication-focused vendor in the July 2024 Liminal Link Index for Account Takeover (ATO) Prevention in Banking report.

Paymentology partners with Salaam Bank’s Waafi to launch the first tokenised tap-to-pay card in the Horn of Africa, advancing digital and contactless payments.

Businesses face rising ESG demands, and Paynetics offers embedded solutions to manage environmental impact, social responsibility, and governance.

Trading 212 partners with Paynetics to integrate multi-currency accounts and card payments, allowing customers to spend directly from their account balance.

Paynetics has acquired Novus, the UK’s first “impact neobank,” to enhance ESG initiatives and allow users to support causes and track their carbon footprint with each transaction.

Early-stage fintech companies must navigate regulatory compliance, protect intellectual property, manage personal data, and maintain organised documentation to ensure smooth operations and growth.

The first stablecoin was launched in July 2014, 10 years ago. A decade later, it has reached a market cap of $165 billion, with trillions in stablecoin payments settled each

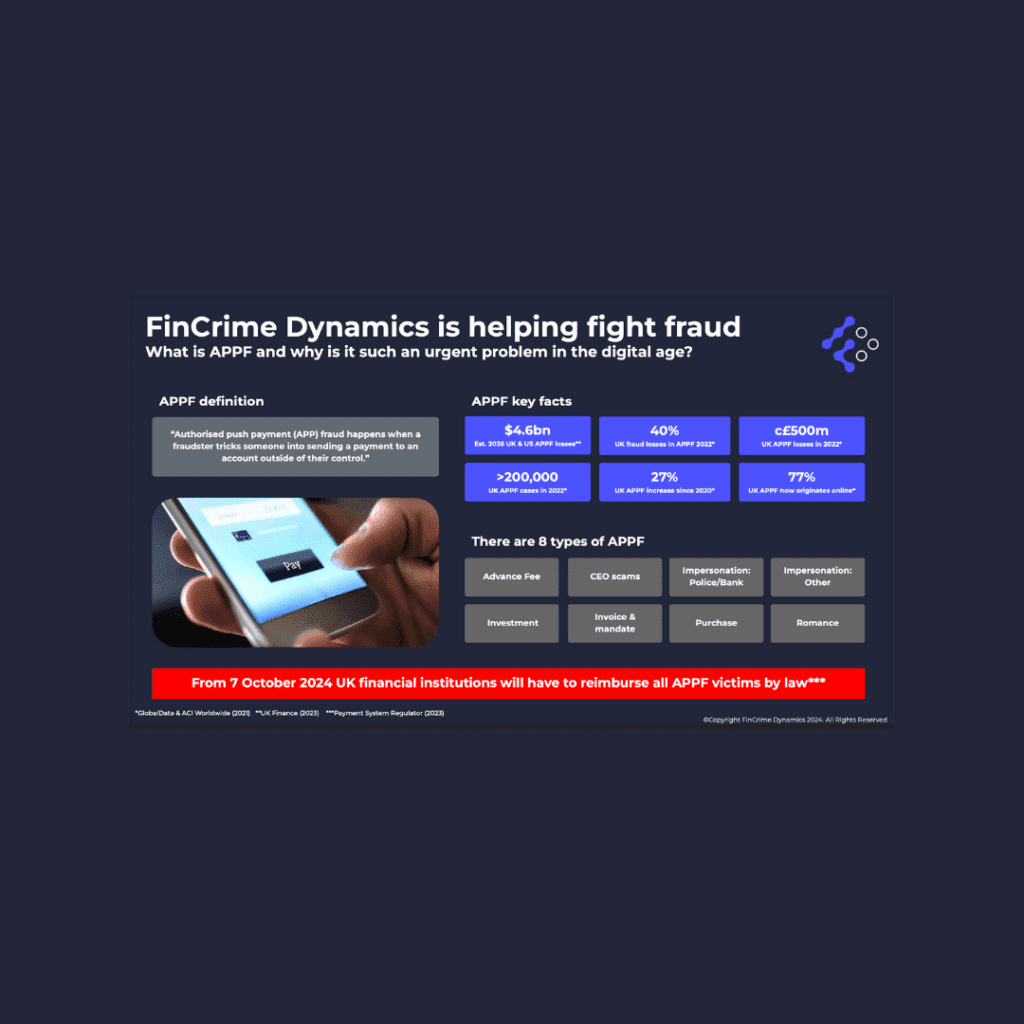

From 7 October 2024, UK financial institutions must reimburse APP fraud victims. FinCrime Dynamics’ SaaS service helps banks identify vulnerabilities, quantify losses, and improve fraud defences.

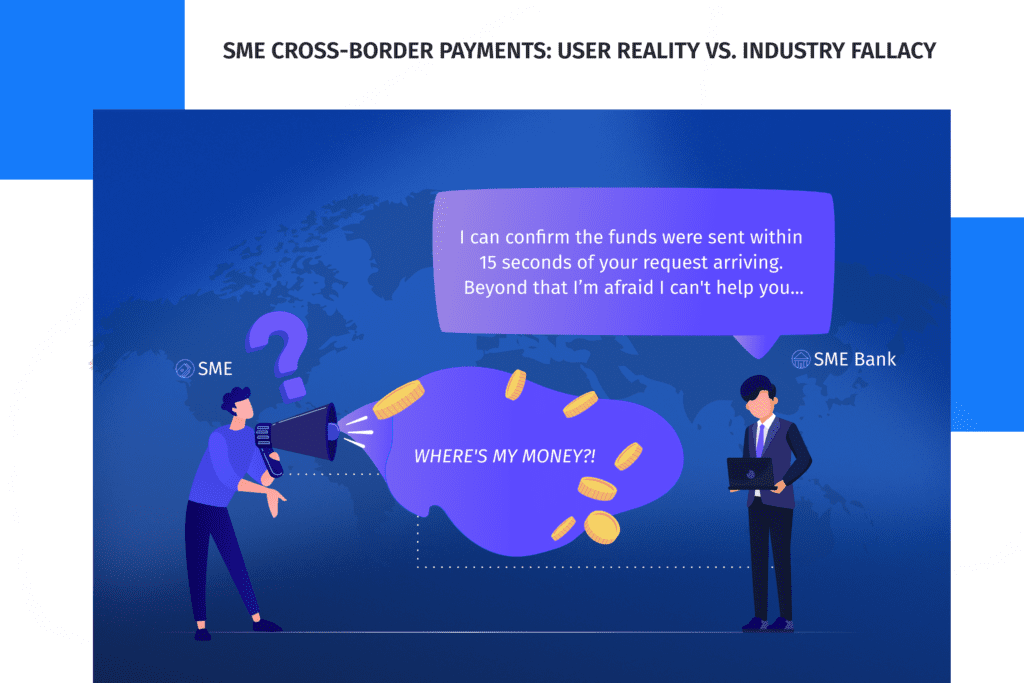

The white paper, “User Reality vs. Industry Fallacy,” examines cross-border payment challenges for SMEs and their crucial role in the global economy.

Mitto’s report shows increasing consumer demand for personalised, real-time communication via SMS and WhatsApp, aiding businesses in boosting satisfaction and engagement.

Issuers and merchants should adopt click-to-pay for a faster, safer eCommerce experience, reducing cart abandonment and enhancing security through tokenisation.

