RT2: A strategic transformation for UK payment providers

RT2 modernises UK payments with ISO 20022, enhanced access, APIs & real-time resilience—enabling innovation, new entrants & a dynamic ecosystem.

RT2 modernises UK payments with ISO 20022, enhanced access, APIs & real-time resilience—enabling innovation, new entrants & a dynamic ecosystem.

HCLTech’s Sudip Lahiri on AI, payment modernisation, self-disruption, CBDCs & why adaptability and partnerships are key in an evolving financial ecosystem.

AI is transforming compliance in financial services, offering efficiency gains while introducing new risks that demand robust governance.

This report presents data-driven insights from a major industry survey, highlighting the key trends, risks, and priorities shaping payments in 2025.

APP scams cost UK victims over £340 million in 2023, exposing systemic vulnerabilities and the urgent need for stronger fraud prevention and collaboration.

Some eight years after its launch in the UK, what progress has open banking made, and where does this stand on its path towards open finance integration?

Operational resilience is key for financial firms amid rapid tech advances, enabling innovation but increasing cyber threats, regulations, and risks.

As digital wallets reshape finance and big tech challenges traditional banks, who will control the future of money?

The EBA’s redefinition of e-money challenges traditional models, raising regulatory uncertainties and requiring compliance reassessment.

Payments Association has released a report, “Transforming the UK’s Payments Infrastructure,” proposing a revamp of the UK’s payments. The paper argues that the current system of account-to-account (A2A) payments hinders

Payments in 2025 will be shaped by AI, instant payments, CBDCs, embedded finance, and sustainability.

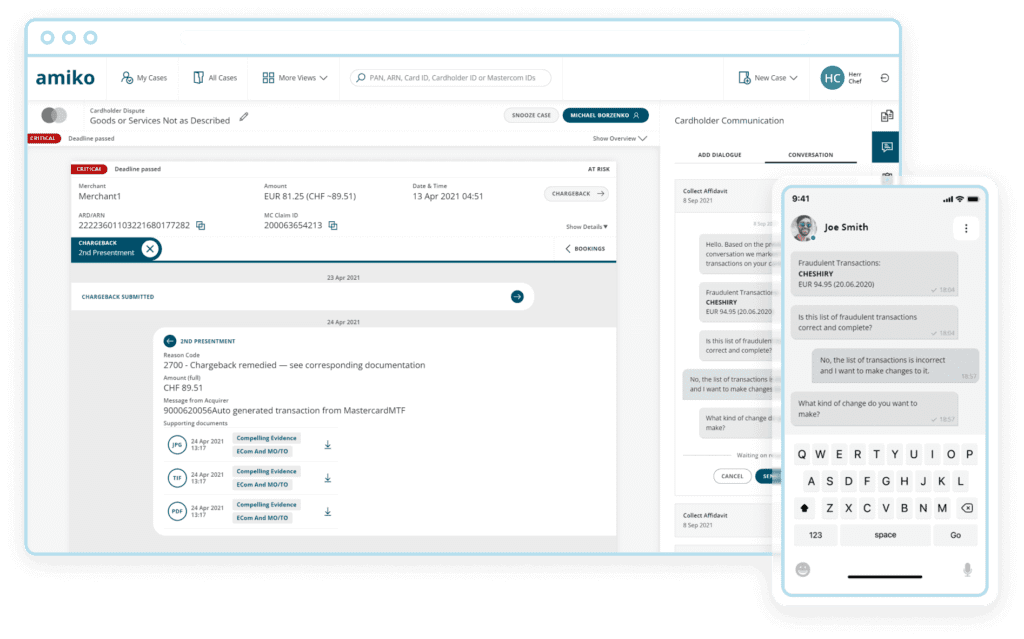

Managing fraud cases has been a top challenge for card issuers, according to recent studies. Rising operations and outsourcing costs and burgeoning fraud recovery caseloads make it especially challenging for

Rising youth involvement in economic crimes highlights the urgent need for robust financial education.

The Payments Association (TPA)’s George Iddenden recently sat down with Peter Theunis, senior vice president sales and European managing director at BPC to discuss the remarkable transformation of the payments processing industry, driven by the rise of fintech, the shift towards digital payments, and evolving consumer behaviours.

The FCA’s new safeguarding reforms strengthen consumer protection in payments and e-money sectors. This article outlines key changes and steps firms must take to comply.

Merchants face new challenges as payment innovations like open banking and tokenisation reshape the industry.

As the cross-border payments industry contends with de-banking and stringent regulations, can emerging technologies and alternative solutions pave the way for a more efficient and accessible global payments landscape?

