Cybertonica – The GDPR Reality: An evening on Cybersecurity and GDPR

The clock is ticking! The deadline for the General Data Protection Regulation is fast approaching. In May 2018, companies will be required by law to comply with the new data

The clock is ticking! The deadline for the General Data Protection Regulation is fast approaching. In May 2018, companies will be required by law to comply with the new data

Since the launch of the SCT Inst rulebook in November 2017, many more banks are live and offering real-time payments to their customers, with most of the rest committed to

The collaboration has created a full-service bank account that combines banking and accounting for freelancers, self-employed people and small businesses. 7th February 2018, London, UK – PrePay Solutions (PPS), Europe’s leading prepaid and

Ramparts welcomes Karen Griffin to our team. We are delighted to welcome Karen Griffin, who joins our legal and fiduciary teams in Gibraltar as our Head of Risk, Compliance &

Banking Circle supports Payments Association FinTech Regulation Helpline www.bankingcircle.com London, 11th April 2018 – The The Payments Association, with the support of its Benefactor, Saxo Payments Banking Circle, has launched

London, 29th May 2018 – According to new research commissioned by ground-breaking financial utility, Saxo Payments Banking Circle, SMEs are facing potentially fatal challenges in accessing finance to support the

For consumers, increased trust and ease of use are key to driving mass adoption of Conversational Commerce and unleashing its potential June 4, 2018 – Mastercard today reveals the insights from

Leading virtual currency platform provider, Coinify, welcomes Hans Henrik Hoffmeyer to solidify their market position Coinify ApS, an established global virtual currency platform offering blockchain payment solutions, is pleased to

First example of a Mastercard service made possible by the integration of Vocalink and its real-time payments capabilities London, June 6th 2018: Mastercard today confirmed that it will soon launch

Coinify has recently experienced a growth spurt where we have welcomed a talented group of experts from various industries to join our team and help grow our company’s breadth of

Atlanta, USA, June 13, 2018 – Entersekt, an innovator in push-based authentication and app security, has opened a new office in Atlanta to support the company’s continued growth and serve as

As part of our company’s growth, we are expanding our current business offering with compliant corporate brokerage services for virtual currencies, with bitcoin and ether as our starting point. Coinify

German consultancy describes Entersekt product as a “state of the art solution” London, United Kingdom, April 12, 2018 — Entersekt, a leader in next-generation digital banking security, today announced that its mobile

May 15, 2018 (Copenhagen, Denmark) In light of the recently launched brokerage service for corporate clients, Coinify is pleased to present the first collaboration. In this partnership, Coinify is assisting the

London, 18th June 2018 – Miranda McLean, VP of Marketing at ground-breaking financial utility, Saxo Payments Banking Circle since its launch, has been appointed to the Executive Board of the

Konsentus, a RegTech company which facilitates checking the regulatory status and eIDAS Seal Certificates of Third Party Providers, along with the issuing of access tokens to enable FIs to be

Investment will accelerate the growth of GPS and drive its international expansion plans – GPS is the tech powerhouse behind the most exciting digital banks, challenger banks, fin-techs and financial

With the vast majority of e-money and payment institutions successfully re-authorised, let’s take a look at how the FCA intends to monitor this growing population of firms. Traditionally, e-money and

Europe’s largest capacity card manufacturer, Nitecrest, are pleased to announce two new Sales Directors will be joining the Group’s retail, commercial and banking divisions. Barry Bevan and Kevin Friedrich both

With all the excitement around re-authorisation, the ban on credit card surcharges and the new payment services activities, the less headline grabbing regulatory changes introduced by the second payment services directive (PSD2) have been

Brussels, 25 June 2018 – The SWIFT Community is to universally adopt the gpi service, in a move which will see all 10,000 banks on SWIFT’s global network use the global payments

This week, NatWest announced that it has teamed up with British mobile phone retailer Carphone Warehouse to trial a new online shopping system that lets customers pay directly through their bank account,

Paysafe has completed the acquisition of iPayment Holdings, consolidating their place as one of the top five non-bank payment processors in the US. Read more here.

