UK Confirms Regulatory Regime for Cryptoassets

Key Takeaways Phase 1 — Regulation of fiat-backed stablecoins The issuance and custody of fiat-backed stablecoins in or from the UK will be subject to regulatory authorisation requirements under

Key Takeaways Phase 1 — Regulation of fiat-backed stablecoins The issuance and custody of fiat-backed stablecoins in or from the UK will be subject to regulatory authorisation requirements under

Our new report, Commercial payments, reinvented, combines input from 211 banks and payments providers with a survey of 223 commercial payments clients from retail, auto and industrial, insurance, travel and rail, telecom and health and public service to explore where expectations and perceptions overlap — and where they diverge. It captures the state of play for today’s commercial payments market and maps its future trajectory.

As part of yesterday’s 2023 Autumn Statement, the Future of Payments Review was published. Commissioned by HM Treasury and led by Joe Garner, the review provides a number of recommendations on the

PayAlly has been recognised as the 19th fastest-growing business in London. This is part of the Fast Growth 50 index for 2023, which identifies the fifty fastest-growing companies across six

Thames Technology, one of Europe’s leading card manufacturers, has partnered with IDEX Biometrics, a leading provider of fingerprint identification technology, to accelerate the commercialisation at scale of biometric payment cards.

Introduction: Getting noticed in the competitive world of fintech can be tough. But you probably have at least one unique asset that you are not making the most of –

As regulatory thinking evolves, firms must ensure that any current or planned use of AI complies with regulatory expectations. As financial services firms digest FS2/23, the joint Feedback Statement on Artificial

FERO is delighted to announce the successful closure of a $3 million seed round from Coatue, Volta Ventures, and Antler. This capital will enable FERO to expand and enhance its unique online payment solution

Inpay is looking a bit different today, you may have noticed. But what’s behind our brand refresh? We’ve been working hard to strengthen and differentiate our commercial proposition during 2023

Form3 to provide SEPA Instant, Credit Transfer and Direct Debit connectivity for Klarna’s 150m active customers across more than 500,000 merchants. Form3, the cloud-native account-to-account platform, is delighted to announce

Extended partnership between PXP Financial and Foregenix to include best-in-class eCommerce cyber security monitoring October 31, 2023 – PXP Financial, the experts in global acquiring and payment, services, today announces a new partnership agreement

The Payment Systems Regulator (PSR) has published its inaugural APP Scams Performance Report, which presents data from the year 2022. This report aims to provide transparency on the state of

