Banks call for all industries to be accountable for APP fraud

Santander is calling for more to be done to combat fraud because the PSR’s mandatory reimbursement plans for APP scam victims will be an unsustainable cost for banks and schemes.

Santander is calling for more to be done to combat fraud because the PSR’s mandatory reimbursement plans for APP scam victims will be an unsustainable cost for banks and schemes.

The ubiquitous adoption of digital technologies and a huge uplift in e-commerce has resulted in unprecedented levels of online financial fraud. The UK alone saw a 71% increase from 2020

Fraud has become the most commonly experienced crime in England and Wales, and Fintech companies are working hard to develop solutions which help to reduce the number of victims. UK-based

We are proud to announce that KYP have been accepted onto the London & Partners Mayor’s International Business Programme as one of the best FinTechs in London. The programme is

Building on its recent launch and in line with its growth plans for North America and Europe, KYP today announced the closure of its pre-seed funding round with total funds

A major report has revealed the key financial crime and anti-money laundering (AML) compliance challenges facing financial services firms in 2022. Produced by leading governance, risk, and compliance consulting firm fscom, the

The PSR is seeking views on proposals to increase the protections against APP scams, create quicker and mandatory reimbursements and put greater pressure on banks and building societies to tackle APP fraud. The Payments Association will be responding.

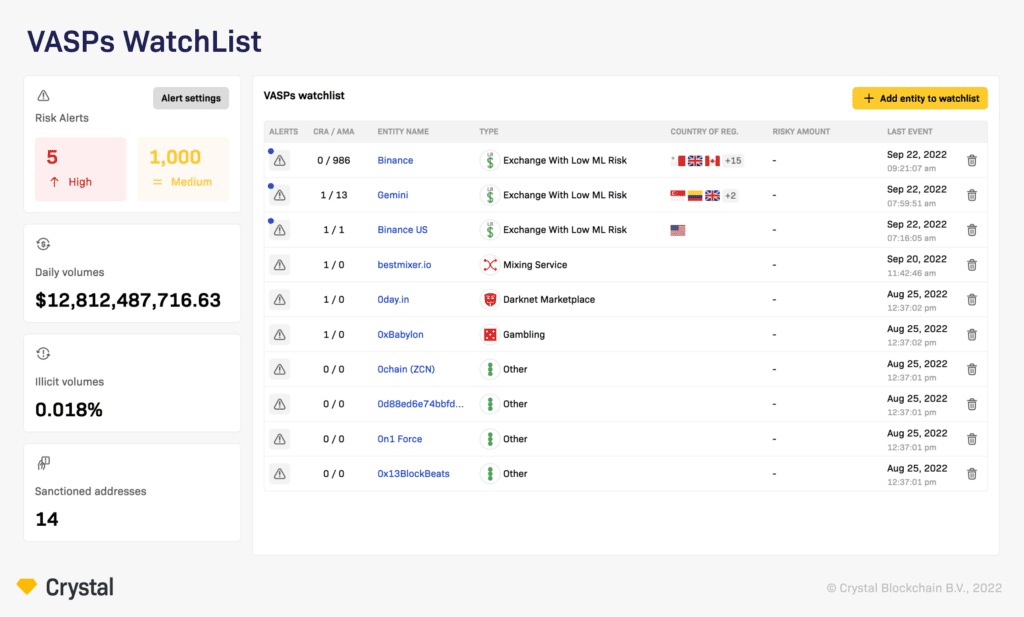

The all-new “watchlist” functionality sends alerts and helps to identify possible risks with VASPs for banks and FIs. The Crystal team is introducing new functionality in BETA that allows for

The Payments Association asked Kate Fitzgerald, head of policy at the Payment Systems Regulator, about her work and what she will be discussing at the Financial Crime 360 conference.

In the coming months, Project Financial Crime members expect criminals to become quicker at exploiting the government’s cost of living schemes to help the vulnerable.

Fraud is a multi-faceted threat. From deliberate error to organised crime there is no one methodology that can be used to tackle all fraud typologies. If we accept this as the reality,

LONDON, September 7th – BaaS (Banking as a Service) fintech firm Griffin announces the launch of Verify, a customer onboarding product. Verify will help regulated fintechs onboard customers at scale

Registration is now closed INNOVATE. EDUCATE. ACCELERATE. Tackling fraud and money laundering head on through industry collaboration and adopting new technology. Financial Crime 360 is a conference and exhibition that

Leading dispute technology specialist, Chargebacks911, today announces the appointment of Ex Accertify Head of Dispute Manager, Jennifer Lichner, as SVP of Operations.

Tickets are on sale now for the Dark Money Conference 2021 – book your place today! https://darkmoneyconf.com/tickets/

– What is Behavioral Biometric Analysis?

– What is a BionicID™?

– What makes Revelock’s BionicID™ solution unique in fraud prevention?