The end of this month marks 10 years since Rihanna’s single, Take a Bow, reached number 1 in the UK singles charts. Although I know a little about Barbados, I am

CEO Acquiring and Card Solutions, Andrea Dunlop, features on the cover of this month’s edition of UK Retail Banker from RFi Group. Read her thoughts on how to bring greater

Mastercard expands investment in Europe to further power the expansion of FinTechs, helping them reach scale at speed May 17th, 2018 – Mastercard today announces the creation of Accelerate, a

Or maybe the headline should really read EU PSD2, open access APIs are not just for banks and the first thing we all need to be clear on is that

Read our interview with our director and Money20/20 and Fintech Finance Bitcoin Racer, Amelie Arras as she discusses what it was like racing across Asia using only bitcoin as payment.

The first thing to be clear about is that PSD2 open banking is not the same as UK Open Banking currently live with the CAM9, although not all of them

On 7th March, Cybertonica held an evening to have an open and frank discussion about The GDPR Reality at Level39, the world’s most connected community for FinTech and cybersecurity supporting fast-growth businesses. Cybertonica received a tremendous amount

Nick Caplan has joined Konsentus as an Investor & Advisor in the same week as Tuxedo Money Solutions becomes a client Konsentus, launched just a few months ago to provide

Cybertonica, a Machine Learning and Artificial Intelligence SaaS fraud management company has appointed Ekaterina Safonovaas Technical Advisor and Director for Partnerships and Training. Ekaterina has a PhD. in Technical Sciences from

Programme Manager, BIN sponsor, Card/Wallet processor confused about how GDPR effects you, this simple info graphic outlines how it could and will have an impact on your business and what

At Currencycloud, we believe that your payment solution should do more than just streamline the payments process; it should help you provide exceptional customer experiences, nurture greater customer satisfaction and

Small to medium size businesses (SMEs) are at the heart of a new multi-media advertising campaign launched by the Current Account Switch Service, which highlights the ease with which SMEs

Banking Circle Marketplaces set to help freemarketFX clients trade internationally www.bankingcircle.com London, 7th March 2018 – freemarket, the disruptive FX and payment platform for SMEs, has joined Saxo Payments Banking

UnionPay International boosts card acceptance globally with ACI, expanding its number of payment endpoints and accelerating the roll-out of new payment services Naples, FLA / Shanghai — March 22, 2018

Saxo Payments Banking Circle co-founder and Chief Executive Officer, Anders la Cour, was invited to discuss the growth of Financial Utilities in the visionary Rebank podcast. Download the podcast to

Saxo Payments Banking Circle White Paper launched at Money20/20 Asia identifies opportunities and challenges facing Asian businesses www.bankingcircle.com Saxo Payments Banking Circle, the global scale financial utility, has today launched

WHEN 18 April 2018 at 15:00 UK time WHERE Online Webinar REGISTER NOW Join Finextra, ACI Worldwide, Vocalink, KPMG and Rabobank on 18 April 2018 at 15:00 UK time as