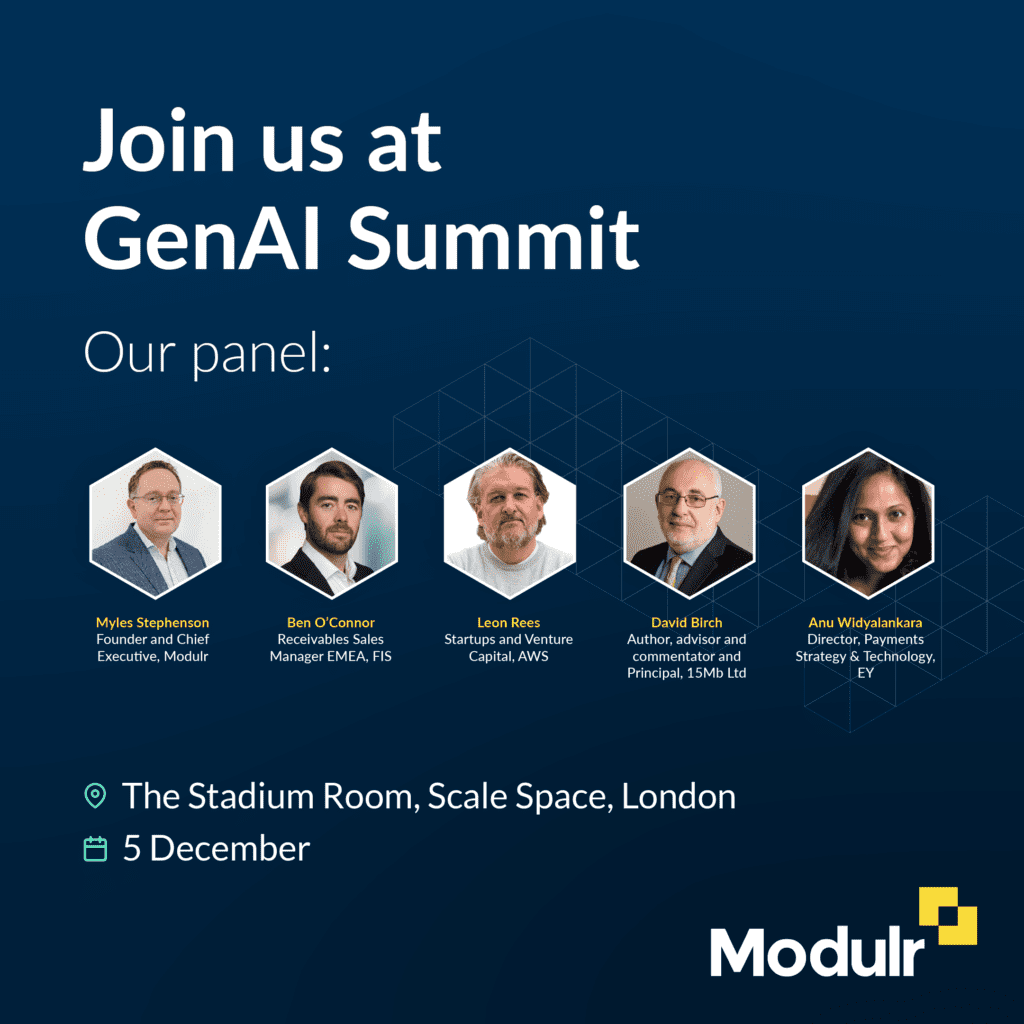

We are excited to invite you to the Modulr GEN AI Summit, scheduled for Tuesday, December 5th at Scale Space in White City, London. The summit will focus on exploring the impact

Due to a dwindling economy, higher inflation and a cash-starved population, retailers are facing a tough battle from the standpoint of acquiring new customers or retaining the existing ones. Adding

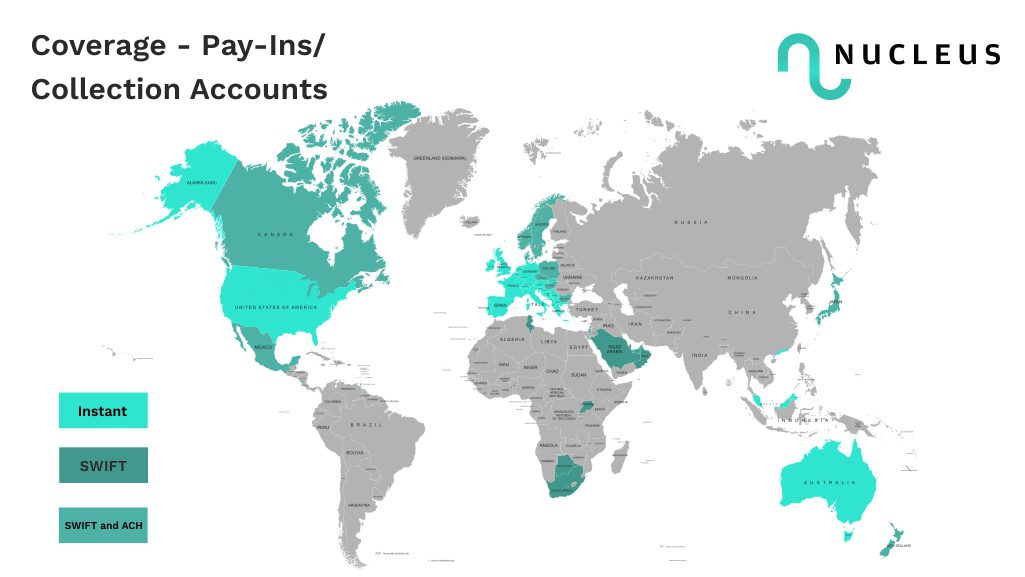

This addition to the Nucleus365 platform unlocks global payments with over 92 licences supporting operations in 30 different currencies, enabling merchants across the globe to make and receive payments in

Projective Group, a leading Financial Services change specialist, has today announced it has partnered with The Payments Association, an international payments community that aims to drive collaboration and innovation within

The financial industry is experiencing a seismic shift, fueled by the advent of artificial intelligence (AI) and open banking. Far from being isolated phenomena, these two revolutionary forces are converging to redefine the very fabric

Asia is the largest and most populous continent in the world, home to more than 60% of the global population – some 4.56 billion people. This vast region spans over

At Starling Banking Services, we want to help financial services thrive. By providing organisations – FinTechs, credit unions, insurance dispersers, investment companies, and point of sale companies – with payment