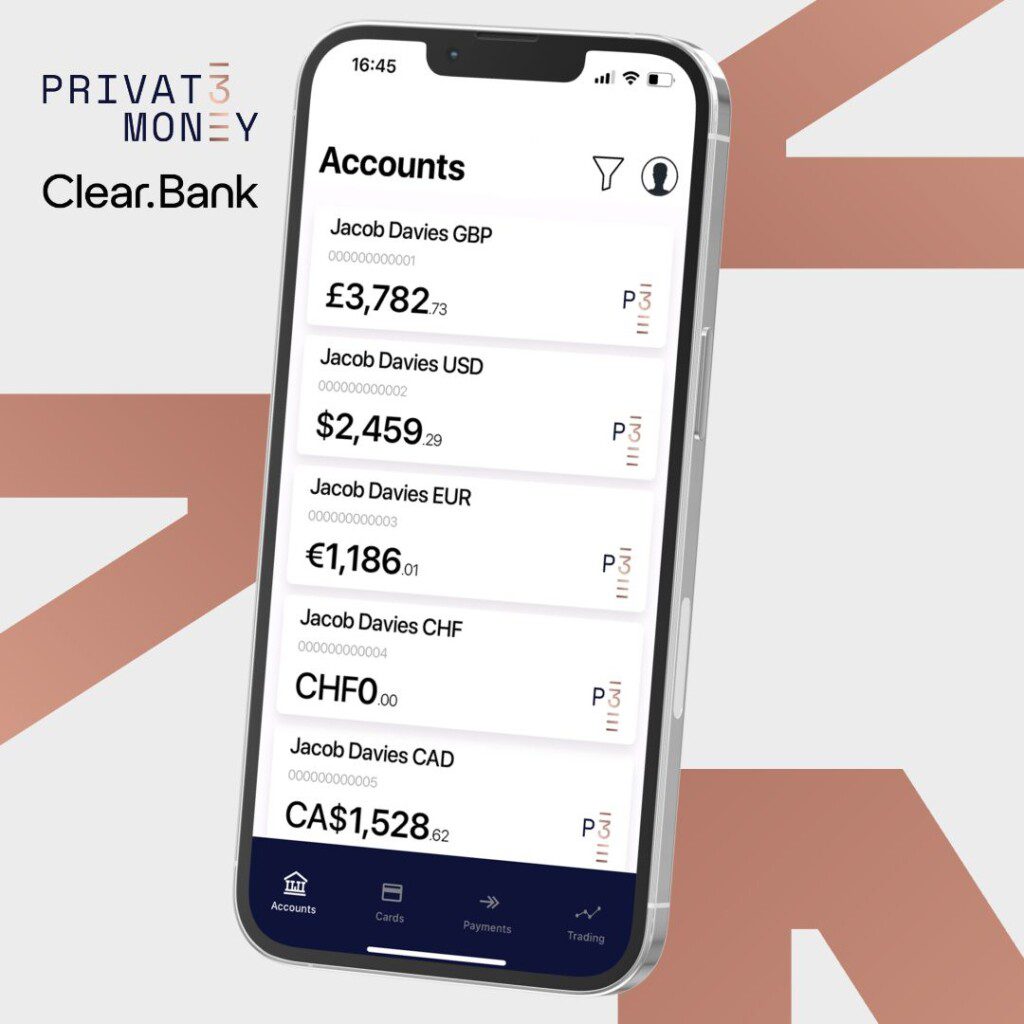

Privat 3 Money and ClearBank offer a multi-currency account with a single IBAN for seamless transactions and a new stainless steel P3 Debit Card, enhancing global financial management.

Paynetics has acquired Novus, the UK’s first “impact neobank,” to enhance ESG initiatives and expand its embedded finance offerings, empowering clients to integrate positive impact efforts with financial services across Europe.

Paynetics has been selected for TechRound’s FinTech 50 list for 2024, recognised for its innovative Embedded Finance solutions that seamlessly integrate payments into business offerings.

Key trends in the payments industry include AI for enhanced accuracy, blockchain for cross-border payments, tokenisation for security, digital wallets gaining popularity, and the growth of buy now pay later solutions.

The Convego Service Market platform by Giesecke+Devrient simplifies access to intelligent payment solutions, offering banks a unified, modular approach to manage physical and digital card issuance efficiently.

Giesecke+Devrient’s Convego payment card portfolio allows banks to use innovative and sustainable materials, such as wood and ceramic, to create unique and personalised payment cards.

