Retail Business Paper – Planet

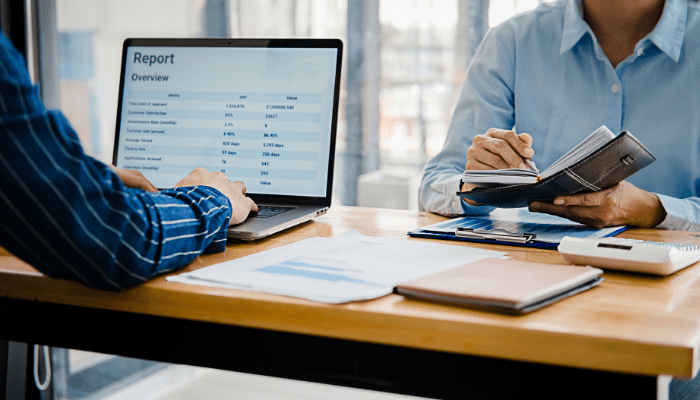

Take a look at Planet’s new Retail report, ‘the best of online in-store: Retail’s next big prize’, and discover what #retailers can do to build an exceptional personalised shopping experience for shoppers from start to finish. One that combines the immediacy of being in-store, with the unlimited inventories, safety and speed of online shopping.