– How can BionicIDs™ be used to stop Impersonation and Manipulation attacks?

– What is BionicID™ analysis best suited for?

– Does BionicID™ data collection or analysis impact the User Experience (UX)?

– Introduction

– Deep fakes

– SIM swap scams

– SMS OTP fraud

– Session hijacking via RATs

– Originality is key

– Introduction

– Reducing false positives and negatives

– Know Your User

– Automating fraud response

– Conclusion

The proposed anti-money laundering (AML) authority (AMLA) will be a gamechanger for the supervision of AML efforts in the European Union, experts in the field have told VIXIO.

Cybertonica are areintensifying their partnership with @W2GlobalData, global experts of regulatory compliance technology to bolster combined regtech and fraud offerings to multiply the value & benefits to all their shared & new clients!

Register today for your place at fscom’s ‘The Dark Money Conference 2021’, taking place over 3 half days from 15-17 September 2021, with 20% OFF exclusive to Payments Association members using the promo code DMCPayments Association20.

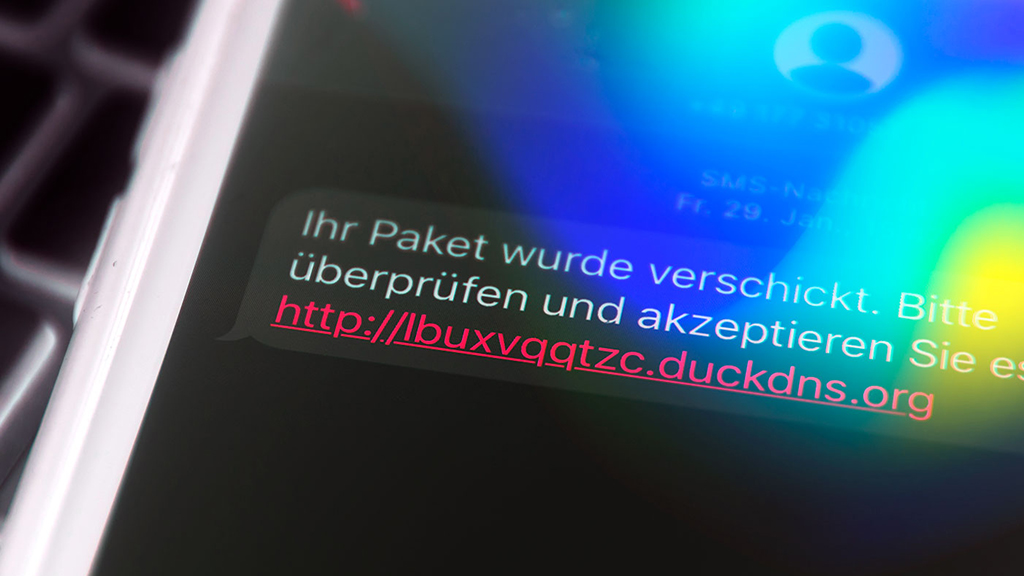

The distribution of this banking trojan is one of its main strengths since the use of text messages impersonating delivery services companies is a really good idea for deceiving the victims and getting them to install the malicious application.

The mandatory geolocation in banking transactions came into force in Mexico as of March 23, 2021

Today is a monumental day for us and we’re delighted to announce that Revelock · A Feedzai Company is getting acquired by Feedzai.

Our CEO Pablo de la Riva Ferrezuelo explains how – by joining forces – the two companies are stepping up the fight against financial crime in this era of cashless commerce..

For e-commerce and contact centre payments, cards have been the only payment option but are costly to businesses and increasingly difficult to use for consumers. Open banking regulation and technologies has created new options for businesses

Monzo Bank has been in financial danger for some time and now, in its latest annual report, has admitted that the UK’s Financial Conduct Authority (FCA) is investigating it for its compliance or otherwise with the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017.

– Introduction

– Poor hygiene & Persistent threats – ‘perfect storm’ of online fraud

– Customers expect Banks to Know Your User

– Fraud Fighting Collective – Fraud Fusion Centers

– Overwhelmed with Alerts, Automation is key

– Clear ‘risk calculation’ – Frictionless First

– No silver bullet – but there are best practices

– Introduction

– What is BionicID™ analysis best suited for?

– Does BionicID™ data collection or analysis impact the user experience?

– Does BionicID™ data collection/analysis comply with SCA/PSD2?

– Does BionicID™ data collection/analysis (behavioral biometric digital identity) comply with GDPR?

– Introduction

– Physical vs. Behavioral Biometrics

– What is a BionicID™

– What makes Revelock’s BionicID™ solution unique in fraud prevention?

– What makes Revelock’s BionicID™ more accurate than other behavioral biometric solutions?

Payments Association members can receive an exclusive 20% discount when purchasing their tickets for the Dark Money Conference 2021!

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.