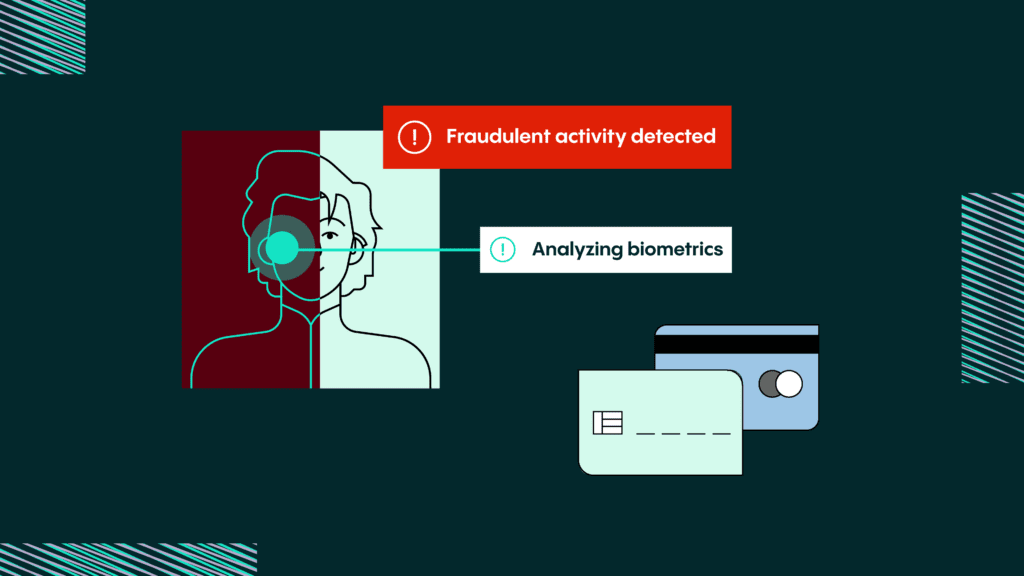

The rise in online payment fraud has led nearly 98% of industry leaders to enhance security with identity verification and facial biometrics.

Trust Payments has partnered with Freepay to enable fast and secure payouts via Visa and Mastercard for Danish merchants, starting with Bingo.dk, enhancing payment processes and customer satisfaction.

Waitrose is partnering with Trust Retail to implement a dynamic inventory management system, improving stock visibility and freeing up Partner time for customer-facing activities, with full rollout expected by 2025.

Griffin, a UK fintech bank, has achieved B Corp certification, demonstrating its commitment to high standards of social and environmental performance, transparency, and accountability.

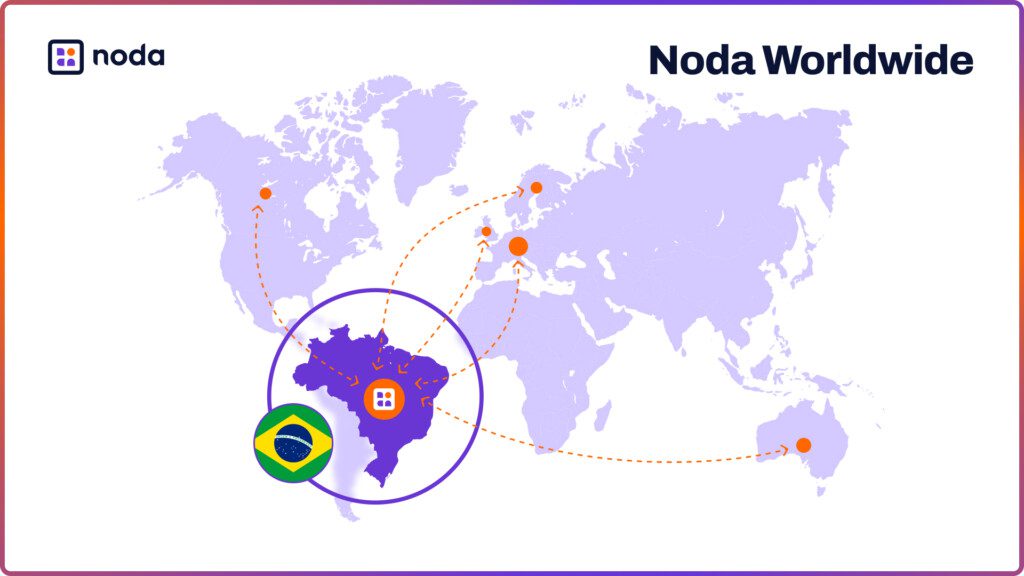

Noda is expanding its open banking network to Brazil, allowing merchants to access seamless cross-border payment services, unified reconciliation, and instant banking across Brazil, Europe, the UK, and Canada.