As banks migrate to the cloud, they must strengthen security with AI, zero-trust, and continuous education to combat growing cyber threats.

Choosing the right custody solution is vital for institutions to securely navigate the evolving digital asset landscape and future-proof their financial operations.

AI-driven solutions are transforming dispute management in the payments industry, enhancing efficiency, reducing costs, and improving customer satisfaction in an increasingly digital landscape.

Swift’s updated CSP and IAF are essential for ensuring robust cybersecurity and compliance across the global banking community.

A deep dive into the Financial Crime 360 survey, highlighting key challenges, prevalent fraud types, and strategic responses across various financial sectors

CEOs discuss top challenges and priorities in a Payments Lab roundtable, focusing on technology, fraud prevention, and regulatory compliance.

The payments and fintech sectors are evolving at breakneck speed in 2024. This rapid change ushers in new technology that brings with it ever-advancing challenges in combating financial crime, where

The PAY360 registrant survey highlights key trends, challenges, and opportunities in the payments industry, focusing on AI, open banking, and real-time payments

Payment businesses must leverage AI technologies to combat increasingly sophisticated fraud networks and protect digital transactions.

Exploring the shift to digital payments, the role of CBDCs, and the strategic implications for central banks.

At ExCel London, PAY360 gathered over 4,000 payment professionals to discuss the future of payments, innovation, and regulatory challenges with industry leaders.

A survey from nearly 6,000 PAY360 pre-registrants reveal the strategic outlook, challenges, and opportunities identified by leaders in the payments industry.

The FCA’s final quarterly authorisations metrics for 2023-2024 reveal high efficiency and effectiveness in meeting statutory targets, though some areas require better application quality.

At PAY360, video interviews with industry leaders highlighted the evolution of payment technologies, ESG integration, and digital accessibility.

On 25 April 2024, the FCA proposed significant updates to its Financial Crime Guide, aiming to enhance clarity and compliance for financial and cryptoasset firms.

Digital wallets are rapidly evolving, increasingly centralising essential personal functionalities like payments, identity verification, and data control, highlighting both immense potential and significant risks.

His Majesty’s Treasury is developing a vision and strategy for UK payments. This could herald a period of leadership of payments by the Government – if the ingredients are right.

IOSCO’s new policy recommendations aim to create a unified global framework for regulating digital assets and cryptocurrencies, enhancing market integrity and investor protection.

With the UK’s financial watchdogs set to establish a regulatory regime for stablecoins, payment service providers must brace for stringent new standards in operations, redemptions, audits, and consumer protection.

The UK and EU are set to implement Confirmation of Payee (CoP) and Verification of Payee (VoP) by 2025 to enhance payment security by verifying account details to reduce fraud and errors.

The PAY360 survey reveals critical insights on AI, real-time payments, and regulatory challenges, guiding stakeholders in adapting to evolving industry demands.

The 2024 assessment reveals evolving financial crime trends, including AI fraud and social media exploitation, providing crucial insights for payment firms to fortify consumer trust and operational security.

The UK Financial Conduct Authority issued a supervisory notice to EPayPro UK Limited, stressing the need for fairness and transparency in fee introductions, following EPayPro’s non-compliant rollout of a new compliance fee

A look inside the innovative work of the ESG working group, as it creates the first greenhouse gas emissions standard designed specifically for the payments industry

Initial assessments of the FCA’s Consumer Duty show that while financial firms have made positive strides in improving practices for consumer outcomes, further improvements and deeper integrations are necessary.

Unveiling the complexities and optimisation opportunities in the card payments industry’s operational landscape.

Exploring how the payments industry can innovate to mitigate the UK’s cost of living crisis, this article highlights fintech’s role in aiding the newly underserved towards financial resilience and inclusivity

In an era where customer focus, innovation, and the challenge of profitable growth take center stage, the payments industry faces a pivotal transformation, signalling the end of ‘easy growth’ for traditional giants

Leaders of companies operating in the payment technology landscape are well-accustomed to the challenges of complex regulations set by various governing bodies. Whether the companies are established financial institutions or agile fintech start-ups, navigating this terrain requires much effort.

In 2021, the Financial Conduct Authority (FCA) Business Plan made clear its intent to apply a more intensive assessment with greater scrutiny of financial information and business models. This is being particularly felt in the payments space.

The Payments Association is proud to have worked alongside UK Finance, Digital Pound Foundation, TheCityUK, Innovate Finance and City of London Corporation, and supported by CryptoUK, CMS, Clifford Chance, Greengage,

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.