Wirecard issues cards to accompany TransferWise’s worldwide banking account

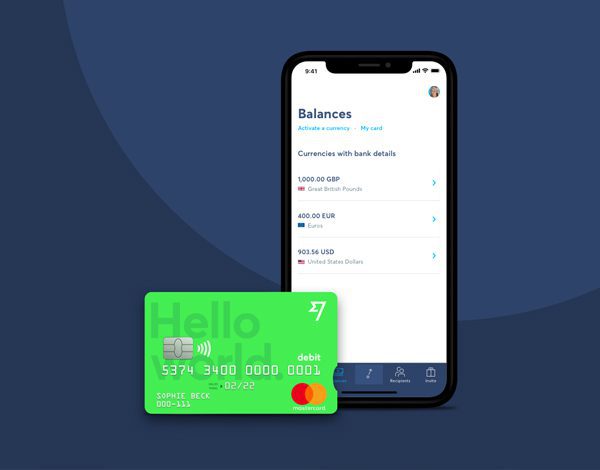

TransferWise launched its borderless account in 2017, allowing anyone to get bank details digitally across the world instantly. A debit card to accompany the account will be launched for all users later in 2018, and will be issued by Wirecard.

Wirecard, the leading international specialists for digital financial technology, has been chosen by TransferWise, the international money transfer company based in London, to issue a debit card to serve alongside its digital borderless account. The debit card was privately launched in January to around one thousand existing TransferWise customers, with a full public roll out planned for later in 2018.

The borderless account will be the first platform to offer true multi-country banking to anyone who needs it. Previously available only to businesses, now TransferWise’s wider customer base can hold and convert 28 currencies at the real exchange rate, with local bank details for the UK, US, Australia and Europe. That means anyone can send, spend and save money like a local, as well as getting paid around the world with zero fees, as if they lived there. Two million people are using TransferWise at the moment to transfer over £1.5 billion every month, saving themselves over £2 million every day.

“Our mission is to make money move without borders, and the borderless debit card is a vital step in bringing that mission to a wider audience”, said Jeremy Buttner, borderless banking lead at TransferWise. “Wirecard is helping us to take the product, and its benefits, to markets that badly need the service more quickly than we’d have been able to otherwise.”

“TransferWise was looking to extend their borderless account by adding a multi-currency debit card. This card will allow customers to access their borderless account around the world without any hidden charges”, added Tom Jennings, Managing Director at Wirecard. “We are delighted to be working with TransferWise, a leading FinTech in the industry. It is a unique product and we see this as being a very successful partnership even for the future.”

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.