New regulations will cap overdraft fees, drastically reducing them from around $30 to approximately $3, significantly impacting banks’ revenue streams.

Thames Technology, a leading provider of innovative payment solutions, has announced that it is one of the first card manufacturers to offer Mastercard-approved pre-paid paperboard cards. Designed exclusively for magnetic

The cross border payments landscape is experiencing rapid expansion. New corridors, new customers and new technology and processes are seeing more money than ever move across the globe. Consumer and

The digital payments landscape is rapidly transforming, driven by technological advancements and changing consumer preferences. Electronic money institutions (EMIs) facilitate secure and efficient digital transactions, enabling businesses and consumers to

Unlimit partners with Convera to simplify cross-border tuition payments for students in emerging markets, starting with Brazil using the PIX payment system.

The payments space is facing a surge in online fraud, with almost 90% of business leaders reporting that online fraud is costing them up to 9% of their annual revenue

Fscom is hosting a webinar session discussing the FCA’s upcoming safeguarding consultation, exploring key implications and considerations for the industry.

Predicting customer lifetime value (LTV) equips businesses to allocate resources efficiently, focus on high-value customers, and enhance personalised marketing strategies, thereby increasing profitability.

Edenred Payment Solutions has appointed Rehana Mitha as its new managing director to enhance offerings and strategic partnerships in the UK and Europe.

Confirmation of Payee (CoP), a relatively new service in the UK banking landscape, has emerged as a powerful weapon in the fight against fraud. By verifying the name on a

PLIM Finance officially launched their Swiss Marketplace service this May, holding an exclusive event on May 23rd, at Fame Gallery, Talstrasse 9, Zurich, that showcased their European expansion within the aesthetic Fintech industry

Unlimit and DEUNA have partnered to enhance cross-border payments for enterprises in Latin America and beyond, aiming to improve approval rates, reduce costs, and lower fraud risks.

Ayruu has partnered with Edenred Payment Solutions to use virtual cards for streamlined B2B payments across France and Europe, enhancing payment efficiency, security, and cash flow management

TerraPay and Multipass have partnered to enhance cross-border payment solutions for corporate customers, improving efficiency and cost optimisation

TerraPay and Al Ansari Exchange have partnered to enhance their remittance services by integrating TerraPay’s payment solutions with Al Ansari’s network.

PSD2 mandated banks to share customer information with licensed third-party providers through secure application programming interfaces (APIs), contingent upon customer consent.

The UK and EU are set to implement Confirmation of Payee (CoP) and Verification of Payee (VoP) by 2025 to enhance payment security by verifying account details to reduce fraud and errors.

Veriff’s 2024 Fraud Index highlights that nearly half of consumers encountered payment fraud last year, underscoring the critical need for enhanced biometric security in online payments.

Chat GPT, nearing 200 million users, powers transformative tools like Gemini to enhance mundane tasks and overall efficiency in various industries, including fintech

In 2023, the UK government committed £100 million and 400 new fraud officers to reduce fraud by 10% by 2025, amid increasing social media and deepfake scams, according to IDnow’s UK Fraud Awareness Report.

Payall has partnered with Latvian regtech leader Huntli to enhance fraud prevention and transaction monitoring for a broad spectrum of financial institutions, bolstering capabilities in fraud and risk mitigation.

ComplyAdvantage acquires Golden to enhance its AI-driven financial crime risk management solutions with advanced data integration capabilities

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.