With over 50 leading brands including Aldi, Asda, Ikea, Primark, Amazon and Currys, HyperJar’s innovative service offers up to 15% cashback Alex Preece, CEO and founder of Tillo, and Nicola

In this webinar, Bottomline, HSBC and Swift will discuss the current status of the ISO 20022 migration and what Banks and FIs should focus on to ensure operational efficiency and

In a digital age where immediacy in payments is crucial, understanding the challenges and opportunities in real-time systems is paramount. As industry leaders, we’ve compiled a comprehensive white paper to

Having a good credit score is life changing. For many, it can open the door to opportunities they would never have been able to access otherwise, whether it’s getting a

Baringa were thrilled to attend Sibos this year. The four days of content covered everything from geo-political and financial headwinds, global payments modernisation, T+1 settlement and tokenisation, through to the

Confirmation of Payee (CoP), initiated in 2017 and launched in 2020, has proven to be an effective tool against Authorised Push Payment (APP) Fraud in the UK. CoP is a

Banks and FIs need to take advantage of the opportunity to compare their strategic priorities, product roadmaps, and plans for future innovation with their peers. In the process, they can

Headline: Too legit to quit: Crypto is going mainstream, whether we like it or not By Dima Kats, Founder and CEO, Clear Junction For thousands of years, any financial transaction

Join Head of Market Insights Steve Dooley as he shares a taste of the 2024 edition of Convera’s annual flagship report to help businesses navigate what promises to be yet

From high inflation to rising interest rates and geopolitical uncertainty, the global trade landscape is as complex as ever. As 2024 approaches, how can your business stay ahead of new

American Express releases new research revealing that UK businesses are investing in modernising their payment systems to boost efficiency and protection against fraudulent activity. The new study surveyed financial leaders