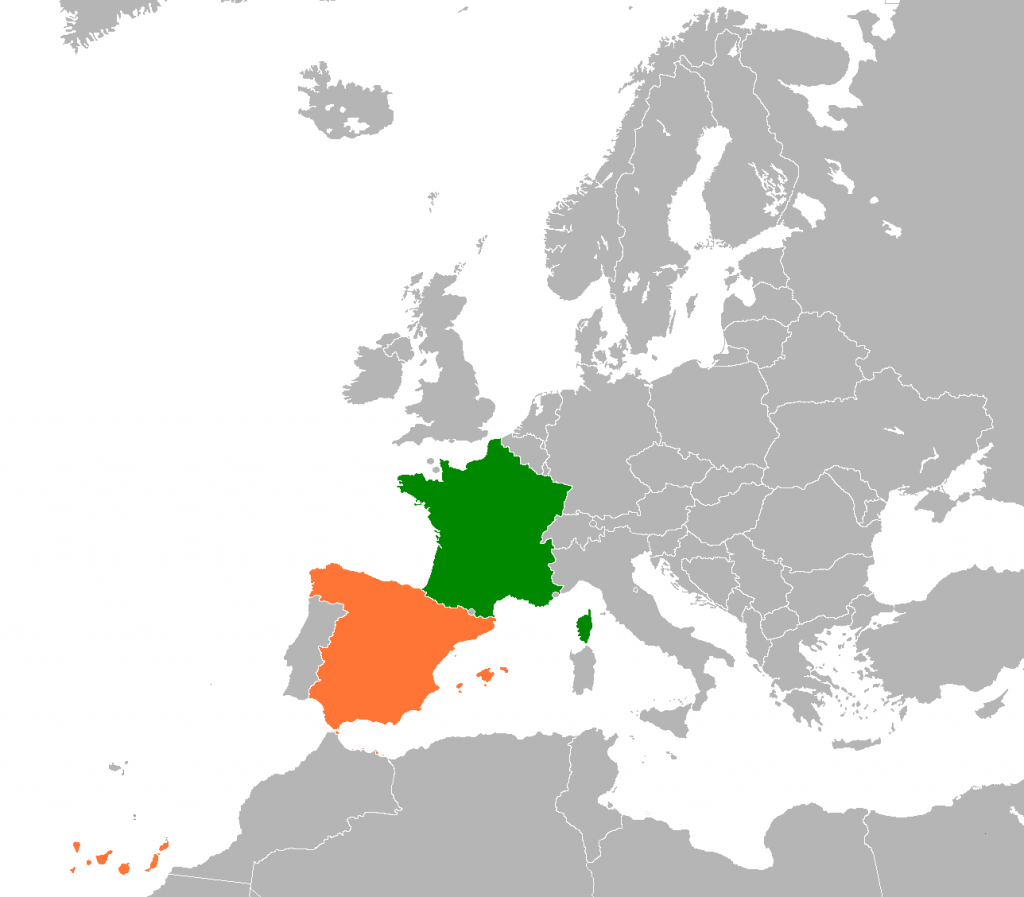

In response to consumer demand for identity verification services in France and Spain, W2 Global Data have now added these to the growing list of countries already supported by our

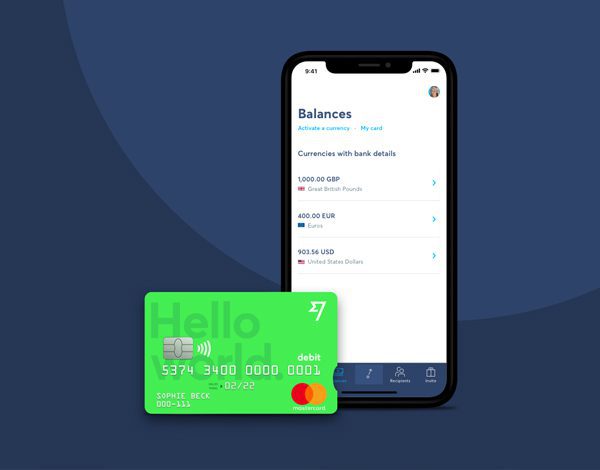

Wirecard issues cards to accompany TransferWise’s worldwide banking account TransferWise launched its borderless account in 2017, allowing anyone to get bank details digitally across the world instantly. A debit card

For many UK and European based businesses, trading in both sterling and euro is an essential part of doing business. Given the size and proximity of the markets it is

W2 Global Data were one of a very small number of companies picked by Sky Betting & Gaming (SB&G) to participate in their prestigious 11-week CoLab programme which kicked off

If you’ve attended any payments event in the last year, chances are you’ve come across Suresh Vaghjiani. Suresh has over a decade of experience in the payment space and is

Time is moving on. With the deadline for the UK to leave the European Union now just 12 months away businesses need to start preparing for the possibility of a

In recent months, many countries have rolled out real-time payments schemes. In the USA, The Clearing House launched their Faster Payments scheme in November 2017, the same month that the

Two of the most respected and outspoken leaders in the payments industry go head to head to answer difficult and controversial questions posed by the ‘BIN of Confusion’. Unscripted and

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.