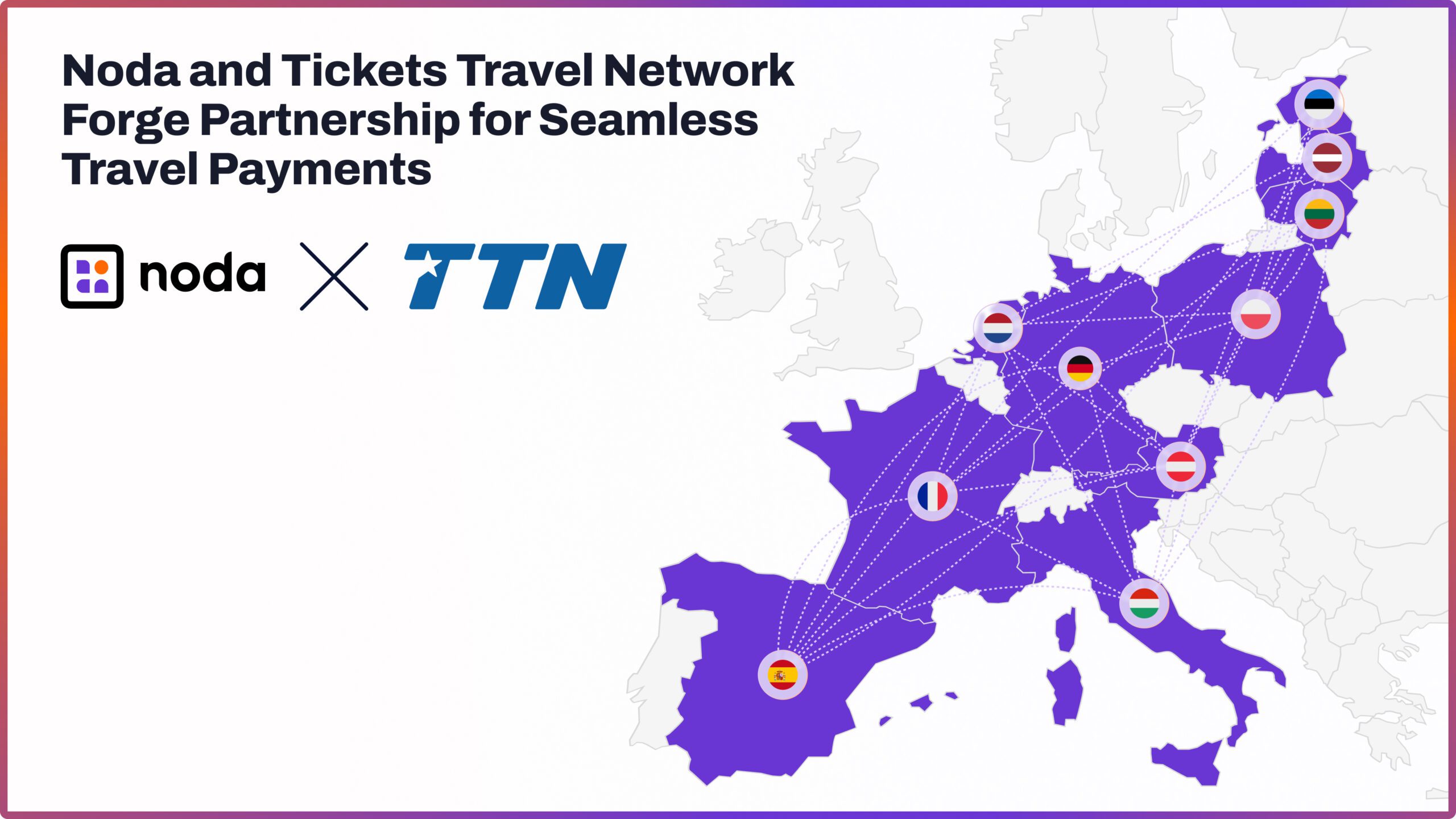

The partnership enables streamlined payment processes across multiple European destinations, with a focus on delivering convenient and efficient payment solutions to travellers. The global open banking provider Noda has joined

Decentralized finance experts discuss how the technology could accelerate and shape the next generation of payments As the outsized hype of decentralized finance (DeFi) from the past couple of years

Sumsub Multiverse: The Roadmap to AI Regulation, a thought-provoking event that delves into the exciting world of artificial intelligence and its regulation. This occasion promises to be an illuminating experience,

UK regulators are prioritising APP scam prevention after £480 million in customer losses in 2022, proposing new PSR rules for stricter fraud warnings and reimbursements, especially protecting vulnerable customers and small businesses

We are excited to launch our Local Payouts – Think Global, Pay Local solution: – Available in 132 countries in 80 currencies. – Facilitated by 235+ verified partners across 4

Nikulipe has unveiled a strategic collaboration with Aircash, a dominant digital wallet provider in Central and South-Eastern Europe. Within this partnership, Nikulipe will offer Aircash additional top-up options for the

Join our Financial Services Regulatory Group experts on Tuesday, 3 October 2023 as they discuss recent developments about the Mansion House Reforms presented by the Chancellor in July 2023 and what

The UK’s Financial Conduct Authority (FCA) has published its latest board minutes highlighting its increasing focus on artificial intelligence (AI), in which it “raised the question of how one could ‘foresee harm’

In an ever-evolving digital landscape, where online banking and digital payment methods are on the rise, it’s crucial to remember that not everyone has fully embraced this shift. At allpay

Open Banking is not just a trend but a transformative force, driving a sea change in how consumers and businesses interact with financial services. Central to this transformation are Application

We are thrilled to announce that Craig Luther has joined Dialect Communications as Head of Sales, another significant milestone for our company as we further expand our team. With over

NatWest’s open banking payment platform Payit has introduced a new way for businesses to make a payment without needing the recipient’s account details, by sending a secure, single-use payment link.

Nium, the leader in real-time global payments, has opened a new European headquarters in London to accelerate business expansion across Europe and affirm its commitment to the UK as a

FIS senior sales executive Julien Farley discusses why he believes that the payment industry should adopt a more open-minded approach to the different payment methods that are used worldwide.

Blankfactor, a leading provider of IT services for payments, has announced the appointment of Petru Metzger as President, Global Head of Payments. Petru brings a wealth of experience in the

More and more and more legacy financial institutions are turning to fintechs and digital-first financial services providers as partners in the race to provide a better customer experience. 🚀Discover how

Learn what “higher rates for longer” may mean for FX markets as central bankers continue the fight to tame inflation. Read full report here: https://convera.com/blog/foreign-exchange/september-outlook-central-banks-stay-vigilant-as-global-growth-slows/?utm_source=TPA&utm_medium=Email&utm_campaign=2023-Smart+Money+Moves-1to1+Meetings+UK-Live-Events-TPA-MKTG&utm_term=TPA-GCO-Sep&utm_content=7016R000001ROcvQAG

Drawing insights from independent research, including a survey of 250 executives and managers from UK banks or financial firms, Weavr’s whitepaper provides a comprehensive look at current attitudes towards, and actions

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.